Lei Jun's Mi Ecosystem Hits Dong Mingzhu's Blind Spot

![]() 07/12 2024

07/12 2024

![]() 720

720

Editor-in-Chief | Su Huai

Gree (000651.SZ) and Xiaomi (01810.HK) are at it again.

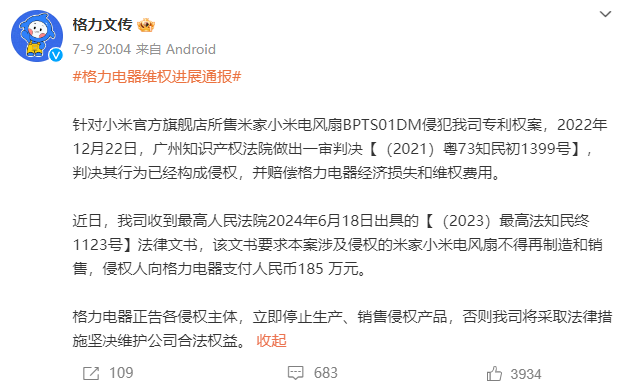

On the evening of July 9, according to the official Weibo account of "Gree Literature Transmission," Gree Electric Appliances recently received a legal document numbered [(2023) Zuifa Zhimin Zhong 1123] issued by the Supreme People's Court on June 18, 2024. The document requires that the infringing Mijia Xiaomi electric fan involved in this case must no longer be manufactured and sold, and the infringer must pay RMB 1.85 million to Gree Electric Appliances.

Image source: Screenshot from Gree Literature Transmission's Weibo

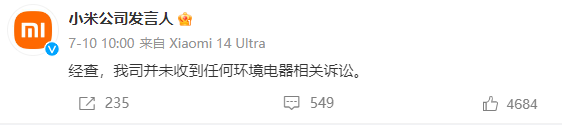

Subsequently, Xiaomi responded firmly on July 10: After investigation, our company has not received any lawsuits related to environmental appliances.

Image source: Screenshot from Xiaomi Company Spokesperson's Weibo

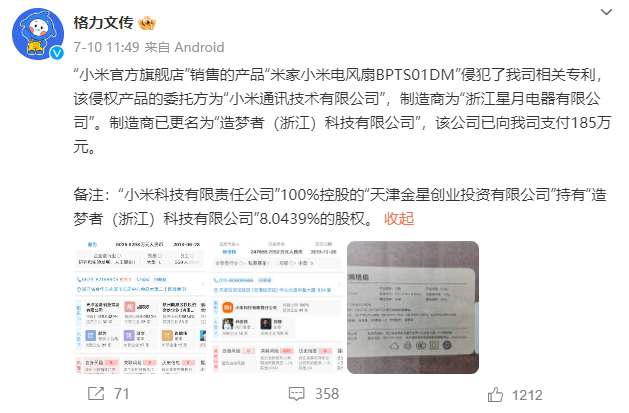

Gree countered with another statement, claiming that the product "Mijia Xiaomi Electric Fan BPTS01DM" sold on the "Xiaomi Official Flagship Store" infringed on the company's relevant patents. The commissioning party of this infringing product is "Xiaomi Communications Technology Co., Ltd.," and the manufacturer is "Zhejiang Xingyue Electric Appliance Co., Ltd." This company has already paid RMB 1.85 million to Gree Electric Appliances.

Image source: Screenshot from Gree Literature Transmission's Weibo

Coincidentally, Gree Electric Appliances Chairman Dong Mingzhu recently criticized Xiaomi in public again, causing the situation to escalate in the tug-of-war between the two sides, temporarily making it a trending topic on social media.

Xiaomi insists that Mijia is an ecosystem built through investment and financing, and therefore, Xiaomi and Mijia are not the same concept. For Dong Mingzhu, an old-school home appliance tycoon, Lei Jun's proficiency in "investment banking" and "capitalization" is precisely her "blind spot," and engaging in a verbal battle in this area is akin to "emphasizing weaknesses and avoiding strengths."

Lei Jun's Confidence

The underlying logic behind Xiaomi's firm response to Gree is that the relevant infringement is committed by Mijia ecosystem enterprises, not Xiaomi itself.

Those sued by Gree Electric Appliances are Zhejiang Xingyue Electric Appliance Co., Ltd. (hereinafter referred to as "Xingyue Electric Appliance") and Dongguan JD Risen Trading Co., Ltd., and the case involves disputes over infringement of utility model patents.

