First Central SOE New Energy Firm Eyes Hong Kong IPO! Avatr's Jan-Jul Revenue Tops 2024 Total, All Indicators Soar | Mirrpro

![]() 11/28 2025

11/28 2025

![]() 480

480

On November 27, Avatr Technology filed an IPO application with the Hong Kong Stock Exchange, signaling that Avatr's IPO has entered its final stretch.

Avatr has long had a clear roadmap for going public. In 2021, its senior management revealed plans for an IPO between 2024 and 2025. In 2023, citing "necessary considerations and balances," Avatr Technology adjusted its IPO timeline to around 2025. In November 2024, the Shanghai United Assets and Equity Exchange, in promoting Avatr's capital increase project, stated that Avatr had set a definitive listing plan for 2026. This marks the first central SOE new energy brand to specify a listing timeline.

Based on current progress, following this application submission, Avatr's IPO is expected to materialize in the second quarter of next year, aligning with its previously announced plan. As a highly distinctive new energy enterprise, Avatr's valuation has surged 40-fold in three years, from RMB 788.2 million in 2021 to over RMB 30 billion by 2024. According to the prospectus, Avatr's IPO application boasts several key highlights:

Firstly, it is the first automotive central SOE new energy vehicle brand to apply for a Hong Kong Stock Exchange listing through conventional channels. Notably, listing via the IPO model demands higher standards for compliant operations and modern governance, implying stricter requirements for enterprise strength. While other central SOE brands have previously submitted Hong Kong Stock Exchange listing applications, they opted for simpler methods like introducing listings. Secondly, from a financial perspective, Avatr is experiencing rapid growth, with significant improvements and swift expansion across various financial metrics. Thirdly, Avatr holds a 10% stake in Yinwang Company, providing crucial performance support and distinguishing it among currently IPO-bound automotive new energy brands.

Additionally, Avatr emphasizes its asset-light operation model as a distinct advantage. Among current new energy brands, only those backed by large groups can truly achieve asset-light operations, allowing Avatr to focus resources on creating higher ecological value for users. For instance, researchers constitute 57.1% of Avatr's workforce, a relatively high proportion, indicating considerable original innovation capabilities.

Currently, the competitive landscape in China's new luxury new energy passenger vehicle market is intensifying. Multiple brands are demonstrating strong growth momentum, showcasing enormous market potential and brand appeal. In terms of annual growth rate, Avatr ranks second in the new luxury new energy passenger vehicle market. Avatr states that as its product portfolio diversifies, it will gradually increase its overall delivery scale and operational flexibility, aiming to reach sales levels comparable to those of leading industry peers. This implies Avatr's ambition to become the industry's top player, rather than being confined to its niche market.

Zhu Huarong, Chairman of Changan Automobile, previously stated, "Based on the original support for Avatr in terms of 'funding, personnel, and technology,' we will also provide 'mechanisms and ecosystems.'" This time, the funds raised from Avatr's Hong Kong listing will primarily be used for product development, platform and technology development, brand building, sales and service network construction, as well as supplementing operational funds to further enhance its core competitiveness. Undoubtedly, another dark horse in China's luxury new energy vehicle market is poised to emerge.

01 Highly Growth-Oriented and Rapidly Expanding Financial Reports

Although Changan previously disclosed some of Avatr's financial data, this prospectus provides more detailed figures, allowing for a closer examination of the company's development potential and value.

