At 45, Yao Ming Is Eligible for Pension, While 51-Year-Old Liu Qiangdong Still Aims to Make Waves in the Auto Industry

![]() 10/15 2025

10/15 2025

![]() 670

670

Lead

Introduction

JD.com is set to revolutionize the auto industry with a distinctive strategy.

During the recent NBA China Game, Yao Ming mentioned discussing pension plans with players. Born in 1980 and having played nine seasons in the NBA, Yao meets the eligibility criteria for NBA pension benefits. Receiving a pension at 45 has ignited widespread discussion and envy.

Meanwhile, as Yao Ming stands on the cusp of receiving his pension, news has surfaced that 51-year-old Liu Qiangdong plans to dive into automobile manufacturing.

On October 14th, JD.com announced a partnership with CATL's Times Electric Service and GAC Group to unveil a new vehicle on November 9th. Many media outlets interpreted this move as JD.com's formal entry into the auto industry, with plans to manufacture and introduce JD-branded vehicles.

Sources close to JD.com revealed, "JD.com will primarily provide consumer insights and exclusive sales channels without directly engaging in manufacturing." Specifically, JD.com will leverage its resources in user insights, vehicle purchasing, and maintenance. GAC Group will contribute its vehicle manufacturing capabilities, while CATL will provide battery technology and battery-swapping ecosystems, ultimately creating a one-stop automotive consumption model.

01 JD.com's Unique Approach to Auto Manufacturing

In fact, cross-industry capital ventures into auto manufacturing are not new.

Companies like Huawei, Xiaomi, Evergrande, Baoneng, LeTV, Skyworth, and even Wuliangye have all been rumored to enter the automotive sector. These giants from the internet, technology, home appliances, and real estate industries have all dipped their toes into auto manufacturing in various ways.

During this period, some, like Huawei and Xiaomi, have achieved success, while others, like Evergrande and Baoneng, have quietly exited. Despite these varied outcomes, the enthusiasm of new entrants remains undiminished, as evidenced by Dreame's recent announcement to enter the market.

Now, even JD.com has announced its foray into auto manufacturing.

However, among the numerous cross-industry players, JD.com has chosen a distinct path.

JD.com's collaboration brings together leading forces from three key sectors of the auto industry. CATL, a global power battery giant, provides battery technology and battery-swapping ecosystems through Times Electric Service. GAC Group contributes its vehicle manufacturing capabilities and comprehensive safety technologies. JD.com's role is clear: to leverage its strengths in user insights, sales channels, and service networks.

According to JD.com's announcement, this "National Favorite Car" integrates JD.com's resources in user insights, vehicle purchasing, and maintenance, along with GAC's manufacturing capabilities and CATL's battery technology and battery-swapping ecosystem.

This division of labor clearly differs from the heavy-asset model of internet companies like Xiaomi and Baidu, which directly engage in manufacturing. From a collaborative standpoint, JD.com acts as a bridge, efficiently connecting upstream manufacturing with downstream demand.

Despite its unique approach, JD.com's determination to enter the auto sector appears bold in today's harsh market environment.

We all know that behind the impressive sales figures in China's 2025 auto market lies a harsh reality: over half of dealers are operating at a loss, once-glorious joint venture brands are exiting the market, and domestic new-energy vehicle startups are closing one after another. All these reveal the ruthless side of the auto market.

Faced with such fierce competition, why is JD.com venturing into the auto sector?

Perhaps the answer lies in JD.com's chosen asset-light model.

As mentioned earlier, unlike Xiaomi's massive investment in building its own factories or Baidu's collaboration with Geely to create Jidu Automotive, JD.com has explicitly stated it will not directly engage in manufacturing. This approach significantly reduces JD.com's entry risks and capital investment.

Moreover, JD.com's core strengths lie in its vast user base, precise consumer insights, and robust online and offline sales networks. JD.com possesses shopping data from hundreds of millions of Chinese consumers, enabling it to accurately understand user demands for car prices, configurations, and performance, thus collaborating with manufacturers to launch models that better meet market needs.

Additionally, JD.com's platform serves as a natural sales channel for automobiles.

According to official plans, the new vehicle will be officially launched during the Double 11 shopping festival and exclusively sold on JD.com's platform. This means JD.com can directly reach potential car buyers without establishing a vast network of 4S dealerships like traditional automakers.

