Mobile Phone Makers Switch Focus: From Performance to Ecosystem – Are Specs Obsolete and Experience King?

![]() 11/17 2025

11/17 2025

![]() 437

437

A profound transformation is quietly reshaping this trillion-dollar industry.

© Original content from TMT Planet · Author | Huang Yanhua

As smartphone hardware specifications converge and technical jargon at product launches leaves consumers weary, a profound transformation is quietly unfolding in this trillion-dollar market.

With major smartphone manufacturers unveiling flagship models in the latter half of the year, the industry's competitive focus has shifted from the 'GHz wars' of processor speeds and 'battery life contests' of capacity to the breadth of imaging capabilities, ecosystem interconnectivity, and the depth of artificial intelligence experiences.

Manufacturers are no longer simply selling communication devices; instead, they are marketing complete ecosystems powered by AI that seamlessly integrate tablets, watches, cars, and even smart home devices.

In this context, the smartphone has emerged as the gateway to this ecosystem.

This is not merely a technological upgrade but a collective 'strategic pivot' by smartphone makers under the invisible ceiling of the existing market.

Given the near-stagnation in global smartphone shipment growth, manufacturers must confront a fundamental question: When users are no longer swayed by incremental parameter improvements, what will drive them to upgrade their devices?

01

Flurry of Flagship Launches Intensifies Imaging Competition

The second half of 2025 has become a 'showdown' for flagship smartphone releases.

Since Apple unveiled its iPhone 17 series in September, leading manufacturers like Xiaomi, Vivo, Honor, and OPPO have rolled out their flagship models, pushing market competition to a fever pitch in the latter half of the year.

Unlike previous years, performance specifications are no longer the centerpiece of manufacturers' presentations. Instead, imaging, photography, and ecological applications have become the core battlegrounds.

The iPhone 17, the first to launch, faced criticism from some users over its metal frame material. However, it boasts improved performance with the A19 chip and ecological advantages. Apple particularly highlighted the A19 chip's enhancements in AI computing and image processing, optimizing night mode and portrait mode, with the main selling point being enabling ordinary users to capture professional-grade photos.

Xiaomi followed closely, skipping the Xiaomi 16 and launching the Xiaomi 17, which Lei Jun dubbed the 'most powerful standard flagship in Xiaomi's history,' directly competing with the iPhone 17.

Vivo's X300 series, through deep collaboration with Zeiss, equips the standard model with a 200-megapixel main camera and Zeiss coating, enabling real-time scene recognition and color optimization. This allows the phone to automatically adjust parameters for optimal results in diverse shooting environments.

Honor's Magic8 series is marketed as a 'well-rounded product with no weaknesses,' claiming to break the industry norm of mediocre mid-range models and powerful high-end ones by maximizing core configurations. Its new AiMAGE imaging engine introduces three core technologies: AiMAGE Night God Engine, AiMAGE Stabilization Engine, and AiMAGE Portrait Engine, catering to users' imaging needs across various scenarios.

Additionally, OPPO's Find X9 series features a quad-camera module co-developed with Hasselblad and a periscope telephoto macro lens, claiming to 'pack a professional camera into a smartphone' and create a 'new generation of travel photography essential' for consumers.

Judging by the flagship models released by leading manufacturers, imaging has unanimously been elevated as a key selling point.

Analysis suggests that with market saturation and Apple maintaining a significant share in the high-end segment, domestic manufacturers need to present compelling strengths to impress users. The imaging function, being one of the easiest for users to perceive and willing to pay a premium for, has become the most direct path for domestic smartphone makers like OPPO, Vivo, and Honor to penetrate the high-end market and enhance their premium pricing capabilities.

02

AI + Ecosystem Interconnectivity: Building New Experience Moats

A closer look at this year's flagship launches reveals that hardware parameters such as processor benchmark scores, screen resolutions, and battery capacities, which were repeatedly emphasized in the past, are now mostly glossed over. Instead, the scene-based applications of AI technology, the actual shooting effects of imaging systems, and the interconnected experience within the ecological closed loop have taken center stage.

The AI integrated this time is no longer a vague concept but deeply embedded in various facets of daily user life.

For instance, Honor's Magic8 series achieves comprehensive improvements in night photography, portrait optimization, and stabilization processing through full-process empowerment by AI algorithms. Users do not need to manually adjust complex parameters during shooting; the phone automatically matches the best solution based on the scene and even offers post-editing functions such as AI photo retouching and inspirational composition.

Another example is OPPO's Find X9 Pro's 'AI Photo Retouching Master,' which can intelligently remove passersby from photos and optimize composition. Vivo's X300 series 'AI Voice Assistant' supports offline voice commands, allowing operations like setting alarms and opening apps even without a network connection.

It is evident that these AI functions are no longer 'gimmicks' but genuinely address users' practical needs in communication, office work, photography, and other scenarios.

In terms of ecosystem interconnectivity, besides Apple, OPPO, Vivo, and Honor have also made it a strategic priority, evolving from simple device connections to service systems centered on scene applications.

According to TMT Planet, Apple emphasized the 'Continuity Camera+' function between the iPhone 17 and MacBook at its launch event, allowing the phone to serve as an external camera for the computer with portrait mode support.

