Inspur Information: 90% Revenue Growth Signals the Prime Harvest Time for AI Computing Power

![]() 10/09 2025

10/09 2025

![]() 561

561

By Yang Jianyong

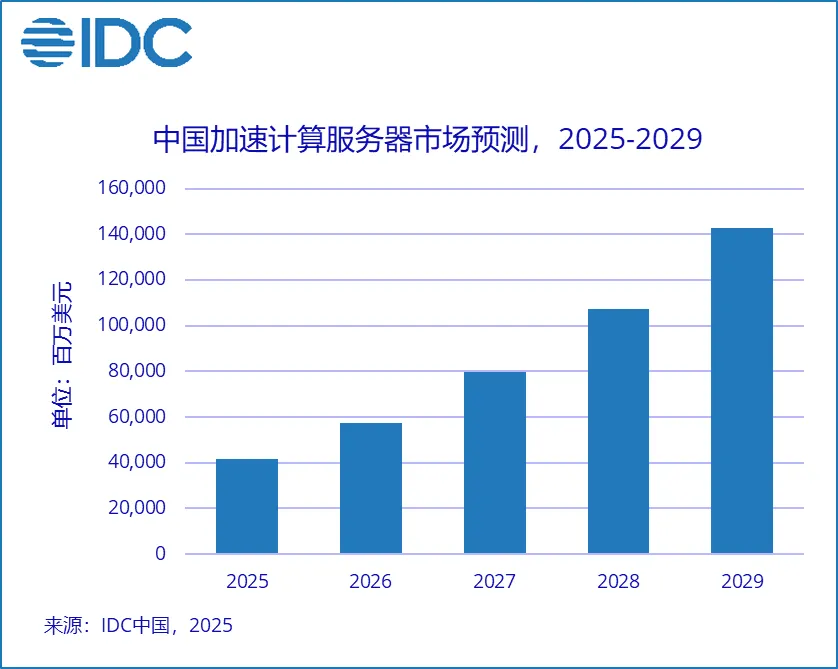

According to the latest IDC report, the Chinese market for accelerated servers soared to $16 billion in the first half of 2025, marking a more than twofold increase compared to the same period in 2024. IDC projects that this market will surpass $140 billion by 2029. In terms of vendor sales, Inspur, New H3C, and Lenovo emerge as the top three, collectively commanding nearly 50% of the market share.

In my opinion, this remarkable growth is propelled by the generative AI era, where industries are swiftly integrating large model services. Particularly with the advent of DeepSeek, its low cost, open-source nature, and outstanding performance have led to widespread adoption across various sectors. This enables a broader range of enterprises to deploy AI applications at a low cost, accelerating the implementation of AI innovations across industries and sustaining the demand for computing power.

The "2025 China AI Computing Power Development Assessment Report," jointly issued by IDC and Inspur Information, reveals that China's intelligent computing power reached 725.3 EFLOPS in 2024, reflecting a 74.1% year-on-year increase. Over the next two years, China's intelligent computing power is anticipated to maintain rapid growth. By 2025, it is projected to reach 1,037.3 EFLOPS, a 43% increase from 2024, and by 2026, it is expected to double to 1,460.3 EFLOPS compared to 2024.

Fueled by robust market demand and a variety of application scenarios, China's intelligent computing power is on an upward trajectory. For computing power vendors, this presents unprecedented growth opportunities. As China's most representative vendor, Inspur Information is reaping the benefits of this market boom.

Benefiting from the increased demand for computing power, Inspur Information's revenue nearly doubled. In the first half of 2025, revenue reached RMB 80.19 billion, a 90% year-on-year increase, while net profit reached RMB 798 million, up by 34.87%. Notably, Inspur Information is a server enterprise with capabilities in both hardware and large model development, boasting a market capitalization exceeding RMB 100 billion.

Inspur Information's "Yuan" series of foundational large models features an optimized model architecture that enhances intelligence while significantly reducing computing power consumption. This provides an efficient pathway for enterprises to develop generative AI applications with high performance and low computing power requirements. The recently launched super-node AI server, "Yuannao SD200," can run multiple large models with over a trillion parameters on a single machine.

At the algorithmic level, Inspur Information has established a synergistic approach for diverse and multi-modal methods, adopting a platform-based, full-stack optimization philosophy. This enhances the efficiency of large model application development through tool empowerment. Additionally, it introduced the "Yuannao Enterprise Intelligence" platform for enterprise large model development, offering tools for data preparation, model training, knowledge retrieval, and application frameworks to help enterprises easily overcome barriers in AI application development and deployment.

At the computing power level, Inspur Information is integrating AI computing into various computing platforms, promoting AI+ development under the "Yuannao" computing brand. To meet customer demand for inference computing power in large model deployment, it launched the "Yuannao R1" inference server, capable of deploying the "full-strength" DeepSeek-671B model on a single machine.

It also introduced the "Yuannao CPU" inference server, enabling users to experience the latest algorithms with low barriers to entry, quickly deploying and efficiently running next-generation inference models like DeepSeek-R1 32B and QwQ-32B. Furthermore, it released the "Yuannao Enterprise Intelligence DeepSeek All-in-One Machine," empowering customers and partners to rapidly deploy large models through software-hardware synergy and out-of-the-box functionality.

Inspur Information has reaped significant rewards from the new wave of global AI development driven by large models and generative AI, continuously enhancing its core competitiveness in hardware, computing power, and algorithms while developing an intelligent computing technology system centered on computing power and large models.

Unfortunately, compared to its rapid revenue growth, Inspur Information's profit growth lags, indicating a trade-off between scale expansion and profitability in the pursuit of market share.

In response to the situation of rapid revenue growth but declining gross profit margins, investors raised questions during an earlier earnings briefing, noting that the gross profit margin was only 3.45% in the first quarter of this year, even lower than Foxconn Industrial Internet's 4.99% for cloud computing in 2024. Is this a long-term trend or a short-term issue?

Inspur Information responded that gross profit margins are influenced by a combination of factors, including customer mix, product mix, raw material supply, and market competition. "Given market factors, fluctuations in gross profit margins are normal," said Peng Zhen, Chairman of Inspur Information.

Overall, Foxconn Industrial Internet and Inspur Information, as two typical domestic computing power service vendors, have successfully capitalized on the rapid growth of computing power. However, from a financial perspective, Foxconn Industrial Internet appears more stable, while Inspur Information has pursued a more aggressive expansion strategy. Although it has captured the computing power market, this has put pressure on its gross profit margins.

Finally, AI large models are undoubtedly the hottest technology today, driving a new growth cycle in the AI market. IDC data shows that global AI IT investment reached $315.9 billion in 2024 and is expected to rise to $1.26 trillion by 2029.

This global trend of capital expenditure expansion reflects that AI large model services have become a strategic high ground in technological competition. Cloud giants like Microsoft, Google, Amazon, and Alibaba, with substantial cash reserves and large free cash flows, will continue to invest heavily in data centers over the next few years to enhance their competitiveness in the AI market, significantly boosting demand for computing power. For computing power vendors, this is expected to drive performance growth through increased demand.

Yang Jianyong is a Forbes China contributor whose views are his own. He is dedicated to in-depth analysis of cutting-edge technologies such as artificial intelligence, AI large models, the Internet of Things, cloud services, and smart homes.