The weekly sales ranking of Lixiang is not the original sin of the new energy market

![]() 08/06 2024

08/06 2024

![]() 684

684

In his novel "Cries in the Drizzle", Yu Hua wrote the following passage:

"When granaries are full, people learn etiquette; when clothing and food are sufficient, people know honor and disgrace." Before material needs are met, the development of spiritual civilization is bound to lag behind. Therefore, poverty is not the original sin.

Similarly, in today's new energy market, the living environment for automakers is also extremely severe. The industry's concentration ratio increased from 59.9% in 2022 to 67.0% in 2023, and according to AlixPartners Consulting, the number of new energy vehicle brands in China may shrink drastically from 137 in 2023 to 19 by 2030.

In this environment, the purpose of price wars, value wars, and public opinion wars is the same: to enable enterprises to survive better. Therefore, many automakers use weekly sales rankings as a strategic high ground in public opinion to promote themselves.

Against this backdrop, on July 30, Lixiang Auto released its weekly sales ranking as usual. However, unlike in the past, this weekly ranking triggered collective opposition from executives of NIO, Xpeng, Geely, and other brands, reminiscent of the scene in "The Six Sects Besiege the Bright Summit."

From the previous "annual ranking" and "monthly ranking" to the current "weekly ranking," why is the cumulative time for the rankings getting shorter and shorter? What is the root cause of the increasingly intense competition in the new energy industry? After fierce competition, what will be the future of China's new energy vehicles?

Behind the backlash against Lixiang, each automaker has its own "most suitable" ranking

Judging from the public statements made by executives of various brands, the focus of different brands varies.

Ma Lin, Assistant Vice President of NIO Brand and Communication, believes that weekly rankings have already affected the company's operations, and that placing automakers with different main product price points and categories together on the same ranking does not reflect the objective market situation. "Ranking must be reasonable and comparable," he said. This is not the first time NIO has opposed weekly rankings. Previously, NIO Chairman William Li expressed his opposition at NIO IN 2024, saying, "Can we stop publishing weekly rankings? If NIO becomes the top-selling brand, we will never publish weekly rankings again."

Meanwhile, Xpeng and Geely focused on the industry as a whole. Xpeng Chairman He Xiaopeng said, "Americans are thinking about how to make end-to-end autonomous driving assistance technology better and how to outperform humans, like Tesla, whose end-to-end large model has made FSD completely different from before. Next year, American autonomous driving systems will be better than experienced drivers. Chinese tech companies are still focused on 'weekly sales rankings,' which is not how technology competition should look." Subsequently, Yang Xueliang, Senior Vice President of Geely Holding Group, agreed with He Xiaopeng, saying, "I also oppose weekly rankings."

However, as early as April 2023, Lixiang had already begun proactively publishing weekly sales rankings, using data from third-party agencies. Although the statistical caliber differs from the monthly sales data published by the China Passenger Car Association (CPCA), the data source is authentic and valid, standing up to practical testing. This is why Lixiang Auto Chairman Li Xiang has the confidence to respond in his social media after facing external doubts.

Previously, when MEGA sales were sluggish, Lixiang also suspended weekly ranking updates, with Li Xiang stating at the time: "We are no longer pursuing sales but returning to value." From an industry perspective, publishing sales rankings is not exclusive to Lixiang Auto; many automakers and automotive media outlets also create numerous segmented market rankings with numerous qualifiers as prefixes.

"With enough qualifiers, you can always rank first." These rankings and Lixiang's weekly rankings share the same goal: to position one's brand or model at the top of the rankings, create public opinion topics through sales rankings, attract consumer attention, thereby enhancing brand image and promoting sales growth.

From the early days of quarterly data disclosure by each automaker to the subsequent monthly sales rankings by the CPCA, and now to weekly rankings, the increase in ranking frequency has little significance for consumers, as no one will choose a particular car solely based on high sales figures. Instead, the entire industry's marketing tactics are intensifying, public opinion wars are escalating, and the "involution" within the industry is constantly intensifying, leading to immense pressure on individual companies and consequently disputes over rankings.

From this perspective, the controversy over rankings is not solely Lixiang's fault but the fault of the entire industry.

How to "involve" effectively?

Today, people have heard too much lamentation and discussion about "involvement." Therefore, it may be worth considering this issue from another angle, which may yield different insights.

