Qualcomm: Mobile phones remain stable, AI holds new hope

![]() 08/06 2024

08/06 2024

![]() 484

484

Qualcomm (QCOM.O) released its fiscal year 2024 third-quarter report (ending June 2024) after the US market close on the morning of August 1, 2024, Beijing time. The key points are as follows:

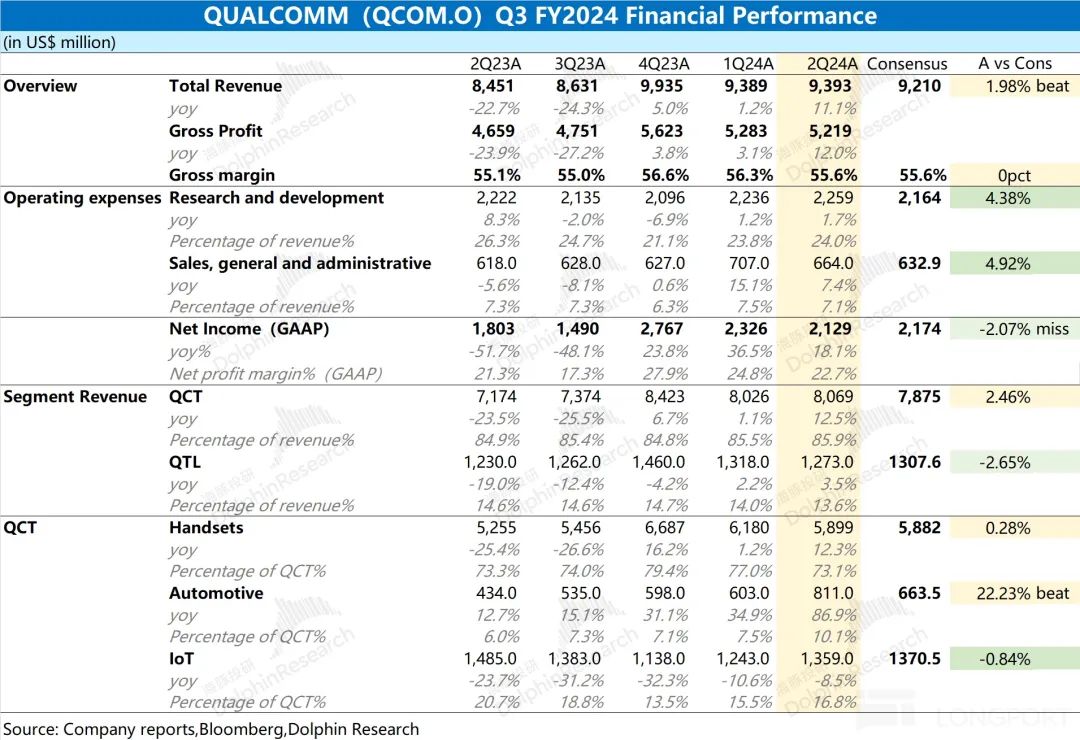

1. Overall performance: Revenue & profit, basically in line with expectations. Qualcomm achieved revenue of $9.393 billion in fiscal Q3 2024 (i.e., 24Q2), up 11.1% year-on-year, slightly better than market expectations ($9.210 billion). The company's revenue growth rate accelerated this quarter, mainly driven by growth in its smartphone and automotive businesses; the company achieved net profit of $2.129 billion in this quarter, up 18.1% year-on-year, slightly below market expectations ($2.174 billion), with the year-on-year increase mainly driven by revenue growth.

