Taobao Live streaming is at a critical juncture

![]() 08/06 2024

08/06 2024

![]() 699

699

Can Taobao Live find the next "Li Jiaqi"?

Recently, amid the high popularity of East Study's divestment of its wholly-owned subsidiary, another important matter related to East Study has been easily overlooked—at a telephone conference with shareholders on July 26, Yu Minhong, founder of New Oriental and CEO of East Study, stated that the company's primary live streaming platform is currently Douyin, and that cooperation with Douyin will become even closer in the future.

In contrast, East Study's live streaming room on Taobao Live, another major platform it joined, has been inactive for over a month, with no live replays available. It's worth noting that East Study made a high-profile entry into Taobao Live in August 2023, generating considerable buzz, but it has been less than a year since then.

Image source: Taobao Live screenshot

Taobao Live began trial operations in 2016, and in early 2019, a standalone Taobao Live app was launched. Industry insiders believe that Ali Group entered the live e-commerce market early enough and can even be considered a pioneer in the field. Moreover, with Ali's vast inventory of products and stores, Taobao Live still holds a leading position in the e-commerce industry.

However, according to the new media outlet "Wan Dian", the gap between competitors and Ali is narrowing. In 2018, Ali held nearly 70% of the Chinese e-commerce market, but that share has now dropped to around 40%. Against this backdrop, Taobao Live has been actively recruiting talent while also undergoing a series of leadership changes. How effective will these measures be for Taobao Live?

01. How many talents can Taobao Live retain from across the web?

The suspension of East Study's live streams on Taobao Live was not unexpected. Data shows that in August 2023, East Study's traffic on Taobao Live dropped rapidly in the first week, with single-session viewership falling from over 10 million to just over 3 million, and the growth rate of its fan base gradually slowed. Since then, although East Study has maintained daily broadcasts on Taobao, it has not disclosed relevant data such as GMV.

Super head anchors like Li Jiaqi and Wei Ya once attracted tens of millions of viewers to Taobao Live. However, after Wei Ya, Xue Li, Lin Shanshan, and other top anchors were embroiled in tax evasion scandals, Taobao Live faced a shortage of anchors at the same level. At that time, content-based e-commerce platforms like Douyin and Kuaishou were rapidly rising, prompting Taobao Live to launch a campaign to recruit anchors from across the internet.

According to Sina Tech, when recruiting niche influencers, Taobao Live prioritizes metrics such as fan count and sales volume, giving preference to those with 1-5 million fans on Douyin and Kuaishou, and over 100,000 fans on Xiaohongshu. Additionally, Taobao Live offers financial incentives and traffic boosts to attract these influencers.

"We've talked to almost everyone you can think of," said Xu Luo, the former head of Taobao Live's new ecosystem business line.

According to incomplete statistics, in recent years, Taobao Live has actively recruited mature anchors from platforms such as Douyin, Kuaishou, Xiaohongshu, Bilibili, and WeChat official accounts, including dozens of individuals such as Li Yixiaozi, Niangaomama, Teacher Xiao P, Li Xuanzhuo, Zhu Yidan, Luo Yonghao's "Make Friends," Liu Genghong and his wife, Thai couple A Fang, Lu Xianren, and East Study.

Image source: Canned Photo Library

Thanks to the platform's support policies, influencers may initially benefit when they first join, but after the support period ends and operations normalize, the situation changes. A notable example is Liu Genghong and his wife Wang Wanfei ViVi, who joined Taobao Live in October 2022. Their first live stream attracted over 2 million viewers but generated less than one million yuan in sales. Currently, their account has no new content updates. Additionally, through searches on the Diantao app, it was found that Thai couple A Fang, Lu Xianren, Niangaomama, among others, have not broadcast on Taobao Live for a long time, and most did not stream during the 618 shopping festival.

According to Jiku Finance, a self-media outlet focusing on the digital economy, some live streaming industry insiders have stated that the recruited anchors discovered that the users attracted by subsidies were not sustainable. Furthermore, due to cost control, Taobao cut the red envelope subsidies for top anchors, leading these anchors to inevitably leave.

