Why Is Alibaba Cloud Recognized Among the World's Four Leading AI Cloud Providers?

![]() 09/22 2025

09/22 2025

![]() 710

710

Introduction: As the sole Chinese company among the world's four leading AI cloud providers and the only one in China's cloud computing sector with comprehensive full-stack AI capabilities, Alibaba Cloud is poised to make significant strides in this pivotal AI decade.

Lu Yan/Author Lishang Business Review/Production

1

In business, opportunity and capability are paramount, as vividly illustrated by Alibaba Cloud's rapid ascendancy in the AI sector over the past two years.

With the dawn of the AI era, alongside the remarkable success of model pioneers like OpenAI and GPU leader NVIDIA, AI cloud services have emerged as the clearest and most promising avenue for monetization. If AI represents the 'electricity' of this new era, then AI cloud services serve as the 'power grid' that distributes it. As a leader in China's traditional public cloud sector, Alibaba Cloud is undeniably one of the primary beneficiaries of this AI cloud market surge.

Traditional cloud computing infrastructure primarily comprises computing, storage, networking, data centers, security, and operations management. However, AI cloud builds upon this foundation, introducing new products and services such as data preparation, model training, inference optimization, and AI application development. Those with distinct competitive advantages are poised to seize the opportunities presented by this technological shift.

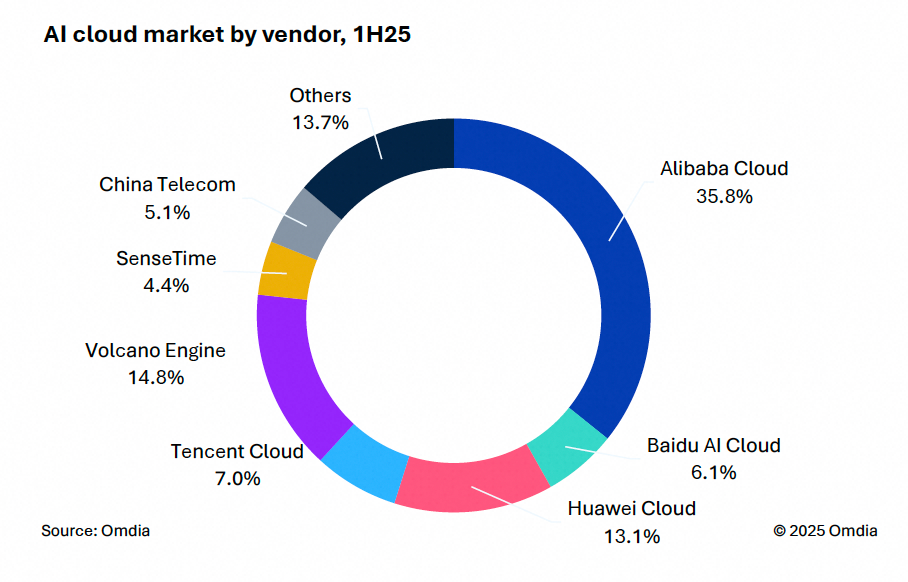

Recently, Informa (Omdia), an internationally recognized market research firm, released a report titled 'China AI Cloud Market, 1H25.' In the first half of 2025, China's AI cloud market reached RMB 22.3 billion, with Alibaba Cloud leading the pack with a 35.8% market share, outpacing the combined share of the second to fourth-ranked providers. The report also forecasts continued explosive growth in China's AI cloud market, with sales projected to reach RMB 51.8 billion for the full year of 2025 and RMB 193 billion by 2030.

So, how has Alibaba Cloud capitalized on the market opportunities in AI cloud? And can it sustain this advantage in the long-term competitive landscape?

2

To gain insight into Alibaba Cloud's long-term prospects, the author first examined the global AI cloud market's competitive landscape and identified four companies with significantly leading market shares. Besides China's Alibaba Group, the other three are Microsoft, Amazon, and Google from the United States. Summarizing the characteristics of these four global AI cloud giants, they share four key attributes.

Firstly, each company invests billions annually in infrastructure. Secondly, each boasts computing clusters with millions of servers and top-tier cloud scheduling capabilities. Thirdly, each possesses world-class large models. Fourthly, each has its own AI chip design and development capabilities.

From these shared attributes, it is evident that AI cloud is a domain reserved for industry giants. This is because cloud services necessitate robust scale and network effects, and to achieve profitability, companies must make substantial upfront capital investments and possess a sufficiently large user base, which is unattainable for small and medium-sized enterprises. Alibaba Group perfectly aligns with these four attributes. On one hand, it has the financial resources to sustain massive infrastructure and technology investments. On the other hand, it has amassed China's largest fixed customer base during the traditional public cloud era, enabling its capital investments to yield higher returns compared to competitors. This is why Alibaba Cloud confidently announced this year that it will invest RMB 380 billion over the next three years to build cloud and AI hardware infrastructure.

