Inflection Point Unveiled! Inovance Pioneers Industrial Control, Estun Dominates Market Share, STEP Electric & Haier Drive Turnaround from Losses to Profits

![]() 10/15 2025

10/15 2025

![]() 524

524

By Yang Jianyong

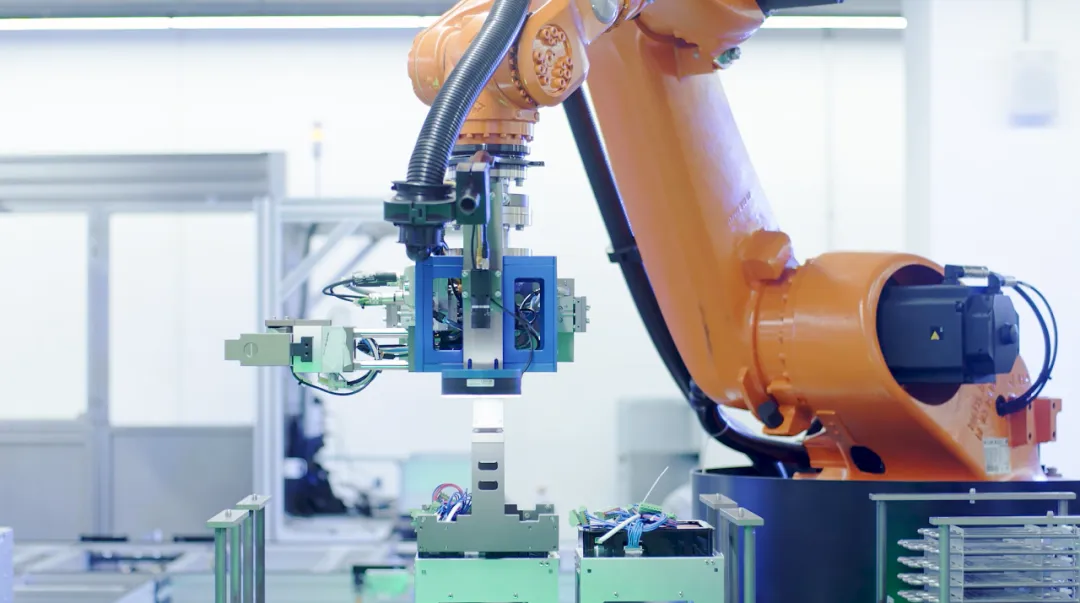

Following two years of profound transformation, the industrial robot sector has reached a pivotal juncture in 2025, with demand signaling a resurgence. Against the backdrop of China's burgeoning smart manufacturing landscape, the industrial robot industry is witnessing robust double-digit growth.

According to MIR Databank, in the first half of 2025, cumulative shipments of industrial robots surpassed 163,000 units, marking a 16% year-on-year surge. Among these, five companies - Estun, Fanuc, KUKA, Inovance, and ABB - each exceeded 10,000 units in sales during the same period.

Fueled by the burgeoning new energy vehicle and semiconductor sectors, manufacturing firms are accelerating their automation upgrades, serving as the cornerstone for the industrial robot market's expansion.

Capitalizing on the double-digit growth in the industrial robot market, manufacturers like Inovance Technology, Estun, and STEP Electric have delivered stellar performances.

Inovance Technology

Initially, the Chinese industrial control market was nearly monopolized by foreign brands. However, after two decades of relentless effort, Inovance has emerged as a formidable competitor to international giants, breaking the monopoly of ABB and Siemens in the industrial automation arena and securing top positions across various automation segments.

As a leader in industrial control, Inovance Technology has achieved double-digit growth in both revenue and profit. In the first half of 2025, its revenue soared to 20.509 billion yuan, up 26.73% year-on-year, while its net profit reached 2.968 billion yuan, up 40.15% year-on-year. This growth is attributed to the gradual recovery in automation demand, the stability of its general automation business as a foundation, and the increasing global penetration of new energy vehicles, which has become a significant growth driver for Inovance.

According to MIR Databank's 2024 statistics, Inovance Technology commands approximately a 28.3% market share in China's general servo system market, ranking first (with Siemens, Panasonic, and Yaskawa following at 9.7%, 7.1%, and 7%, respectively). In China's industrial robot market, it holds around an 8.8% market share, ranking third, while its SCARA robot product sales lead the Chinese market.