The community for sharing marketer methodology, "Growth Factory," also wrote in a WeChat public account article that a service provider revealed that Taobao's support policies were quite generous, even involving cash investments. For example, for a top influencer with an annual GMV of nearly 100 million yuan from self-broadcasting and collaborations on Xiaohongshu, Taobao offered up to 2 million yuan per month in cash support for promotion and traffic for six months. However, due to incompatibility, it's difficult to say that these recruited anchors have brought more users to Taobao Live, and their sales performance has been unsatisfactory. As a result, some anchors have chosen to withdraw from Taobao Live.

02. As anchors leave Taobao Live, can the content ecosystem be strengthened?

To address the issue of incompatibility among newly recruited anchors, Taobao Live has been dynamically adjusting its measures. In February, Taobao announced the establishment of a live e-commerce company, operated by the Taobao Live operation team, to provide "full-service" management services for celebrities, KOLs, and MCN agencies interested in joining Taobao Live. Notably, during the crucial 618 shopping festival, Zhang Xiaohui, the "top influencer" of Xiaohongshu, appeared in Taobao Live, marking the latest success of Taobao Live's recruitment efforts.

Judging from netizen comments, Zhang Xiaohui, who once had negative labels like "materialistic," has received some positive evaluations since joining Taobao Live, with some people finding her "calming and soothing." However, in terms of sales performance, during the 618 shopping festival, Zhang Xiaohui's Taobao Live debut gained 195,000 new followers, with the highest sales volume for a single product exceeding 3,000 units and live stream viewership reaching 10 million. Compared to her Xiaohongshu debut, which garnered over 600 million views and over 50 million yuan in sales in just over five hours, there is still a significant gap. Additionally, her debut live stream was met with negative feedback regarding "high product prices" and accusations of "taking advantage of fans" and "Taobao Live failure."

Image source: Screenshot of Zhang Xiaohui's Taobao Live account

Image source: Xiaohongshu note screenshot

While Zhang Xiaohui joined Taobao Live, other anchors left. For example, host Shen Tao, who initially live-streamed on Taobao, switched to Douyin in September 2021. Mi Jie, who runs a clothing factory in Guangzhou, became a top anchor on Kuaishou with monthly sales nearing 100 million yuan after switching from Taobao. When Kuaishou went public, she was the only e-commerce anchor representative to ring the bell. Another success story is "Skirt Sister," the only jewelry anchor to participate in the third China International Import Expo's live streaming, who also transitioned from Taobao Live to other platforms. In particular, Shen Tao reportedly generated around 300,000 yuan in sales per live stream on Taobao but achieved significant growth after switching to Douyin, with cumulative sales of 70.595 million yuan in the first two live streams in September 2021, including one session with sales exceeding 50 million yuan. During this year's 6.18 shopping festival, Shen Tao reportedly sold 3.3 million tubes of toothpaste in a single live stream, achieving a GMV of over 30 million yuan, setting a new record for the oral care industry.

On the one hand, some anchors are leaving Taobao Live, and on the other, Taobao Live's content has had limited impact on traffic empowerment. Currently, many consumers prefer an immersive shopping experience—they engage with content that interests them, follow anchors, and then generate purchasing behavior. The importance of content ecosystems in live streaming continues to grow. In this regard, the head of a Tmall brand told China Business Network in an interview in April this year that, in terms of results, content-based strategies have had minimal impact on brand traffic, and the traditional e-commerce operational advantages and industry knowledge of Alibaba veterans have been diluted.

Image source: Canned Photo Library

In March of this year, Cheng Daofang, the former head of Taobao Live and Content Business Unit, told the media that in terms of daily active users, the user penetration rate of Taobao Live rooms was only 5%-10%. Additionally, data shows that Taobao Live's GMV share has increased by less than 6 percentage points in four years.

Furthermore, on content-based e-commerce platforms, new anchors emerge daily, and the algorithm efficiency for selecting them surpasses that of Taobao Live. On the other hand, due to the strategy of focusing on super top anchors and the "anchor battle" waged by other platforms during their rise, Taobao Live has also lost some mid- and small-tier anchors, which has, to some extent, affected the ecosystem it has built.

Six years ago, Li Jiaqi was a super top anchor on Taobao. Now, following incidents involving super top anchors like Wei Ya, Li Jiaqi's importance to Taobao Live has become even more prominent.

According to the first wave of official pre-sales data for this year's 618 shopping festival, Li Jiaqi was among the first anchors to surpass 100 million yuan in sales within the first hour of Tmall's 618 spot sales. However, according to data from Aoyan, the GMV of beauty products in Li Jiaqi's first live stream during the 2024 618 shopping festival decreased by 46% compared to last year.

