Nubia's Partnership with Doubao: The Imperative for Survival

![]() 12/12 2025

12/12 2025

![]() 625

625

Author: Chuan Chuan

Editor: Da Feng

Ni Fei, the President of Nubia, took it upon himself to test Nubia's latest smartphone.

On December 10, Ni Fei, who is both the President of ZTE's Mobile Device Division and Nubia Technology Co., Ltd., announced that he would entrust the management of his Weibo comment section to the Doubao mobile assistant for half an hour, inviting netizens to post their questions and comments.

Ni Fei declared, "For the next half hour, I'll let the Doubao mobile assistant handle my Weibo comment section. Feel free to leave any questions in the comments, and it will respond on my behalf."

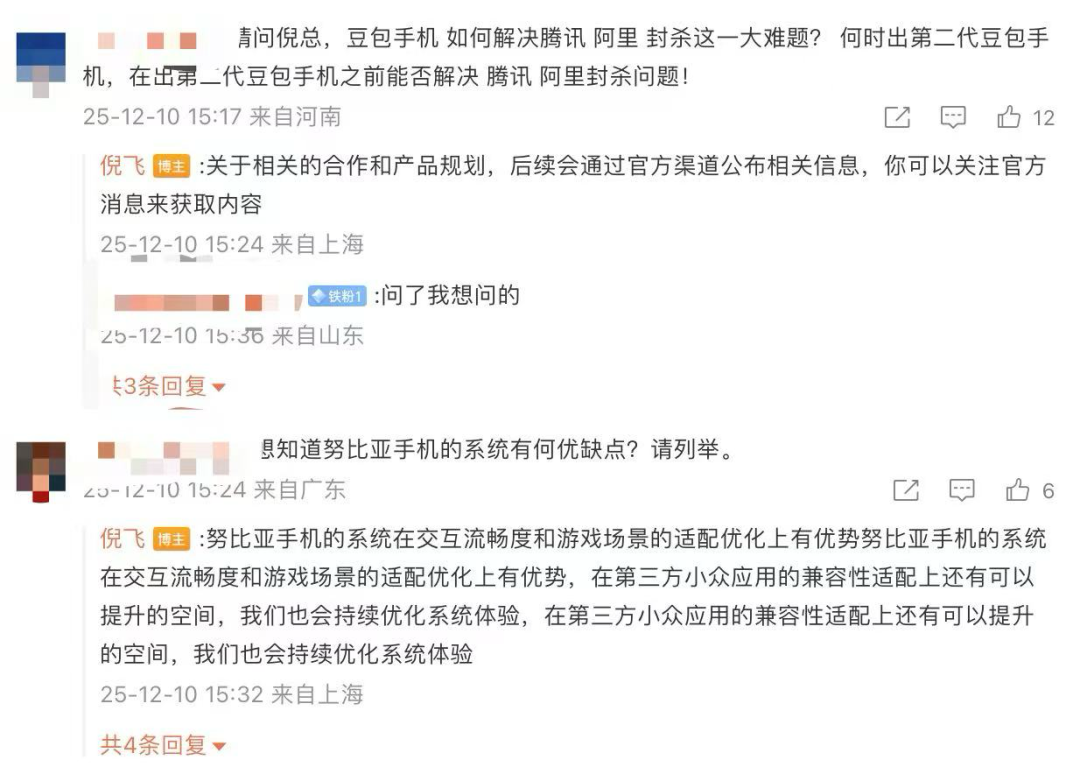

From the responses, it was evident that Doubao's replies were quite formal, with some even being repeated.

On the surface, this appeared to be a routine technical test, but for Nubia, it seemed more akin to a 'self-rescue experiment' that was long overdue. After all, amidst the controversy, Nubia phones have once again captured public attention.

Where Has the 'Photography Phone' Gone?

If you were to visit any major mobile phone store today in search of a new Nubia phone, you might find it challenging to locate one. On e-commerce platforms, Nubia's sales consistently hover at the lower end of the rankings. The monthly sales of its flagship model, the Z60 Ultra, sometimes don't even come close to a fraction of the sales achieved by a mid-range phone from a leading brand.

Third-party data reveals that in 2023, Nubia held a mere 0.8% share of China's domestic smartphone market, a decline of over 90% from its peak.

This marginalized position did not occur overnight. Nowadays, when young people are in the market for a phone, they first consider chip performance, followed by AI capabilities, and also take into account ecosystem integration. Nubia's emphasis on the 'NeoVision camera system' and 'bezel-less design' may sound professional, but ordinary users do not find them particularly appealing or useful.

Supply chain pressures have also made life increasingly challenging for Nubia.

According to industry insiders close to Nubia, due to limited shipment volumes, its bargaining power with core suppliers such as Qualcomm and Sony has continuously diminished. "For screens of the same specifications, our purchase price is 15% higher than Xiaomi's, and battery costs are 8% higher." This cost disadvantage is directly reflected in pricing—when the Redmi Note series offers flagship-level imaging at a thousand-yuan price point, Nubia's mid-range models still struggle to compete in the 2,000-yuan range, gradually eroding the label of 'cost-effectiveness'.

The Years When It Was So Close to 'Mainstream'

Let's rewind to 2013. At the launch event in Beijing's 798 Art District, Ni Fei, then Vice President of ZTE Corporation, held up a bezel-less phone, and the flashbulbs below merged into a sea of stars.

This product, named the 'Nubia Z5,' was the first to bring the concept of 'universal network compatibility' to the mainstream. At the time, custom phones from the three major carriers were still competing independently, and it was common for users to switch phones when changing numbers. The Z5 supported 4G networks from China Mobile, China Unicom, and China Telecom, instantly addressing the pain point of 'multi-SIM users.' On its first sales day, the 100,000 units prepared for online channels sold out within 30 minutes, and offline stores saw lines stretching over a hundred meters, with scalpers even reselling them for a 500-yuan markup.

