Cloud Workshop IPO: Is the "First Edge Cloud Stock" Trapped in the "Intermediary Model"?

![]() 06/11 2024

06/11 2024

![]() 729

729

The "First Edge Cloud Stock" is about to make its debut.

It is understood that Cloud Workshop Technology Holdings Limited (hereinafter referred to as "Cloud Workshop") will be listed on the main board of the Hong Kong Stock Exchange on June 14. It is currently conducting a share offering from June 5 to June 11, with a pricing of HK$4.6 per share. Pu Yin International is the exclusive sponsor.

According to Tianyancha, the company was founded in 2013 and primarily engages in IDC solution services and edge computing services. Among them, IDC solution services are the company's development focus, accounting for more than 90% of its business revenue. In recent years, due to the rapid development of technologies such as cloud computing, the Internet of Things, blockchain, and AI, the market demand for IDC solution services has continued to rise, and Cloud Workshop has also achieved certain development results.

According to the prospectus, from 2021 to 2023, Cloud Workshop achieved revenue of approximately RMB 464 million, RMB 549 million, and RMB 696 million, respectively, with a compound annual growth rate of 22.43%. Net profits for the year were approximately RMB 12.685 million, RMB 8.034 million, and RMB 14.224 million, respectively, with a compound annual growth rate of 5.89%.

Overall, Cloud Workshop has maintained a certain performance growth trend, but its scale is not large, and the stability of its profitability seems to be low. Especially when placed in the vast IDC solution service market, the relevant issues become more significant.

According to a Frost & Sullivan report, in terms of revenue, from 2019 to 2023, the scale of China's IDC solution service market increased from RMB 6.916 billion to RMB 24.101 billion, with a CAGR of 36.6%. It is expected that the relevant market size will reach RMB 53.032 billion by 2028.

Based on 2022 revenue, Cloud Workshop ranks 11th among IDC industry carrier-neutral service providers, with a market share of only 0.6%. It is clear that Cloud Workshop still has considerable room for improvement.

However, its current small development scale may be closely related to the company's business model.

It is understood that in the core business operation of IDC solution services, Cloud Workshop primarily plays the role of an "intermediary." That is, after receiving demand from downstream customers, it usually feeds the demand back to upstream data center resource suppliers, purchases resources such as bandwidth from them, and then allocates them to the corresponding customers. In other words, during the business development process, Cloud Workshop mainly engages in resource coordination and allocation.

This differs from the business models of other IDC service providers. It is understood that the asset-heavy nature of the IDC industry is quite prominent. To facilitate business operations, practitioners generally build large data centers with complete facilities such as electricity, air conditioning, and networks to provide users with server hosting, leasing, operation management, and network access services.

Cloud Workshop, however, has not built its own data centers but has attempted to become a "middleman" to "lighten" its business model. The benefits are self-evident, avoiding the huge costs of data center construction and making business management more flexible.

However, the disadvantages are also apparent. As an "intermediary," the company is susceptible to constraints from upstream and downstream parties, especially when facing large data operators and internet vendors. Due to a lack of technological dominance in the industry chain, its bargaining power is difficult to improve. Coupled with necessary investments in areas such as bandwidth procurement, Cloud Workshop faces significant cost pressures.

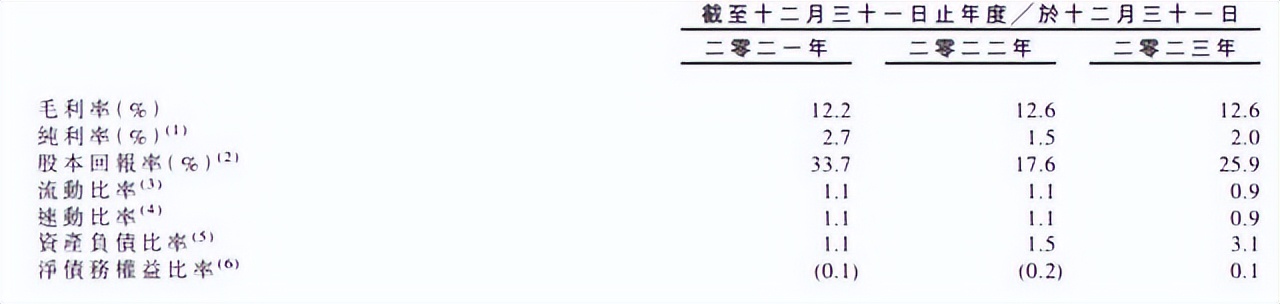

According to the prospectus, from 2021 to 2023, the company's bandwidth procurement costs were RMB 328 million, RMB 456 million, and RMB 533 million, accounting for 80.3%, 95.1%, and 87.5% of sales costs for the same year, respectively. As cost pressures continue to increase, the company's profitability has not seen significant improvement. Data shows that in recent years, Cloud Workshop's gross profit margin has basically remained at around 12%, while its peer, Alphafly Data, has a gross profit margin of nearly 30%.

These issues will undoubtedly raise concerns in the market. Of course, it cannot be denied that there are still some highlights in its development worth noting, such as edge computing services. Although it is not the company's core business, its growth trend is quite significant and may indicate the direction of the company's future promotion.

It is understood that Cloud Workshop's "Lingjing Cloud" brand for edge computing services has become a new growth driver for the company. According to the prospectus, as of the end of 2023, the service revenue reached RMB 18.1 million, a year-on-year increase of 248.1%. Currently, the company has signed 16 edge computing service contracts and was selected as one of the "Top 10 in China's Edge Computing" in 2024, ranking 8th, along with giants such as Huawei, Alibaba, and Tencent.

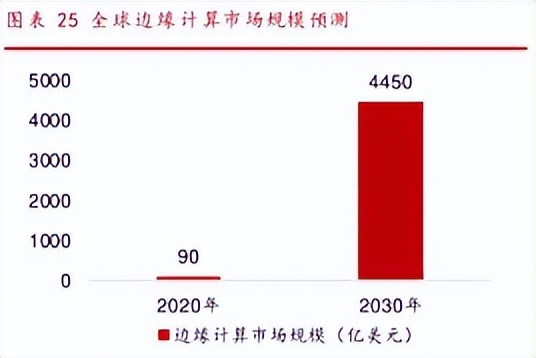

The potential of the relevant market is also being fully released. According to data from the Huaxi Securities Research Institute, it is expected that the global edge computing market size will expand to US$445 billion by 2030, representing a staggering nearly 50-fold increase compared to 2020.

Under this trend, the growth ceiling for Cloud Workshop has been opened, but it remains to be seen whether it can accurately position itself and dispel development mists.