Transformers, Roll Out?

![]() 06/04 2025

06/04 2025

![]() 559

559

In 1984, "Transformers" premiered in the United States and made its way to China a few years later. This animated series sparked an enduring battle between the Autobots and Decepticons, etching itself into our childhood memories. I vividly recall Yunnan Satellite TV broadcasting "Transformers" at 6 a.m., which inadvertently set my personal record for early morning wake-ups from childhood to adulthood.

Young boys like me must have all wondered when the Autobots would become a reality. Today, that dream has taken a small but significant step forward: automakers are now planning to venture into robot manufacturing.

At the recent Shanghai Auto Show, some visitors complained that they had come to see cars, but all they found were robots displayed by auto companies. A deeper dive into this phenomenon reveals that over a dozen automakers worldwide have announced their robot plans. Some even speculate that the number of automakers diving into robot manufacturing has already surpassed that of startups specializing in embodied intelligence.

Car + robot, roughly equal to Transformers?

While we're still far from seeing Optimus Prime in real life, this development offers a glimmer of hope to our lifelong fascination with Transformers.

Let's delve into the strategies and core logic behind automakers' participation in robot manufacturing.

Can Transformers truly transform and roll out?

XPeng: Gradually Emerging as an Aggressive Force in Car and Robot Manufacturing

Entering 2025, XPeng has been the most active automaker in the robot manufacturing space.

At this year's Shanghai Auto Show, XPeng unveiled its robot, IRON, marking the first public appearance of its robot product. Accompanying this unveiling was XPeng's high-profile announcement of its robot mass production and business plan. During an earnings conference call, XPeng expressed its aspiration to achieve industrial mass production of robots by 2026, targeting industrial and commercial scenarios with humanoid robots.

Regarding its commitment to the robot strategy, XPeng views it as the third growth curve following AI+cars and globalization. Robots, alongside chip and flying car business layouts, will serve as supporting factors for XPeng to achieve profitability in the fourth quarter of this year.

Why did XPeng suddenly make such a high-profile push into robots? The outside world believes it's related to XPeng's delayed profitability and its urgent need for a new strategic direction to create differentiation and accountability. From chips to flying cars and humanoid robots, XPeng has become the most aggressive new force in car manufacturing in terms of product layout beyond traditional vehicles. While most automakers opt for ecological cooperation and investment to deploy robots, XPeng has chosen the "heaviest" model of self-research, starting from chips. However, whether this strategy of "bypassing and overtaking" with products beyond cars will succeed remains to be seen over time.

Besides XPeng, other new forces in car manufacturing have also invested in or laid out humanoid robots, but they have been much more low-key and cautious. Li Xiang, CEO of Li Auto, once responded that Li Auto would definitely make robots, but not at the current pace. NIO was once rumored to have started organizing a robot team, but there has been no clear response.

XPeng's sudden high-profile push into robots has become a significant variable in the robot field in 2025. This may prompt other automakers, especially those with more direct competition among new forces, to follow suit.

Tesla: A Long Wait and Return

After discussing new developments, let's revisit an old story.

The trend of automakers making robots was, of course, first hyped by Tesla. As early as 2021, Tesla announced its humanoid robot project, Optimus, and unveiled the first prototype in 2022. In 2023, Optimus Generation 2 was launched. The name Optimus, of course, is inspired by Optimus Prime, demonstrating the significant influence of "Transformers".

However, following the groundbreaking Optimus plan and a series of subsequent high-profile showcases, Tesla's robot dream has stalled. The reason is that mass producing humanoid robots is extremely difficult. Stringent requirements for yield and industrial cost control test Tesla's manufacturing and scheduling capabilities. This new demand for robots also poses a significant challenge to Tesla's global supply chain, which has not fared well in recent years. The trade war initiated by the United States has affected Tesla's robot supply chain everywhere, causing mass production delays.