What truly cemented Nubia's position in the 'photography phone' realm was the 'star trail mode' introduced in 2014.

At the time, mobile photography was still in the 'recording images' stage. Nubia's engineering team spent half a year developing 'slow shutter + algorithm noise reduction' technology. Users could capture galaxy trails and city nightscape light paintings without professional equipment, just using their phones.

During an extreme test at Namtso Lake in Tibet, a photographer continuously exposed the Nubia Z7 Max for 2 hours, and the final image showed star trails as clear as ribbons. This photo later made it onto the annual image list of 'Chinese National Geography.'

Official data shows that in 2015, Nubia's domestic market shipments exceeded 10 million units, with overseas markets covering over 30 countries. Its European market share once ranked in the top five, and 'the phone that can photograph stars' became its most distinctive label.

At that time, Nubia was a benchmark for ZTE's 'large state-owned enterprise + internet' transformation. Leveraging ZTE's accumulated communication technology, it pioneered FiT gesture operations (controlling photos and screenshots through edge swipes); with precise insights into young users, it signed Cristiano Ronaldo as a global spokesperson and sponsored Bundesliga powerhouse Schalke 04; even launching the 'RedMagic' sub-brand in 2016 to preemptively position itself in the niche 'gaming phone' segment—keep in mind that Black Shark and ROG only officially entered the market in 2018.

A former Nubia product manager recalls those days with a sparkle in his eyes: "Back then, everyone in the company believed we could reach the top three domestic brands within three years."

The Lost Decade and the Reason for Survival

The turning point came in 2017. That year, China's smartphone market saw its first negative growth, entering an era of 'stock competition'; Huawei solidified its high-end position with imaging breakthroughs in the P and Mate series, Xiaomi captured the mid-to-low-end market with 'full-screen displays' and 'cost-effectiveness,' and OV completed a comeback through offline channel expansion. Meanwhile, Nubia gradually lost focus amid strategic vacillation of 'trying to do everything.'

First was unclear positioning. While Huawei focused on 'business flagships' and Xiaomi on 'ecosystem chains,' Nubia wanted to maintain its 'photography expert' identity while also capturing the gaming phone market with RedMagic and sustaining a mid-to-high-end image with the Z series, dispersing resources and failing to excel in any direction. The Z18 launched in 2018 emphasized 'notch-less full-screen displays,' but during the same period, the vivo NEX's pop-up camera and OPPO Find X's slider design generated more buzz; RedMagic's gaming phone, though the first to feature air cooling, was overshadowed by Black Shark's 'liquid cooling + shoulder buttons' solution.

Second was technological conversion lag. Nubia's once-proud 'NeoVision camera system,' overly reliant on algorithmic optimization, gradually fell behind in hardware iterations. While Huawei collaborated with Leica to tune colors and Xiaomi introduced 100-megapixel sensors, Nubia's imaging solution remained stuck at 'high resolution + filters,' leaving users with the impression that 'photos look good but not 'premium.''

Even more fatal was that its once-differentiating 'bezel-less design' faced high accidental touch rates and low yield rates, ultimately forcing a return to traditional bezels—turning a former advantage into a burden on innovation.

Financial strain accelerated the decline. In 2019, ZTE faced U.S. sanctions, weakening the parent company's ability to provide financial support, and Nubia had to cut back on R&D investment. According to financial reports, from 2018 to 2021, Nubia's R&D expense ratio dropped from 8.2% to 4.5%, while Huawei and Xiaomi maintained ratios above 10% during the same period. A former employee revealed: "At that time, we cut one-third of the imaging lab staff, halted many pre-research projects like 'periscope telephoto' and 'computational optics,' and could only piece together mature solutions."

But Nubia didn't disappear entirely. What kept it alive was, first, the parent company's 'strategic retention.' As a key part of ZTE's 'consumer business,' Nubia served as a 'technology testbed'—for example, its early FiT edge touch technology was later integrated into ZTE Axon series' air gesture controls; RedMagic's gaming cooling solutions also provided references for ZTE's subsequent tablet products. Second were 'niche market diehards.'

Despite its overall low market share, Nubia still had loyal fans in geek circles: photography enthusiasts valued the freedom of its manual mode, gamers recognized RedMagic's control optimizations, and outdoor users favored the durability of its rugged models. Third was the 'small but beautiful' survival wisdom. Abandoning direct competition with leading brands, Nubia shifted toward custom and industry-specific machines, such as the 'He Series' for China Mobile and encrypted phones for the public security sector. While these B2B orders weren't highly profitable, they provided stable cash flow.

Back at Ni Fei's test site. When the Doubao team proposed 'optimizing voice interaction with AI,' there were internal disagreements at Nubia: some believed 'AI is a game for giants, and we can't afford to play,' but more recognized that this might be the last chance to break the deadlock—after all, if you can't even 'understand users,' how can you 'redefine smartphones?'

The collaboration progressed more difficultly than imagined. At least judging by the current wave of negative publicity, one could only say 'any publicity is good publicity.'

The significance of this collaboration may not lie in boosting sales in the short term but in Nubia finally learning to 'leverage external forces.'

For Nubia, the partnership with Doubao may be just a small step on its long road to self-rescue. But when a once-glorious yet silent smartphone brand is willing to set aside its 'technological obsessions' and embrace change with an open mindset, who can say it doesn't have a chance to be 'seen' again? After all, in an era where 'the only constant is change,' surviving itself is the most powerful rebuttal to 'disappearance.'