Perspective on Kingdee's Financial Report: 'AI+Management', Envisioning a Market Value Beyond 100 Billion

![]() 03/20 2025

03/20 2025

![]() 662

662

When the tide recedes, we discern the resilient players who have triumphantly reached shore.

On March 17, Kingdee International (0268.HK) unveiled its 2024 annual report, showcasing an operating cash flow of 934 million yuan, a 42.9% year-on-year increase; revenue of 6.256 billion yuan, up 10.2% year-on-year; and losses narrowed significantly by 32.2% to 142 million yuan.

From a holistic to a granular perspective, dissecting the subtle shifts across multiple enterprise dimensions, 'Market Value Observation' asserts that Kingdee now stands at the cusp of a new transformation cycle, with old and new drivers converging, further validating its upward trajectory.

['Cloud Walk' for 11 Years: Kingdee Successfully 'Breaks Out of the Cocoon']

In its 11th year of cloud transformation, Kingdee has successfully 'emerged from the cocoon' as anticipated.

The financial report reveals that in 2024, Kingdee's cloud services business generated revenue of 5.107 billion yuan, a 13.4% year-on-year increase, accounting for 81.6% of total revenue, up 2.3 percentage points from the previous year, solidifying its position as the company's core business.

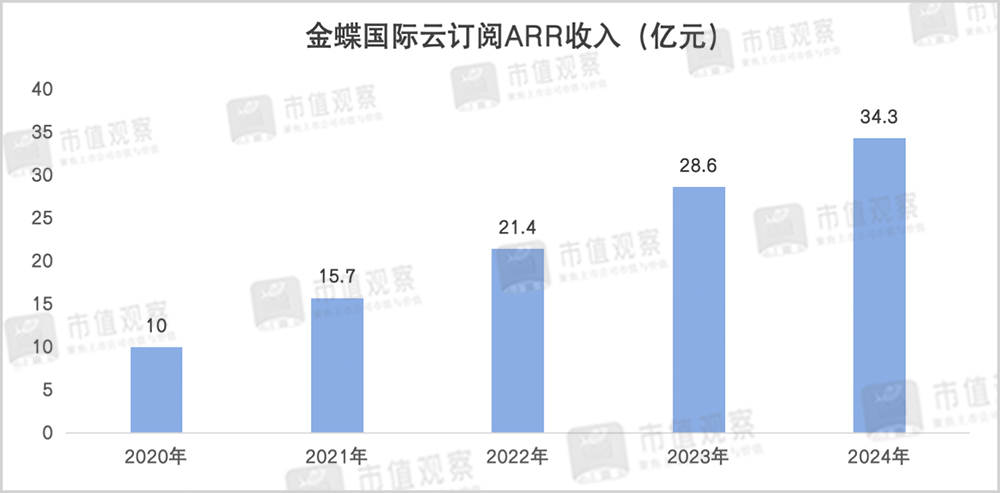

Specifically, the annual recurring revenue (ARR) of cloud subscription services amounted to 3.43 billion yuan, a 20% year-on-year surge. Extending the timeline, from 2020 to 2024, Kingdee's cloud subscription ARR grew from 1 billion yuan to 3.43 billion yuan, with a compound annual growth rate (CAGR) of 36%, demonstrating robust cyclical resilience.

In contrast, the national software and information technology services industry's revenue in 2024 was 13.73 trillion yuan, with a year-on-year growth rate of only 10.0%, a 3.4 percentage point decrease from 2023.

ARR signifies a continuous 'flow' of income from customer subscriptions, characterized by high repurchase rates, measurability, and certainty. It serves as the bedrock for future revenue expansion and is a crucial metric for assessing the financial health and true market value of SaaS enterprises.

With 3.43 billion yuan in cloud subscription ARR, Kingdee can ensure stability for three years, even without acquiring new customers, as long as it maintains a consistent renewal rate.

Regarding when Kingdee will cross the breakeven line, a question of great interest to external stakeholders, Kingdee disclosed that the operating profit margin of its cloud services business turned positive to 6% in the second half of 2024.