OPPO's Find X9 Pro and OPPO Watch, earphones' 'Super Interconnectivity' function enables cross-device synchronization of incoming calls and messages.

Vivo's X300 series emphasizes integration with smart homes, allowing voice control of lights, air conditioners, robot vacuum cleaners, and other devices via the phone.

Honor's Magic8 series boasts collaboration with Honor tablets and notebooks, featuring a delay as low as 89ms and file drag-and-drop transmission speeds reaching 85MB/s.

Clearly, all manufacturers are striving to make smartphones the 'control hub' of smart living.

In this context, consumers who purchase a smartphone from a certain brand will enjoy a smoother experience when using other smart devices from the same brand. This ecological binding not only brings convenience to consumers but also becomes a crucial factor in attracting them to upgrade their phones.

03

Ecosystem Layout Becomes Key as Manufacturers Seek New Growth

With the smartphone market no longer experiencing high growth and entering a phase of slow or even negative growth, finding new growth avenues within the existing market has become a challenge that all manufacturers must face.

According to data released by IDC, smartphone shipments in the Chinese market in the third quarter of 2025 reached approximately 68.46 million units, a slight year-on-year decline of 0.5%, marking six consecutive quarters of negative or zero growth.

Another research report by Omdia indicates a 3% year-on-year decline in the Chinese mainland smartphone market in the third quarter of 2025.

In terms of manufacturer performance, Vivo ranked first with 11.8 million units shipped and a 17.2% market share, although this represented a 7.8% year-on-year decline. Apple came in second with 10.8 million units shipped and a 15.8% market share, achieving a mere 0.6% year-on-year increase. Huawei, Xiaomi, OPPO, and Honor all had market shares ranging from 14% to 16%, with OPPO achieving a 0.4% year-on-year increase and Xiaomi experiencing a 3.5% decline.

The continuous elongation of consumers' phone replacement cycles has further intensified market pressure.

Data released by a research institution shows that the average replacement cycle for Chinese smartphone users has extended from 24 months in 2020 to 36 months or even longer in 2024. Many users report that their 'current phones are still smooth after three years of use, making an upgrade unnecessary.' This situation forces manufacturers to seek new growth breakthroughs.

Currently, retaining users through ecological layout has become a strategic focus for major manufacturers.

Apple's ecosystem speaks for itself, with the iPhone at its core and the Mac, iPad, Apple Watch, and AirPods forming a solid 'moat' that many competitors envy.

Currently, domestic smartphone manufacturers such as Huawei, OPPO, Vivo, and Honor are also stepping up their ecological layout.

While compiling data, TMT Planet noticed that Xiaomi, with the phone at its core, has rapidly expanded its business to smart homes, smart cars, and notebooks. In the first half of 2025, its IoT and lifestyle consumer goods business generated revenue of 58 billion yuan, accounting for 28% of total revenue. Additionally, OPPO, Vivo, and Honor have all increased their investments in smart wearables, smart homes, and vehicle-phone interconnectivity.

These ecological businesses not only bring new revenue streams to manufacturers but also, more importantly, enhance user stickiness through multi-device collaboration, creating a 'domino effect' of consumers buying tablets after phones and watches after tablets.

Moreover, by ecologically binding users, manufacturers can ensure that user data and interactions remain within their platforms, laying the foundation for future more diversified service revenues.

Notably, ecological layout has also become 'new material' for manufacturers to tell their stories. Take Apple, for example; its stable growth in service businesses has earned it a higher valuation premium from the capital market.

Industry analysis points out that with stagnant smartphone shipment growth, the performance of ecological businesses directly affects capital market confidence in manufacturers, making it one of the key motivations for smartphone makers to vigorously promote ecologicalization.

04

Rise of Domestic High-End Phones Faces User Acceptance Test

With continuous breakthroughs in technological innovation and ecological experience by domestic brands, consumer attitudes toward high-end flagship phones are also shifting.

According to data released by a digital website, in the high-end phone market priced between 4,000 and 5,999 yuan during the 2025 Double 11 shopping festival, although Apple continued to lead, domestic manufacturers such as OPPO and Vivo are accelerating their pursuit, with their market share increasing from 19% last year to 38%, while Apple's share declined from 81% to 62%. This change reflects users seeking a balance between cost-effectiveness and brand.

Although Apple leads the domestic high-end phone market, complaints about its 'incremental' innovation have persisted in recent years, with accusations of insufficient innovation. Coupled with the rise of domestic high-end phones, the brand aura surrounding the iPhone is gradually fading.

Furthermore, the issue of the Pro version of the newly released iPhone 17 switching from a titanium metal frame to an aluminum alloy one, resulting in susceptibility to scratches, has drawn significant attention. Many users on social media complain that the 'blue version gets scratched after just a couple of rubs in the pocket,' affecting some users' choices.

On consumer complaint platforms, there are also numerous complaints about product quality issues with the iPhone 17.

