ZEEKR is in a hurry

![]() 08/14 2024

08/14 2024

![]() 584

584

ZEEKR, the new force in car manufacturing that completed its IPO in just three years, is facing a critical juncture.

After going public, ZEEKR's share price has taken an overall downturn, falling nearly 30% from its issue price, and July sales plunged by over 22% month-on-month. Under this pressure, ZEEKR has significantly shortened the update cycle of its models, achieving remarkable speed.

However, updating models is a double-edged sword. While enhanced configurations boost market competitiveness, they also elicit complaints from some early adopters.

After the ZEEKR press conference on August 13th, the hearts of some early adopters were finally broken.

Just five months after the launch of ZEEKR 001 and seven months for ZEEKR 007, both models simultaneously introduced their 2025 versions. The former upgraded to NVIDIA's autonomous driving chip and lidar, with the same price for the upgraded version; the latter adopted Golden Brick Battery 2.0, and the starting price of the autonomous driving version dropped by RMB 20,000 to RMB 209,900.

While early adopters of electric vehicles are somewhat prepared for updates, many couldn't hold back their emotions this time.

Image source: ZEEKR Weibo

The rare short-term model updates have angered early adopters. ZEEKR wisely disabled comments during the live stream and selected comments on Weibo. However, early adopters continue to vent their anger on various online platforms.

Of course, early adopters can receive compensation, such as a RMB 10,000 voucher for trade-ins or upgrades, limited to the first owner. Some owners feel this falls short compared to the integral offered by other automakers, lacking sincerity.

Prospective buyers are delighted. Some believe the RMB 209,900 ZEEKR 007 rear-wheel-drive autonomous driving version offers better value than Xiaomi's popular SU7 Standard version.

ZEEKR's sales achievement rate for the first half of the year was 38.2%. Is the rapid update driving sales or maintaining the balance between new and early adopters? ZEEKR seems a bit too eager.

01

New models upset early adopters

Why are early adopters breaking down?

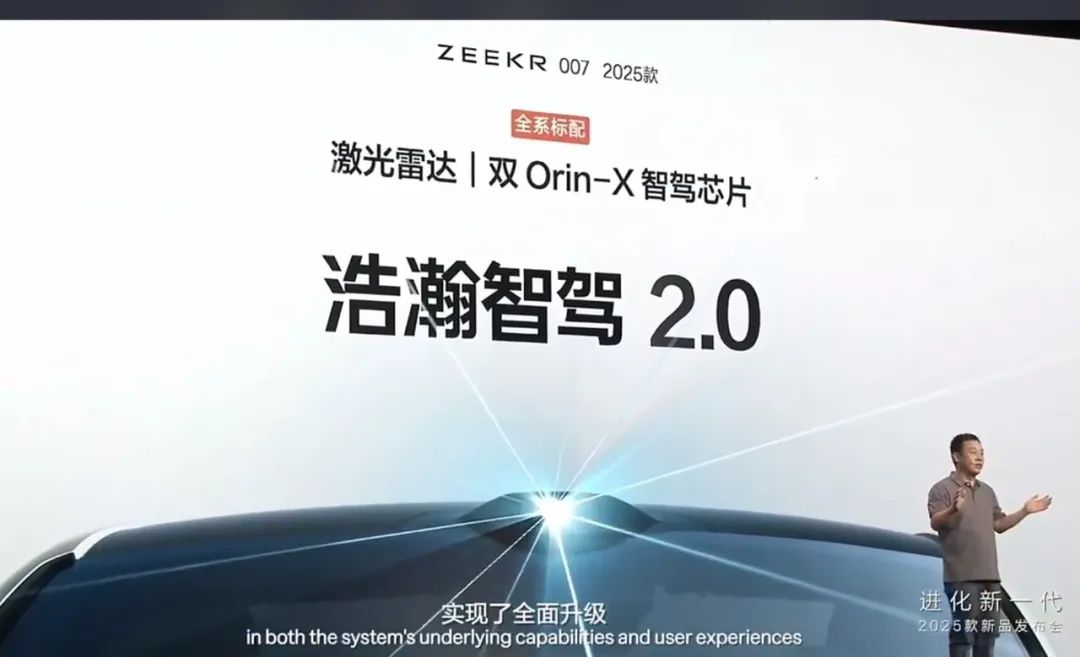

The press conference highlighted Golden Brick Battery 2.0, in-house developed Haohan Autonomous Driving 2.0, and ZEEKR AI OS, representing the new generation of batteries, autonomous driving, and cockpit systems.

The new ZEEKR 007 comes standard with Golden Brick Battery 2.0, combined with the 800V platform, enabling LFP batteries to charge faster than ternary lithium batteries for the first time. With a maximum charging rate of 5.5C, it takes just 10.5 minutes to charge from 10% to 80%, boasting a 5-minute charge for two hours of highway driving.

Both the new ZEEKR 001 and 007 feature in-house developed Haohan Autonomous Driving 2.0 and ZEEKR AI OS.