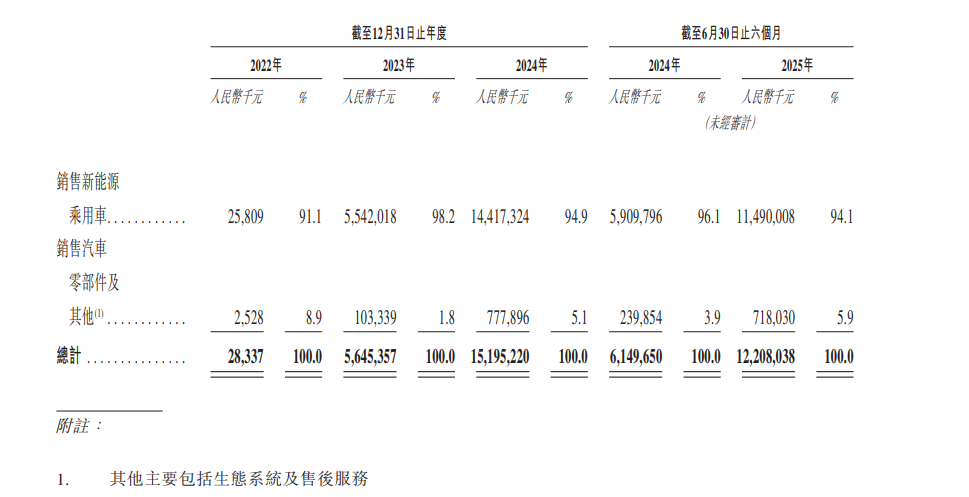

In terms of revenue, from 2022 to the first half of 2025, Avatr's operating revenues were RMB 28.34 million, RMB 5.645 billion, RMB 15.195 billion, and RMB 12.208 billion, respectively. In the first half of 2025, Avatr's operating revenue exceeded RMB 12.208 billion, doubling from RMB 6.149 billion in the same period of 2024, with a growth rate of 98.52%. Official data also shows that in the first seven months of this year, Avatr's revenue has surpassed RMB 15 billion. At the current pace, Avatr's revenue this year may reach RMB 30 billion.

Breaking it down, revenue from the main business of complete vehicles has grown rapidly. Avatr's complete vehicle revenue from 2023 to the first half of 2025 was RMB 5.542 billion, RMB 14.4173 billion, and RMB 11.49 billion, respectively. From the perspectives of revenue and complete vehicle revenue, the first half of this year has already surpassed the performance of the entire previous year. In the first half of this year, the year-on-year growth rate of complete vehicle revenue also reached as high as 94.4%. Additionally, Avatr's revenue from other businesses (including ecosystems and after-sales services) increased from RMB 103 million in 2023 to RMB 777.9 million in 2024, accounting for 1.8% and 5.1%, respectively. As the number of complete vehicles in ownership gradually increases, non-complete vehicle revenue is rising rapidly and has enormous potential.

Regionally, Avatr's overseas market growth has also been remarkable. In 2024, when Avatr just started exporting, it generated only RMB 220 million in revenue, while in the first half of 2025, it achieved RMB 686 million in revenue, with annual revenue expected to exceed RMB 1.3 billion.

In terms of gross profit, there was a significant increase in 2025, with the growth rate far exceeding that of revenue. From 2022 to the first half of 2025, Avatr's gross profits were -RMB 103 million, -RMB 169 million, RMB 960 million, and RMB 1.237 billion, respectively. From the data, it can be seen that Avatr's gross profit performance in the first half of this year has achieved a major reversal, with a substantial year-on-year increase of 364% from 2024, a net increase of RMB 970 million. The growth rate of gross profit far exceeds that of revenue, indicating that Avatr's profitability is improving at an accelerating pace.

In terms of gross profit margin, Avatr is also in a rapidly improving upward trend. Avatr achieved a positive gross profit margin in 2024, with a full-year gross profit margin of 6.32%, increasing to 10.1% in the first half of this year. Compared to the first half of last year, there was a significant year-on-year increase of 6 percentage points. It should be mentioned that Avatr has made substantial investments in research and development in the first half of this year. The R&D investment in the first half of this year was RMB 830 million, a year-on-year increase of 167%.

From the financial report data, Avatr can be described as being in a 'high-speed development phase' at this stage, characterized by high investment and high growth. After this stage, the company will reach the break-even point.

The automotive industry is characterized by economies of scale, with the core being to expand sales volume. In the first half of this year, Avatr's cumulative sales were 59,084 vehicles, compared to 29,030 vehicles in the same period last year, a year-on-year increase of 103.5%. However, on a monthly basis, starting from the third quarter, monthly sales have been continuously rising. In October, Avatr's sales reached 13,506 vehicles, a year-on-year increase of 34%, setting a new historical high, and sales have exceeded 10,000 vehicles for eight consecutive months. From January to October, cumulative sales were 104,245 vehicles. Sales in the third quarter alone were close to those in the first half of the year. Following this trend, annual sales are expected to exceed 140,000 vehicles. With rapid scale expansion, Avatr's profitability will arrive soon.

