XPeng bets on humanoid robots as a new ticket

![]() 05/29 2025

05/29 2025

![]() 638

638

As a radical player in the field of creating humanoid robots among new-energy vehicle makers, whether the ambition of the "third growth curve" will affect the core business of vehicle manufacturing remains to be seen. Perhaps the key for XPeng is to tell a compelling story of profitability.

Original Tech News, Frontier Tech Team

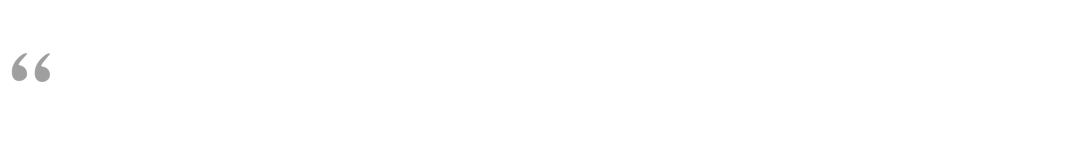

XPeng Motors is continuously elevating its position among new-energy vehicle makers. According to XPeng's first-quarter 2025 financial report, its total deliveries reached 94,008 units in the first quarter, reclaiming the top spot among new-energy vehicle makers after several years. In terms of growth, XPeng delivered a year-on-year increase of 330.8% in the first quarter, achieving a 2.73% increase on top of the surge in sales in the fourth quarter of 2024. In financial indicators, XPeng's total revenue for the first quarter reached 15.81 billion yuan, a year-on-year increase of 141.5%; net loss was 660 million yuan, marking a significant narrowing. During a conference call after the financial report's release, Chairman He Xiaopeng optimistically predicted, "We are confident in achieving profitability in the fourth quarter of 2025 and achieving free cash flow on a full-year scale."

Both in terms of sales and financial indicators, XPeng Motors is showing a positive development trend, with everything thriving. Based on this, He Xiaopeng outlined a more ambitious blueprint for corporate development during the conference call and planned three growth curves for XPeng Motors: AI integration with automobiles, globalization, and humanoid robots.

Judging from the current development background and competitive landscape of automakers, AI and intelligent driving technology have become indispensable for automakers, and going global has long been the goal and ambition of most automakers. As for humanoid robots, serving as the third growth curve, it is currently a new race filled with heated discussions and some controversy in its early stages of development. From the popularity of Unitree Technology's dancing robots during the Spring Festival Gala to robot marathons and the recently held world's first humanoid robot free fighting tournament, humanoid robots have frequently been at the center of public discourse this year. Due to the high degree of technology reuse between automobile manufacturing and humanoid robots, there have been continuous news about automakers deploying in the field of humanoid robots in recent years. According to statistics, the current deployment methods of automakers in the field of humanoid robots mainly include investment, ecological cooperation, and independent research and development. In the field of independently researched and developed humanoid robots, which requires more effort and has higher technical barriers, the main participants include Tesla, FAW Group, and GAC Group. A common characteristic of these companies' layout in independently researched and developed humanoid robots is that they all began their deployments after achieving profitability. Among XPeng Motors' peers in the new-energy vehicle sector, despite rumors of multiple automakers deploying in the field of humanoid robots, they have been relatively cautious, making XPeng Motors the most radical player in "creating humans" among the new forces. Compared to the cautious attitudes of its peers, XPeng Motors' layout in the humanoid robot sector may aim to seize the core entry point for future human-computer interaction through humanoid robots and thereby construct a more complete ecological closed loop, taking the lead in competing for the "next decade's" ticket. However, the maturity of robot technology is still in its climbing phase, and it is impossible to estimate when the so-called GPT moment will arrive. On the other hand, it should be noted that despite the robust growth momentum, XPeng's leading position is not impregnable amidst the respective in-depth cultivation of new-energy vehicle makers and the step-by-step pressure from traditional automakers. In the core business of new energy vehicles, XPeng still faces fierce industry competition. At this crucial juncture before profitability, telling a compelling story about humanoid robots may need to give way to safeguarding the core business.

