Qingdao's AI Dark Horse Sets Sights on HKEX Listing

![]() 01/27 2026

01/27 2026

![]() 407

407

As a wave of AI companies rushes to list in Hong Kong, a Qingdao-based AI 'little giant' has embarked on the journey to list on the Hong Kong stock exchange.

On January 20, Shandong Extreme Vision Technology Co., Ltd. (hereinafter referred to as 'Extreme Vision'), a leading domestic AI platform enterprise, submitted a prospectus to the Hong Kong Stock Exchange (HKEX), aiming to list on the Hong Kong Main Board through 'Chapter 18C'.

According to available information, Extreme Vision was founded in Macau in June 2015, specializing in the fields of artificial intelligence and computer vision algorithms. The company's founder and chairman, Chen Zhenjie, is a 'post-90s' entrepreneur hailing from Macau. He holds degrees from Sun Yat-sen University and the Guanghua School of Management at Peking University and has previously worked at Tencent Strategy, Bain & Company, and KPMG Advisory.

From its development trajectory, Extreme Vision initially operated out of Macau and Shenzhen. Later, at the end of 2021, the state-owned assets of the West Coast New Area successfully attracted Extreme Vision through capital investment. In 2022, Extreme Vision was selected as one of the fourth batch of national specialized, refined, and new 'little giant' enterprises.

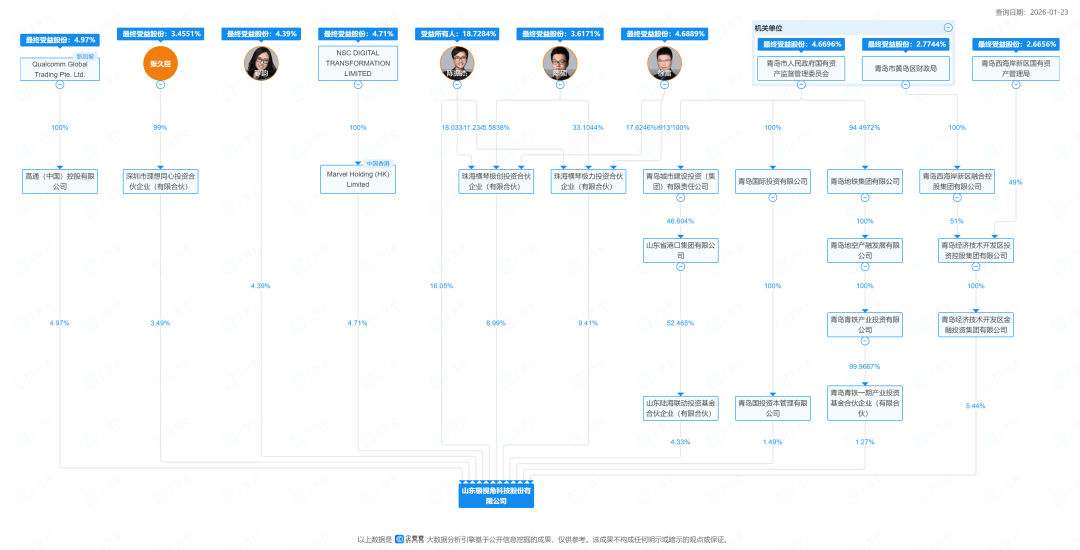

Through equity information, it is revealed that Qingdao Economic and Technological Development Zone Financial Investment Group Co., Ltd., the state-owned assets entity of the West Coast New Area, is currently the fifth-largest shareholder of Extreme Vision, holding a 5.44% stake. Additionally, entities under the Qingdao Municipal State-owned Assets Supervision and Administration Commission, such as Qingdao State Investment and Qingdao Railway Phase I Industrial Investment Fund, collectively hold a 4.67% stake in the company. In other words, Qingdao's municipal state-owned assets currently hold a total of 10.11% stake in Extreme Vision.

Since relocating to Qingdao, Extreme Vision appears to have been gearing up for a listing.

In addition to this determined push towards a Hong Kong stock listing, in January 2024, Extreme Vision filed for pre-listing tutoring and registration with the Qingdao Securities Regulatory Bureau, intending to strive for a listing on the Science and Technology Innovation Board (STAR Market). On January 8 of this year, the company completed its eighth phase of tutoring.

