Has NIO "succeeded" just because its cash flow has turned positive? No, NIO's recovery has only just begun

![]() 11/28 2025

11/28 2025

![]() 609

609

NIO has returned to the spotlight with a financial report boasting its best gross profit margin in three years, positive operating cash flow, and a surge in deliveries.

At the earnings call that evening, Li Bin, founder, chairman, and CEO of NIO, stated, 'The strong performance growth is attributable to the combined competitiveness of NIO, Leo, and Firefly brand products. These products continue to gain user favor in their respective market segments.'

Image source: Internet

Looking back at NIO's 11-year development journey, 'losses' have always been its most prominent label. Across the entire landscape of China's emerging EV manufacturers, NIO also stands out as the one with the most severe cumulative losses.

Public data shows that from 2016 to 2024, NIO's net losses were RMB 2.573 billion, RMB 5.021 billion, RMB 9.639 billion, RMB 11.295 billion, RMB 5.304 billion, RMB 4.020 billion, RMB 14.437 billion, RMB 5.593 billion, and RMB 22.4 billion, respectively. Over nine years, this figure has soared to a staggering RMB 80.282 billion, like a heavy mountain.

While the market is excited, a core question arises: Has this emerging EV manufacturer, mired in losses for years, truly reached a turning point in its fate?

A closer look at the financial report reveals that beneath the surface, NIO is still walking on a precarious ridge. On the left lies the dawn of efficiency improvements and cost optimizations, while on the right, there is an abyss of net losses and untested scalability challenges.

Image source: Internet

The 'efficiency revolution' led by Li Bin has bought NIO time, but the journey to ultimate profitability remains long and arduous.

Efficiency gains realized, but foundations remain shallow

The most significant highlight of this financial report is that a series of key indicators demonstrate the initial success of Li Bin's 'efficiency revolution.' This is not a superficial tweak but a reform that touches the core.

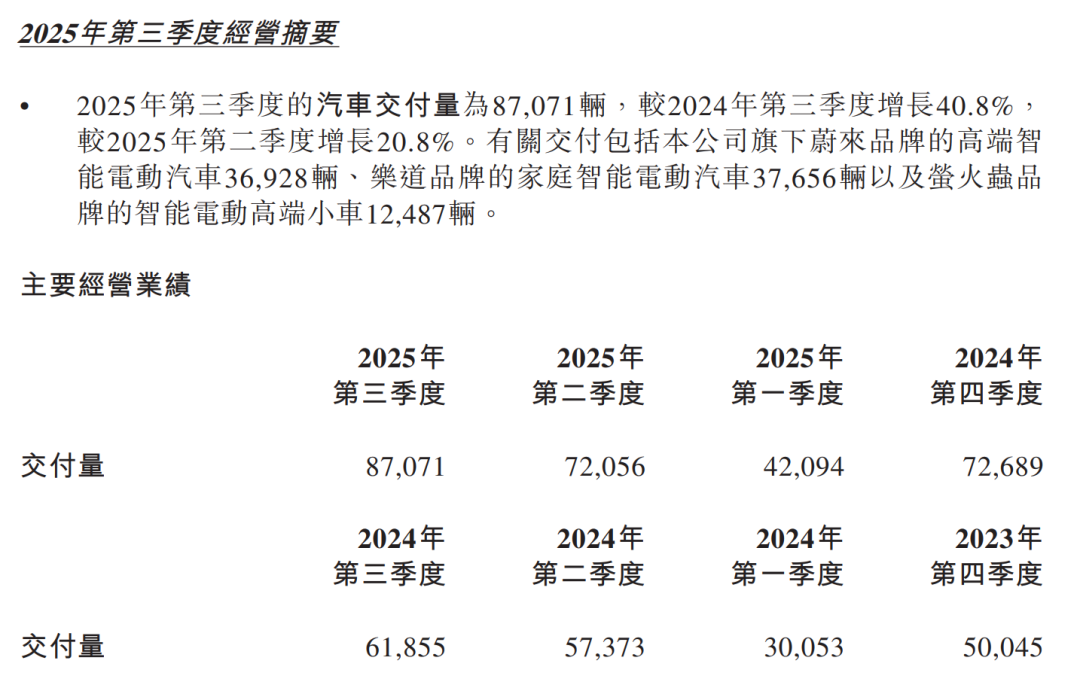

Record-breaking sales and revenue: In Q3, NIO delivered 87,071 units, up 40.8% YoY and 20.8% QoQ. Revenue reached RMB 21.79 billion, up 16.7% YoY and 14.7% QoQ, both setting new company records.