According to current information, Tesla hopes to achieve a mass production target of 5,000 Optimus units in 2025, reach 50,000 units next year, and reduce the cost of a single robot to below $20,000. However, like its mass production plans for new cars and autonomous taxis, the outside world generally has great doubts.

Just a few days ago, Tesla's robot plan suffered a setback. Chris Varty, the former head of Tesla Optimus, stated that humanoid robots like Optimus are not suitable for factory work. The structure of such humanoid robots is too complex, and their humanoid form lacks practical value in industrial environments, which instead reduces the efficiency of executing industrial tasks.

This is actually a common concern in the industry: our obsession with developing humanoid robots often stems from human narcissism. There is no essential connection between complex humanoid forms and industrial needs.

In short, Tesla's robots are still a long way from mass production.

What does the "return" mentioned in the subtitle mean? The answer is that Musk has at least returned to the spotlight...

Xiaomi and Other Automakers: Robots in the Workshop

In fact, most automakers manufacturing robots are at this stage: highly visible strategically but低调 in the process of waiting for mass production.

However, there's another characteristic of robots made by automakers: their first stop is usually the automakers' own factories to tighten screws.

Our Transformers are really going through it. Before finding the AllSpark, they first learned how to be beasts of burden.

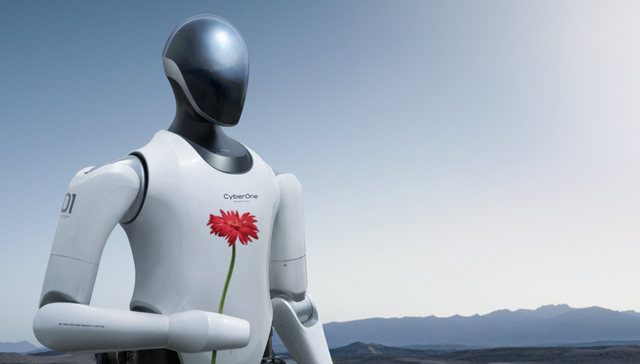

Many automakers have clearly stated that they will deploy robots in their own factories. For example, Xiaomi, which released the humanoid robot CyberOne as early as 2022, announced this year that it will deploy it in stages to its Beijing Yizhuang factory.

The FAW Group's humanoid robot, "Qi Xiaozhi", which appeared at the previous Shanghai Auto Show, will also be mainly applied in FAW's logistics workshops. The humanoid robot GoMate developed by GAC Group also plans to achieve mass production this year and be the first to be applied in the production lines of the OEM workshop.

The matter of humanoid robots entering factories is still in the planning stage, but it has become a consensus among many automakers. At this point, we can summarize the three major characteristics of automakers manufacturing robots: strategies can be very aggressive, mass production is mostly challenging, and entering factories is basically the first step.

So, why is this the case?

Transformers Transforming: What is the Logic Behind Automakers?

Statistics show that over ten domestic automakers, including XPeng, Xiaomi, BYD, GAC, SAIC, and FAW, have announced their robot layouts in various ways. Overseas, automakers such as Tesla, Mercedes-Benz, and BMW have also proposed humanoid robot plans. It can be said that automakers manufacturing humanoid robots have become the mainstream choice, injecting a large-scale "Transformer" team into the increasingly crowded robot industry.

Why do automakers prefer robots compared to pure-bred players in embodied intelligence and other technology companies? This can be explained from three aspects of automakers' logic:

1. High Degree of Technology Reuse Between Robots and Autonomous Driving

Today, all automakers worldwide have invested heavily in research and development for autonomous driving, and maximizing the reuse of these R&D resources is obviously the most reasonable approach. Robots, which also need to make autonomous decisions and understand real-time tasks, are the best target for automakers to reuse autonomous driving technology.

When Tesla announced Optimus, it bluntly stated that this plan mainly stemmed from the reuse of technology in autonomous driving, AI decision-making, and other aspects. XPeng's ability to propose a more aggressive humanoid robot plan also stems from its reuse of technical resources such as Turing chips, the physical world base model VLA architecture, and AI infrastructure. He Xiaopeng once said that cars and robots share 70% of the same resources in terms of organization, etc.

