Double 11 Mobile Phone Market Recap: Slight Growth Fuels Anticipation for Major Structural Shifts

![]() 11/28 2025

11/28 2025

![]() 682

682

The 2025 Double 11 shopping spree has drawn to a close, with the mobile phone sector sustaining the positive momentum seen during the October 1st Golden Week holiday. Throughout the Double 11 promotion, a harmonious blend of promotional efforts and new product launches propelled the market to achieve modest overall growth. Against the backdrop of the mobile phone industry's transition from rapid to more stable replacement cycles, product innovation and fierce competition in the mid-to-high-end market have emerged as pivotal growth drivers. Beyond the slight uptick observed during Double 11, a new structural competition is quietly brewing.

Industry Characteristics

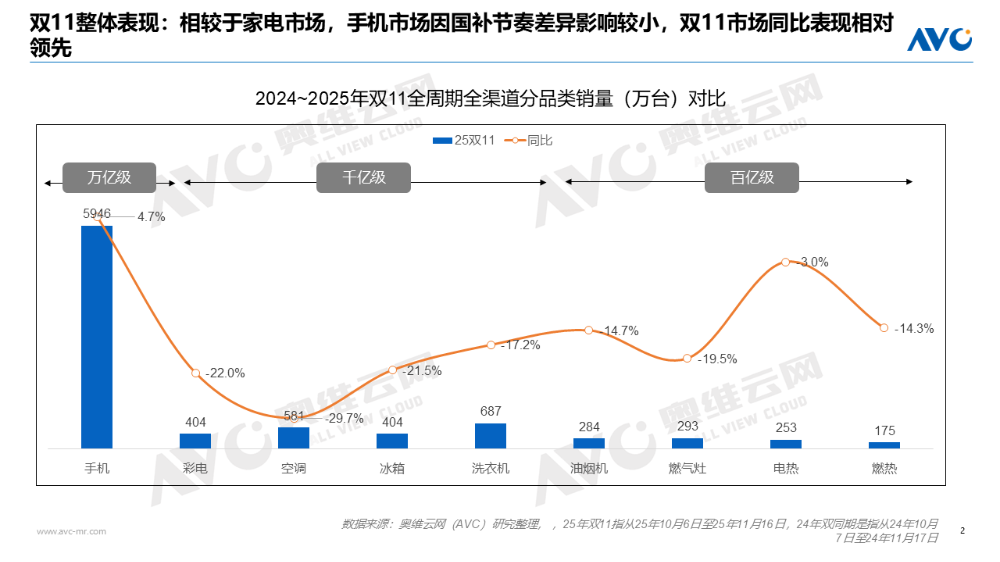

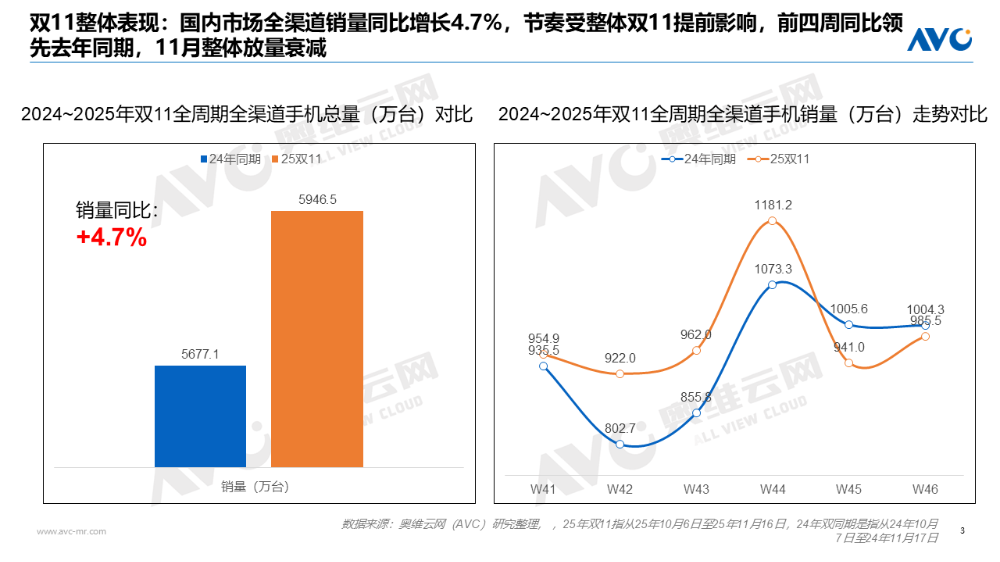

Dual Rhythms Propel 4.7% Growth Across the Entire Period, with Demand Peaking Early

According to research conducted by Aowei Cloud Network (AVC), the domestic mobile phone market recorded a cumulative 59.46 million units in online and offline sales from October 6th to November 16th, marking a 4.7% year-on-year increase. Unlike home appliances, mobile phones and digital products were not extensively included in the national subsidy program during the 2024 Double 11 period, thereby experiencing a lesser impact from the high base effect caused by last year's subsidies. Consequently, the mobile phone market outperformed the home appliance sector overall.