Image source: NIO's Q3 2025 report

Multi-brand strategy creates synergies: In terms of brand composition, the NIO brand delivered approximately 36,900 units, the Leo brand around 37,700 units, and the Firefly brand about 12,500 units. The three brands cover a price range from RMB 100,000 to RMB 800,000, forming a complete product matrix.

From a longer-term perspective, NIO's growth momentum has remained strong this year: In October, NIO delivered 40,397 new vehicles, up 92.6% YoY. Cumulative sales from January to October reached 241,500 units, surpassing the full-year performance of 2024. It is expected that full-year deliveries in 2025 will exceed 320,000 units, setting another record.

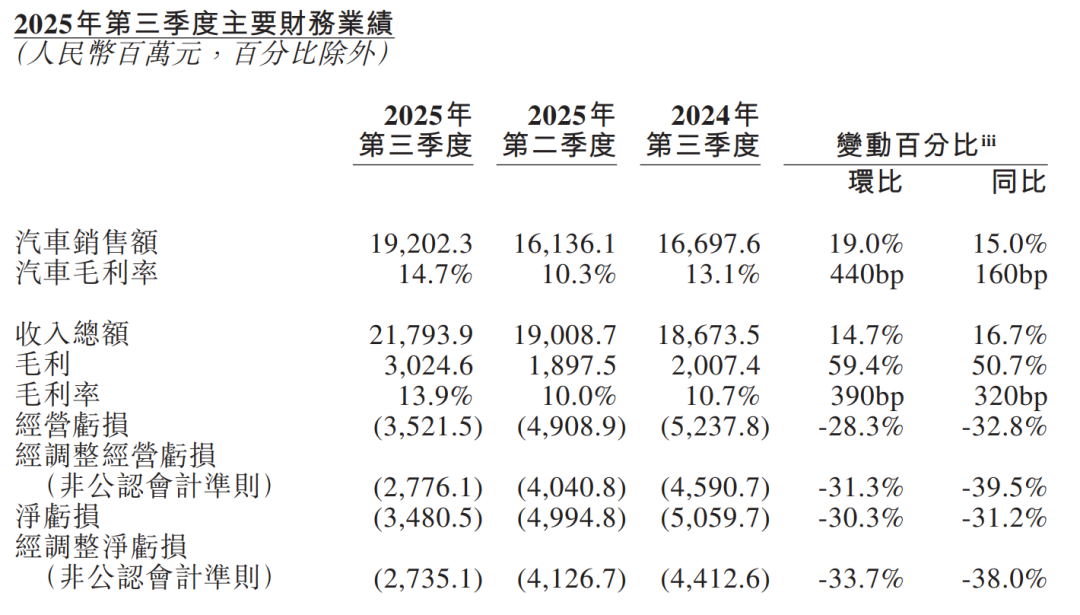

The reversal of the gross profit margin is most critical. The consolidated gross profit margin in Q3 was 13.9%, and the vehicle gross profit margin was 14.7%, both reaching new three-year highs.

This is driven by three factors: First, supply chain optimization and the localization of the self-developed Shenji NX9031 chip have reduced per-unit costs. Second, product mix optimization has increased the proportion of high-margin models. The gross margin of the new ES8 exceeds 20%, while the ES6 and EC6 reach or exceed 25%, and the Leo L60 remains between 15% and 20%. Third, organizational streamlining and strict cost control measures have begun to take effect.

Image source: NIO's official website

Secondly, the positive operating cash flow holds more practical significance. For a company long reliant on external 'blood transfusions,' this marks a symbolic step toward 'self-sufficiency.'

It benefits not only from the cash inflow driven by rising deliveries but also reflects progress in working capital management—inventory control and capital turnover efficiency are improving. Cash reserves reached RMB 36.7 billion in Q3, a significant increase of nearly RMB 10 billion QoQ, achieving positive operating and free cash flows.

