Yicheng Interactive IPO: Scrutiny over Ties with Yuxin Tech and Deep Reliance on Alibaba Cloud

![]() 03/16 2024

03/16 2024

![]() 612

612

Author | Fangfang

Source | New Economy Observer Group

On February 26, Beijing Yicheng Interactive Network Technology Co., Ltd. (hereinafter referred to as "Yicheng Interactive"), a bank IT solution provider, made new progress in its IPO on the ChiNext board. According to the official website of the Shenzhen Stock Exchange, it has issued a letter to implement the review center's opinions to the company. This is also the latest development after Yicheng Interactive first submitted its prospectus on June 27, 2022, and underwent two rounds of regulatory inquiries.

As an IT solution provider, 80% of Yicheng Interactive's procurement relies on its major customer Alibaba Cloud, but its R&D expense ratio has consistently been less than 10%, lower than comparable listed companies. In addition, due to its intricate relationship with competitor and long-time friend Yuxin Tech, Yicheng Interactive has encountered regulatory inquiries twice, with the inquiry letter mentioning "Yuxin Tech" 143 times. Yuxin Tech, which has been listed for many years, far surpasses Yicheng Interactive in terms of operating scale and market share.

Founded in 2012, Yicheng Interactive is an emerging IT solution provider. The company's main business focuses on the internetization and digital transformation of financial services, mainly providing integrated solutions to financial institutions, mainly banks, including mobile banking, internet banking, open banking, transaction banking, business intelligence, etc., covering services such as innovation, architecture design, software development, testing, and operation and maintenance.

