The Rise of ByteDance's Gaming Empire: A Strategic Shift from Food Delivery

![]() 07/20 2025

07/20 2025

![]() 477

477

Source: ByteSource

Just as the world thought ByteDance's gaming ambitions had waned, fresh news of its expansion ripples through the industry.

According to insiders, ByteDance's Moonton Technology has successfully acquired Hangzhou Xinguangliumei, finalizing the transaction by the end of June, although the specific acquisition amount remains undisclosed. Moreover, Xinguangliumei isn't the only game company capturing ByteDance's attention; currently, another SLG game team is in active negotiations.

Having learned from the pitfalls of its previous aggressive "miracles through effort" approach, ByteDance's gaming division is "re-entering" the domestic market with a fresh strategy of "controlled expansion." By acquiring teams with domestic business acumen like Xinguangliumei, ByteDance aims to establish a firm foothold and broaden its presence in the domestic gaming landscape.

Conversely, ByteDance's once high-profile local life business has faded into the background, overshadowed by the intense subsidy wars waged by Alibaba, Meituan, and JD.com. Only recently has ByteDance introduced an AI-driven food recommendation service named "Tanfan" and subsequently adjusted its "Suixin Tuan" business. In response, ByteDance clarified to the media that Douyin's life services focus on on-site businesses and have no intention of venturing into food delivery services.

Amid the narrative of Internet giants prioritizing cost reduction and efficiency enhancement, ByteDance has retained its gaming division. With the current influx of game licenses, ByteDance hopes to capitalize on this opportunity and propel its gaming business forward. Having achieved notable success in its overseas gaming endeavors, the division boasts a higher success rate and return on investment compared to the money-intensive food delivery sector.

01

Games Are Still in the Game

In the latter half of 2022, ByteDance's gaming division underwent significant layoffs, studio closures, and a wave of job cuts, leading many to believe that ByteDance's gaming dreams had been shattered.

Post-layoffs, ByteDance's self-developed gaming efforts shifted focus to overseas markets. Studios specializing in overseas projects, such as Beijing Oasis Studio, Hangzhou Jiangnan Studio, and Shanghai Wushuang Studio, also underwent minor adjustments, with layoff rates below 20%. Notably, Hangzhou Jiangnan Studio produced the highly anticipated self-developed title "Planet: Restart," which launched concurrently with Tencent's similar game "Daybreak Awakening: Life" in Hong Kong, Macao, and Taiwan, sparking a "distant rivalry."

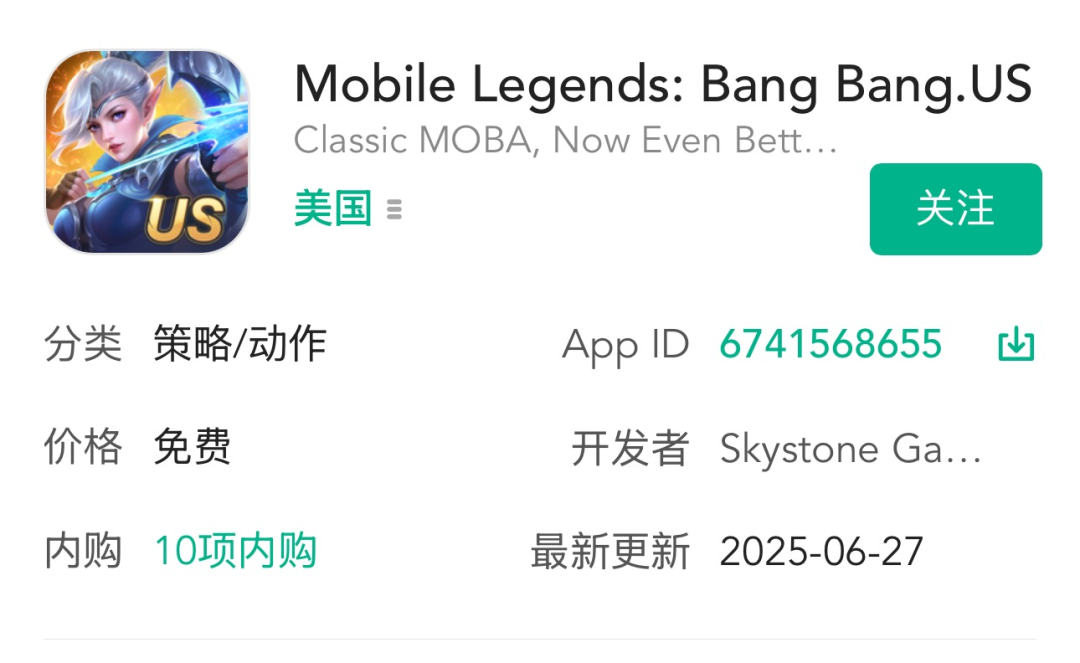

However, ByteDance's most successful overseas project is Moonton Technology's "Mobile Legends: Bang Bang" (also known as "Mobile Legends: Adventure"). This game topped the App Store bestseller charts in 13 countries and ranked among the top ten in 53 countries, surpassing even "Vainglory," hailed as the pioneer of mobile MOBA, and bringing honor to domestic mobile games.

Game "Mobile Legends: Bang Bang" | Screenshot from Qimai Data

Thus, ByteDance's gaming division was merely hampered by its aggressive "miracles through effort" model, not left empty-handed. According to media reports, the overall valuation of ByteDance's gaming projects up for sale at the time hovered around 40 to 50 billion yuan.