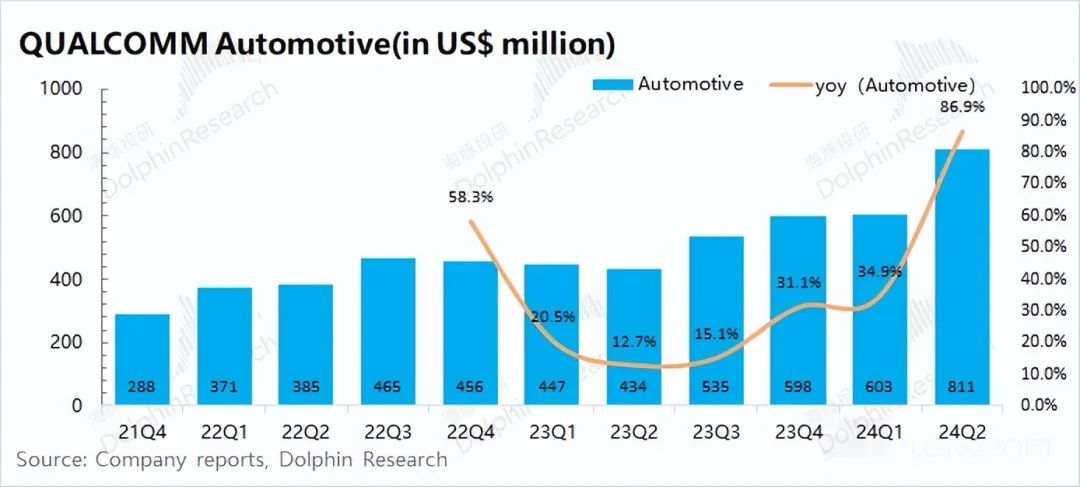

2. Business segments: Both mobile phones and automobiles showed growth. Mobile phones are still the largest segment of the company's business, accounting for over 60%. Although the mobile phone business grew year-on-year, it remained relatively low, mainly due to insufficient demand in the industry. The automotive business grew by 86.9% this quarter, but its relatively small share meant a limited impact on the company's overall performance.

3. Qualcomm's guidance: Qualcomm.US expects revenue of $9.5-$10.3 billion (market expectation: $9.7 billion) and adjusted earnings per share of $2.45-$2.65 (market expectation: $2.48) in fiscal Q4 2024 (i.e., 24Q3).

Dolphin Insights: Qualcomm's financial results were generally in line with expectations. The company's revenue and profit were both in line with guidance, with year-on-year growth primarily driven by the mobile phone and automotive businesses. Based on the company's guidance for the next quarter: fiscal Q4 2024 (i.e., 24Q3) revenue is expected to be $9.5-$10.3 billion (market expectation: $9.7 billion) and adjusted earnings per share of $2.45-$2.65 (market expectation: $2.48). Both revenue and profit are expected to rebound in the next quarter, but they are close to market expectations. Dolphin believes that with the launch of new products in the second half of the year and the recovery of demand from mobile phone customers, the company's performance will improve. However, based on the company's guidance, the overall recovery pace is generally in line with market expectations. Although markets such as AI PCs can bring new growth to the company, the mobile phone business currently accounts for over 60% of the company's revenue, and the performance of the mobile phone market directly affects the company's final results. After share price adjustments, the company's PE ratio has returned below 20, which is relatively neutral. However, to further expand the upside potential, the mobile phone or AI business needs to exceed expectations.

Detailed Analysis

I. Overall Performance: Revenue & Profit, Basically in Line with Expectations

1.1 Revenue for Qualcomm

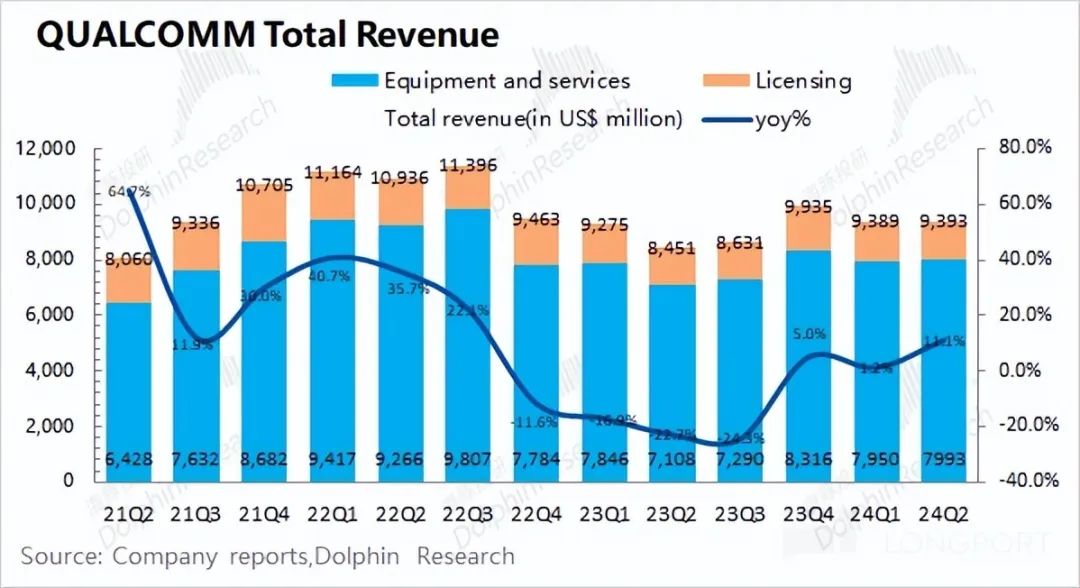

Achieved revenue of $9.393 billion in fiscal Q3 2024 (i.e., 24Q2), up 11.1% year-on-year, slightly better than market expectations ($9.210 billion). The company's revenue growth accelerated this quarter, mainly driven by the smartphone and automotive businesses.

