Bilibili: Is the Little Breakout Station About to Experience Secondary Growth?

![]() 11/17 2025

11/17 2025

![]() 541

541

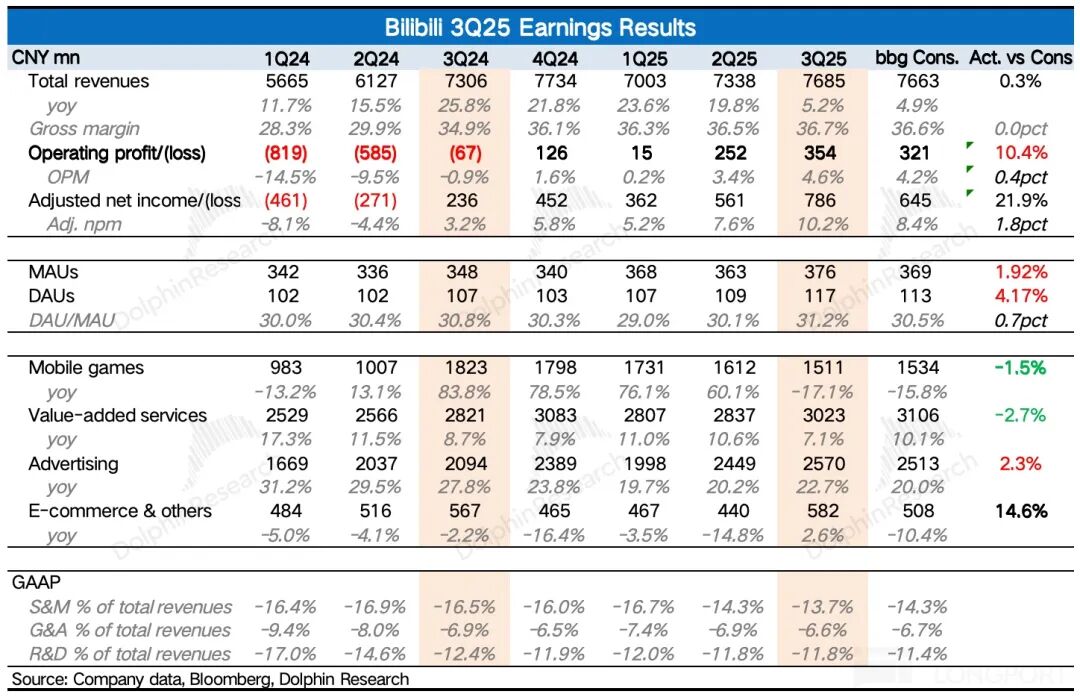

After the market closed in Hong Kong on November 14 (Beijing Time), Bilibili released its Q3 2025 financial report, which slightly outperformed expectations overall. Highlights included advertising revenue, profits, and user metrics, while gaming and live streaming performed relatively poorly. The market reaction was muted on the day of the report, primarily influenced by broader market trends. Additionally, some investors may have been concerned about the lack of significant short-term guidance surprises.

Let's take a closer look:

