Are BBA firms on a hot plate justified in raising prices against the trend?

![]() 08/06 2024

08/06 2024

![]() 657

657

Barely months after announcing price cuts, luxury automakers BMW, Audi, and Mercedes-Benz (BBA) have abruptly reversed course, leaving consumers caught off guard.

Following BMW's decision to hike prices, Audi and Mercedes have also followed suit, with small adjustments to prices for popular models like Audi's Q5L, A6L, and A4L. Although Mercedes has yet to issue an official announcement, price increases at dealerships are already an open secret.

BMW's move was even more direct, with reports of the BMW X3 seeing a RMB 20,000 price increase and the BMW X5 a RMB 40,000 hike. Some sales representatives even mentioned that prices could fluctuate within a single day, with morning and afternoon prices significantly different. BBA briefly dipped their toes into the price war before quickly pulling back.

The reasons for BBA's price hikes vary widely, ranging from dealer pressures, insufficient sales gains from previous discounts, and potential damage to brand value. While these reasons are valid, BBA's abrupt exit from the price war without giving the market time to adjust raises many questions.

Perhaps the current state of the automotive market has worn down the patience of many automakers, even BBA.

Should BBA have waited longer?

Before launching widespread price cuts in June, BBA had already shown signs of entering the price war in 2024. However, despite their efforts, the results were disappointing.

In the second quarter of this year, BMW's global sales declined 1.3% year-on-year to 618,800 units, with sales in China down 4.7% to 188,500 units. Similarly, Mercedes' cumulative deliveries in China in the first half of 2024 fell 5.8% compared to the same period in 2023. Audi's cumulative sales for the first half of this year were 292,000 units, down 0.61% year-on-year.

After briefly offering discounts, BBA quickly realized the error of their ways and stabilized prices. However, it's worth questioning whether their price war was truly futile. Over the years, BBA has benefited from price cuts in a highly competitive automotive market.

Take BMW as an example.

In 2021, the newly launched BMW iX3 offered a massive RMB 70,000 discount, stimulating sales significantly. In late November to early December 2022, BMW i3 offered discounts of RMB 50,000 to RMB 60,000 nationwide. This aggressive pricing strategy boosted sales, with 6,565 BMW i3s insured in December 2022.

In the previous three months, the number of insured BMW i3s was 273, 1,414, and 3,291, respectively, significantly elevating BMW's position in the domestic electric vehicle market. However, the recent price cuts had limited impact, partly due to market volatility and pricing uncertainty. Cars have taken on an investment role in recent years, making luxury car price wars unsettling for consumers.

BBA's hasty retreat from the price war is closely tied to current consumer psychology. However, this mindset is not permanent. As cars return to their role as consumer goods rather than investments, BBA's price cuts may yield opposite results.

While BBA chose to halt their price cuts, a long-term perspective suggests that these cuts could revitalize their brands.

Firstly, the automotive consumer base is gradually becoming younger. Data shows that 36.05% of first-time car buyers are aged 18-25, followed by 34.88% aged 25-30. This means nearly 70% of car owners acquired their first vehicle before turning 30.

BBA firms have been pursuing a youth-oriented transformation in recent years. BMW data indicates that post-90s consumers dominate sales of the new 5 Series. Audi has also announced plans to create a younger brand image. According to public data, the average age of Mercedes-Benz S-Class owners in China is 39, compared to 60 in Europe and 50 in the US.

Young consumers tend to have lower budgets but prioritize car quality and driving experience over previous generations. Shell Finance data shows that young people prefer first-time car purchases priced between RMB 150,000 and RMB 250,000, exceeding the popularity of budget cars under RMB 100,000.

This places discounted BBA models squarely in the purchasing range of young consumers. While brand heritage and value may suffer from price cuts, reaching this demographic could potentially enhance brand reach.