01

New forces observe the humanoid robot sector

The pioneer in automakers' deployment in the humanoid robot sector is Tesla. At the 2021 AI Day event, Musk publicly announced the launch of the humanoid robot project Optimus for the first time. The following year's AI Day saw Tesla unveil the first prototype of Optimus. Tesla's layout in the field of humanoid robots mainly benefits from Optimus' reuse of technologies in automotive autonomous driving and AI decision-making, the cost advantages arising from automotive mass production capabilities, and the beautiful blueprint of ecological synergy between "AI + robots + automobiles." Taking Tesla as an example, more and more automakers have begun to deploy in the field of independently researched and developed humanoid robots. In August 2022, Xiaomi launched the humanoid robot CyberOne, positioning it as an "intelligent companion for all scenarios"; at the 2025 Shanghai International Automobile Industry Exhibition, FAW Group's humanoid robot "Qi Xiaozhi" made its debut, mainly applied in FAW's logistics workshops; GAC Group released the third-generation embodied intelligent humanoid robot GoMate in 2024 and plans to complete small-scale production by 2026, gradually expanding to mass production.

Currently, domestic automakers that independently research and develop humanoid robots are mainly traditional automakers with good profitability. Although Xiaomi Automobile falls into the category of new forces, Xiaomi had not yet started mass production of its cars when it launched CyberOne.

In addition, new-energy vehicle makers are currently relatively cautious about deploying in the humanoid robot sector. As the first automaker among the new forces to achieve full-year profitability, Li Auto has not yet deployed in the humanoid robot sector. At the 2024 Li Auto AI Talk, CEO Li Xiang responded to whether the company would make humanoid robots, saying that the probability is definitely 100%, but the timing is not now. "If we can't even solve L4-level autonomous driving vehicles, how can we solve something more complex?" NIO, the second new-energy vehicle maker to achieve profitability, turned its net profit positive in the fourth quarter of 2024 but returned to a loss in the first quarter of 2025. In March of this year, NIO founder Zhu Jiangming stated during a media communication meeting that the company has already formed a humanoid robot R&D team, but the project is still in the pre-research stage. Another new force, Xpeng, was rumored to have formed a team of about 20 people focusing on research into robot dog projects, but the company has not provided a clear response. Compared to the above-mentioned new forces, XPeng Motors' attitude and deployment in the field of humanoid robots can be described as radical. While its peers are still observing or are in the pre-research stage, XPeng Motors has already exhibited its fourth-generation humanoid robot product Iron at this year's Shanghai Auto Show. Recently, XPeng Motors announced that it will launch its fifth-generation humanoid robot for industrial and commercial scenarios within 2026. Under the new windfall of embodied intelligence, which holds great potential, new-energy vehicle makers are relatively cautious, possibly constrained by profitability, technical prowess, etc. In contrast, XPeng Motors' deployment pace is faster. This points to a question: How can XPeng Motors, which has not yet achieved profitability, have the confidence to deploy in the humanoid robot sector, while Li Auto, which has already achieved profitability, has yet to do so?

02

New ambitions of the "third growth curve"

XPeng Motors' earliest signs of deploying in the humanoid robot sector can be traced back to 2020. During the latest financial report conference call, He Xiaopeng stated that XPeng aims to launch its fifth-generation humanoid robot for industrial and commercial scenarios within 2026.

Compared to other new-energy vehicle makers, XPeng Motors has started early and progressed quickly in its deployment of humanoid robots. The underlying logic likely lies in its technological prowess. It is reported that since its inception, XPeng Motors has bet on intelligence and technology and currently possesses full-stack independent research and development capabilities, with differentiated advantages in AI intelligent driving. XPeng Motors' core strengths lie in its vertical integration of intelligent driving algorithms, electrification technologies, AI interaction, and manufacturing capabilities. Within this technological scope, a high degree of technology reuse can be achieved between automobiles and humanoid robots. He Xiaopeng once stated that the robot's EEA architecture is derived from the automotive EEA architecture, the robot's joints come from the automotive battery, electric drive, and powertrain teams, and the robot's cerebrum, cerebellum, and spine come from the robot, intelligent driving, and intelligent cabin teams. Automobiles and robots share 70% of their organizational origins. The high degree of technology reuse undoubtedly allows XPeng Motors to have lower R&D and trial-and-error costs compared to innovative enterprises focusing on humanoid robots. According to the plan, XPeng's fifth-generation robot will be equipped with Turing chips to improve the robot's edge computing power, enhance learning small models, and segmented end-to-end capabilities. At the same time, XPeng Motors will improve the intelligence level of the robot's cerebrum and cerebellum by directly sharing the VLA architecture of XPeng's physical world base model and reusing XPeng's cloud AI infrastructure.