In recent years, amidst a tightening A-share IPO environment, many companies have pinned their listing hopes on the Hong Kong stock market.

Meanwhile, the HKEX has been opening its doors wider to hard-tech companies. For instance, since March 2023, Chapter 18C has been incorporated into the Main Board Listing Rules, allowing specialist technology companies without revenue or profits to list in Hong Kong. This move has driven a batch of hard-tech companies to seek listings in Hong Kong.

Taking AI companies as an example, as of July 24 last year, there were 214 companies (including one that passed the hearing) that had submitted applications to list on the HKEX but had not yet been listed. Among them, 48 were AI concept companies, marking a significant increase from previous years.

With the nationwide surge in 'Artificial Intelligence+', Extreme Vision, which focuses on artificial intelligence scenario applications, is poised to seize significant market opportunities.

According to Frost & Sullivan, it is projected that by 2029, the market size of enterprise-level computer vision solutions in China will reach RMB 182.4 billion, with a compound annual growth rate of 37.7% expected from 2024 to 2029.

From the perspective of industry market ranking, based on 2024 revenue, Extreme Vision ranks eighth in China's emerging enterprise-level computer vision solutions market. However, its market share is only 1.6%, still lagging far behind the top-ranked 'Company A' (with a 12.1% market share).

It is evident that Extreme Vision still needs to solidify its competitive edge, especially by capitalizing on the opportunities in AI+manufacturing.

Currently, Extreme Vision is accelerating its strategic positioning in core cities such as Qingdao and Jinan within Shandong Province and continuously expanding its footprint in economically vibrant regions such as the Yangtze River Delta and Guangdong-Hong Kong-Macao Greater Bay Area.

Looking ahead, leveraging the rich industrial scenarios across the city and even the province, actively opening up scenarios to assist companies in expanding their markets, and providing professional support for company listings in terms of valuation and cornerstone investments will also require local assistance.

1

Relying on its platform model, Extreme Vision specializes in providing AI visual algorithm solutions and large model solutions for various industries, including industrial, energy, and retail.

On one hand, Extreme Vision has pioneered an AI algorithm mall based on AI visual algorithm technology. Currently, it offers over 1,500 algorithms covering more than 100 industry scenarios and has served over 3,000 government and enterprise clients.

Taking industrial scenarios as an example, Extreme Vision's intelligent industrial AI safety production algorithm solution can create N algorithm combinations targeting three aspects: 'unsafe human behaviors', 'unsafe states of objects', and 'unsafe environmental factors', to meet the needs of various industrial scenarios. Through Extreme Vision's algorithms, factories can initiate warnings in case of unsafe situations without manual intervention, significantly enhancing industrial production safety management levels and production efficiency.

Around 'AI+manufacturing', Extreme Vision has collaborated with leading companies such as China National Uranium Corporation, Shanxi Aluminum Industry, Sinosteel Tianyuan, and BYD.

In its collaboration with BYD, Extreme Vision utilizes the 'AI Safety and Environmental Intelligence Platform + Customized Algorithm Matrix' as the core, achieving the goal of 'full-process visual supervision' through the seamless integration of AI algorithms with the operational processes in industrial production scenarios.

On the other hand, Extreme Vision is actively developing large model solutions. It first introduced large model solutions in the second half of 2024 to empower enterprise digital transformation.

Subsequently, Extreme Vision launched the delivery platform 'Extreme Intelligence' for large model solutions at the end of 2025. This platform provides functional modules, including knowledge bases, plugin libraries, model libraries, and MCP, to help enterprise clients integrate large language models with their specific business needs.

It can be said that Extreme Vision's platform model can effectively address fragmented and dispersed customer needs across different industries at a relatively low cost, accelerating the application of artificial intelligence technologies across various sectors.

This model has also enabled the company to swiftly penetrate the market, as reflected in its business performance.