This signifies that, compared to its peers, Kingdee will be the first to bid farewell to the painful 'cash-burning' phase and enter the 'profit-making' takeoff stage sooner.

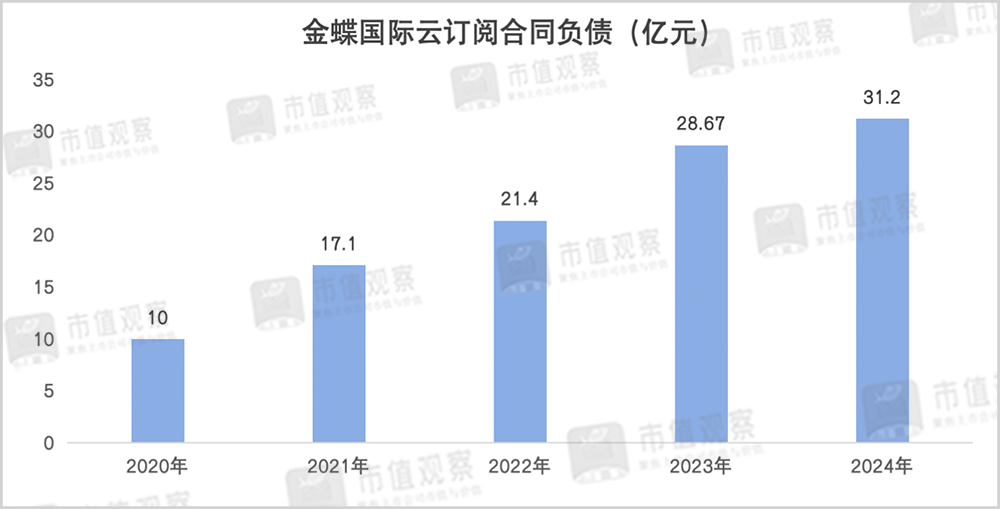

Behind the vitality of cloud subscription ARR lies Kingdee's robust contract liability 'reservoir'.

In 2024, Kingdee's cloud subscription service contract liability reached 3.12 billion yuan, a 28.5% year-on-year increase, virtually the largest in the industry, and a 5.4-fold jump from the end of 2019.

Contract liabilities, colloquially, represent money collected for services yet to be rendered. Kingdee International securely stores its 'grain' through contract liabilities, which progressively convert into actual income as services are delivered.

From a medium- to long-term perspective, it resembles having a 'reservoir' that continuously receives customer recharges, nourishing stable and sustained development.

Reflected in the financial statements, in 2024, Kingdee generated a net cash flow from operating activities of 934 million yuan, the highest since 2020.

In terms of customer acquisition, targeting large, medium, and small/micro enterprises, Kingdee 'fired three arrows simultaneously' and delivered a high-scoring 'answer sheet' of coordinated progress, avoiding neglect or imbalance.

Notably, in the previously weaker large enterprise services market, Kingdee Cloud Sky and Kingdee Cloud Xinghan have become adept at leveraging large orders through innovative AI applications and scenario implementation.

During the reporting period, Kingdee signed contracts with several Fortune 500 giants, including China National Petroleum Corporation, China Aviation, China Electronics, and China Life Insurance, recording a total cloud services revenue of 1.3 billion yuan, a 32.9% year-on-year increase; cloud subscription ARR surged 30.0% year-on-year; contract amount reached 2.1 billion yuan, a 51.9% year-on-year leap; and net amount renewal rate climbed from 97% in the semi-annual report to 108%.

In the view of 'Market Value Observation', the breakthrough in the large enterprise services market is significant not only due to the large contract values and long service life cycles but also because it connects to an entire ecosystem and the upstream and downstream of the industrial chain. That is, when Kingdee secures a business giant, it opens doors to more cooperation opportunities.

Next, let's shift focus to the medium and small/micro markets. In 2024, the former generated cloud services revenue of 2.15 billion yuan, a 10.3% year-on-year increase, with a net amount renewal rate of 95% and a customer base of 44,000; the latter generated cloud services revenue of 1.23 billion yuan, a 13.8% year-on-year increase, with a net amount renewal rate of 93%.