In terms of timing, influenced by the earlier commencement of this year's Double 11 and the advance release of new products by certain brands, the overall Double 11 rhythm further diverged from that of 2024. Mobile phone sales in the four weeks leading up to Double 11 significantly surpassed those of the same period last year. However, post-Week 45, as market demand was largely satiated, the overall momentum weakened. Although sales rebounded slightly in Week 46 with the rising popularity of some brands' November new product launches, there remained a gap in single-week performance compared to 2024.

Competitive Performance

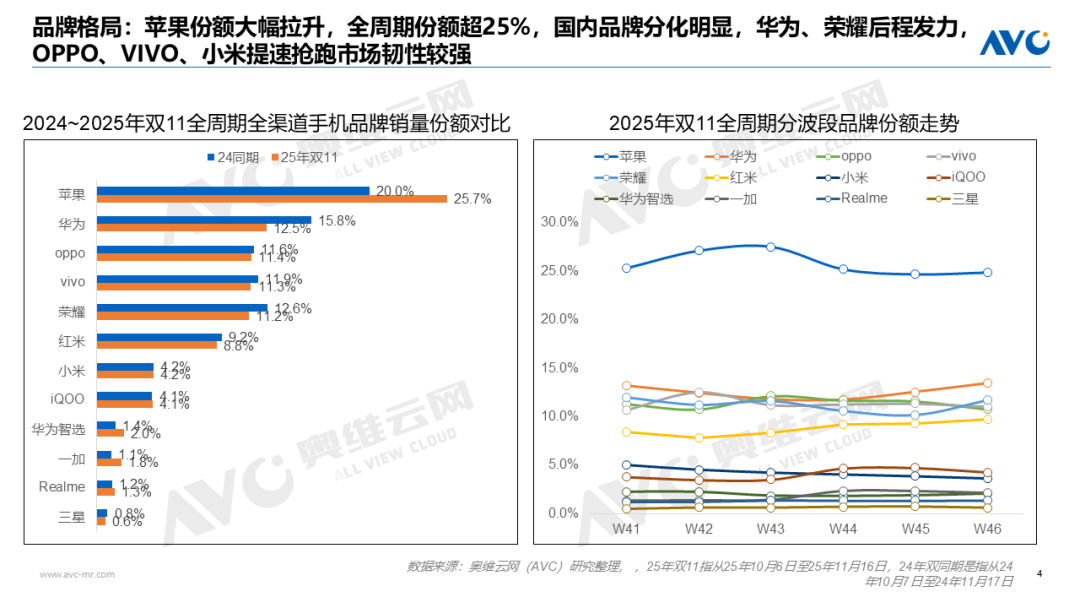

Apple's Market Share Soars, Surpassing 25% Across the Entire Period; Domestic Brands Exhibit Significant Rhythmic Variation, with Xiaomi, OPPO, and VIVO Showcasing Strong Resilience

AVC's research indicates that from October 6th to November 16th, Apple's overall market share surged to 25.7%, a nearly 6% increase compared to the same period during Double 11 in 2024. Benefiting from the innovation of the iPhone 17 series and its swift adaptation to new marketing strategies such as instant retail and local life services in the Chinese market, Apple's Double 11 performance was particularly remarkable.

Meanwhile, domestic brands displayed notable performance disparities. Xiaomi, in particular, achieved clear breakthroughs in the high-end market, fueled by its accelerated strategic shift and the iterative success of the 17 series, demonstrating strong market resilience. VIVO and OPPO maintained their steady market presence, while their sub-brands, IQOO and OnePlus, effectively collaborated with their parent brands during Double 11, alternating to fill promotional gaps in the early and late stages, thereby sustaining overall market leadership. Huawei and Honor, constrained by the timing of their main new product releases and the overall misalignment with the Double 11 rhythm, showed relatively weaker performance in the early stages. However, they exhibited strong catch-up momentum in the latter half, with their market shares continuously rising in the last two weeks of Double 11. With the upcoming launches of the Mate 80 series and Honor 500 new products, they are poised to continue the upward trend observed at the end of Double 11.