At such a valuation, ByteDance may not compete head-to-head with gaming giants like Tencent, NetEase, and miHoYo in the domestic market, but it can solidly occupy the second tier.

In March 2024, ByteDance issued an internal letter announcing the re-incubation of its gaming division, with former Perfect World Games President Zhang Yunfan assuming overall responsibility in May of the same year. Zhang Yunfan's appointment and subsequent large-scale project launches by ByteDance Games, such as the establishment of the Zero36 Studio and the agency distribution of "Hatsune Miku: Colorful Stage," signal the recovery and controlled expansion of ByteDance's gaming division.

This controlled expansion entails no longer providing strategic funding for the gaming division but emphasizing "internal blood generation." After over a year of adjustments, ByteDance Games appears confident in its "return" to the domestic market. Beijing Oasis Studio's "Mist Hunter" (a third-person PvPvE survival evacuation game) obtained a game license this June and is expected to launch on Steam within the year. Built with the UE5 engine, it offers a "sci-fi realism + biological swarm" gameplay aimed at attracting hardcore players. Additionally, Volcano Engine has partnered with Giant Network to integrate the Doubao large model into "Among Us," achieving AI-native gameplay upgrades like dynamically adjusting reasoning difficulty and generating personalized plots in real-time, resulting in an 18% increase in user retention during testing.

02

Games Are the "Top Students"

Amid ByteDance's frequent adjustments to non-core businesses and emphasis on "cost reduction and efficiency enhancement," the gaming division has been retained and even exhibits an expansion trend.

Among ByteDance's diverse businesses, gaming stands out as one of the few "top students."

In contrast, ByteDance's ventures into sectors like VR and education have yielded minimal results, with most projects being disbanded. As for its heavily invested local life business, it has recently been completely overshadowed by the subsidies offered by Alibaba, Meituan, and JD.com.

The gaming division, particularly "large DAU games," holds significant strategic importance for ByteDance.

When ByteDance first ventured into gaming, it recognized the huge DAU potential of "national-level games" like MOBA and battle royale. If it could nurture its own "national-level game," even if it couldn't outshine giants like Tencent, it would still have the potential to compete.

Through Moonton Technology's "Mobile Legends: Bang Bang," ByteDance has validated its ability to compete in the large DAU sector and isn't powerless in the domestic market. Thus, the gaming division not only provides financial revenue but also serves as another traffic foothold for ByteDance in overseas markets, offering substantial strategic significance.

Zhang Yiming once remarked at a ByteDance all-hands meeting in 2020 that while there hadn't been a major breakthrough in the gaming division, there had been progress, and patience was required. However, facts have proven that patience isn't the only test for a business; teamwork, product genes, and timing are equally crucial.

ByteDance's previous contraction in the gaming industry was partly influenced by the significant reduction in game licenses in 2021, overlooking macro-level impacts. Nowadays, game licenses have seen a surge in approvals. On June 24, the State Administration of Press and Publication announced the domestic and imported game licenses for June. A total of 147 domestic games and 11 imported games were approved, amounting to 158 games successfully approved, setting a peak for the number of licenses issued this year. The number of domestic game licenses is the highest for a single month since 2022.

According to Sensor Tower data, "Honor of Kings" remained at the top of the global mobile game revenue rankings in May, while "Whiteout Survival" jumped to second place. This not only underscores the vast potential of the domestic market but also indicates that high-quality content can still shine even in the most competitive environments.

This time, having learned from the pitfalls of its previous "miracles through effort" model, ByteDance intends to capitalize on the historic "flood" of game licenses to make another strategic move.

03

Changing Tactics

To re-enter the domestic market, ByteDance still lacks a solid foothold, and the rumored acquisition target, Xinguangliumei, fits this role perfectly.

This summer's gaming season is poised to become the "most competitive" period in Chinese gaming history. With 26 new games officially scheduled for July and 15 limited tests successively launched, market competition has reached unprecedented levels.

Amid such intense competition, it would be more pragmatic for ByteDance to directly initiate an acquisition mode rather than painstakingly engage in self-research.

Zhang Yunfan's appointment and subsequent large-scale project launches by ByteDance Games, such as the establishment of the Zero36 Studio and the agency distribution of "Hatsune Miku: Colorful Stage," all point to the recovery and controlled expansion of ByteDance's gaming division.

The acquisition of Xinguangliumei underscores that ByteDance hasn't completely abandoned the domestic market in its gaming business but is "re-entering" in a new way by acquiring companies with domestic business experience. This strategy, which focuses on overseas self-research while retaining the "spark" of overseas business, forms a trend of "striking back" into the domestic market after accumulating experience from overseas.

Currently, Xinguangliumei's "Radiant Strike" and "Dark Shuttle" have obtained game licenses, and the agency for "Radiant Strike" is handled by ByteDance's Nubian Technology, ensuring smoother internal integration.

Screenshot from TapTap

An insider revealed that ByteDance's acquisition of Xinguangliumei is also closely tied to the potential of "Radiant Strike." Based on its performance in previous tests, this game fully embodies Xinguangliumei's unique style and is undoubtedly an anticipated and promising work.

Currently, ByteDance is also in talks to acquire another SLG game team. The SLG category has always been a "cash cow" in the gaming industry, so ByteDance's intention to deploy in this field is evident.

After a round of business contraction last year, ByteDance is now back in the acquisition game, sending a clear signal: ByteDance's ambition in the gaming field has never waned; it has merely changed its tactics.

Some images are sourced from the internet. Please inform us for deletion if there is any infringement.