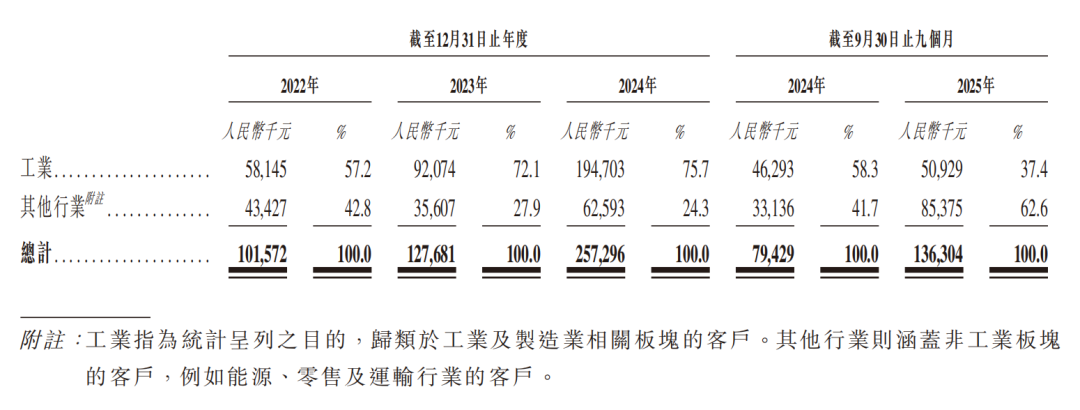

Data shows that from 2022 to the first three quarters of 2025, Extreme Vision achieved revenues of RMB 102 million, RMB 128 million, RMB 257 million, and RMB 136 million, respectively, indicating a significant growth trend. Net profit fluctuated during the same period, with losses of RMB 61 million and RMB 56 million in 2022 and 2023, respectively, but turning a profit in 2024 with a net profit of RMB 5 million.

Further analysis reveals that industrial-related business is the absolute pillar of the company. According to the prospectus, the proportion of Extreme Vision's industrial-related revenue has been increasing year by year, reaching 57.2%, 72.1%, and 75.7% from 2022 to 2024, respectively, accounting for three-quarters of the company's revenue.

Breakdown of Extreme Vision's Revenue by Industry

From the perspective of the use of proceeds from this listing, Extreme Vision will continue to delve deeper into the AI visual algorithm market and accelerate the expansion of emerging businesses such as AI large models.

According to the prospectus, in terms of technology research and development, funds will be primarily invested in AI algorithm iteration, upgrading the integrated platform for full-domain training, labeling, and inference, and technological reserves related to AI large models. In terms of market expansion, the focus will be on deepening existing industry clients and exploring emerging application scenarios.

2

Overall, through model innovations such as the visual algorithm mall, Extreme Vision has established competitive advantages in differentiated algorithm supply and scenario implementation.

However, as industry giants enter the fray and the industry consolidates towards the top, squeezing the development space for small and medium-sized enterprises, Extreme Vision still faces significant pressure in taking further steps towards higher development.

Additionally, since its establishment, Extreme Vision has undergone 11 rounds of financing and may, to some extent, face issues such as capital exit and increasing valuations in the primary market.

According to the adjustments made by the HKEX to Chapter 18C starting from August 2024, the minimum market capitalization threshold for listed commercialized companies has been lowered from HK$6 billion to HK$4 billion, while for non-commercialized companies, it has been reduced from HK$10 billion to HK$8 billion. The criterion for commercialization is achieving audited revenue of RMB 250 million in the most recent fiscal year.

For instance, RoboTK, which listed on the HKEX in December 2024, had a valuation of RMB 3.531 billion after its last round of financing in 2022. Meanwhile, the company's revenue from 2021 to 2023 was RMB 174 million, RMB 241 million, and RMB 287 million, respectively. In other words, RoboTK 'just met' the 18C criteria to list on the HKEX.

Currently, due to the stringent requirements for company listing valuations, many local state-owned assets are providing support to companies in terms of valuation enhancement to facilitate their listings in Hong Kong.

For example, after relocating to Taizhou, Zhejiang, Yifei Technology, an industrial robot company from Jinan, quickly announced its 'plan to list on the Main Board of the HKEX through Chapter 18C'. A crucial aspect here is that the issues Yifei Technology needed to address before listing in Hong Kong, such as valuation enhancement and old share transfers, received support from the state-owned assets of Yuhuan City, Taizhou.

Such more specialized capital support requires local attention.