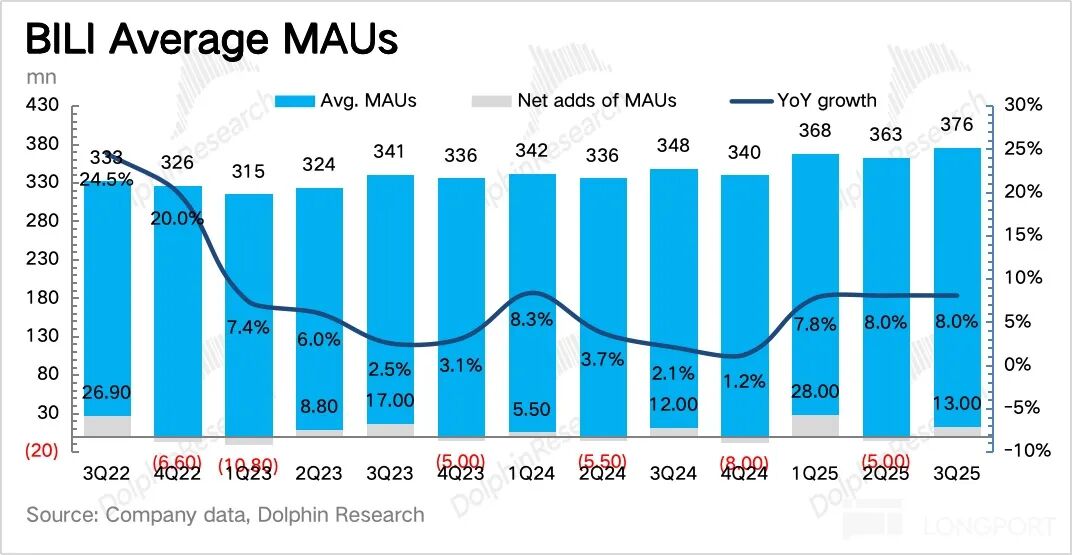

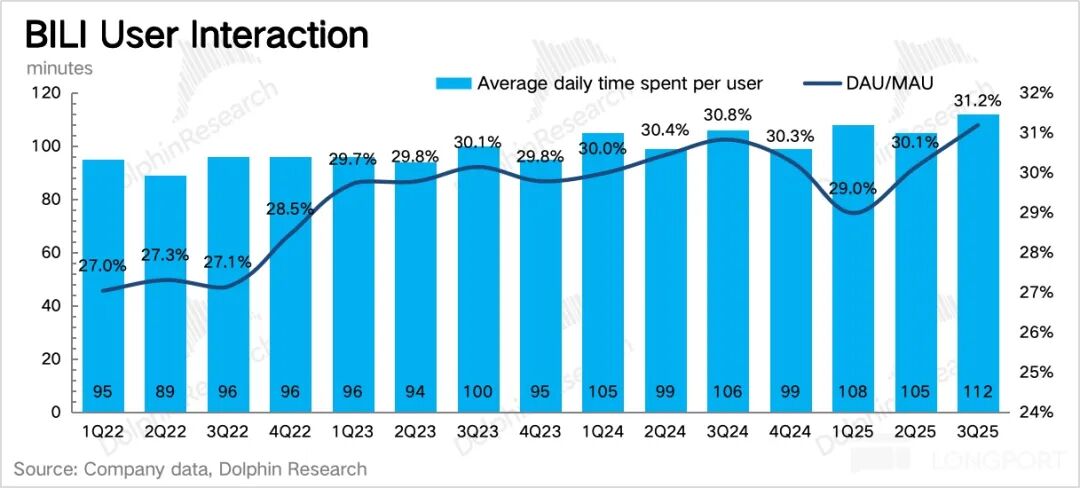

1. Healthy Expansion of the User Ecosystem: This is the biggest highlight of the financial report, according to Dolphin Research. Q3, being the peak summer season, saw Bilibili's monthly active users (MAU) increase by 13 million month-over-month, with the DAU/MAU ratio rising to 31.2%. The re-expansion of Bilibili's ecosystem began earlier this year. Last year, due to slowing MAU growth, the company temporarily stopped disclosing MAU metrics and shifted focus to DAU.

However, starting this year with the benefits of securing Spring Festival Gala broadcast rights, the ecosystem experienced a new wave of healthy recovery. During this ecosystem expansion, engagement (DAU/MAU and average daily user time) also increased.

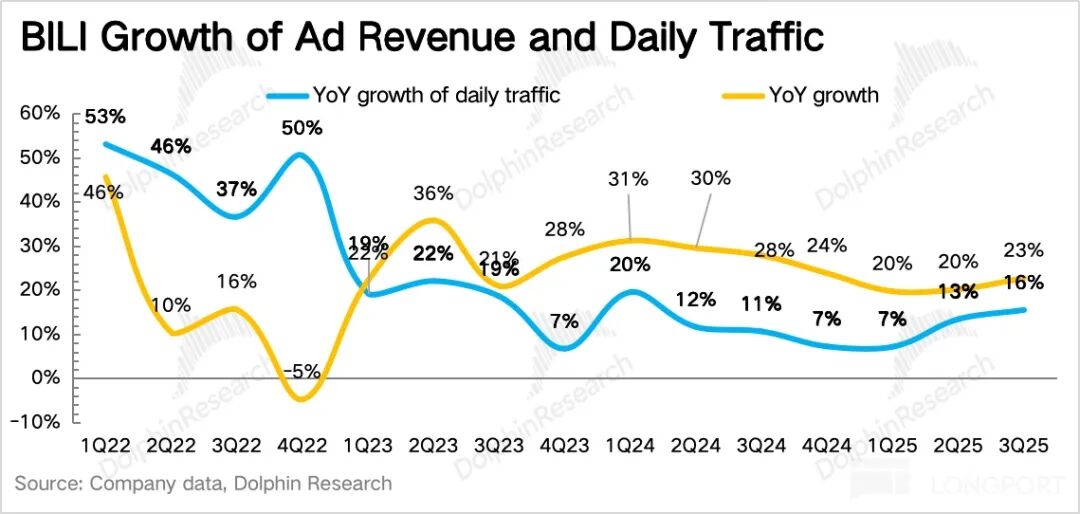

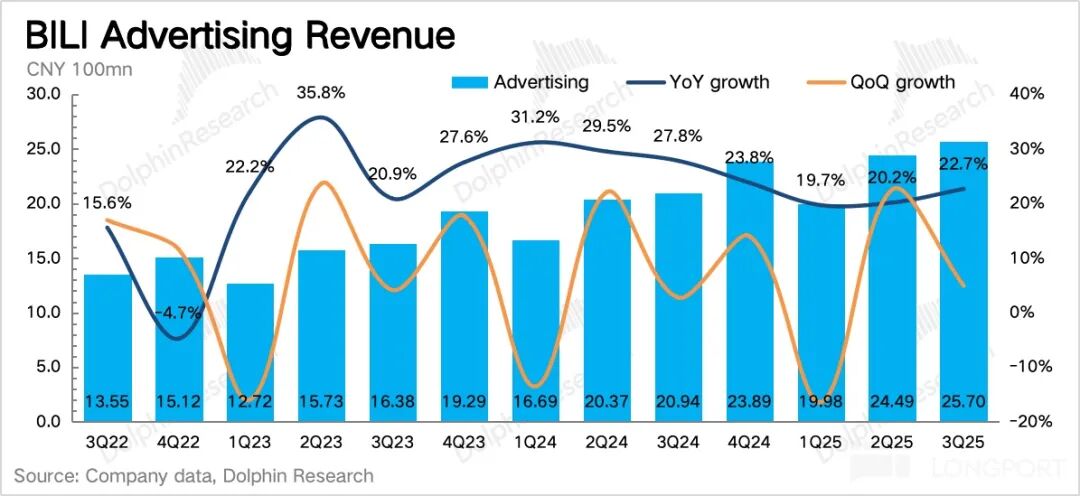

2. Room for Growth in Advertising: Advertising revenue slightly exceeded market expectations and previous guidance, with a year-over-year increase of 22%. Despite Bilibili's advertising revenue maintaining a high growth rate of over 20% for more than two consecutive years, there is still room for further commercialization and stable growth due to the platform's unique attributes and AI-driven improvements in recommendation algorithm efficiency.