02 The Uniqueness of Avatr

Of course, judging the value of an automaker is not just about its current profitability but also about its long-term development value and potential. Currently, listed new automakers include NIO, Li Auto, XPENG, Zeekr, and Leapmotor, among which only Li Auto, Leapmotor, and Zeekr have achieved profitability. Moreover, all six companies were in substantial losses at the time of their listings. From the third quarter reports this year, it can also be seen that some companies that previously achieved rapid profitability have suddenly turned to losses. Therefore, judgments about companies should be more dynamic and focus on long-term value.

So, among the numerous new forces, what are Avatr's unique value points and advantages? Firstly, unlike other automakers, Avatr's unique highlight is that it is the only one created through a 'tripartite alliance.' Avatr was established through a joint effort by Changan, CATL, and Huawei. For Huawei, Avatr can be regarded as its 'prodigal son' in terms of strategic importance. As a result, Avatr has received the maximum support from these three top players in core technologies such as complete vehicle design, intelligent software, and battery power. Now, with Changan upgraded to a new central SOE, Avatr has received more resource support, and the tripartite cooperation has further deepened.

Through the empowerment of these three parties, in three years, Avatr has completed the layout of four main models, including Avatr 11, Avatr 12, Avatr 07, and Avatr 06, achieving a full range of pure electric + extended-range dual power layouts. It has also derived the Avatr 11 and Avatr 12 Royal Theater Editions, as well as the Avatr 011 and Avatr 012, two limited edition co-branded models in the 0 series, covering the mainstream high-end and luxury markets in the price range of RMB 200,000 to RMB 700,000. In particular, the newly launched Avatr 12 Four-Laser Edition in November this year has set a new benchmark for product competitiveness in its class.

Of course, for Avatr, it is also one of the two major non-Huawei shareholders of Huawei's subsidiary Yinwang Automobile, which is Avatr's unique value. Currently, Avatr holds a 10% stake in Yinwang Company, with an investment of RMB 11.5 billion (fully paid). This not only provides Avatr with reliable technical support but also brings the strongest support to its performance. Currently, Avatr Technology and Huawei are smoothly and orderly promoting the Hi Plus model. The joint team of the two parties, consisting of nearly a thousand people, has been stationed at Avatr's headquarters in Chongqing, and the first jointly created product will be launched in the second half of next year.

In addition, Yinwang also brings tangible profit contributions. According to previous announcements, Yinwang started to turn a profit in 2024 and quickly achieved profitability. From January to June 2024, Yinwang's revenue was RMB 10.43 billion, with a net profit of RMB 2.23 billion and a net profit margin of 21.38%. Obviously, as Yinwang gradually expands its cooperation with various automakers, this will become an important source of income for Avatr's performance. Of course, this also makes Avatr's investment value more prominent among all listed new energy brands. As a reference, Seres, which also holds a stake in Yinwang, currently has a market value exceeding RMB 100 billion, providing Avatr with considerable room for imagination.

With the empowerment of multiple parties, Avatr Technology's new offensive has begun. In September this year, Avatr released its Strategy 2.0, planning to fully promote product, technology, and service upgrades as well as global advancement, striving to achieve global sales of 400,000 vehicles and annual revenue of RMB 100 billion by 2027, 800,000 vehicles by 2030, and challenging 1.5 million vehicles by 2035. With the support of the three parties, Avatr will jointly launch five upgraded models in 2026 and 17 new models by 2030, covering niche segments such as sedans, SUVs, and MPVs.

In terms of technology, Huawei's Qiankun ADS 4, HarmonyOS Cockpit, Taihang Intelligent Control Chassis, Kunlun Smart Extended-Range, CATL's Shenxing Ultra-Fast Charging, and CATL's Xiaoyao Extended-Range/Hybrid Batteries—these six major technologies are comprehensively advancing, with continuous technological evolution. The continuous technological support will be the key to Avatr's sustained improvement in the market.

As the high-end strategic carrier of the new central SOE China Changan, Avatr's listing in Hong Kong makes it the first central SOE new energy automaker to submit an IPO application to the Hong Kong Stock Exchange. This is not only a capital process for the company itself but also a substantive measure to actively respond to national industrial policies and implement the 'Brand Strong Country' strategy, becoming a benchmark for capital operations of central SOE new energy companies. This year, Avatr has continuously entered explosive moments in the market, followed by refreshing its strategic layout. Now, with the IPO bringing new capital support, under the combined efforts of these three points, it has entered a new stage of development.