Furthermore, BBA firms are deepening their commitment to the Greater China region. Last year, Audi sold approximately 729,000 vehicles in China, up 13.5% year-on-year, second only to Europe. BMW saw varying degrees of global sales growth, but domestic sales declined 4.2% in the first half of this year. Mercedes-Benz sales in China fell 12% year-on-year in Q1 2024.

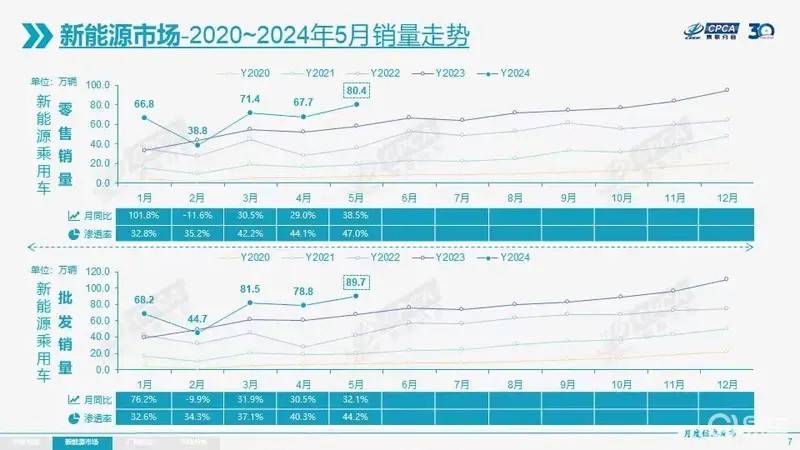

To stabilize the Greater China market, automakers must understand the current automotive landscape. According to the China Passenger Car Association, 136 models reduced prices in the first five months of 2024, exceeding the scale of price cuts in 2022 and 2023 combined. Exiting the price war against this trend may not be wise.

Does BBA still have counterattack potential?

Domestic automakers have targeted BBA from the start. BBA frequently serves as a backdrop in new car launches. Interestingly, the new energy vehicle (NEV) market has, to some extent, surpassed BBA.

In H1 2024, a brand research report showed declining brand awareness among traditional luxury automakers like BBA, while NEV brands like NIO, Xpeng, Lixiang, AITO, and even newcomer Xiaomi maintained higher awareness levels.

In terms of customer acquisition, NEV brands have successfully poached BBA customers. The Jielanlu Research Report shows that 50% of AITO M9 buyers are upgrading or replacing their vehicles, including from high-performance luxury brands like Porsche and BBA.

With price wars yielding limited results, does BBA still have counterattack potential?

In fact, BBA has dominated the Chinese luxury car market for years and remains formidable globally, with financial and technological resources that other automakers cannot match in the short term.

Take BMW as an example. In FY 2023, BMW Group's revenue reached RMB 1.21 trillion, with a profit of RMB 94.5 billion. This surpasses even BYD, with BMW's revenue and profit being twice and three times that of BYD's, respectively. Amid the NEV challenge, BBA is increasing R&D costs, particularly in electrification.

Last year, BMW's R&D costs surged 13.8% to EUR 7.538 billion, with increased investments in electrification, digitization, and autonomous driving. Audi plans to invest EUR 41 billion by 2028 to accelerate its transformation, with EUR 29.5 billion dedicated to pure electric vehicles and digitization. Mercedes-Benz's R&D costs also exceeded RMB 10 billion in 2023.

Substantial financial resources underpin BBA's dignity.

Secondly, BBA realizes it is late to the NEV game. Facing pressure from NIO, Xiaomi, and AITO, they have even begun partnering. In November last year, BMW and Mercedes announced a joint venture in China to operate a supercharging network.

By 2023, BMW was close to selling 400,000 pure electric vehicles, while Mercedes and Audi had also reached significant electric vehicle sales. BMW and Mercedes plan to build at least 1,000 supercharging stations with around 7,000 charging piles in China by 2026.