Moreover, Li Jiaqi was once embroiled in the "Huahzi Eyebrow Pencil Incident," damaging his reputation. According to the "Report on Public Opinion Analysis of Consumer Rights Protection in Live Streaming E-commerce (2023)," which analyzed data on consumer rights protection in live streaming by 17 anchors, Taobao Beauty's Li Jiaqi had the highest number of complaints, accounting for up to 41% of all complaints. Specifically, the report cited Li Jiaqi's "Estée Lauder Empty Bottle" and "Huahzi 79-yuan Eyebrow Pencil" incidents as examples of product quality and pricing misleading issues, respectively.

Xie Pu, a senior observer in the TMT industry, stated that Taobao Live's over-reliance on super top anchors led to insufficient investment in its content ecosystem, making it a "weak link" that now needs to be addressed. With fierce competition among live streaming platforms, Taobao Live has reached a critical juncture concerning its future development.

On July 4, Cheng Daofang, the former head of Taobao Content E-commerce and "top leader" of Taobao Live, was reassigned. Wu Jia, head of the Taobao User Platform Business Unit and Alimama Business Unit, will succeed him in this position. Just a week later, it was reported that Jialuo, head of Tmall, would concurrently serve as head of Taobao Live and Content.

Image source: iMedia Research

According to information, Jialuo has successively overseen the Taobao Marketing Department, Taobao University, Juhuasuan Business Unit, Tmall Marketing Platform Business Unit, and Alimama. Despite numerous adjustments within Taobao and Tmall, he is one of the few senior executives who have remained.

Why were there two leadership changes in just one month? According to the new media outlet "Wan Dian," "The Alibaba content e-commerce team has undergone staff reductions, and business head Cheng Daofang has recently been reassigned. We understand that the Taobao and Tmall management believes that the content team has spent a lot of money but has not changed the GMV share or commercial efficiency."

In fact, as early as the beginning of this year, in response to the issues mentioned in the above report, Taobao Live had already taken action. In March, Taobao Live set a goal of increasing GMV by 80% year-on-year with an additional 10 billion yuan in cash. Some analysts have pointed out that as live e-commerce has matured, each subsidy roughly drives a predictable amount of GMV growth. Significant growth of 80% with 10 billion yuan is only possible with a sufficiently low GMV base.

Today, in the e-commerce live streaming battlefield, Taobao Live faces competition from platforms such as Douyin E-commerce, Kuaishou E-commerce, Xiaohongshu Live, WeChat Video, JD.com Live, and Pinduoduo Live, all of which are constantly challenging the "industry leader," Taobao Live.