According to the Ministry of Industry and Information Technology's planning, by 2027, the cloud adoption rate of small and medium-sized enterprises will exceed 40%. This indirectly confirms that the digital penetration rate of numerous 'capillaries' is low, indicating a high growth 'ceiling'.

This territory has always been Kingdee's 'base camp', with strong discourse power and solid foundational skills. Coupled with macro policy promotion, it is poised to usher in new growth opportunities.

Currently, Kingdee ranks first in the Chinese SaaS cloud services market, with a high market share in enterprise SaaS ERM (Resource Management Cloud), financial cloud, and other domains.

Based on the above, it is evident that after a year of grinding, Kingdee International's core strength has been further bolstered, and it has fully transformed into a cloud service provider focused on the cloud subscription model and product orientation.

['AI+Management': Kingdee Embraces the DeepSeek Moment]

Great enterprises forge ahead while keeping an eye on future trends.

Through Kingdee's 'report card', we glimpse not only its past year's summary but also its foresight and grasp of current and future trends (AI).

At this financial report conference, Kingdee first announced its aspiration to become a globally leading AI company in enterprise management by 2030.

According to Omdia's latest report, benefiting from the maturity of AI technology and robust demand for enterprise digital transformation, the global AI+software market size will reach $97 billion in 2024, a 32% surge compared to 2023, and is projected to exceed $218 billion by 2029, with a compound annual growth rate of 18% over the next five years.

Kingdee has a prophetic insight into AI and has repeatedly emphasized the core strategy of 'subscription first, AI first' in public forums.

As early as 2017, the company began exploring AI technology. Since then, from the launch of the Kingdee Cloud Sky platform in 2018, to the unveiling of the Kingdee Cloud Sky GPT large model platform and China's first large financial management model in 2023, to the introduction of the AI management assistant and Sky APP in 2024, Kingdee has consistently been at the industry's forefront.

The term 'AI first' transcends the product level, signifying that Kingdee will embrace AI wholeheartedly, leveraging it for all solvable challenges. Simultaneously, adhering to its new mission of 'Empowering Enterprises to Achieve Extraordinary Results', it aids customers in converting beta potential into operational momentum.

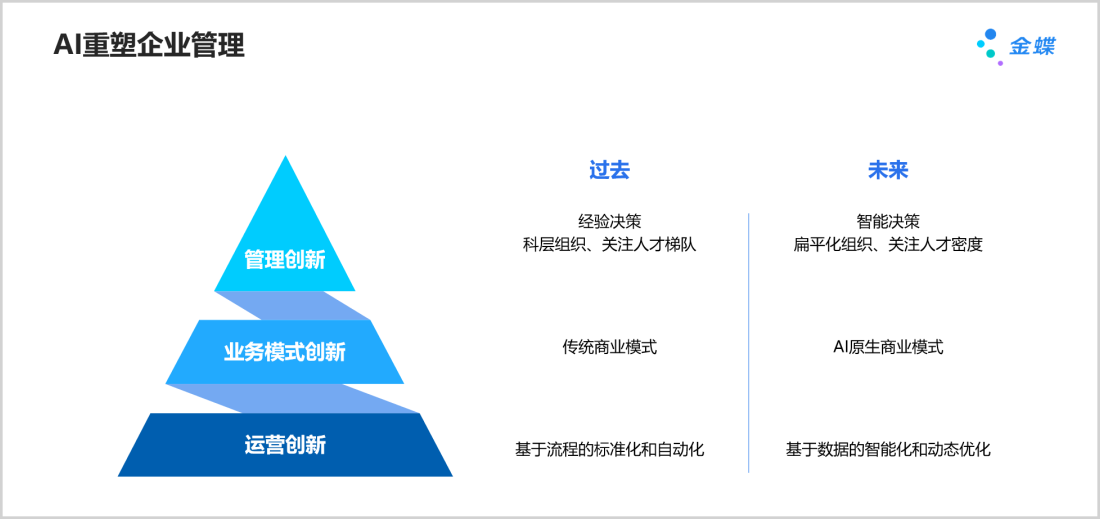

In Kingdee's view, with the advent of DeepSeek, we will enter the era of AI for all, reshaping enterprise management.