Product Performance

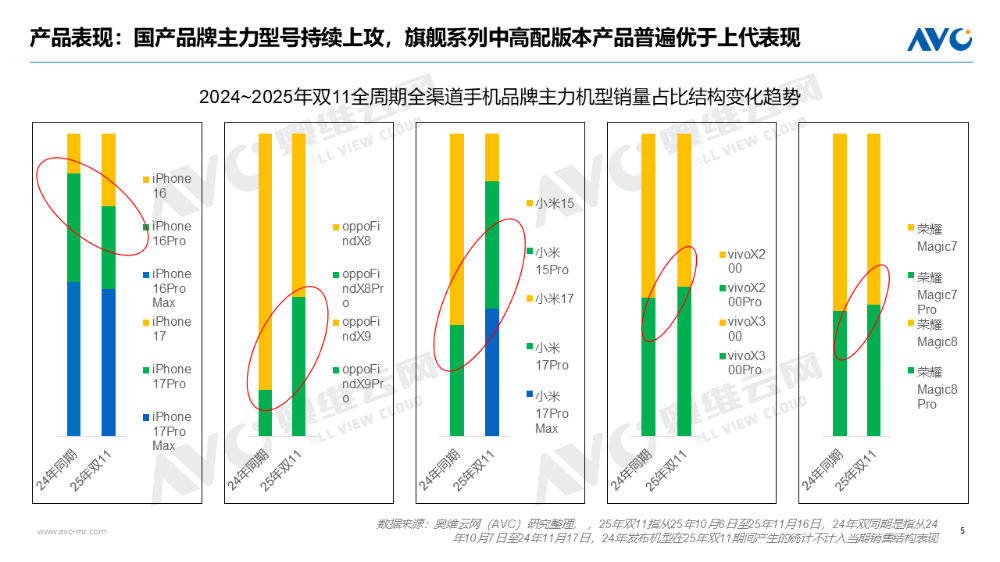

Domestic Brands' Flagship Models Continue to Climb, with Mid-to-High-End Versions Generally Outperforming Previous Generations

AVC's research reveals that from October 6th to November 16th, flagship models from major brands engaged in fierce competition. For Apple, the standard version within the same series saw a significant increase in its structural proportion compared to the previous generation. In addition to substantial upgrades in high refresh rate screens, storage, processors, imaging, and battery life, the iPhone 17 series standard version maintained its previous pricing strategy, further enhancing the product's overall value proposition and winning user favor.

On the domestic front, we observed a contrasting trend to Apple's. The structural proportion of the standard version declined, while the proportions of mid-to-high-end positioned Pro and ProMax versions increased within the flagship series. OPPO Find X9 Pro, Xiaomi 17 Pro/ProMax, VIVO X300 Pro, and Honor Magic 8 Pro all performed admirably. Despite the pressure of rising memory costs prompting many brands to raise prices, the technological advancements of domestic brands in product innovation and functional differentiation over recent years have also become crucial factors in solidifying user choices in the mid-to-high-end market.

New Product Performance

Apple's iPhone 17 Series Leads the Market with Over 9 Million Units Sold During Double 11; Xiaomi's 17 Series Emerges as the Biggest Winner Among Domestic New Products

AVC's research indicates that from October 6th to November 16th, cumulative sales of the Apple iPhone 17 series exceeded 9 million units, dominating the top three best-selling products, with the iPhone 17 ProMax becoming the most popular choice among Double 11 flagships. Among domestic brands, the Xiaomi 17 series closely trailed Apple, with cumulative flagship sales exceeding 1.3 million units. The VIVO X300 series and OPPO Find X9 series followed with 760,000 and 630,000 units sold, respectively.

Meanwhile, Apple launched its new Air series products this year, with overall sales currently around 120,000 units. Huawei's Mate 70 Air maintained a synchronized strategy, selling approximately 80,000 units during Double 11. As an ultra-thin variant within the flagship lineup, Air products have boldly ventured into new product territories. However, market feedback has been below expectations, with subsequent market enthusiasm waning. Given the current functional abundance in the mid-to-high-end market, although the Air series leads in design philosophy, it still necessitates further exploration of more effective functional combination strategies for the domestic market.

The conclusion of Double 11 merely marks the commencement of the next competitive phase, with numerous new products such as the Huawei Mate 80, Xiaomi 17 Ultra, Honor 500, VIVO S50, and OnePlus Ace 6T slated for release, continuously reshaping the December mobile phone market. To stay abreast of the performance of subsequent new products, please continue to follow Aowei Cloud Network's mobile phone industry data releases for the latest and most comprehensive insights into the domestic mobile phone market!

Original content by Aowei Cloud Network. Unauthorized access or extraction of this content by any organization or individual for purposes such as training AI large models is strictly prohibited.