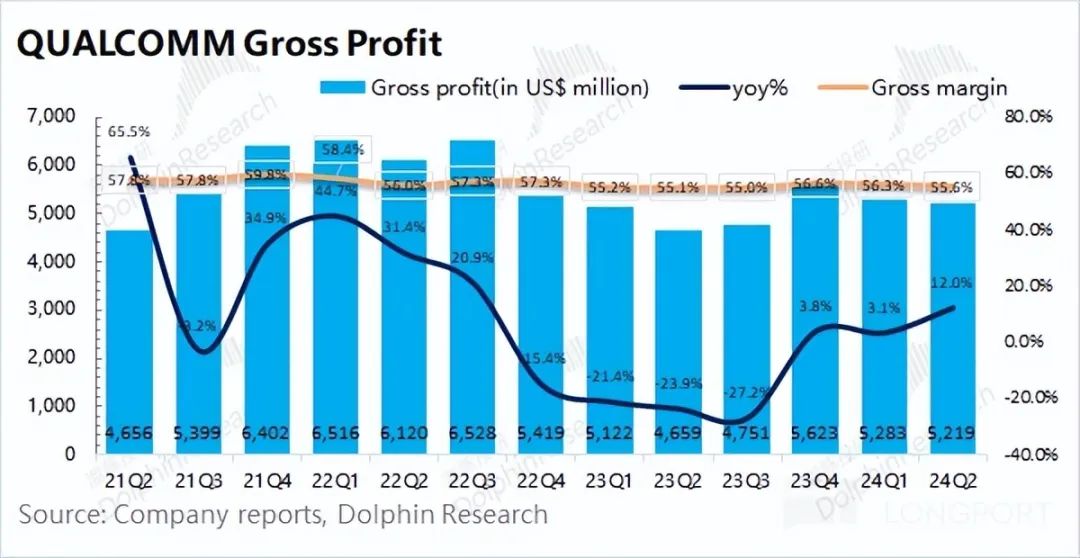

1.2 Gross Profit

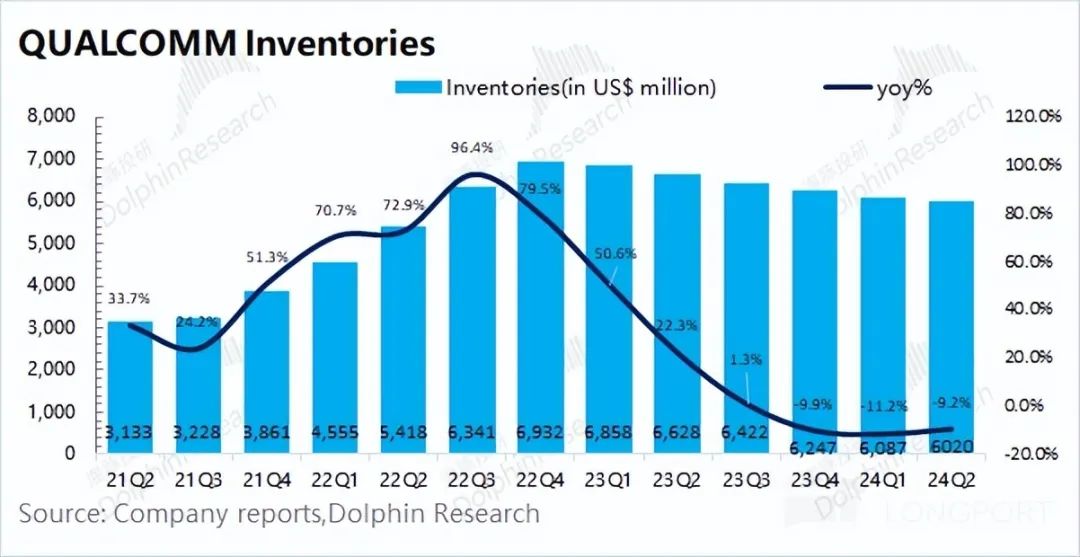

Achieved gross profit of $5.219 billion in fiscal Q3 2024 (i.e., 24Q2), up 12% year-on-year. The gross profit growth rate was faster than revenue growth, mainly due to a year-on-year increase in gross margin. Qualcomm's gross margin was 55.6% this quarter, up 0.5pct year-on-year, in line with market expectations (55.6%). The company's gross margin remained relatively stable at over 55%, reflecting its influence in the industry chain. As the mobile phone market recovers, the company's gross margin is also expected to rebound.

