DJI and Insta360 Engage in a Remote “Battle”, “Mimicking” Each Other Amid Growth Concerns

![]() 11/13 2025

11/13 2025

![]() 517

517

By Dong Xuan

Source: Node Finance

The two industry titans, DJI and Insta360, are locked in a remote “duel”. The conflict has escalated from product price cuts and marketing clashes to a fierce competition for market share.

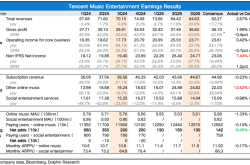

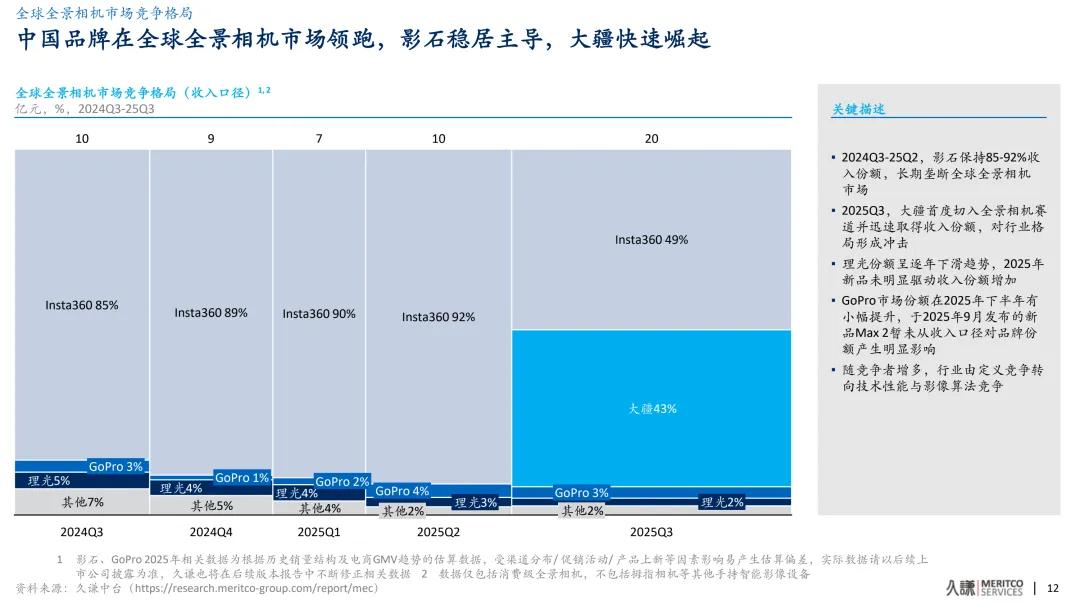

Recently, the research institution Jiuqian Middle Office published a report titled “Panoramic and Action Camera Market Research”. It disclosed that in terms of revenue, Insta360's market share in this segment plummeted from 92% in the second quarter to 49% in the third quarter. Meanwhile, DJI managed to secure a 43% global market share in just three months with its debut product, the Osmo 360.

However, Frost & Sullivan's data tells a different story. In the third quarter of 2025, Insta360 still maintained a 75% global market share, firmly occupying the top spot in the industry, while DJI only held a 17.1% share.

Faced with such vastly different statistical results, Insta360's response was rather understated. The company stated that the accuracy, completeness, and authority of some third-party data could not be guaranteed and reminded investors to exercise caution.

Previously, in October 2025, DJI suddenly launched a new round of price reductions, sparking widespread dissatisfaction among users. Complaints like “speculating in the digital realm” and “buying early means taking a big loss” flooded social media platforms.

Interestingly, while DJI had not yet commented on the price cuts, Insta360's CEO, Liu Jingkang, preemptively “apologized on behalf”.

In a Weibo post, he mentioned that DJI's significant price reductions were somewhat related to Insta360. To express his apology, customers who purchased DJI products between October 2nd and October 8th could receive a 100 yuan no-threshold voucher from Insta360 by sharing their order proof.

This combination of “courtesy before conflict” immediately ignited public opinion and sparked considerable debate. It was also seen by outsiders as a sign of escalating tensions between Insta360 and DJI.

From Node Finance's perspective, the “clash” between DJI and Insta360 is not just a competition based on established business strategies on the surface. It is also an alternative manifestation of the growth anxieties faced by these two giants.

01 “Mimicking” Each Other Amid Growth Concerns

Both the panoramic camera market and the drone market are relatively specialized and niche sectors with limited capacity and low growth ceilings.

According to Frost & Sullivan data, the global panoramic camera market size was 5.03 billion yuan in 2023, representing a year-on-year increase of 21.79%. It is expected to reach 7.85 billion yuan by 2027, with the compound annual growth rate slowing to 11.8%.

The drone market fares slightly better but still faces the dilemma of “operating within a confined space”.

According to Valuates Report data, the global aerial drone market size was approximately 7.1 billion USD in 2023 and is projected to climb to 12 billion USD by 2027, with a compound annual growth rate of around 8%.

Compared to industries with market sizes in the trillions, the panoramic camera market and drone market, with their hundred-billion-yuan scale, can hardly be described as having a “long runway and thick snow” for growth.

Therefore, once market penetration rates reach a certain level, seeking a second growth curve becomes crucial for the future survival of these companies.

Against this backdrop, in July 2025, Insta360 officially announced its entry into the drone market, directly venturing into DJI's core territory, which DJI had operated in for years and fortified with high barriers.