The company stated that its current advertising load rate of 6-7% is significantly lower than that of its peers. It plans to increase this rate by 1 percentage point annually until it reaches 10% (the threshold for user perception).

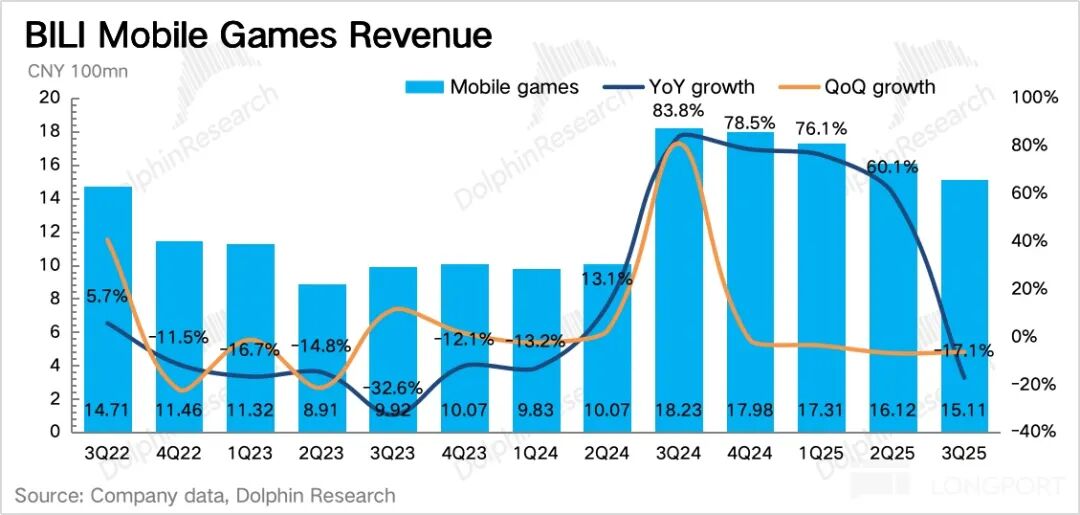

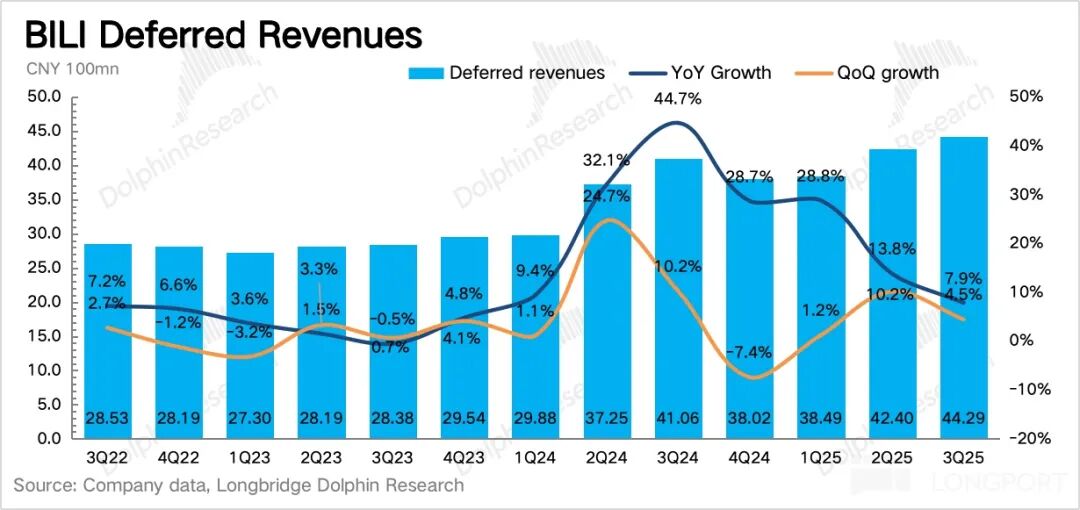

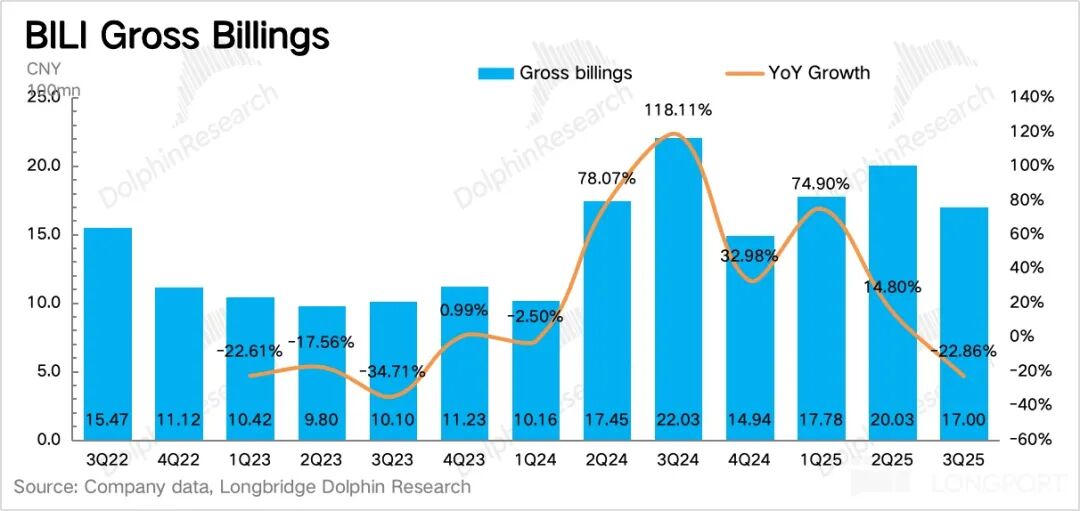

2. Short-Term Pressure on Gaming: Due to the lack of a new game release of the same caliber as "San Mou" (Three Strategies), the gaming sector entered a period of pressure in the second half of the year due to high comparison bases. This quarter, gaming revenue declined by 17%, with actual pressure slightly exceeding expectations. From deferred revenue (which showed a significant slowdown in year-over-year growth and a calculated decline in running water (revenue)), it is evident that Q4 and Q1 of next year will continue to face similar pressure. The company expects a relatively rich pipeline only in the second half of next year.

However, the gaming sector is not entirely stagnant in the short term. The October release of the PC game "Escape from Yakov" was a huge success, maintaining a daily online player count in the global top 10 on the Steam platform for half a month and surpassing 3 million sales in less than a month.

The game's success is not only attributed to its fun and easy gameplay but also to platform synergies (Bilibili's internal promotion, Up main videos, and live streaming), showcasing the unique effectiveness of Bilibili's gaming ecosystem. Development for console and mobile versions has commenced, but no specific timeline has been announced.

Additionally, another game based on the Three Kingdoms IP, "Three Kingdoms Hero Cards," is poised for release, scheduled for the end of Q1 next year. However, its main revenue contribution will not be in Q1. Current testing feedback has been positive, and the company plans to operate it as a large DAU game for the long term, without setting short-term commercialization goals, aligning with the current mainstream preferences of young people.