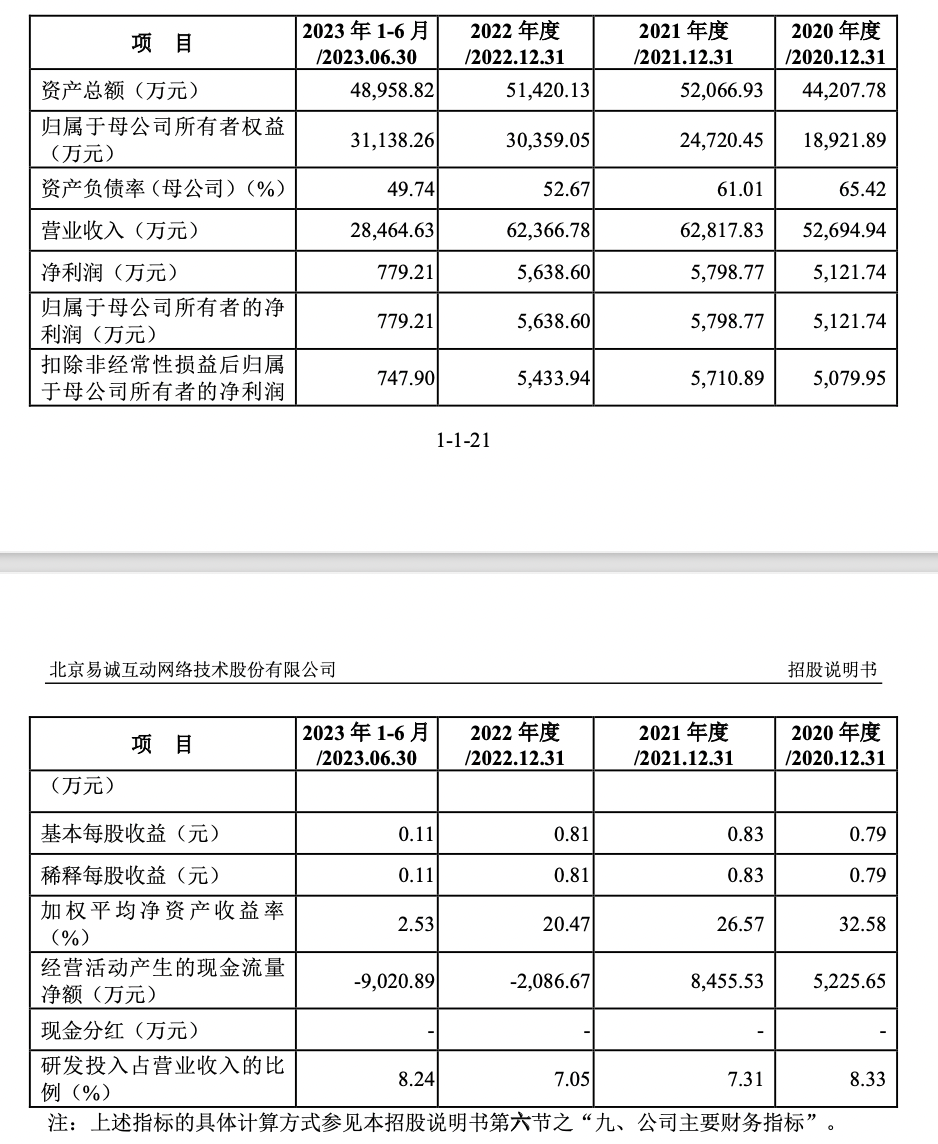

To date, Yicheng Interactive has served many well-known commercial banks, including China Guangfa Bank, Bank of Hangzhou, Bank of Communications, and others. However, despite the continuous expansion of its customer base, Yicheng Interactive's operating status is not optimistic. According to the latest updated prospectus, the company's revenue reached 527 million yuan, 628 million yuan, 624 million yuan, and 285 million yuan in the first half of 2020-2023, respectively.

It can be seen that in recent years, Yicheng Interactive's revenue growth has significantly slowed down. From 2020 to 2022, the company's revenue growth rates were 26.41%, 19.21%, and -0.72%, respectively, with the growth rate declining year by year and even turning negative in 2022.

At the same time, Yicheng Interactive's net profit performance is also unsatisfactory. In the first half of 2020-2023, the company's net profits attributable to the owners of the parent company were 51.2174 million yuan, 57.9877 million yuan, 56.386 million yuan, and 7.7921 million yuan, respectively. It can be seen that in 2022, both Yicheng Interactive's revenue and net profit declined, and the situation has become very severe.

In addition to concerns at the operational level, Yicheng Interactive also has the shortcoming of excessive reliance on major suppliers.

According to the prospectus, during the reporting period, the procurement ratios of Yicheng Interactive's top five suppliers were 96.06%, 98.28%, 94.92%, and 100%, respectively. These five suppliers almost "monopolized" Yicheng Interactive's procurement sources. Among them, Yicheng Interactive's procurement ratio from Alibaba Cloud Computing Co., Ltd., the largest supplier, was as high as 86.02%, 89.42%, 84.52%, and 53.77%.

In addition to being Yicheng Interactive's largest supplier, Alibaba Cloud is also its major customer.

During the reporting period, Yicheng Interactive's sales to Alibaba Cloud reached 8.107 million yuan, 13.3556 million yuan, 3.5651 million yuan, and 3.6006 million yuan, respectively. The Shenzhen Stock Exchange has obviously paid close attention to this, raising issues in the first round of inquiries about the overlap between Yicheng Interactive's customers and suppliers, asking Yicheng Interactive to explain the reasons for being both a customer and a supplier of Alibaba Cloud, Jirong Cloud, and Ant Cloud during the reporting period, the related product and service procurement and sales situations; whether procurement and sales are independently executed, whether prices are fair, and whether they have reasonable business logic.

In response, Yicheng Interactive explained that there is sufficient competition in the domestic financial cloud platform solution market, and the company can choose different cloud platform suppliers for procurement. For the company, the products of different cloud suppliers are highly interchangeable, and there are no technical barriers to deployment when switching between different private cloud platforms. Listed companies in the same industry have formed cooperation with one or more cloud platform suppliers, and the company can also provide software development for different customers based on different cloud platforms, with no significant differences from listed companies in the same industry. Therefore, the company does not have a significant reliance on Alibaba Cloud and has the ability to independently conduct business.

Nevertheless, this still cannot conceal the fact that Yicheng Interactive relies heavily on Alibaba Cloud. It has been almost two years since the company submitted its prospectus, during which it has repeatedly faced regulatory inquiries, and its IPO journey has not been successful. The above operating structure may be one of the reasons.

However, the stumbling block for Yicheng Interactive's listing is not limited to this. Its intricate relationship with Yuxin Tech has also frequently attracted regulatory attention.

On the one hand, Zeng Shuo, the actual controller of Yicheng Interactive, once jointly established Yuxin Yicheng (the predecessor of Yuxin Tech) with Hong Weidong, the actual controller of Yuxin Tech, but later parted ways due to differences in development strategies and business philosophies. On the other hand, after Zeng Shuo's "departure," several senior management members of Yuxin Tech also "departed" and joined Yicheng Interactive as core team members. In addition to Zeng Shuo, Zhong Mingchang, a director of the company, once served as the vice president of Yuxin Tech, and Peng Jizhou, the chairman of the company's board of supervisors, once served as the deputy general manager of Yuxin Tech's channel business department.