Therefore, even though the market maturity of Transformers is much further away than that of autonomous driving, automakers are willing to simultaneously deploy this branch to seize this strategic opportunity with the advantage of technology reuse.

2. Maturity of the Supply Chain

Another favorable factor for automakers deploying robots is that the supply chain has already been established, so it might as well be used to produce more things. The supply chain of new energy vehicles in areas such as batteries and motor control, coupled with the supply system of autonomous driving in areas such as lidar, cameras, and sensors, and even the large model supply system of intelligent cockpits, can essentially be replicated onto robots.

By utilizing the existing mature intelligent automobile supply chain, automakers can better realize resource integration, thereby compressing the procurement costs and processes of robot components to gain a competitive advantage against technology companies.

3. Car Manufacturing Itself is a Self-Production and Self-Sales Opportunity

There's an industrial consensus on humanoid robots that industrial robots are much more mature than household robots. This is why the first stop for automakers making robots is definitely the workshop. Compared to pure-bred companies in embodied intelligence that need to find ways to recommend their products to industrial customers, automakers themselves have a huge manufacturing layout and can realize self-production and self-sales of robots.

In the immature stage of the robot industry, this closed loop within the enterprise system has extremely high strategic value.

Of course, besides these industrial considerations, automakers facing fierce competition may objectively need to tell a new story. And the story attribute of robots has long been woven into everyone's genes by animated cartoons.

These subjective favorable factors drive automakers to deploy robots. However, more objective unfavorable factors also make most of these deployments barely noticeable.

Decepticons Haven't Arrived, and the Situation is Also Complex

I've seen a saying that many young people fantasize about robots taking care of them when they grow old. But if they intend to purchase a humanoid robot on the market today to experience it, they will feel in advance how challenging it can be to take care of themselves when they are old and disabled...

Compared to autonomous vehicles driving on the road, family and medical companionship scenarios are more complex, sophisticated, and detail-oriented, and far from forming effective targeted technological breakthroughs. We are very optimistic about the long-term value of robots, but at the same time, we are very pessimistic about their short-term commercial benefits.

For most automakers, making robots today is like doing autonomous driving over a decade ago. It's fine to talk about it and invest slightly, but there's no need to dive in headfirst. Emerging technologies are not the earlier the better; they need to seize the right opportunity.

At the current stage, the overall pressure on automakers manufacturing robots is still very significant.

For example, the high hardware costs of robots directly lead to the fact that no automaker can truly achieve the mass production target for robots, let alone withstand market tests. Under such circumstances, automakers can only showcase their robots at press conferences, auto shows, and social media, and are still far from delivering them to application scenarios.

Moreover, most automakers are still under the cost pressure of intelligent automobiles and cannot open another money-burning outlet on robots.

Additionally, robots still lack technical solutions for algorithms and data. Compared to autonomous driving, the data collection and algorithm training schemes for robots are very vague and lack a standardized architecture.

To solve these problems, automakers need to pay huge data costs and algorithm development costs. These are not things that automakers, whose main battlefield is cars, are willing to face.

A more important issue is the lack of market prospects for robots in the short term. Watching robots run marathons and participate in sports competitions may be entertaining, but purchasing expensive robots with basically no application value is highly unlikely. In industrial scenarios, there is no clear inevitability for humanoid robots to replace other industrial intelligent terminals such as robotic arms and AGV carts.

In summary, automakers have some advantages in making humanoid robots, but they are not obvious. Automakers cannot solve the inherent problems of those humanoid robots alone.

Therefore, the choice of most automakers is to invest some efforts into robots to ensure competitiveness but are not willing to invest too much. Making robots a new growth curve is still too far away overall.

Certainly, should any automotive company endeavor to create a robot capable of transforming from a car into a humanoid form, I would extend my wholehearted support. The ability to transform is paramount; take my word for it.