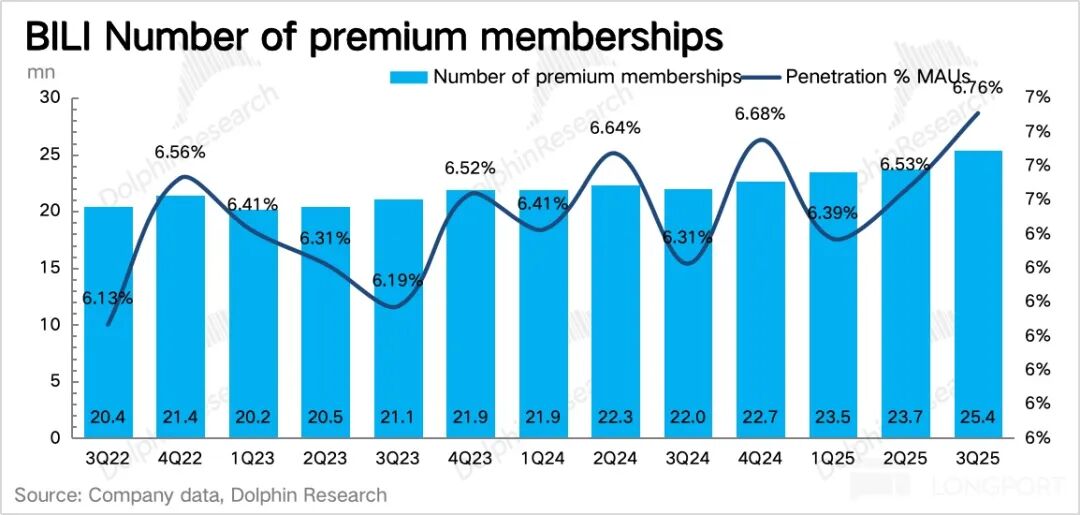

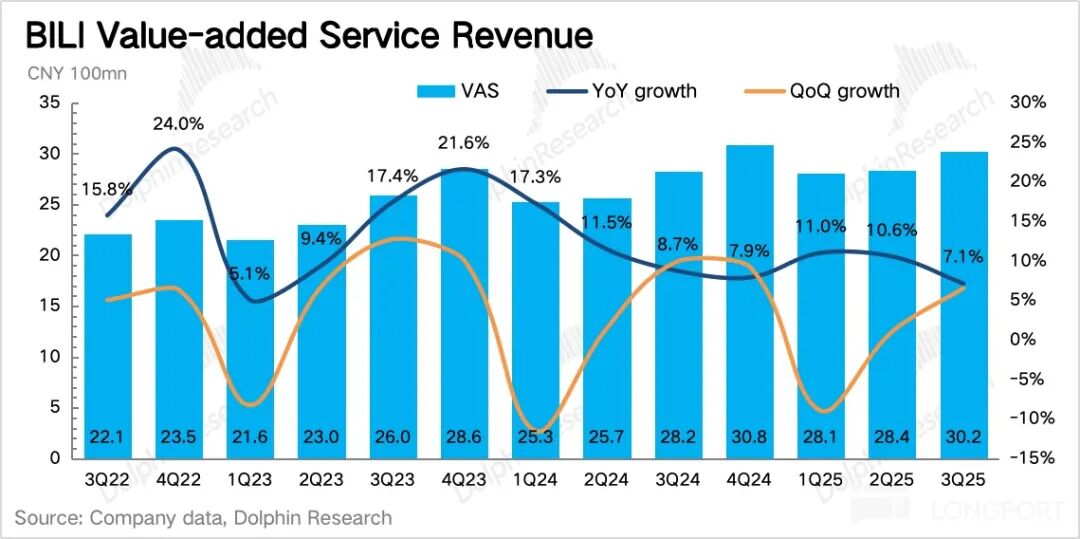

3. Live Streaming Possibly Nearing the End of Its Bonus Period: The performance of VAS (Value-Added Services) in Q3 was average, with growth slowing significantly to 7%. However, the increase in premium memberships was notable, benefiting from several exclusive Chinese animated series and documentaries. The net increase in premium members reached 1.7 million in Q3, significantly higher than in previous quarters, with a year-over-year subscription growth of 16%. Value-added services related to the fan economy, such as charging and paid videos, continued to experience high year-over-year growth. Therefore, the final drag may stem from live streaming.

Bilibili's live streaming push began in the second half of 2023 and has since gone through a period of rapid growth. However, given the unfavorable industry trends, subsequent growth may further slow down.

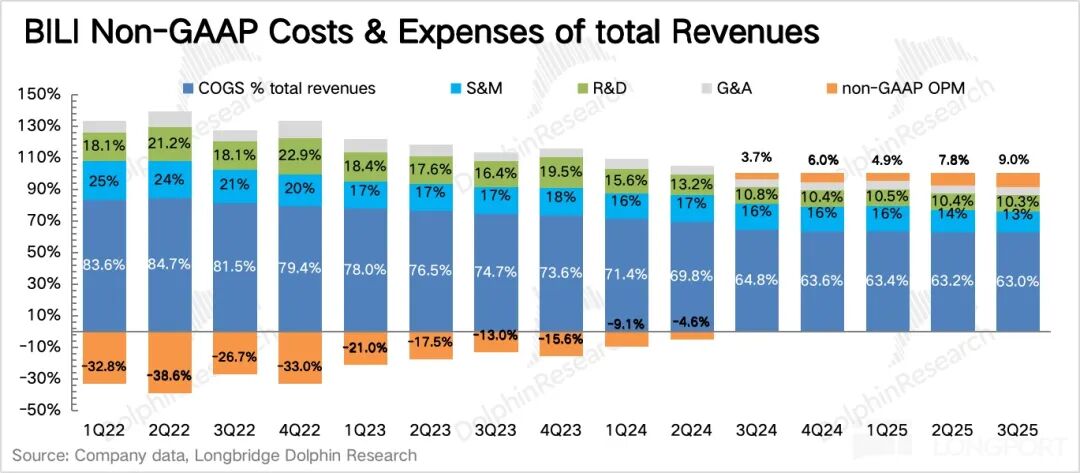

4. Profits Exceed Expectations: Q3 profits once again surpassed expectations, with an adjusted operating profit margin of 9%, up 1.2 percentage points from the previous quarter. The company guides for continued improvement to 10% in the next quarter. The optimization of operating expenses has been elevated to a core business objective since the end of 2023. While expanding gaming and advertising monetization, the company strictly controls content costs, reduces bandwidth expenses, and operating costs (promotional spending, R&D/management salaries), driving a rapid increase in profit margins. The company's medium- to long-term target for operating profit margins remains at 15%-20%, indicating significant room for improvement.

5. Improved Cash Flow: In Q3, Bilibili's net cash (cash, deposits, and short-term investments minus short-term debt) reached RMB 21.9 billion, an increase of RMB 1.3 billion from Q2, primarily driven by core business operations. The two-year, $200 million share repurchase program approved last year now has $84 million remaining, with the repurchase progress exceeding expectations. Given the current cash position, the company may increase its repurchase budget after exhausting the current program.

6. Overview of Performance Metrics

