Surge in market value, Luxshare Precision no longer limited to the "Apple supply chain"?

![]() 06/25 2024

06/25 2024

![]() 761

761

In recent years, there have been frequent rumors in the market that Apple is "farewelling" the Chinese supply chain, but in fact, Apple may still find it difficult to give up this important position.

According to official data, among the 186 supply chain manufacturers owned by Apple, there are 49 mainland Chinese manufacturers, accounting for approximately 26.3%; and 45 Taiwanese manufacturers, accounting for approximately 24%.

It can be seen that for Apple, the Chinese supply chain still has important value, and the development of some representative manufacturers also confirms this point.

It is understood that as of the closing of June 25, Luxshare Precision's share price closed at 37.16 yuan per share, with a total market value of 266.8 billion yuan. In the past two months, Luxshare Precision's share price has increased by more than 42%, and its market value has surged by 80 billion yuan.

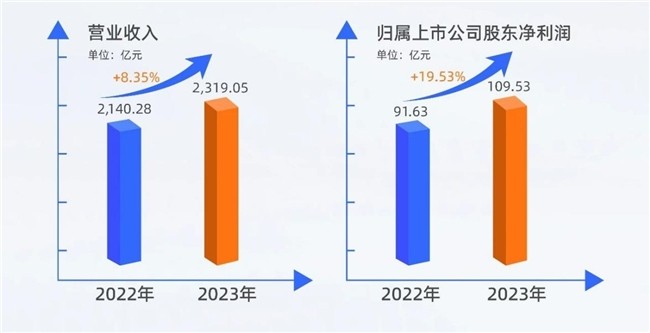

Luxshare Precision is still "popular" in the capital market, and this is largely due to Apple's support. According to financial reports, in 2023, Luxshare Precision achieved revenue of 231.905 billion yuan, representing a year-on-year increase of 8.35%. Among them, the revenue from Apple accounted for up to 75.24%, a further increase from 69.02% in 2020, which also means that the cooperation between the two is still strengthening.

Deeply speaking, for Apple, the importance of the domestic supply chain lies not only in cost-effectiveness, but also in the outstanding advantages of related manufacturers in terms of product quality, process technology, production capacity flexibility, logistics systems, and other aspects.

Taking Luxshare Precision as an example, it is understood that since 2016, Luxshare Precision has delved into areas such as acoustic devices, wireless charging modules, tactile motors, structural components, and SiP packaging, accumulating rich technical experience and continuously improving the maturity of business operations. This has, to a certain extent, promoted its cooperation with Apple. In recent years, it has also entered the AI server field, further matching Apple's business development needs.

Specifically, "AI+" has become a major transformation path in the mobile phone industry, and many industry insiders believe that the emergence of AI phones is expected to trigger a new wave of phone replacements. Against this backdrop, Apple has also begun relevant layouts. For example, at this year's WWDC 2024, Apple launched the personalized intelligent system Apple Intelligence, which will provide a series of AI functions for devices such as the iPhone in the future.

Apple's innovative moves have also enabled manufacturers on the "Apple supply chain" to find new development directions, especially in the context of Apple's supply chain relocation. Luxshare Precision and other companies urgently need to unleash their potential in digital and information-based production to a greater extent to consolidate their cooperation with Apple.

Luxshare Precision has also shown sufficient confidence in its new layout. Wang Laichun, Chairman and General Manager of Luxshare Precision, once said, "Luxshare Precision will definitely become an excellent manufacturer in this field as long as it enters this field; for every product that Luxshare Precision deploys, as long as the direction is right, our goal is to move towards the forefront of the world."

Against the backdrop of the personalization and intelligent upgrading of consumer electronic products, Luxshare Precision has also provided a positive guidance for its future performance: in the first half of 2024, it will achieve a net profit attributable to shareholders of the listed company ranging from 5.227 billion yuan to 5.445 billion yuan, representing a year-on-year increase of 20% to 25%.

In addition, it is worth mentioning that Chinese manufacturers on the "fruit chain" are unable to have a strong voice due to their low gross profit margin and low technical barriers in main contract manufacturing and assembly, raw material supply, and other businesses. Even top enterprises have a greater passive development. For example, in order to stabilize Apple orders, Foxconn has compressed OEM profits from 5% to less than 2%.

Moreover, the competitive situation within the "fruit chain" is continuing to intensify. The existence of the above problems means that companies such as Lixun Precision need to explore more diverse paths beyond embracing the Apple industry chain.

Returning to the business itself, it can be found that Lixun Precision has made more attempts, such as partnering with global chip giant Intel. According to Tianyancha information, Intel has invested in Dongguan Lixun Technology Co., Ltd., a subsidiary of Lixun Precision, holding 3% of the company's shares with a subscribed capital of 17.66 million yuan.

It is reported that Lixun Technology mainly produces and operates communication equipment such as base station antennas, filters, RRUs, as well as interconnection products such as connectors, connecting wires, optical modules, AOCs, etc. In terms of communication and data center business, Lixun Precision has also achieved certain results. Data shows that in 2023, the revenue of this business reached 14.538 billion yuan, with a gross profit margin of 15.8%.

It is obvious that Lixun Precision is stepping out of the framework of the "fruit chain" and seeking greater development opportunities, which is also what the market most wants to see.