Almost simultaneously, DJI, the dominant player in the drone field, adopted a symmetrical offensive strategy. Leveraging its deep technological accumulation in flight control, image stabilization, and intelligent tracking, DJI swiftly launched its first panoramic camera, the Osmo 360.

Source: DJI Official Website

This move was widely interpreted as a direct counter to Insta360's “invasion” and a bold attempt to make a significant impact in the latter's domain.

In other words, the situation between Insta360 and DJI has shifted from the past “observing each other across the river” to the current “close-quarters combat”. Both sides have moved from their comfortable “strongholds” into each other's most advantageous territories. Insta360 attempts to carve out a share in the drone market, while DJI stealthily cultivates new growth in the panoramic camera market.

This high degree of overlap in business boundaries means that any move by either side, including new product releases, price adjustments, or marketing rhetoric, may be perceived by the other as a deliberate provocation, thus triggering a chain reaction.

The recent controversy, sparked by DJI's price reductions, Insta360 CEO's “apology”, and the conflicting market share data, is a concrete manifestation of this new competitive norm where “you are intertwined with me, and I am intertwined with you”.

To some extent, when a company reaches the pinnacle in its field but finds the market “ceiling” within reach, growth concerns inevitably arise. This is a common dilemma currently faced by both Insta360 and DJI.

The recent frictions between the two are not just impromptu verbal sparring but an inevitable outcome of strategic and tactical “mimicking” driven by growth concerns.

02 A Steady “Veteran” vs. a Flamboyant “Newcomer”

A company's competitive strategy is deeply rooted in its unique growth path and organizational DNA. The differing responses exhibited by DJI and Insta360 in this incident also reflect their distinct corporate personalities.

Founded in 2007, DJI resembles a steady “veteran”, with its operational logic built upon a profound technological foundation and strong supply chain control.

After years of development, DJI has constructed a solid technological barrier composed of tens of thousands of patents. Its products, from flight platforms to imaging systems, have achieved a high degree of in-house development, granting it significant cost advantages and pricing flexibility.

In the “price reduction controversy”, DJI's official subsequent response defined it as a “regular Double 11 promotional activity” and emphasized “continuously optimizing services and communication mechanisms”.

This unremarkable attitude aligns with DJI's consistent pragmatic style of “letting products speak through technology” but also reveals a hint of arrogance. If not handled properly, it may backfire.

In contrast, Insta360, founded in 2015 and ten years younger than DJI, has emerged as a “flamboyant newcomer”, showcasing agile marketing thinking and the ability to establish emotional connections with users.

Source: Insta360 Official Website

Insta360 CEO Liu Jingkang's “friendly gesture towards competitors” can be seen as a meticulously planned communication event. From his personal Weibo “apology” to issuing vouchers to competitors' users, these maneuvers achieved significant public attention and brand exposure at a minimal cost.

However, it cannot be overlooked that such tactics, which closely follow the negative news of competitors, can easily be labeled as “riding on trends” or “being overly clever”. While they generate substantial buzz in the short term, overdoing it may make the brand appear unstable and unfocused, potentially eroding the trust of investors and partners. The obvious “humblebrag” undertone may also leave consumers with an impression of impulsiveness.

Neither strategy is inherently superior; they reflect natural choices made by companies at different development stages and market positions.

Node Finance believes that DJI's steadiness is a necessary requirement for it as a market leader and a large-scale enterprise, while Insta360's flamboyance is one of the paths it has chosen to achieve brand breakthroughs with relatively limited resources. This dispute represents a direct collision of two business philosophies in the same arena.

03 Common Challenges

Regardless of how the situation evolves, the challenges facing DJI and Insta360 are formidable.

On one hand, the “ceiling” is approaching.

As leaders built on technological prowess, DJI and Insta360 wield significant influence in their respective sectors.

According to Node Finance, DJI holds an absolute dominant position in the drone field, with a consumer market share exceeding 70%. It enjoys a monopoly in North America, Europe, and Asia. Insta360, on the other hand, dominates the panoramic camera market, with its global market share having long exceeded 80%.

Source: Insta360 Official Website

The straightforward numbers reflect the strength of both companies but also indicate that their upward growth potential is nearly exhausted, placing them under growth pressure and leading to the natural outcome of “mimicking” each other.

On the other hand, they face common external pressures.

In overseas markets, particularly in the United States, both DJI and Insta360 have recently found themselves entangled in patent litigation.

This shared external pressure will also intensify their fierce competition in the domestic market.

In other words, when the external environment is filled with uncertainty, the strategic importance of stabilizing and expanding the domestic market becomes even more pronounced, making each domestic confrontation more “critical”.

On the surface, the dispute between DJI and Insta360 appears to be a dramatic marketing episode triggered by price reductions. However, its underlying logic profoundly reflects the common challenges faced by Chinese tech companies in the process of innovation-driven development. When the blue ocean market pioneered by companies through disruptive innovation gradually transforms into a “white-hot” red ocean, transitioning from yesterday's misaligned competition to today's head-on confrontation is an inevitable stage.

For companies in the midst of this battle, beyond marketing and price wars, they should focus more on how to continuously build a solid technological barrier that cannot be easily replicated, cultivate user loyalty beyond transactions, and create a healthy and win-win industrial ecosystem. They should also consider how to strike a balance between offense and defense and how to build the “ladder to the clouds” for the next decade or two while competing for the current market.

This will be the true test for DJI, Insta360, and all Chinese tech companies aspiring for long-term success.

*The cover image is generated by AI