Haohan Autonomous Driving 2.0 comes standard with lidar and dual OrinX chips, enabling cutting-edge end-to-end autonomous driving. It supports mechanical parking across China's 3D garages, with the city NZP commuting mode to be delivered in batches, followed by OTA updates for point-to-point autonomous driving. In terms of AEB, it can stop at speeds up to 150km/h, enhancing user safety.

Image source: Press conference screenshot

ZEEKR AI OS features the in-house developed KR AI model and AI EVA voice assistant, capable of understanding over 150,000 generalized commands, making it easier to interact with natural language. It also has active perception abilities, such as detecting living beings around the vehicle, warning against fingers being trapped in closing windows, and automatically recognizing real-time traffic conditions during daily commutes, suggesting alternative routes as needed.

Some of these features will be OTA-updated for early models, and ZEEKR emphasizes continued support for older 001 models with the ME autonomous driving solution.

However, since the new models use NVIDIA's autonomous driving chips, it's unclear how much the old models can mimic their performance through upgrades.

With varying degrees of upgrades across both models, price points have also shifted.

The ZEEKR 001 retains its starting price of RMB 269,000 but introduces a new variant with a 95kWh battery and ME autonomous driving solution priced at RMB 259,000.

The ZEEKR 007 now comes standard with autonomous driving, with the RMB 209,900 price tag previously reserved for the rear-wheel-drive non-autonomous version now applicable to the rear-wheel-drive autonomous version. The all-wheel-drive autonomous version has dropped by RMB 30,000 to RMB 229,900.

Both models have significantly improved product competitiveness, leaving early adopters feeling envious and resentful.

02

Uncommon update pace

Early adopters' anger is understandable: the extremely short replacement cycle, significant configuration upgrades, and insufficient compensation from the manufacturer.

Image source: Press conference screenshot

The previous ZEEKR 007 was launched in December 2023, while the previous ZEEKR 001 was introduced in March 2024.

Typically, model replacements or facelifts occur annually, reflecting both corporate product planning and market norms.

However, ZEEKR shortened this cycle to just 5-7 months, an unprecedented pace even in China's highly competitive smartphone industry.

Moreover, these aren't minor updates but mid-cycle refreshes involving significant changes to autonomous driving, cockpit systems, and batteries.

Such major changes are particularly difficult for early adopters who've had their cars for just a few months, or even those who took delivery around the Qixi Festival. Their new cars suddenly seem outdated, with lower resale values and experiences inferior to the new models, some of which are even cheaper.

In fact, rumors of updates for both ZEEKR models surfaced as early as July. ZEEKR's legal department denied rumors of the new 001 being announced at the end of the month, even offering a ZEEKR 7X as a reward for tips.

However, ZEEKR wasn't lying since the rumored July 31st announcement didn't materialize. Instead, both the new ZEEKR 001 and 007 were unveiled two weeks later.

Some early adopters criticized ZEEKR for neglecting their emotions and offering disappointing compensation.

Image source: Press conference screenshot

Emotions are hard to control. New owners will eventually become early adopters, and if manufacturers fail to cater to their needs, will potential buyers have faith in the brand?

At the press conference, the manufacturer asked, 'If you had a chance to do it all over again, would you still choose ZEEKR?' This question resonated deeply with early adopters.

03

ZEEKR is indeed in a hurry

Normally, few manufacturers would willingly introduce new models so quickly, placing immense pressure on production lines and material ordering.

No automaker wants to alienate early adopters, as the hard-earned reputation of new-energy vehicle brands could suffer.

This may be a necessary choice for ZEEKR at present.

On one hand, market competition is fierce.

The ZEEKR 007, launched at the end of last year, sold over 5,000 units only in January 2024, with the rest of the months hovering around 3,000-4,000 units and July sales at 3,498.

The ZEEKR 001, which sold just 2,663 units in February this year, introduced a new model in March, boosting monthly sales to 14,383 in June but dropping below 10,000 in July.

Some believe the primary pressure comes from Xiaomi's SU7, which started deliveries in April. Both brands and products share similar positioning, targeting sports sedans with autonomous driving and smart cockpits. However, the newly launched SU7 is more appealing, selling 14,296 and 13,120 units in June and July, respectively, despite Xiaomi's production ramp-up.

After the first half of the year, ZEEKR's annual sales achievement rate was just 38.2%. To meet targets and become more competitive in the second half, model updates are imperative.

On the other hand, sluggish sales pressure ZEEKR in the capital market.

In just over three months, ZEEKR's share price has plummeted from a peak of USD 32.234 to around USD 15, halving its market value.

Image source: Baidu Stocks

In June, Geely's founder Li Shufu noted that excessive competition and sole reliance on price wars could lead to issues like declining product quality, counterfeiting, and disorderly competition.

However, based on ZEEKR's current stance, the intense competition in the automotive market persists. In the face of sales, even without relying solely on price wars, manufacturers must enhance product value for money.

In fact, owners of new-energy vehicles have gradually become accustomed to rapid product iterations, often feeling helpless but willingly embracing them.

Still, it begs the question: Are expensive cars truly consumable goods?