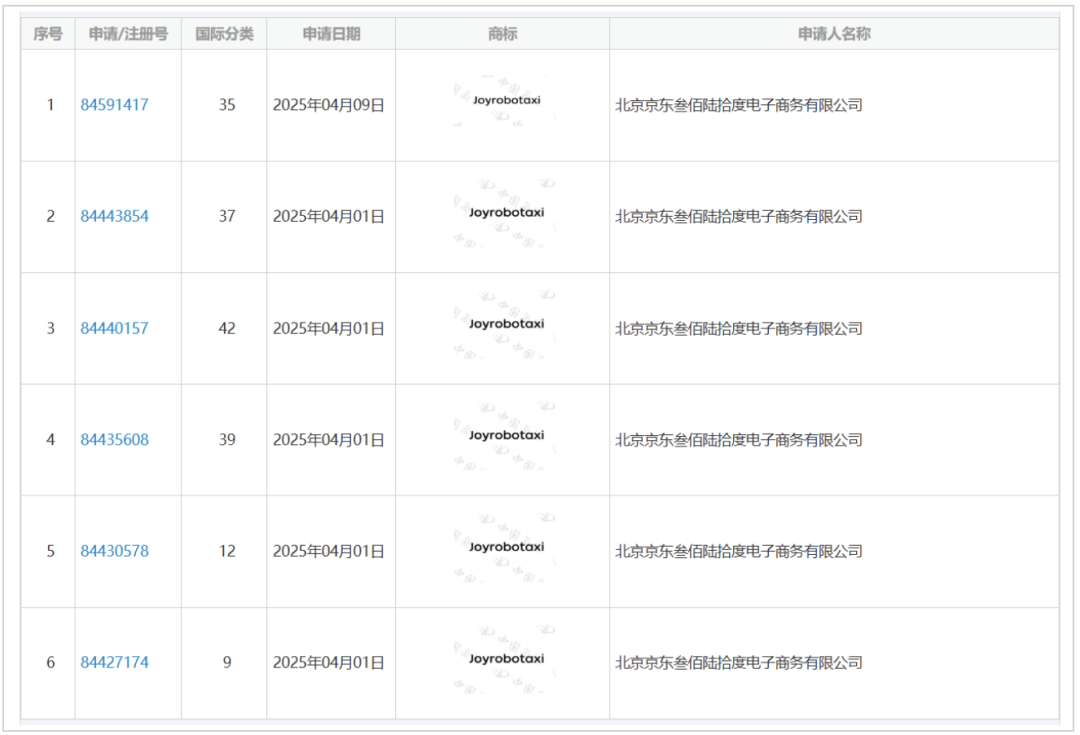

In June of this year, JD.com applied to register the "JoyTaxi" trademark in Hong Kong, China, hinting at a potential entry into the Robotaxi market. Subsequently, in July, JD Logistics unveiled its self-developed light truck product, the JD Logistics Autonomous VAN, designed to enhance logistics efficiency with a maximum range of 400 kilometers on a full charge and L4-level autonomous driving capabilities on public roads.

These moves indicate that JD.com's interest in the auto sector is not a passing trend but part of a long-term strategic plan.

02 JD.com's Ambitions

JD.com's chosen partners each possess significant advantages in their respective fields, enhancing the project's likelihood of success.

Firstly, CATL, as a global leader in power batteries, not only provides battery technology but also addresses range and charging challenges for electric vehicles through its chocolate battery-swapping ecosystem. Notably, in April of this year, CATL, along with five major automakers including GAC Group, unveiled ten new chocolate battery-swapping vehicle models.

GAC Group, as one of China's leading automakers, boasts a complete production process and quality control system. Additionally, Aion, GAC Group's new energy vehicle brand, has established a strong market reputation.

According to reports, the new vehicle jointly launched by JD.com, CATL, and GAC is expected to be an Aion battery-swapping model. Industry insiders interpret that this "National Favorite Car" will focus on four key aspects: stylish design, safety performance, range capabilities, and affordability, striving to achieve the optimal balance.

Beyond the product itself, this collaboration introduces an innovative "one-stop solution" consumption model.

Users can choose not only the standard vehicle model but also flexible options covering custom car wraps, accessory installations, maintenance services, and more, providing full-cycle coverage from purchase to usage. This innovative model leverages JD.com's core strengths in user insights and service integration.

Of course, it cannot be denied that JD.com faces an exceptionally competitive market in its cross-industry venture into auto sales.

China's auto market in 2025 has transitioned from scale expansion to quality competition. In the first eight months of this year, domestic new energy vehicle sales exceeded 8 million units, with a penetration rate rising to 48%. It is expected that the full-year penetration rate will surpass 50% in 2025. This milestone not only represents a numerical increase but also signifies China's auto market entering a new era dominated by new energy vehicles.

However, automobiles, as highly complex consumer goods, require long-term investment and accumulation in after-sales service systems and maintenance networks. While JD.com can rely on its existing automotive service network, providing full lifecycle services comparable to traditional automakers still poses numerous challenges.

Therefore, for JD.com, the significance of this cross-industry venture may lie more in exploring new auto sales and service models. Given the widespread losses among traditional dealers, JD.com's combination of online sales and service network points may bring about a revolution in the auto distribution sector.

Looking back, JD.com's entry into the auto sector may seem ill-timed, but its asset-light approach allows it to bypass heavy manufacturing and focus on its strengths in user insights and sales services. In the crowded auto manufacturing landscape, JD.com is less a competitor and more a service provider connecting people with cars.

Editor-in-Chief: Yang Jing Editor: He Zengrong