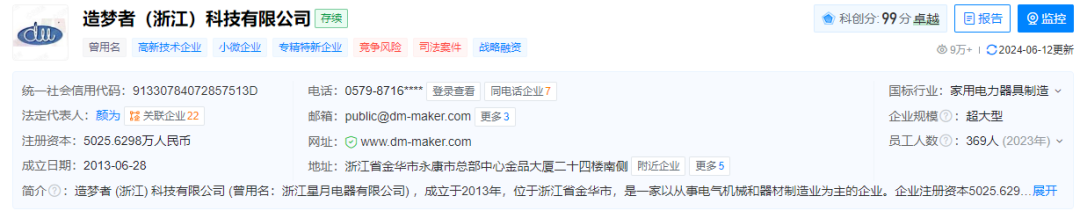

According to information from Tianyancha, Xingyue Electric Appliance has changed its name to "Dreamweaver (Zhejiang) Technology Co., Ltd." The company's business scope covers the research and development, manufacture, and sales of household appliances; research and development of motors and their control systems, etc. It entered the Xiaomi ecosystem in 2018.

Image source: Screenshot from Tianyancha

Although Xingyue Electric Appliance has a strong business connection with Xiaomi, it cannot represent Xiaomi itself, allowing Xiaomi to maintain its "innocence."

As for Xiaomi's Mijia ecosystem, it has grown into an important force in the Internet technology industry. By the end of 2023, Xiaomi had invested in over 430 companies, with a total book value exceeding RMB 67.1 billion. During this period, industry unicorns such as Qusleep Technology (301336.SZ), Deerma (301332.SZ), and Huami (NYSE: ZEPP) emerged.

In the book "Xiaomi Entrepreneurial Thoughts," Lei Jun made a judgment about Xiaomi's growth direction, stating that it would deeply integrate the global supply chain. In other words, in addition to operating its own products, Xiaomi also deploys related industrial chains through investment banking methods, thereby forming a complete ecosystem.

This methodology is what Lei Jun has gained through more than a decade of trial and error with Xiaomi. When Xiaomi first ventured into the mobile phone industry, it partnered with Qualcomm (NASDAQ: QCOM) for chips, AU Optronics for screens, BOE (000725.SZ) for mobile phone displays, Samsung Electronics for memory, and even Foxconn (601138.SH) for manufacturing.

Lei Jun discovered that investing in the upstream and downstream of the industrial chain would significantly shorten the time required for cross-border mobile phone manufacturing.

For Xiaomi, the vertical upstream and downstream of mobile phones have become relatively fixed, making it difficult to cut in. However, if it deploys horizontally, using mobile phones as the terminal core driver, it can still form a complete IoT ecosystem as 5G and other infrastructure facilities gradually improve.

In this system, as long as Xiaomi mobile phones maintain high growth in the long term, they can drive the continuous prosperity of the entire ecosystem. In the initial stage of mobile internet, domestic mobile phone brands gradually formed a first-tier team with "Huawei, Xiaomi, Oppo, and Vivo" as the core, giving them the strength to drive the Internet.

Building on this momentum, Xiaomi began to construct the Mijia ecosystem and gradually grew it into one of the company's core businesses. According to relevant financial report information, in 2020, Xiaomi's revenue from smartphones accounted for 61.9% of total revenue, while IoT (Internet of Things) and consumer products accounted for 27.4%.

Dong Mingzhu's "Blind Spot"

Compared to Lei Jun, an experienced investor, Dong Mingzhu is not proficient in investment.

Among them, Dong Mingzhu's once highly anticipated new energy business, as one of the few investment projects undertaken by this "Iron Lady" of the business world, may now only leave behind a mess.

Image source: Gree Titan Energy official website

In March 2016, Gree Electric Appliances announced plans to restructure Yinlong New Energy, intending to acquire Zhuhai Yinlong with RMB 13 billion.

At that time, Zhuhai Yinlong was enjoying immense popularity in the new energy sector: in 2011, it received its first investment of RMB 216 million and successively acquired Zhuhai Guangtong Automobile, Shijiazhuang Zhongbo Automobile, etc.; in 2015, it turned a profit, with a net profit of RMB 416 million that year, showing rapid growth momentum.

According to the planned script, Gree Electric Appliances should have united as one and ultimately acquired this project to enter the new energy sector.

Unexpectedly, Gree's minority shareholders deemed the deal unprofitable and cast opposing votes at the shareholders' meeting held in October that year.

Helplessly, Dong Mingzhu could only mobilize personal connections to "put together a deal." At the end of 2016, Dong Mingzhu personally invested RMB 1 billion and joined forces with five investors, including Wang Jianlin, Liu Qiangdong, and CIMC (000039.SZ, 02039.HK), to invest a total of RMB 3 billion, acquiring 22.39% of Yinlong's equity.

Just as Dong Mingzhu was envisioning the new energy business, the development of titanium acid lithium battery technology, which she had high hopes for, fell short of expectations, failing to support Yinlong's vigorously developed new energy bus operations.

Image source: Gree Titan Energy official website

Although titanium acid lithium batteries have advantages such as safety, low-temperature resistance, fast charging, and long lifespan, their energy density is only half that of lithium iron phosphate batteries, and their cost is two to three times higher. With the maturity of lithium iron phosphate and ternary lithium battery technologies, even in the new energy bus sector, titanium acid lithium batteries struggle to gain an advantage over lithium iron phosphate batteries.