Specifically, Kingdee will adopt the 'AI+Management' paradigm, encompassing three levels: operational innovation, business model innovation, and management innovation. It will replace the old 'calendar' of 'process-based automation and standardization', 'traditional business models', and 'experience-based decision-making' with new productive forces of 'data-driven intelligence', 'AI-native business models', and 'intelligent decision-making', as illustrated below.

According to 'Market Value Observation', to date, Kingdee has provided '1+1+N' intelligent capabilities centered around enterprise-level AI applications of 'AI+Management', comprising 1 Sky APP, 1 Agent platform, and N intelligent agents, along with over 100 AI application scenarios spanning finance, HR, supply chain manufacturing, and application development, to assist enterprises in reshaping their business capabilities.

At the application level, these have been implemented in numerous high-tech fields such as photovoltaics, advanced manufacturing, robotics, and life sciences, with contracts signed with 20 customers, including Hisense Group, Wens Group, Zhiyang Innovation, and Hubei China Tobacco. Kingdee Cloud Xinghan has launched over 20 AI applications and signed contracts with nearly 20 large enterprises. Among them, Wuchan Zhongda enhances financial management process efficiency with intelligent data insights; Tongwei deploys HR AI assistants for intelligent inquiries, seamless order submission, and one-click navigation; and Zhongchuan Jiujiang improves contract management and review efficiency while reducing contract risks through intelligent contract management.

The applications jointly developed by Hisense Group and Kingdee, such as the intelligent living platform, intelligent qualification assessment, and intelligent cadre inspection, involve nearly 20 sub-business scenarios, amplifying endogenous energy, increasing the internal recruitment ratio by 120%, and enhancing the efficiency of the cadre inspection process by 70%.

It is evident that Kingdee's empowerment or value-addition to enterprises is not mere verbal promises but quantifiable and tangible results.

In Gartner's recently released first 'China AI Code Assistant Market Guide', Kingdee successfully made the list with its Sky AI programming assistant, being the only selected Chinese management software enterprise, fully demonstrating its leading position and profound strength in the AI domain.

As the saying goes, 'What you sow, you shall reap.' Kingdee's customer-centric considerations and dedication will ultimately benefit itself, integrating into its DNA to become a flywheel driving continuous performance enhancement.

Amidst the AI revolution, 'Market Value Observation' believes that Kingdee's pioneering actions are likely to reap the 'first taste' of the era's dividends.

Reflecting on past experiences, in the PC era, while IBM invented the personal computer, it was Microsoft, with its killer applications (like Windows and Office), that truly reaped substantial profits. In the mobile internet era, while Google deeply optimized the Android system, the biggest winners were application giants like Facebook, TikTok, and X, which grew rapidly leveraging the platform ecosystem.

From this perspective, Kingdee, empowered by AI, is also expected to embrace its own 'DeepSeek moment', not only with rapidly advancing product capabilities but also with a significantly extended revenue and profit radius, fueled by multiplier effects and accelerated competitive barriers.

[Conclusion]

From a traditional ERP vendor to a cloud service provider, 'AI+Management' has shattered the growth 'ceiling'. Clearly, a better Kingdee is on the horizon.

At this financial report conference, Kingdee once again led the industry by providing a 2025 profit guidance.

Following established economic laws, when the facts of mutual pursuit and fully loaded expectations are reflected in the capital market, Kingdee, which has previously touched a market value of over 100 billion, now holds even greater imagination and may usher in a 'Davis Double Play' of double boosts in both performance and valuation.

For investors, it is time to re-evaluate Kingdee.

Disclaimer

This article involves content related to listed companies, based on personal analysis and judgment by the author, derived from information publicly disclosed by listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms, etc.). The information or opinions in the article do not constitute any investment or other business advice. 'Market Value Observation' does not bear any responsibility for any actions taken as a result of adopting this article.

——END——