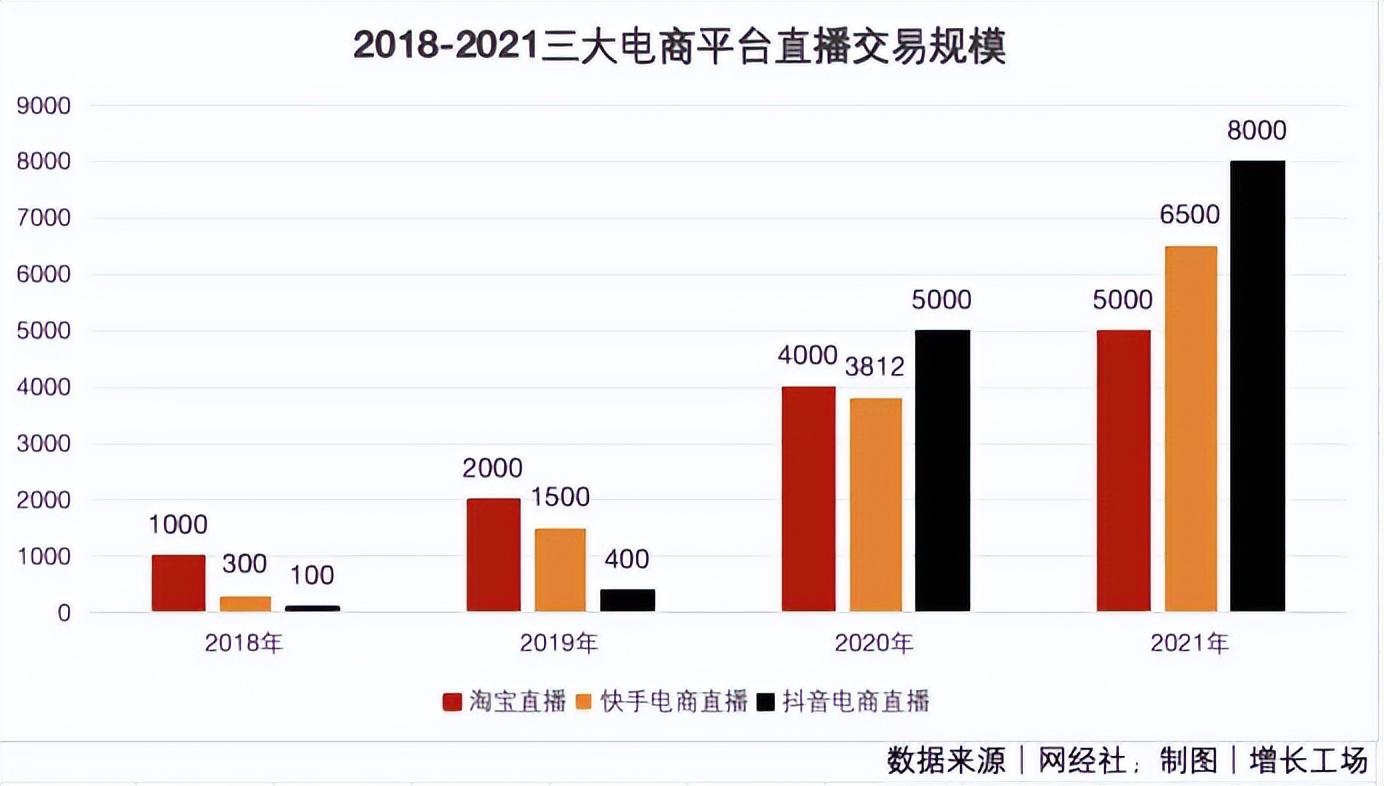

Taking Kuaishou as an example, according to data from iMedia Research, in 2020, the transaction scale of Kuaishou's e-commerce live streaming was 381.2 billion yuan, while that of Taobao Live was 400 billion yuan, meaning Taobao Live barely surpassed Kuaishou. However, by 2021, the transaction scale of Kuaishou's e-commerce live streaming had reached 650 billion yuan, surpassing Taobao Live's 500 billion yuan.

According to the latest 2024 financial report, last year, Taobao and Tmall Group generated revenue of 93.216 billion yuan, representing a year-on-year growth of only 4%.

As the gap between Taobao Live and its competitors narrows and competitors surpass Taobao Live, industry insiders have expressed concern about the situation faced by Taobao e-commerce. According to the Times Weekly, Zhang Xiaorong, Dean of the Institute of Deep Technology Research, stated that Taobao Live has failed to reverse its decline and is now at a critical juncture. It needs to make significant innovations in technology, content production, and user experience to address market competition and changing user demands.