Dolphin Research's View

Although Q3 was another quarter of generally inline performance, including guidance, it lacked surprises, especially in the gaming sector. Considering the unclear short-term commercialization goals for "Three Kingdoms Hero Cards" and the delayed pipeline cycle, a true recovery may not occur until the second half of the year.

However, if operational performance continues to improve steadily, even if short-term investors leave disappointed, causing market value adjustments, it can also attract more long-term investors.

Looking beyond short-term expectation gaps, similar to last quarter, Dolphin Research remains pleasantly surprised by the user ecosystem metrics, which are a more core long-term growth driver. A healthy user ecosystem signifies a return to growth, with sustainable commercialization trends and continued expansion potential.

In terms of monetization, in addition to the closed-loop operation of the gaming ecosystem mentioned earlier, AI's contribution to enhancing Bilibili is significant. One aspect is the optimization of advertising recommendation algorithms (which has a more pronounced marginal effect on Bilibili), and another is the provision of more AI tools to assist Up mains in creating richer, high-quality content, further engaging users. This enhances the platform's commercial value, allowing Up mains to benefit from genuine monetization and forming a positive cycle.

Furthermore, regarding the company's operational objectives, since a quantified target for profit margins has been set, control over past inefficient operations will at least be strengthened from a management perspective. A more detailed value analysis has been published in the article with the same title in the "Updates - Research" section of the Longbridge App.

The following is a detailed analysis:

I. Ecosystem: Healthy Expansion Lays the Foundation for Long-Term Growth

In Q3, a peak season, user numbers increased by 13 million month-over-month. Since the rapid expansion driven by the Spring Festival Gala broadcast earlier this year, and benefiting from rich exclusive content (Chinese animations, self-produced variety shows, documentaries, and short dramas), user metrics have performed well for three consecutive quarters.