Qualcomm had $6.02 billion in inventory in fiscal Q3 2024 (i.e., 24Q2), down 9.2% year-on-year. Although the company's inventory situation continued to improve, the relatively high inventory still affected the rebound in gross margin.

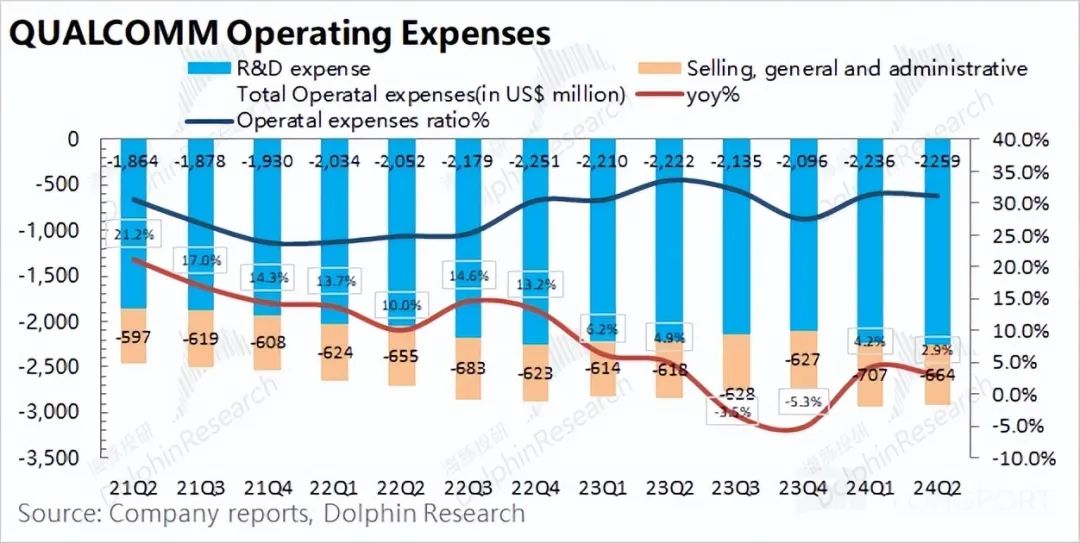

1.3 Operating Expenses

Operating expenses were $2.923 billion in fiscal Q3 2024 (i.e., 24Q2), up 2.9% year-on-year, with varying degrees of growth in both sales and R&D expenses. Breaking down the specific expenses: 1) R&D expenses: The company's R&D expenses were $2.259 billion this quarter, up 1.7% year-on-year. As a technology company, R&D expenses remain the largest item of investment, with little year-on-year change; 2) Sales and administrative expenses: The company's sales and administrative expenses were $664 million this quarter, up 7.4% year-on-year, with sales expenses correlated to revenue.

