Amazon: An Irreplaceable "Pseudo" E-commerce Giant

![]() 06/05 2024

06/05 2024

![]() 599

599

Illustrated Text | Tangjie

Whether in China or the United States, compared to technology companies that are scrambling to release large models, Amazon's (NASDAQ: AMZN) presence has become increasingly diminished in recent times, even surpassed domestically by emerging e-commerce stars like Temu and Shein. The stock price also reflects this, with a lackluster recent performance.

However, unlike Apple (NASDAQ: AAPL) and Tesla (NASDAQ: TSLA) that we have previously analyzed, Amazon's recent weakness does not indicate any problems with the company or that Temu and Shein's rise has impacted its future prospects. Instead, the company's stock price performance is more influenced by non-fundamental factors.

For instance, interest rate expectations, a crucial external condition for large tech companies and the entire US stock market. With recent declines in inflation and employment data, the expected timing of the Federal Reserve's interest rate cut is advancing. Another factor is dividend payout levels, with Amazon being the only company among the "Seven Sisters" of US stocks, excluding Tesla, that does not pay dividends.

What else? Nothing. In fact, those who are unfamiliar or have limited knowledge of Amazon often misunderstand it. They are not simply the American versions of Alibaba (NYSE: BABA) or JD.com (NASDAQ: JD), and the analysis frameworks used for Chinese internet companies do not apply to them.

01 "Pseudo" E-commerce Giant

The term "pseudo" does not question Amazon's status as a giant, but rather a reinterpretation of its "e-commerce" label.

As everyone knows, Amazon started in the book industry in both China and the US. In the US, they disrupted the traditional business logic of book publishing and distribution, becoming the largest book sales channel in the country. In China, however, they never achieved such a commercial status, as "acclimatization" was always a significant obstacle for US internet companies entering the Chinese market during that era.

E-commerce is Amazon's underlying gene and its most important label.

In the first quarter of this year, Amazon's total revenue reached $143.3 billion, an increase of 12.53% year-on-year. Among this, online stores generated $54.7 billion, accounting for 40%. Including the $34.6 billion from third-party seller services, e-commerce accounted for 60% of the total revenue. From a revenue perspective, e-commerce remains Amazon's most important label, contributing the majority of the company's income.

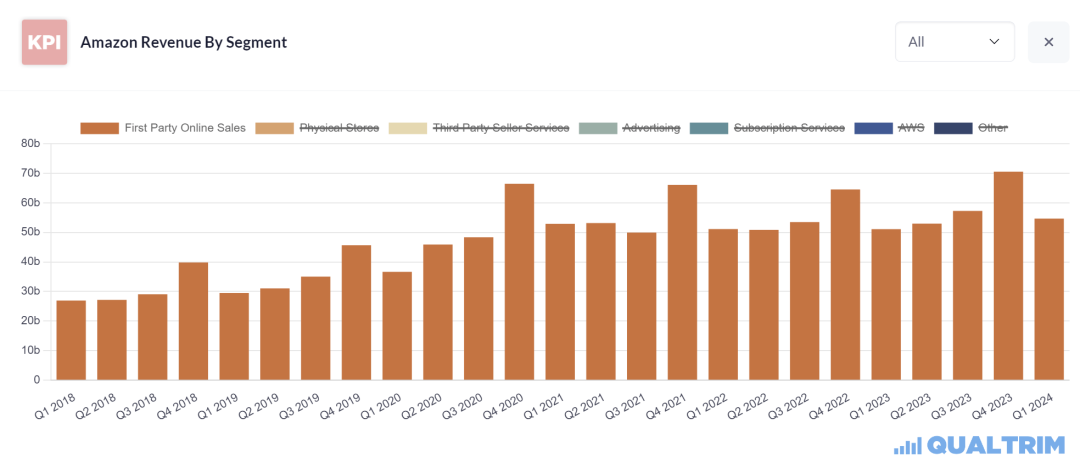

Amazon's e-commerce revenue over the past six quarters. Source: qualtrim

However, in reality, e-commerce has stagnated since 2021. Except for the relatively better performance in the fourth quarter of 2023, it is evident that Amazon has hit a growth plateau in the e-commerce space. Achieving high single-digit growth, or even maintaining mid-to-low single-digit growth in the future, will be challenging.

Moreover, from a profit perspective, e-commerce's contribution is even weaker. In the first quarter of this year, Amazon's operating profit increased from $5 billion in the first quarter of 2023 to $15.3 billion, a three-fold increase year-on-year. However, the largest contributor was not e-commerce, but AWS (Amazon Web Services), which contributed an operating profit of $9.4 billion, accounting for 61.4%.

Even if Amazon does not measure operating profit by specific businesses, several profitable segments can be logically identified. These include advertising, third-party services,