Engagement metrics have also improved simultaneously, with the DAU/MAU ratio increasing to 31% and user time reaching a record high of 112 minutes, an increase of 6 minutes year-over-year.

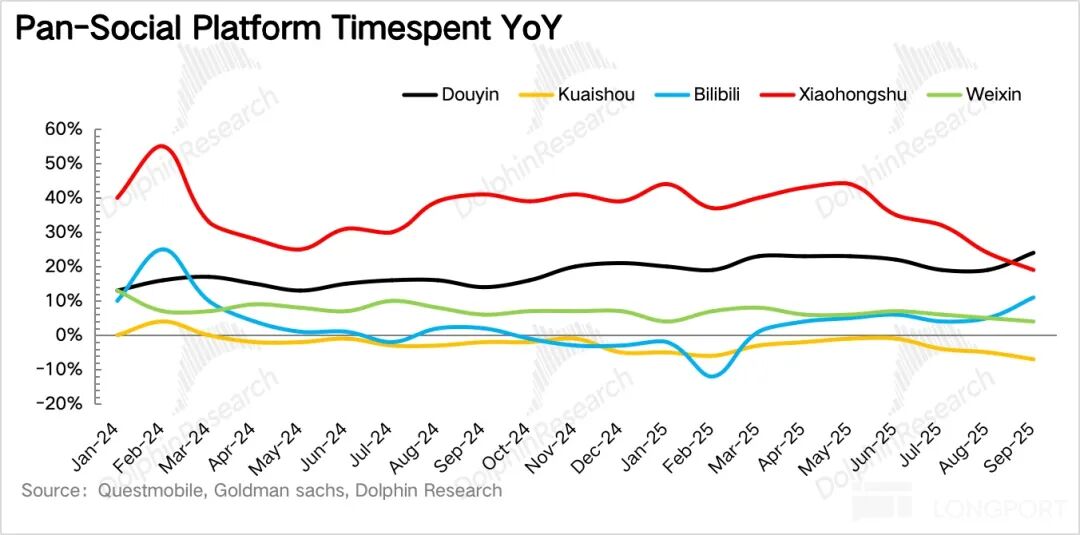

Looking at the social platform industry, according to Questmobile's tracking of platform user total time growth data, in Q3, Bilibili and Douyin (TikTok) showed upward trends in growth, while Xiaohongshu's (Little Red Book) growth started to slow significantly, and Kuaishou's decline widened.

II. Advertising: Slightly Exceeds Expectations, Room for Long-Term Growth

In Q3, Bilibili's advertising revenue exceeded RMB 2.57 billion, a year-over-year increase of 22%, surpassing guidance and expectations. Advertising growth primarily benefited from increased user time within the ecosystem (+16% year-over-year) and the company's upgrades to advertising algorithms, delivery systems, and AIGC creative tools. Over 50% of advertising materials are now automatically generated through AIGC, significantly improving production efficiency and conversion rates.

III. Gaming: Falls Short of Expectations, Recovery Expected in the Second Half of Next Year

Gaming revenue began to feel the impact of high comparison bases in Q3, declining by 17% year-over-year, worse than market expectations.

From deferred revenue, this issue is expected to persist. In Q3, deferred revenue increased by 5% quarter-over-quarter and 8% year-over-year, showing a significant slowdown. Calculated revenue declined by 23% year-over-year, with Q4 revenue expected to decline by around 15%.

Although the October release of the PC game "Escape from Yakov" was a huge success, maintaining a daily online player count in the global top 10 on the Steam platform for half a month and surpassing 3 million sales in less than a month, "Escape from Yakov" primarily relies on buy-to-play sales, with skin purchases contributing little in the short term.

Regarding future pipelines, the main plans currently include the overseas release of "San Mou" (Hong Kong, Macau, and Taiwan expected by the end of the year, Japan and South Korea expected in Q2 next year), the global release of the secondary mobile game "Conspiracy RE: VIVE" in the second half of the year, and "Three Kingdoms Hero Cards" in Q1 next year. The mobile and console versions of "Escape from Yakov" have just restarted development, with no release timeline yet.

IV. Value-Added Services: Live Streaming Possibly Nearing the End of Its Bonus Period

VAS revenue, primarily from live streaming and premium membership subscriptions, increased by 7% year-over-year in Q3, with a significant slowdown in quarter-over-quarter growth.

In Q3, the number of premium members increased to 25.4 million, a significant increase of 1.7 million month-over-month, much higher than in previous quarters. Subscription numbers increased by 16% year-over-year, with the payment rate reaching a new high. Meanwhile, value-added services related to the fan economy, such as charging and paid videos, continued to experience high year-over-year growth. Therefore, the final drag may stem from live streaming.