Sales of Zhuhai Yinlong buses have been declining, with only 1,789 sold in 2022, far behind the first-tier players. The top three, Yutong Bus (600066.SH), Zhongtong Bus (000957.SZ), and Suzhou Kinglong (600686.SH), sold 24,892, 8,957, and 7,741 vehicles, respectively.

During this period, Zhuhai Yinlong was exposed to negative news such as defaulting on supplier payments and significant production cuts at its factories. Yinlong's former president, Sun Guohua, and others were imprisoned for embezzlement of company assets, while the former chairman, Wei Yincang, was reportedly absconded overseas with funds, leaving Dong Mingzhu with a mess.

In contrast, Lei Jun has earned a fortune through the listing and share reduction of Mijia ecosystem enterprises. Lei Jun has completed seven equity transfers in Qusleep Technology alone, cashing out nearly RMB 200 million in total.

The Mijia Ecosystem Expands

Lei Jun's success with the Mijia ecosystem has not only allowed him to replicate this approach in other business lines of Xiaomi but has also prompted many competitors to follow suit.

For Xiaomi's automotive business, Lei Jun is deploying it through an "investment banking" approach. As long as Xiaomi's automotive scale and reputation can increase, it can drive the Mijia ecosystem in the automotive sector. Even if selling cars is not profitable, it can still generate profits through the upstream and downstream Mijia ecosystem or even cash out by entering the capital market.

Image source: Xiaomi Automotive promotional video

After Lei Jun announced Xiaomi's entry into the automotive industry, with the advancement of related businesses, Xiaomi's investment focus shifted to companies in the automotive transportation and advanced manufacturing chains.

In September 2021, the Xiaomi Smart Manufacturing Fund was established, with Lei Jun serving as the Investment Decision Committee Chairman of the fund. In addition to the Xiaomi Smart Manufacturing Fund, Xiaomi also invests in the upstream and downstream of the automotive industry through multiple platforms such as Xiaomi Capital, Shunwei Capital, and Xiaomi Private Equity Fund Management Co., Ltd.

In the few years since announcing its entry into the automotive industry, Xiaomi has virtually swept through the entire upstream and downstream of the new energy automotive industry chain.

According to statistics from the Zhangtongshe Link database, from March 2021 to the present, Lei Jun has invested in 104 "automotive" enterprises through Xiaomi Group's investment entities, with a total investment amount of RMB 42.762 billion. Among them, upstream enterprises account for up to 93%, totaling 98, with 6 midstream and 2 downstream enterprises.

With the explosive traffic generated by the launch of Xiaomi SU7, the Mijia ecosystem in the automotive sector has been directly activated. A research report from Cinda Securities (601059.SZ) points out that Xiaomi Automotive has its own traffic, and since announcing its entry into the automotive industry, more than 20 listed companies have expressed their intention to cooperate with Xiaomi's automotive business. Relying on Xiaomi's advantages in intelligence, ecological collaboration, fan effects, and channels, Xiaomi's automotive deliveries are expected to gradually increase, and relevant parts suppliers are expected to fully benefit. Investment opportunities in Xiaomi's automotive industry chain deserve attention.

Huawei has also directly replicated a similar approach in its automotive business. The only difference from Xiaomi is that Huawei does not manufacture cars but focuses on playing the role of a "shovel seller."

Centering on its business priorities, Huawei has developed over 300 upstream and downstream partners in the industry chain. This includes more than 100 ecological partners in the intelligent vehicle digital platform ecosystem, more than 70 in the intelligent driving computing platform ecosystem, and more than 150 software and hardware partners in the intelligent cockpit platform.

Public information shows that by the end of 2022, Huawei had launched over 30 intelligent automotive components and shipped nearly 2 million sets of components, including products and solutions such as intelligent cockpits, intelligent driving, intelligent electric, intelligent vehicle clouds, millimeter-wave radars, cameras, gateways, LiDARs, computing platforms, ARHUDs, and T-Boxes.

Although Huawei cannot launch popular models to drive the Mijia ecosystem like Xiaomi, it can gain support by "rescuing" automakers, thereby successfully launching the "Huawei Chain." In 2023, the revival of AITO allowed automakers such as Seres (601127.SH), JAC Motor (600418.SH), Chery, Beijing Automotive Group (01958.HK), and Changan Automobile (000625.SH) to choose to embrace Huawei.

Today, Huawei's goal of launching the "Huawei Chain" has been achieved. To allay concerns among automakers about its excessive penetration into automotive terminals, Huawei recently sold the AITO trademark and patents to Seres for RMB 2.5 billion.

This approach is not only beyond the capabilities of traditional home appliance tycoons like Dong Mingzhu but also not the strength of traditional automotive circle tycoons. Competition in areas such as technology, products, and channels is where they are familiar.

Faced with the "infiltration" of this technological internet force, some choose to actively embrace it, while others, like Dong Mingzhu, directly choose to confront it.

Some images are quoted from the internet. If there is any infringement, please inform us for deletion.