Regarding the complex relationship between Yicheng Interactive and Yuxin Tech, the Shenzhen Stock Exchange raised multiple questions in two rounds of inquiries, asking Yicheng Interactive to explain the relationship between the company and its subsidiaries and Yuxin Tech, whether Yuxin Tech has ever invested in the company or its subsidiaries, and whether there are any assets from Yuxin Tech. The term "Yuxin Tech" appeared as many as 143 times in the first round of inquiries.

In the second round of inquiries, the Shenzhen Stock Exchange still required Yicheng Interactive to further explain the adequacy of the basis for determining that the company does not have assets from Yuxin Tech based on relevant circumstances.

In response, Yicheng Interactive explained that Yuxin Tech, operated by the Hong Weidong team, has not invested in the company, and there is no direct or indirect investment relationship. Since the establishment of the company's predecessor, there has been no relationship between the company and Yuxin Yicheng or the renamed Yuxin Tech.

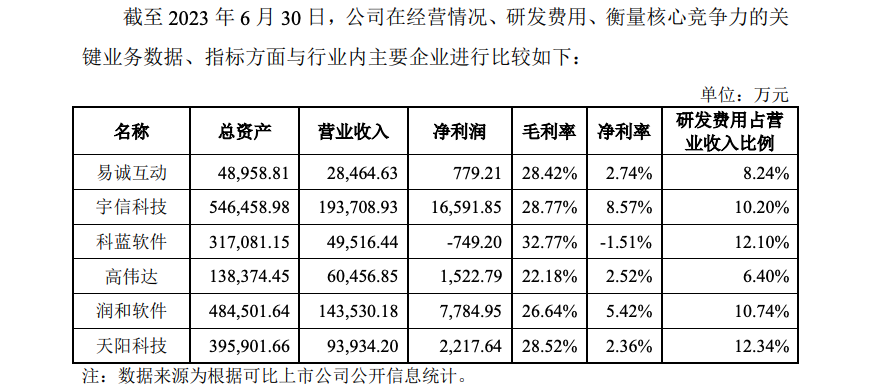

Although Yicheng Interactive clarified its complex relationship with Yuxin Tech in the explanation, Yuxin Tech's prior listing has made it impossible for Yicheng Interactive to escape its shadow throughout the IPO process. In the prospectus, Yicheng Interactive has even repeatedly listed Yuxin Tech as a competitor, but the latter far surpasses Yicheng Interactive in terms of total assets, revenue, net profit, and other aspects.

Taking the period ending June 30, 2023 as an example, Yuxin Tech's total assets have reached 5.465 billion yuan, while Yicheng Interactive has only 490 million yuan, which is only a fraction of the former. Yuxin Tech's revenue reached 1.937 billion yuan, nearly seven times that of Yicheng Interactive, and its net profit is as high as 166 million yuan, more than 20 times that of Yicheng Interactive.

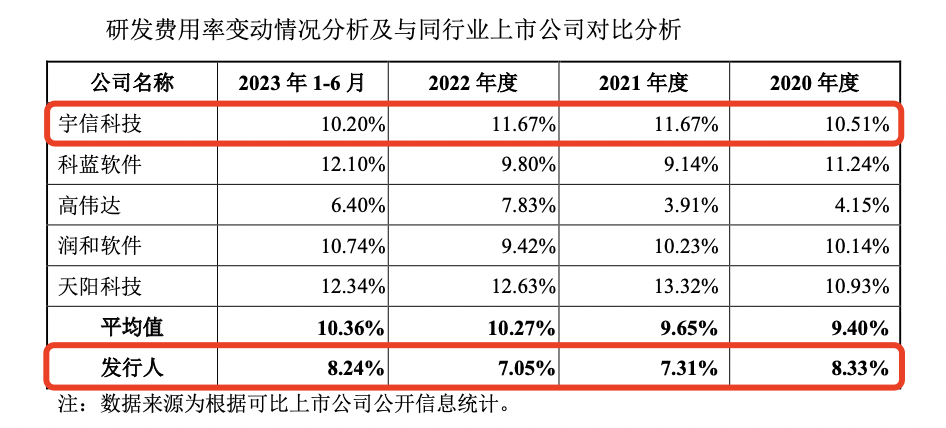

Moreover, during the reporting period, Yicheng Interactive's R&D expense ratio was only 8.33%, 7.31%, 7.05%, and 8.24%, consistently below the double-digit mark and lower than Yuxin Tech's 10.51%, 11.67%, 11.67%, and 10.20% over the same period.

For Yicheng Interactive, as an IT solution provider, it cannot go all out in research and development, which may also be related to its heavy procurement of Alibaba Cloud. However, as a company planning to list on the ChiNext board, having solid technological strength is a prerequisite for gaining recognition from the capital market. Therefore, Yicheng Interactive still needs to continue improving its R&D capabilities and profitability.