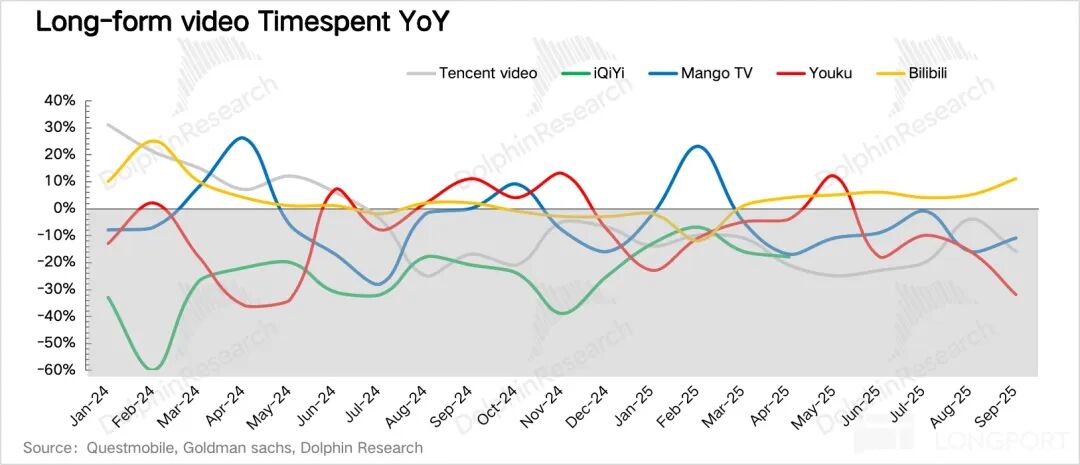

Although Bilibili lacks an advantage in terms of time spent on the platform compared to social platforms, it still outperforms traditional long-form video platforms. In Q3, in addition to its original animated content, Bilibili's self-produced variety show "Dinner at Your Place?" Season 3, documentary "Guardians of Jiefangxi 6," and the ancient costume revenge drama "Jin Zhao Yu Zui," which debuted at the end of September, all attracted significant new subscriptions. Therefore, long-form video platforms other than Bilibili continue to struggle.

V. Continuous Improvement in Profit Margins

In Q3, Bilibili's profits continued to expand. From the perspective of core business operating profits (= gross profit - operating expenses), it reached RMB 350 million in the current period and RMB 680 million after adjustments, with optimizations in both cost and expense components.

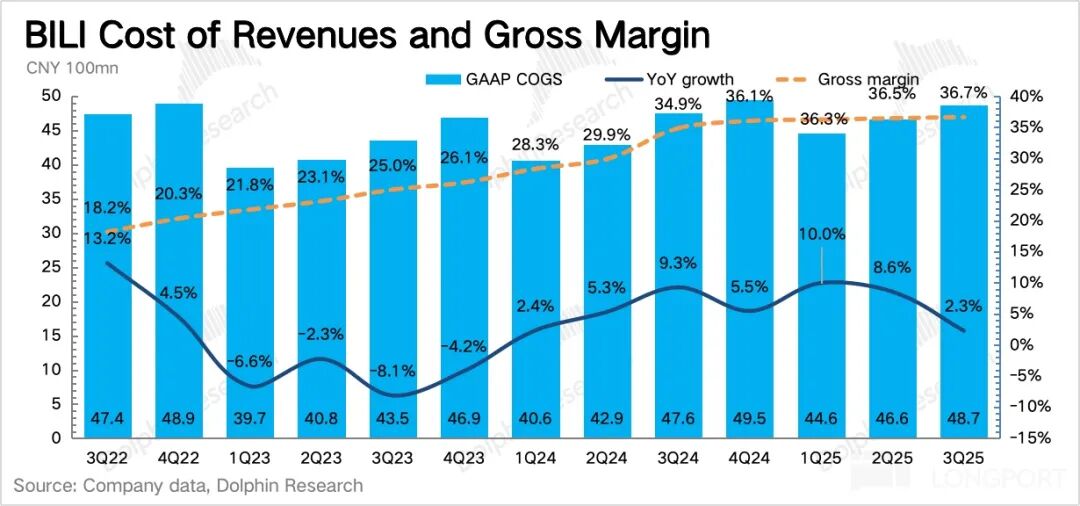

1. Slow Increase in Gross Profit Margin

The increase in gross profit margin is primarily driven by the sustained high growth of high-margin gaming and advertising sectors.

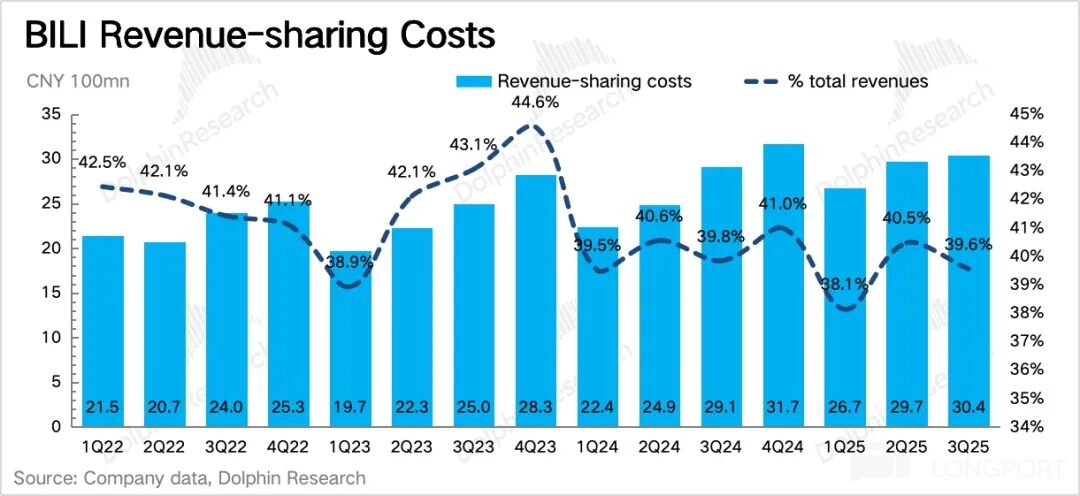

In terms of specific cost structures, revenue-sharing costs account for the majority, primarily related to gaming, live streaming, and Huohuo Advertising. In Q3, revenue-sharing costs continued to increase to RMB 3.04 billion, with the growth rate significantly slowing to 4% due to the decline in gaming.