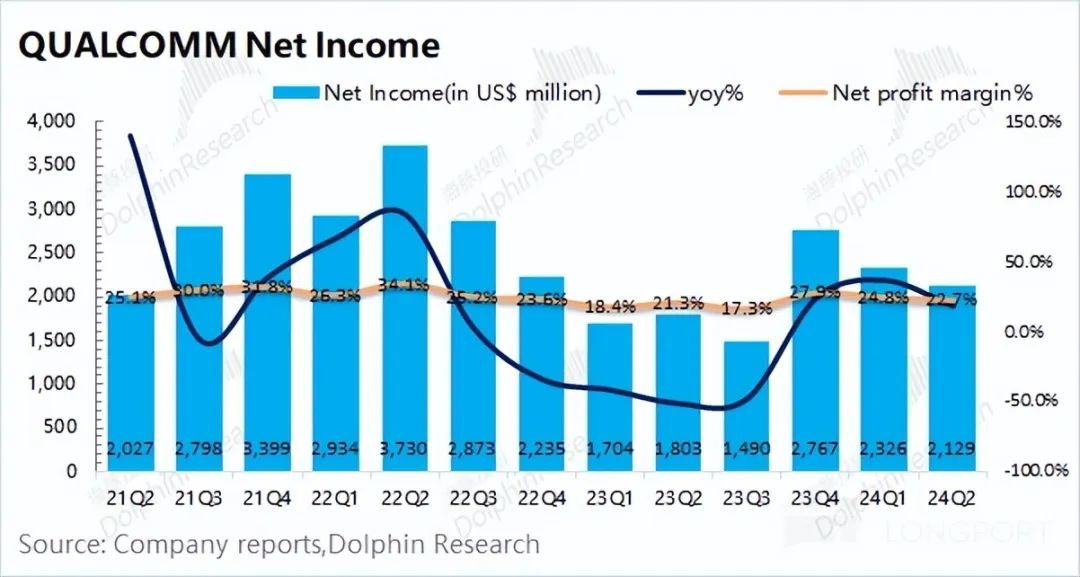

1.4 Net Profit

Achieved net profit of $2.129 billion in fiscal Q3 2024 (i.e., 24Q2), up 18.1% year-on-year, slightly below market expectations ($2.174 billion). The net profit margin was 22.7% this quarter, maintaining profitability at around 20%. Excluding non-operating factors such as investment income, the company's core operating net profit increased year-on-year, mainly driven by the recovery in Android phone shipments, but the company's performance has not yet fully recovered.

II. Business Segments: Both Mobile Phones and Automobiles Showed Growth

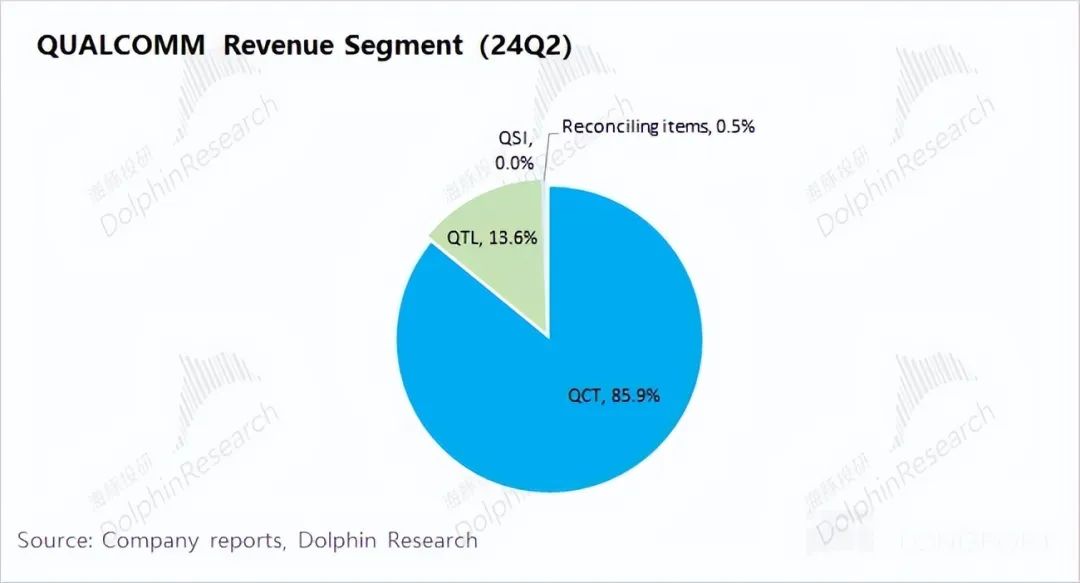

From Qualcomm's business segments, QCT (CDMA Technologies) remained the company's largest source of revenue this quarter, accounting for 85.9%, mainly comprising chip semiconductor business; the rest of the revenue came mainly from QTL (Qualcomm Technology Licensing), accounting for around 13.6%.