For a long time, XPeng Motors has used "intelligence" as its core label, which naturally makes it possible to migrate technology to the field of robots. In addition, deploying in the humanoid robot sector can further strengthen its "tech company" attributes and pave the way early for a future vehicle-robot collaborative ecosystem. Based on its advantages in technology reuse, unlike new-energy vehicle makers, XPeng has elevated the strategic position of humanoid robots to the "third growth curve" on par with AI + automobiles and globalization. However, as an emerging field, the entire humanoid robot sector is currently mostly in the trial stage. For it to grow into an independent "third growth curve," two major indicators need to be considered: supply chain costs and commercial orders. In terms of the supply chain, the automaker's own supply chain system can be reused to a certain extent for humanoid robots. However, in terms of commercial orders, humanoid robots still face controversy in terms of price, usage scenarios, and relevant regulations. Currently, industry pioneers such as Boston Dynamics' Atlas and UBTECH's Walker series have not yet achieved large-scale profitability, and Tesla, the earliest automaker to deploy in the humanoid robot sector, has not yet achieved mass production. For XPeng, it may take some time for humanoid robots to truly grow into an independent "third growth curve."

03

A choice between the core business and new curves

In addition to deploying in the humanoid robot sector, XPeng Motors' ambitions also include flying cars. On May 23, XPeng Motors' Co-President Gu Hongdi revealed in an interview that the company plans to launch flying car products to the market in 2026. In fact, whether it's humanoid robots or flying cars, they are both "elevated" moves by XPeng Motors based on its core business of new energy vehicles, potentially giving it an earlier lead in the second half of the competition among new-energy vehicle makers. Although as a "tech company focusing on future mobility," continuous technological exploration is a necessary action, at this crucial juncture, just one step away from profitability, XPeng Motors' top priority is to safeguard its core business of new energy vehicles. According to the first-quarter financial report, XPeng Motors' sales increase was mainly driven by the two best-selling models, MONA M03 and P7+, which both have price and technological configuration advantages. To achieve profitability in the fourth quarter, it is extremely important to maintain stable sales of existing popular models and introduce new popular models. However, as competition in the new energy vehicle market continues to intensify, its "high-specification, low-price" strategy is facing challenges.

On the one hand, BYD's wave of promoting intelligent driving equality after the Lunar New Year has led to follow-ups from automakers like Geely and Changan, which has somewhat leveled out the price advantage of Xpeng's intelligent driving technology. This year, BYD has conducted several promotional activities to continuously improve its overall cost-effectiveness, which has further impacted Xpeng's inherent cost-effectiveness advantage. On the other hand, in terms of creating new best-sellers, Xpeng plans to launch multiple models in 2025 but will face direct competition from Xiaomi YU7, Lixiang's pure electric SUV i8, and others. With the differentiation advantage of "high configuration at a low price" being impacted, it will not be easy for Xpeng to replicate the myth of a best-seller amid fierce competition. Moreover, Xpeng's new models also seem to be caught in the uncertainty of becoming a best-seller, with neither the G6 nor the G9 clearly standing out, and the future of its extended-range vehicles also remaining uncertain. Against this backdrop, Xpeng still faces many uncertainties in achieving profitability in the fourth quarter. Furthermore, under the general direction of pursuing cost-effectiveness, the decline in Xpeng's average vehicle price will to some extent limit its upward profitability. If Xpeng fails to continuously produce best-sellers, even if it achieves its profitability target in the fourth quarter, the vision of achieving overall profitability will still be full of challenges. To safely navigate through the eve of profitability, Xpeng currently needs to continue to focus on the layout and investment in new energy vehicles. Xpeng's aggressive layout in humanoid robots is not only a bet on the trend of "automaker ecologization" but also a confidence in its ability to reuse technology. It is also a necessary layout to seize the initiative in the next competitive cycle for automakers. However, the uncertainty of the commercialization path and the long cycle of technology implementation destine the layout of humanoid robots to be a high-risk, high-reward gamble. For Xpeng to bet on the future, it also needs a stable foundation to support it.

Perhaps only after passing the inflection point of profit and loss and possessing sustainable profitability can Xpeng truly let go and forge ahead with the "third growth curve" of humanoid robots. References: Photon Planet, "Xpeng's Democratization: Aiming to Sleep in BYD's Upper Berth" LatePost Auto, "Not Making Mistakes is the Most Correct Thing for Xpeng Now" Linked Car, "He Xiaopeng Has Changed, and Xpeng is Taking a Turn" China Business Journal, "Automakers Compete in Layouts, Xpeng Announces the Launch of the Fifth Generation of Humanoid Robots" Youjie UnKnown, "Automakers Enter the Field of Humanoid Robots, Just for Show?"