Further examination of these four global AI cloud giants reveals two distinct development paths.

The first path is the 'Cloud + Ecosystem' model, exemplified by Microsoft and Amazon. Both have globally leading public cloud businesses and AI chip layouts but have opted to collaborate deeply with external partners for large models. Microsoft has partnered with OpenAI, while Amazon has aligned with Anthropic.

The second path is the 'Full-Stack Self-Research' model, represented by Google and Alibaba. Both possess strong self-research capabilities in cloud, large models, and AI chips. Currently, many predict that this vertically integrated full-stack self-research approach may hold stronger development potential. For instance, renowned Chinese investor Duan Yongping anticipates that Google may emerge as the most promising U.S. tech company in the future AI landscape, and an increasing number of investors believe that Alibaba is the most promising company in China's AI sector. The recent surge in Alibaba Group's market value largely reflects this investor sentiment.

Specifically, examining Alibaba's full-stack self-research capabilities in AI, at the AI IaaS layer, Alibaba Cloud has established 90 availability zones across 29 regions globally, offering customers GPU elastic computing power and Lingjun large-scale AI training cluster services, along with high-performance storage CPFS and high-performance networking HPN7.0. According to Alibaba officials, the Lingjun intelligent computing cluster achieves over 96% performance linearity at a scale of 10,000 cards, with parallel storage throughput of 20TB/s and network bandwidth utilization exceeding 99% at the same scale, supporting AI computing power at the scale of 100,000 cards in a single cluster, significantly outperforming domestic peers.

At the AI PaaS layer, Alibaba Cloud provides services such as the AI platform PAI, big data computing MaxCompute, and inference service EAS, covering mainstream AI frameworks and enabling integrated model training, data processing, and model deployment. Some domestic cloud providers lack capabilities at the AI PaaS layer, not due to a lack of desire, but because this field demands extremely high engineering expertise, and insufficient accumulation naturally renders it unattainable.

At the AI MaaS layer, Alibaba Cloud promotes AI democratization through open-source ecosystem building. The concept of MaaS (Model as a Service) was first introduced by Alibaba Cloud in the industry. On one hand, Alibaba Cloud offers its self-developed Tongyi series large models. On the other hand, it provides services for open-source large models like DeepSeek and Llama, including API access, model fine-tuning, and AI application development. Among them, Alibaba's self-developed 'Tongyi' large model actively pursues comprehensive open-sourcing in terms of 'full sizes,' 'full modalities,' and 'multi-scenarios,' with the number of derived large models exceeding 170,000 and a 17.7% market share, ranking first in China's large model enterprise market. Simply put, it is the model most favored by Chinese enterprises. For consumers and small and medium-sized enterprises, Alibaba Cloud's open-source model significantly lowers the threshold and cost of utilizing top-tier large models while offering greater flexibility in development, making it highly appealing to a vast array of enterprise customers.

Additionally, in the AI chip field, Alibaba Group CEO Wu Yongming previously hinted at a 'backup plan' during an earnings call, sparking considerable speculation.

Currently, from some definitive trends in the industry, future AI cloud growth will primarily be driven by demands such as multi-agent collaboration, contextual engineering, AI security, and large-scale API calls. These demands place increasingly stringent requirements on the complex engineering capabilities and vertical integration capabilities of AI cloud providers. Alibaba Cloud's full-stack self-research capabilities precisely offer significant advantages that peers lack in these areas, constructing a formidable competitive moat and providing robust support for its future development.

3

In a free-market economy, two groups exhibit the highest sensitivity in their perceptions: entrepreneurs who invest in real industries with substantial capital and investors who purchase listed company stocks with real money.

Alibaba Group's decision to invest RMB 380 billion over three years in AI infrastructure must stem from the decision-making team, led by Wu Yongming, recognizing opportunities that others overlook. The enthusiastic purchase of Alibaba Group's listed stocks by a large number of investors this year must reflect their belief in Alibaba Cloud's increasingly strong leadership potential in the AI field under Alibaba Group's umbrella.

Alibaba Cloud's financial performance indeed validates the industrial foresight of entrepreneurs and the acumen of excellent investors. In the past two quarters, Alibaba Cloud's revenue growth reached 18% and 26%, respectively, with AI-related income achieving triple-digit growth for eight consecutive quarters. Buoyed by its AI business, Alibaba Group's stock price recently reached a near-four-year high, with its total market value returning to HK$3 trillion.

However, all of this is merely the beginning. As the sole Chinese company among the world's four leading AI cloud providers and the only one in China's cloud computing sector with comprehensive full-stack AI capabilities, Alibaba Cloud is poised for even greater achievements in this pivotal AI decade.