However, this interim victory still harbors concerns.

Currently, NIO's gross profit margin heavily depends on its product mix and pricing. If competition drives down premiums or upstream material/transportation costs rebound, gross margins could quickly decline.

Similarly, whether the positive operating cash flow can be sustained or is merely a fleeting phenomenon during peak delivery periods remains to be seen.

The dividends from efficiency improvements will eventually hit a ceiling. NIO's 'indicators have improved,' but it is far from 'fully recovered.'

Three-step path to profitability: Only halfway there

If NIO's journey to profitability is likened to climbing three tiers—'positive gross margin,' 'positive operating cash flow,' and 'positive net profit'—then NIO is currently catching its breath on the second tier.

It has narrowly crossed the threshold of positive operating cash flow, but the steepest third tier—'positive net profit'—remains shrouded in fog and out of reach.

Although the loss is narrowing—Q3 2025 net loss was RMB 3.48 billion, down 31.2% YoY; adjusted net loss under non-GAAP was RMB 2.735 billion, down 38.0% YoY—the sheer existence of massive losses brutally exposes a reality: Despite Li Bin's aggressive 'efficiency revolution,' the company's enormous fixed cost and expense structure remains a profit-devouring 'beast.'

Image source: NIO's Q3 2025 report

This 'beast' consists of two parts: First, the heavy burden from asset-intensive layout (you may want to translate this as 'deployments' or 'investments'). As of October 31, NIO has built 3,614 battery swap stations, 4,801 charging stations, and 27,396 charging poles worldwide. This vast energy network completed its 90 millionth battery swap service on October 26, with a vehicle 'fully charged and departing' every 0.86 seconds on average.

Battery swapping is indeed NIO's most unique competitive moat, offering users an irreplaceable experience. However, commercially, each swap station is a continuous cost center—high construction costs, ongoing land rent, equipment depreciation, battery reserves, and operational labor costs all continuously drain the company's cash flow. Before achieving sufficient network effects and scalable revenue, this proud energy system will continue to 'bleed.'

Image source: Internet

Charging stations and poles are also engaged in price wars with other networks. The author once charged at a NIO Power station, and the unit price was indeed relatively affordable, but this also means it cannot contribute much profit in the short term and may even require financial support.

Second, three major expense categories remain high. Despite Li Bin's strong push for cost reduction and efficiency improvement, R&D investment necessary to maintain technological leadership and high-end brand positioning, as well as the maintenance costs of a nationwide sales and service network, remain substantial.

Image source: Internet

This means NIO's 'efficiency revolution' scalpel has not yet reached these deepest structural costs. Li Bin's current efforts resemble a strategist conducting a carefully calculated 'trade space for time'—buying precious breathing room through operational efficiency gains to stockpile ammunition for the upcoming ultimate showdown.

The true outcome remains distant.

Ultimate gamble: Scalability driven by technological advantages is the only 'life-saving pill'

Ultimately, efficiency improvements are merely NIO's 'life-extending pill,' while the true 'life-saving pill' lies in achieving scalable profitability. In this industry where scale determines survival, failure to achieve large-scale deliveries will render any refined operational achievements unsustainable.

NIO's future hinges on three interlocking strategic gambles:

The technological gamble is fundamental. NIO is betting that full-stack self-development can establish long-term technological barriers and achieve continuous cost reductions. However, this path requires sustained massive R&D investment and is a race against time. The core question is whether its self-developed achievements can truly translate into irreplaceable product advantages and continuously declining marginal costs before the window of opportunity closes.

Image source: NIO's official website

The ecological gamble is the heaviest. NIO believes its battery swap network will create high user stickiness and energy service revenue, setting it apart from competitors. However, this 'moat' requires continuous investment. The key is whether this asset-heavy system can transform from a current 'cost black hole ' (you may want to translate this as 'cost sinkhole') into a self-sustaining value engine.

The brand gamble is a matter of survival. Sub-brands like Leo and Firefly carry the mission of scaling up for NIO. The main brand establishes a high-end image, while sub-brands handle volume to distribute costs—whether this strategy can continue to work will directly determine NIO's survival space.