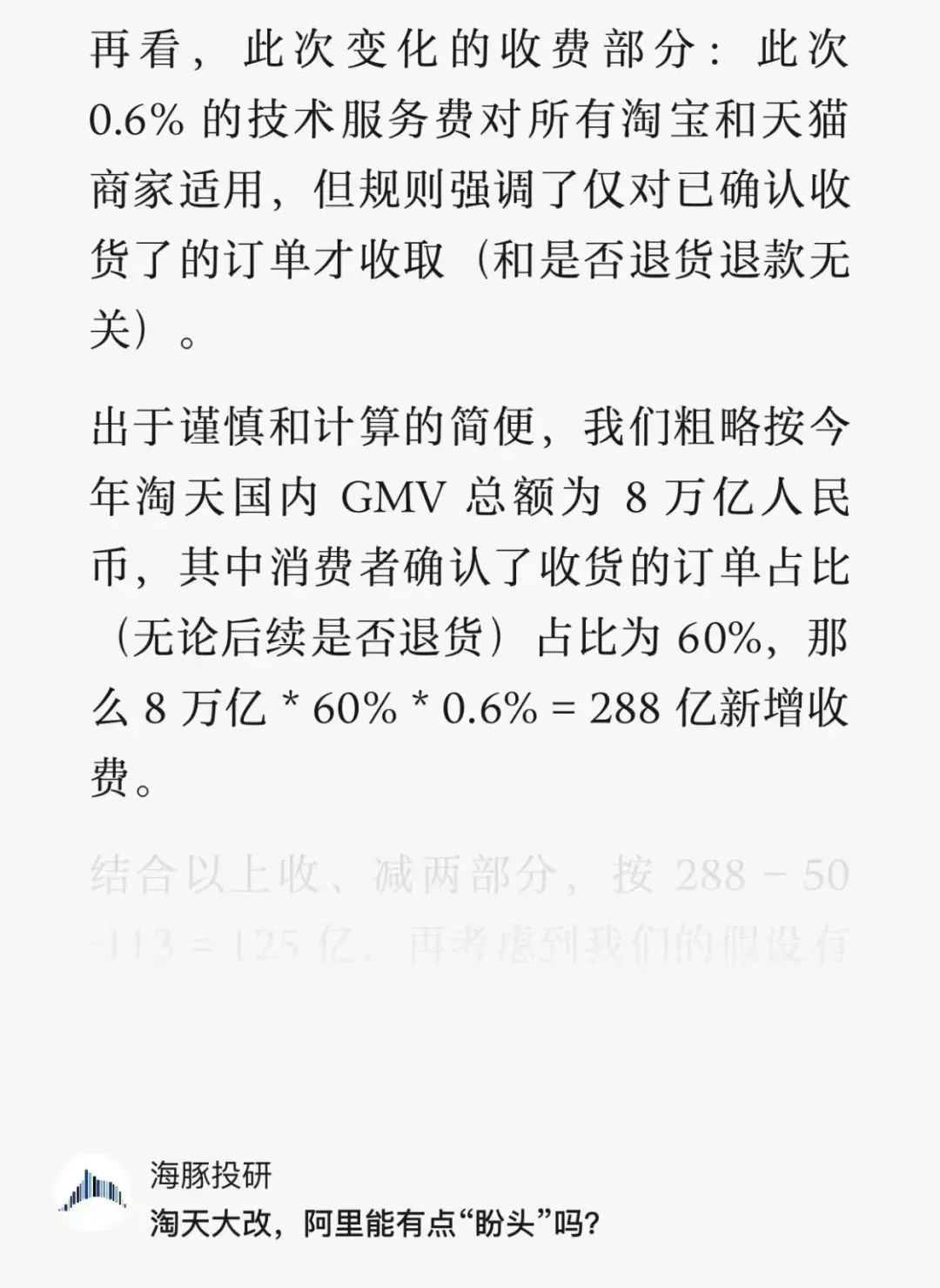

According to the new media outlet "Wan Dian LatePost," on July 26, Taobao and Tmall announced several new merchant rules, including eliminating annual fees and starting to charge a basic software service fee of 0.6% on the confirmed transaction amount for each order. Previously, Taobao C-store merchants did not pay a certain rate based on the order transaction amount to the platform, but now the 0.6% basic software service fee applies to Taobao merchants as well.

The adjusted fee structure: The 0.6% technical service fee applies to all Taobao and Tmall merchants, but the rule emphasizes that it is only charged for orders that have been confirmed as received (irrespective of whether there are subsequent returns or refunds). According to rough calculations by Dolphin Investment Research, a secondary market investment research brand under the Changqiao Group, assuming that Taobao and Tmall's domestic GMV totals 8 trillion yuan this year, and the proportion of consumer-confirmed orders (regardless of subsequent returns) is 60%, the new fee would generate an additional 28.8 billion yuan in revenue.

Image source: screenshot of public account

From the creator of the industry to 2021, when the live e-commerce scale was surpassed by Kuaishou, and then in November last year, the market value was also surpassed by Pinduoduo for a time, Taobao Tmall is being caught up with, or even surpassed, by latecomers. Since last year, some media outlets such as "Kung Fu Finance" and "E-commerce Reference" have argued that "Ali has reached its most dangerous moment." Alibaba's next countermeasures will become particularly crucial.

Facing the intensifying competition in the e-commerce industry today, Taobao, including Tmall, adjusted its platform rules on July 26. Whether it is to say no to refunds only or to increase the operating costs of merchants, and what impact this will have on Alibaba's competitive position, we will have to wait and see!

Which e-commerce live streaming platform do you often shop on? Welcome to leave a comment.