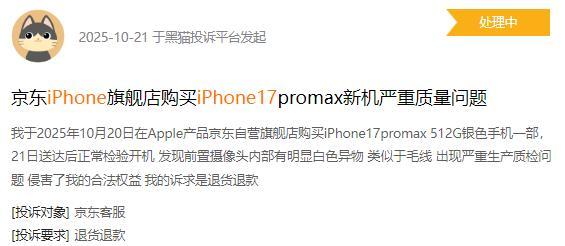

For example, a netizen complained on the Heimao Complaint Platform that the iPhone 17 Pro Max version they purchased from the Apple JD.com Self-Operated Flagship Store had a noticeable white foreign object inside the front camera upon normal startup, suspecting a 'severe production quality control issue.'

Figure / Heimao Complaint Platform

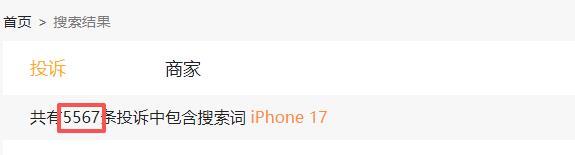

TMT Planet also searched for 'iPhone 17' as a keyword on the Heimao Complaint Platform, revealing a staggering 5,567 complaints, mainly focusing on product quality defects, misrepresentation, delayed shipments, and poor after-sales service.

Figure / Heimao Complaint Platform

These poor experiences complained about and criticized by numerous consumers have, to some extent, further weakened and demystified Apple's aura, prompting them to turn to domestic brands.

However, TMT Planet also notes that domestic high-end phones still have significant room for improvement in quality control and after-sales service.

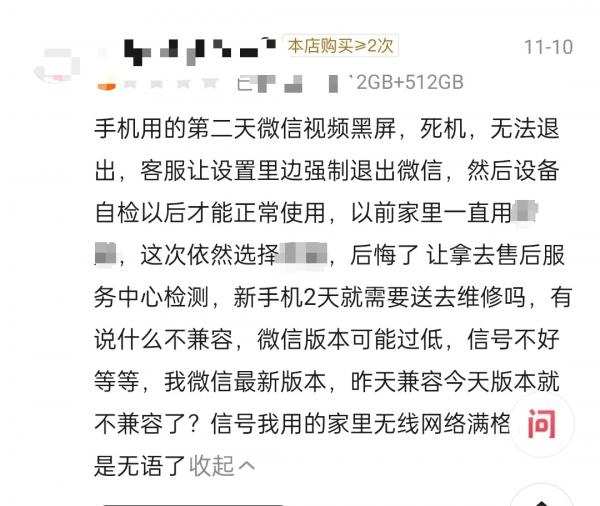

Some users reported that after using a certain domestic high-end flagship phone for just two days, they encountered issues such as a black screen, crashes, and inability to exit. However, after-sales inspection failed to identify the root cause of the problem, and the situation of 'needing to send the new phone for repair after just two days' greatly affected the user experience.

Figure / JD.com

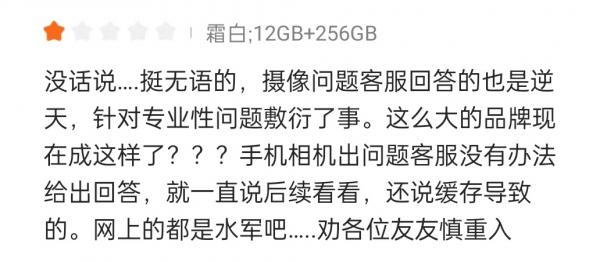

Other users stated that after purchasing a certain domestic high-end flagship phone, they encountered camera issues. When inquiring with customer service, they received no satisfactory answer, with responses like 'we'll see later' and 'it's due to cache.'

Figure / JD.com

Moreover, on the Heimao Complaint Platform, a significant number of netizens have voiced their grievances regarding issues plaguing certain domestic high-end flagship smartphones. These issues range from "frequent signal disruptions" and "camera focusing difficulties" to "maliciously undervalued appraisals during official mall trade-in programs." Although the volume of these complaints pales in comparison to those directed at Apple, they nonetheless serve as a crucial wake-up call for domestic brands. After all, quality that merely appears to transcend (a more idiomatic translation than 'surpassing' in this context) expectations without delivering on substance is ultimately a castle built on sand.

05

Conclusion

From a fierce competition centered on specifications to an ecological race, the flagship phone market in 2025 has witnessed a profound transformation in its competitive dynamics.

This shift underscores the industry's introspection into the "core of growth," compelling manufacturers to abandon their reliance on mere configuration upgrades as a catalyst for phone replacements. Instead, they are now focusing on integrating life scenarios, extending user lifecycles through ecological interconnections, and unlocking new avenues for growth through service innovation.

However, it is imperative to acknowledge that for domestic high-end flagship phones, despite having transitioned from a phase of "technological catch-up" to one of "experience leadership," there remain areas requiring continuous refinement. These include the seamless integration of ecological collaborations, the practicality of AI functionalities, and stringent product quality control.

Looking ahead, the brand that can truly deliver a flawless "person-machine-vehicle-home" experience will seize the initiative in the existing market competition. This battle of innovation and experience will ultimately propel the entire industry towards a stage of higher-quality development.

*The featured image in the article is sourced from the OPPO official website.