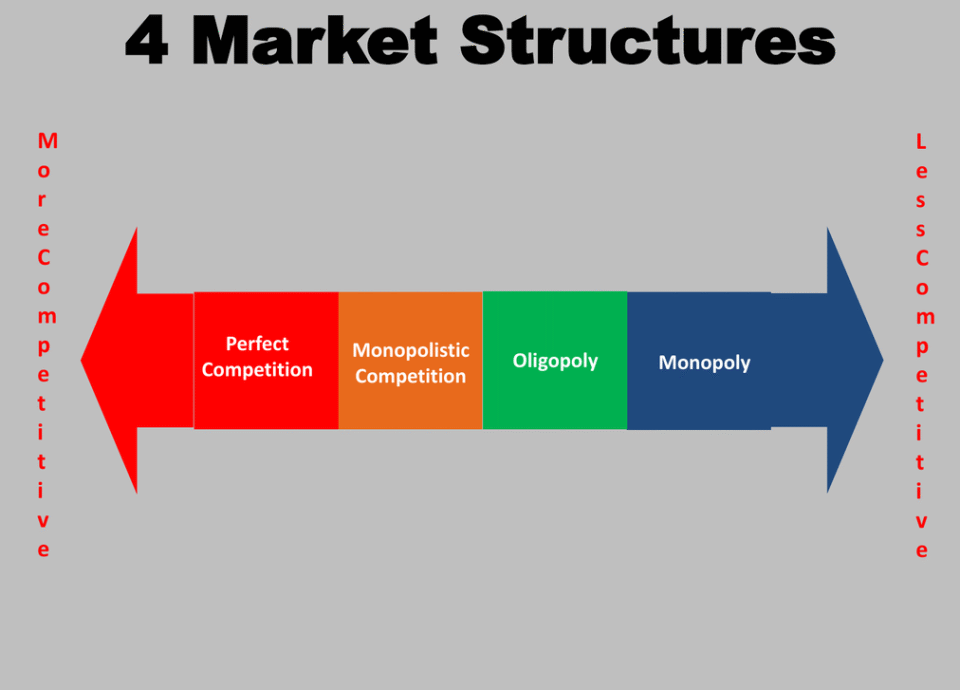

From an economic perspective, "involvement" means "perfect competition," and in a "perfectly competitive" market, enterprises can at most achieve a "break-even" and cannot earn "excess profits" because as soon as one enterprise makes money, other enterprises will immediately enter the market, driving down profits.

In reality, a "perfectly competitive" market is rare. Taking China as an example, mobile payments are dominated by WeChat Pay and Alipay. E-commerce and food delivery are also led by a few major platforms. Although the competitive landscape may change, the overall situation remains relatively stable. Unless enterprises like ByteDance and Pinduoduo bring disruptive innovations to the industry, it is difficult for new enterprises to join.

However, since 2023, the entire industry has fallen into a quagmire of price wars. In the first half of the year, gasoline-powered vehicles experienced widespread price cuts; in the second half, new energy brands such as BYD, NIO, and XPeng also launched price offensives to varying degrees. Although these price wars have promoted sales growth to some extent, they have also sacrificed corporate profits, leading to declining gross margins, and some automakers even face losses, making today's new energy vehicle market closely resemble a state of "perfect competition."

There are two main reasons for this state:

1. Product homogeneity: There is no decisive non-replicability or irreplaceability between products of different brands, so there is no absolute brand premium, and no "killer" products emerge.

2. No seller has an absolute cost advantage, even if companies like BYD and Tesla can achieve temporary cost advantages through relatively complete industrial chains. Today, with other manufacturers catching up, this advantage is gradually diminishing, and the economies of scale and network effects of the entire industry have not yet formed.

Therefore, to break the deadlock, relying solely on sales rankings is clearly insufficient. It is necessary to start with the product itself: either leverage the "first-mover advantage" and "dividend" of the product to help enterprises achieve significant sales during the product cycle and establish a phased profit advantage; or gain stronger pricing power through larger sales volumes, establishing a phased cost advantage; or leverage resources acquired during the dividend cycle (data accumulation, technological accumulation) to establish a phased technological advantage.

From this perspective, continuously innovating and launching differentiated products with "first-mover advantages" that can form in the short term allows enterprises to capture new product dividends, put immense competitive pressure on competitors who are unable to effectively catch up, suffer huge losses, and ultimately be forced to withdraw. This is the correct approach for enterprises to stand out.

The end of "involution" is "evolution"

In fact, "involution" is not unique to the new energy industry. Similar scenarios have occurred in industries such as shared bicycles, ride-hailing, and food delivery in the past. In the early stages of these industries' development, multiple forces contended with each other, ultimately deciding the outcomes of phased competitions through "burning money," leaving only a few giants to survive.

Moreover, this phenomenon is not limited to China. Looking at the global market, similar cases abound. Wherever there are people, there is competition; wherever there are profits, competition inevitably exists. Industries formed after the Industrial Revolution and those imported from abroad are mostly oligopoly industries. In the gasoline-powered vehicle era, the global market underwent decades of competition after two world wars, eventually leading to the oligopoly of automakers from Europe, the United States, and Japan. The international brands that exist in the market today are the lucky survivors of the "great sieve" of corporate survival cycles.

However, in comparison, the competition in China's new energy market is even more intense, with a faster pace. Ultimately, the "involution" of the past and present will not differ significantly, leading to a situation where only a few giants remain. Although it is difficult to predict who will emerge victorious, the number of enterprises, and how long it will take, one thing is certain: Chinese enterprises that grow amidst such brutal competition will certainly possess stronger international competitiveness.

After all, while people discuss the "involution" of domestic new energy vehicle brands, traditional automakers like Volkswagen, BMW, Audi, and Mercedes-Benz have seen declines in their market shares in China, quietly ceding their central stage. Furthermore, Chinese new energy automakers have demonstrated strong competitiveness in vast markets across Europe, America, Asia, Africa, and Latin America, "evolving" beyond their borders and launching attacks on local brands.

From this perspective, during this round of "leadership changes" among oligopolies, the global automotive market is bound to undergo an iteration of "rising in the East and falling in the West." After all, if Chinese automakers cannot win at home, they can still go abroad; if foreign automakers cannot win in the Chinese market, they may truly be left with nowhere to go.

Source: Stock Research Club