With their combined technological, financial, and human resources, BBA's cooperation against domestic NEV players offers high potential for success. Moreover, the sustainability of the domestic price war is uncertain, with some automakers already questioning its rationale.

Once the price war ends, BBA is poised to return with renewed vigor. At present, they are far from being vulnerable. Domestic NEV players must brace for a potential BBA counterattack.

Gasoline Cars Defend, NEVs Attack

Apart from BBA, most gasoline carmakers that previously engaged in price wars have quietly retreated, including Toyota, Volkswagen, and Volvo. The Huaxia Times reported that Cadillac will raise prices across its lineup from August.

The automotive market now primarily comprises NEV players engaged in a price war, while gasoline cars observe from the sidelines. However, the NEV battle ultimately targets the gasoline car market.

Why have gasoline cars exited the price war? The answer is simple: most automakers rely on gasoline cars for profit margins. As price wars intensify, the Chinese automotive industry has suffered, with industry profits hitting a seven-year low of 4.6% in the first four months of this year.

Financial reports reveal similar trends. In 2023, GAC Group's net profit plummeted 45.08% year-on-year to RMB 4.429 billion. SAIC Motor's total revenue reached RMB 744.704 billion, but net profit fell 12.48% to RMB 14.106 billion. Great Wall Motor's revenue increased to RMB 173.212 billion, but net profit declined 15.06% to RMB 7.022 billion. Dongfeng Motor Group suffered its first annual loss in 18 years, with a net loss of approximately RMB 3.996 billion.

This trend continued into 2024, with Changan Automobile's first-quarter net profit down 83.39% year-on-year to RMB 1.158 billion. GAC Group's first-quarter revenue fell 19.12% to RMB 21.346 billion, with net profit down 20.65% to RMB 1.22 billion. JAC Motor's net profit attributable to shareholders declined 28.72% year-on-year to RMB 105 million.

Last year, the combined net profits of China's 12 profitable automakers totaled less than RMB 90 billion.

While NEVs are mired in a price war, the industry's profitability relies heavily on gasoline cars. However, gasoline cars are struggling with sales. In June 2024, China's passenger vehicle retail sales reached 1.767 million units, down 6.7% year-on-year but up 3.2% month-on-month.

Traditional gasoline car sales were 905,000 units, down 27% year-on-year, while NEV sales were 856,000 units, up 29% year-on-year. In June, NEVs accounted for 48.4% of domestic retail sales, up 13.5% year-on-year, approaching the 50% penetration threshold. This poses a significant challenge for gasoline cars.

Gasoline cars urgently need to regain lost ground. In 2024, they face unprecedented competition from NEVs. Balancing market share and profits has become a difficult choice, and BBA has offered its perspective.

Fortunately, the gasoline car market is not yet in dire straits. In Q1 2024, China's gasoline passenger car exports grew 26% year-on-year, outpacing pure electric passenger car exports (12%). Domestic gasoline car exports have increased from 1.47 million units in 2021 to 3.34 million units in 2023, with a compound annual growth rate of 51%.

This is a positive sign, indicating potential growth opportunities outside the domestic market. NEVs have encroached on gasoline cars primarily due to their ongoing technological and Intelligentization advancements. Gasoline cars are recognizing this and adapting. For example, SAIC Volkswagen's Tiguan L Pro, launched in May, boasts the title of 'the smartest gasoline car,' with endorsements from DJI, Tencent, and iFLYTEK executives at its launch event.

As gasoline cars attempt to exit the price war, accelerating their technological progress and directly competing with NEVs on the intelligence front could be a viable strategy.

In summary, while NEVs continue to struggle in the price war, gasoline cars are attempting to retreat but cannot escape its aftermath. The impact on gasoline cars is unlikely to subside soon, necessitating their efforts to adapt and compete.

Dao Zong You Li is an internet and tech media outlet. Follow us on WeChat: Dao Zong You Li (daotmt). This article is original and reproduction without proper attribution is prohibited.