Image source: Internet

These three gambles are interdependent yet mutually restrictive: Technological advantages require scale to dilute R&D costs; the value of the battery swap network needs a sufficiently large user base for support; and the success of sub-brands relies on strict cost control and scale, but can profits from affordable scalability dilute investments in technology and battery swapping?

Pricing challenges are already emerging. NIO's average selling price in Q3 dropped to RMB 220,500, down RMB 49,000 YoY, mainly influenced by the rising sales proportion of the lower-priced Firefly brand. While the multi-brand strategy expands market coverage, it inevitably dilutes brand premium capabilities. Balancing sales growth and brand positioning has become a long-term challenge for NIO.

External threats are equally daunting. Next year, several extended-range models equipped with large-capacity batteries will enter the market, significantly boosting their pure electric range and even approaching that of peer pure electric models. For NIO, which adheres to a pure electric route, this could constitute new market pressure.

Internal challenges are equally severe. The new ES8 needs to achieve a monthly delivery target of 15,000 units in December, placing enormous pressure on production ramp-up. Sources indicate that NIO has submitted a request to the Hefei municipal government to urgently recruit 1,000 workers by the end of October to boost production capacity.

As Li Bin stated at the earnings call, the phasing out of trade-in subsidies has significantly impacted the market, and the entire industry is unlikely to see a repeat of last year's year-end surge. Among them, mid-to-low-priced models like the Leo L60 will face greater policy headwinds.

Image source: Leo Auto's Weibo

In this highly volatile market environment, NIO's three gambles face dual tests from both internal and external factors.

Conclusion: Far from time to celebrate

NIO has outlined an aggressive blueprint for Q4: Delivery guidance of 120,000 to 125,000 units, up 65.1% to 72.0% YoY; revenue expectation of RMB 32.76 billion to RMB 34.04 billion, up 66.3% to 72.8% YoY. Both figures will set new records.

Image source: Internet

But it is far from time to celebrate.

A single quarter of impressive data is never sufficient to prove a company's true recovery. Sustainable revival requires consecutive quarters demonstrating continuous improvement in gross profit margin, cash flow, and profitability. Li Bin's 'efficiency' scalpel has shown its edge, but judging the success of this operation requires several more quarters.

In the coming quarters, NIO needs to prove to the market that the current improvements are not fleeting—that its gross profit margin can withstand industry cycle shocks and its cash flow can form a healthy closed loop.

Objectively speaking, the Q3 financial report did serve as a timely rain, alleviating long-standing market anxieties. Multiple indicators, including deliveries, revenue, and gross profit margin, reached new highs, confirming the rebound in product competitiveness and operational efficiency improvements.

What is particularly crucial is that the cash reserve increased by nearly 10 billion yuan quarter-on-quarter to reach 36.7 billion yuan. The simultaneous turnaround of both operating cash flow and free cash flow to positive has reserved sufficient ammunition for the all-out sprint in the fourth quarter.

After navigating through the 'wild growth and survival tests' in the first half, NIO has now entered the second half, characterized by 'efficiency improvement and scale victory.' Although the capital market has provided Li Bin with a much more generous time window than a year ago, the whistle deciding the fate has already blown.

Image source: Internet

This transformation experiment, the most representative among China's emerging automakers, still holds a suspenseful ending—NIO's ultimate fate could either be to become the 'Apple of the electric vehicle world' with its unique energy ecosystem and comprehensive brand positioning, or to become a classic case for reflection in business school textbooks due to an overly ambitious strategy and unsustainable funding.

At this moment, what investors need to determine is no longer how much loss NIO will incur next quarter, but whether the speed of its strategic execution can outpace the rate of capital consumption. This is a high-stakes gamble with no retreat: win, and the sky is the limit; lose, and it's irreversible doom.

The story of NIO is far from over. The most thrilling—or perhaps the most brutal—chapter may have just begun.

References:

1. 'NIO Financial Report'

2. 'NIO's Latest Financial Report Shows Narrowed Losses, Li Bin: Still Confident in Q4 Profitability' - Yicai Global

3. 'Is NIO Finally on the Path to Profitability?' - China Business Journal

END