Estun

This year, with the resurgence in industrial automation demand, Estun's downstream industries have witnessed robust growth, particularly in the automotive, electronics, and lithium battery sectors. Consequently, after two years of sluggish performance, Estun has achieved double-digit growth in both revenue and net profit, turning losses into profits, and its industrial robot shipments have topped the domestic market.

According to MIR Databank statistics, in the first half of 2025, Estun's industrial robot shipments surpassed those of foreign brands for the first time, making it the first domestic robot brand to lead the Chinese industrial robot market, with its market share further increasing to 10.5%. In the first half of 2025, its revenue reached 2.548 billion yuan, up 17.5% year-on-year, and its net profit was 6.68 million yuan, compared to a loss of 73.41 million yuan in the same period last year.

Based on the long-term trends of robot replacement and domestic substitution, as well as the increasing demand for automation and intelligent development in downstream industries, Estun believes that the industrial robot market in 2025 still holds significant growth potential.

STEP Electric

For STEP Electric, after Haier became its actual controller and with the recovery in the industrial robot market, following three consecutive years of losses, 2025 marked a departure from its previous sluggish performance. Revenue showed signs of recovery and growth, successfully turning losses into profits and ending three consecutive years of losses.

In the first half of 2025, STEP Electric's revenue reached 1.644 billion yuan, up 8.45% year-on-year, and its net profit was 1.86 million yuan, compared to a loss of 18.75 million yuan in the same period last year. It is evident that collaboration with Haier Group has provided operational assurance, with revenue recovering and growing while achieving a turnaround from losses to profits, demonstrating STEP Electric's entry into a new stage of development empowered by Haier.

After Haier Group's strategic investment in STEP Electric, it officially became a member of Haier's COSMOplat Industrial Internet ecosystem. Through the profound empowerment of Haier's COSMOplat Industrial Internet platform, this once-troubled enterprise has been successfully revitalized and is thriving once again, epitomizing the saying, "It's good to be under a big tree."

Leveraging the scenario resources of Haier's more than 160 manufacturing centers worldwide and combining STEP Electric's technological accumulation in automation and robotics, both parties are jointly promoting the industrialization of embodied intelligence. By utilizing Haier's global supply chain and customer network, they are enhancing brand, channel, and supply chain capabilities. Simultaneously, they are promoting the integration of IT and OT, constructing a closed loop of "software + hardware + platform," and achieving the evolution from point intelligence to ecological intelligence.

Finally

In the era of generative AI, driven by new technologies such as AI large models, big data, and the Internet of Things, new impetus has been brought to industrial transformation and upgrading. Particularly, intelligence centered on AI technology applications represents the future trend of industrial robot development. Through the integration of industrial robots with cutting-edge technologies such as AI large models and machine vision, industrial robots are being propelled towards intelligence and autonomous decision-making.

Overall, the increasing levels of digitization, automation, and intelligence in production processes are driving the expanding deployment of industrial robots. As a result, China has become the world's largest consumer of industrial robots and has maintained its position as the world's largest robot market for 12 consecutive years.

Meanwhile, the trend of domestic substitution is inevitable. Customers are placing increasing importance on the autonomous controllability and customization needs of product supply during the product selection process, indicating that China's industrial robot industry is in the midst of an accelerated phase of domestic substitution. Consequently, the previous situation where foreign manufacturers primarily dominated the market share has changed, with domestic leading manufacturers now experiencing sustained growth in industrial robot sales and surpassing foreign brands in market share.

Driven by market demand for industrial robots, domestic industrial robot brands have also experienced rapid development, firmly occupying a favorable position in market competition and accounting for half of the market share. The market competition landscape is undergoing reshaping, with strong momentum for domestic substitution. The industrial robot market in 2025 still holds significant growth potential. For manufacturers in this sector, there is potential for continued revenue growth.

Yang Jianyong, a Forbes China contributor, expresses views solely on behalf of himself. He is dedicated to in-depth interpretations of cutting-edge technologies such as artificial intelligence, AI large models, the Internet of Things, cloud services, and smart homes.