2. Continued Restraint in Expenses

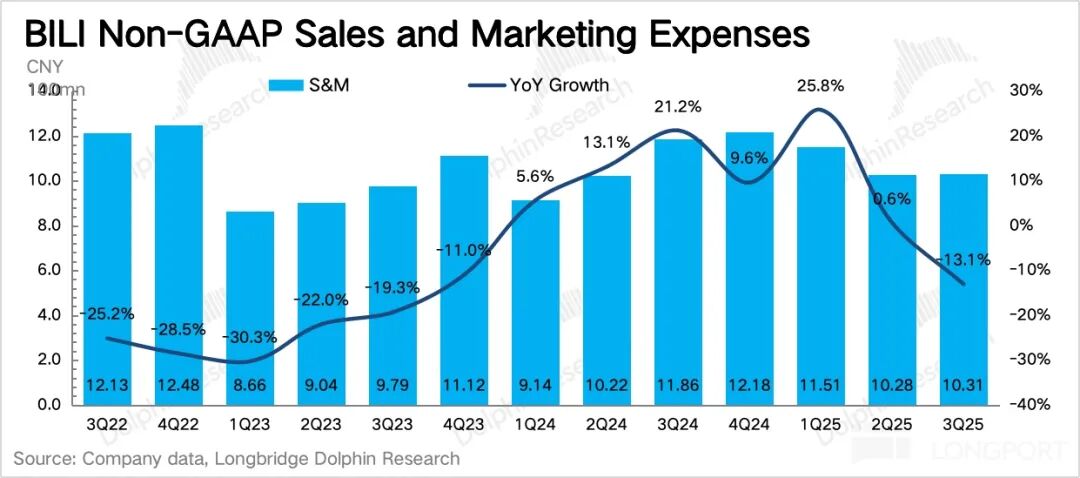

In terms of operating expenses, there were no major new games released during the current period, resulting in a significant decline in sales expenses, with the expense ratio decreasing by 3 percentage points year-on-year. Meanwhile, the scale of research and development expenses and administrative expenses remained stable, but under the backdrop of revenue growth, the expense ratios contracted slightly.

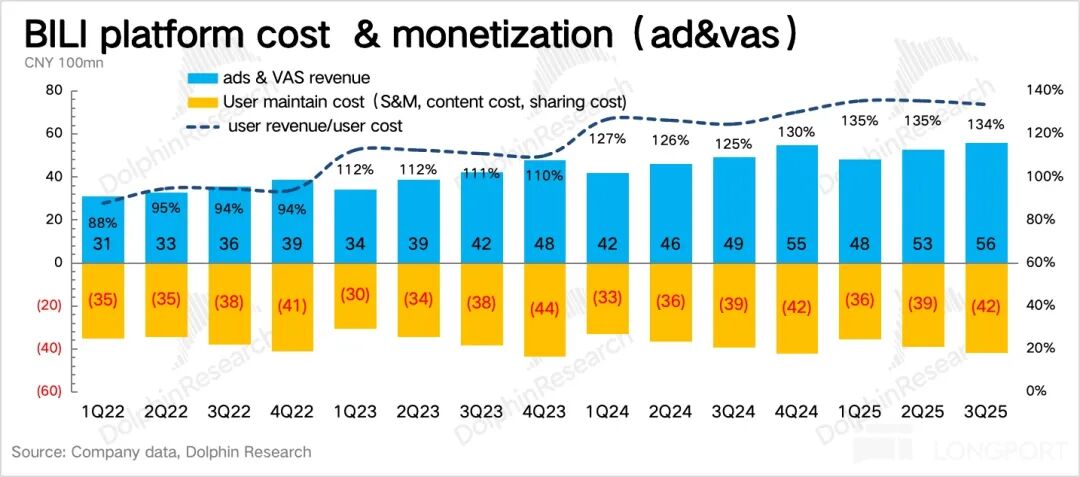

From the perspective of the 'traffic monetization/cost relationship' that Dolphin Research has been observing, in the third quarter, due to pressure on the gaming sector, the direct revenue generated from traffic monetization per user saw a slight sequential decline in its coverage of customer acquisition and maintenance costs. Therefore, this also reflects that the continued improvement in profit margins is also related to the control of other operating expenses, such as research and development and management.

- END -

// Reposting Permission

This article is an original piece by Dolphin Research. If you wish to repost it, please obtain authorization.

// Disclaimer and General Disclosure Notice

This report is intended solely for general comprehensive data purposes, designed for general viewing and data reference by users of Dolphin Research and its affiliated institutions. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making any investment decisions based on this report. Any individual making investment decisions based on or referring to the content or information mentioned in this report assumes all risks. Dolphin Research shall not be held liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives for, but does not guarantee, the reliability, accuracy, and completeness of the relevant information and data.

The information mentioned or the views expressed in this report shall not, under any jurisdiction, be regarded as or considered an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, a quotation, or a recommendation regarding relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for, nor are they intended to be distributed to, jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would contravene applicable laws or regulations, or would result in Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions, nor to citizens or residents of such jurisdictions.

This report merely reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) produce, copy, reproduce, duplicate, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all related rights.