QCT is the most important part of the company's business, specifically:

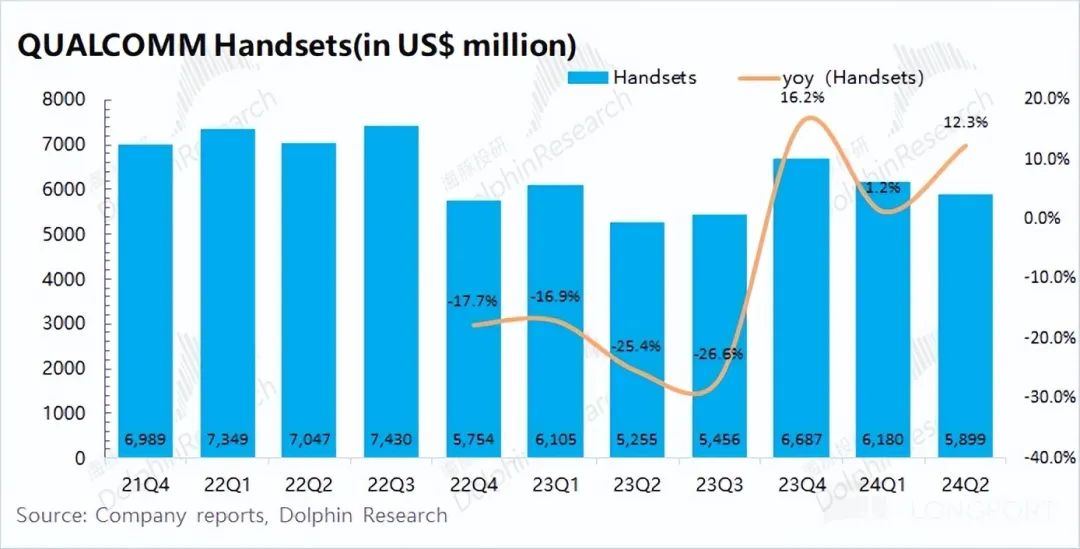

2.1 Mobile Phone Business

Achieved revenue of $5.9 billion in fiscal Q3 2024 (i.e., 24Q2), up 12.3% year-on-year. Quarterly growth was mainly driven by the recovery in demand from Chinese Android vendors, but it remained relatively low. Of the over $600 million increase year-on-year, $443 million was from increased chip shipments to OEM vendors, and $159 million was from increased shipments of higher-end Snapdragon products.

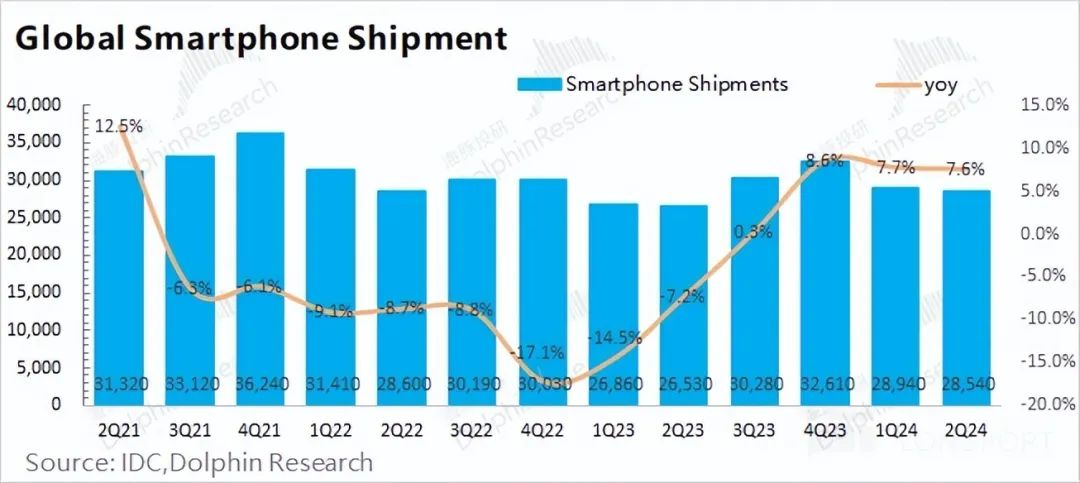

According to industry data, global smartphone shipments were 285 million units in Q2 2024, up 7.6% year-on-year, with relatively stable growth. Although smartphone shipments have recovered from their lows, they remain relatively low, still below 300 million units. This is mainly due to the current weakness in overall demand in the mobile phone market.

The mobile phone business accounts for over 70% of QCT revenue and over 60% of Qualcomm's overall performance. In October this year, the company will showcase details of its next-generation Snapdragon 8 flagship mobile platform, the first to be powered by Qualcomm's Oryon CPU, combined with NPU AI capabilities. Only a significant recovery in the mobile phone business can lead to a substantial improvement in the company's performance.

2.2 Automotive Business

Achieved revenue of $811 million in fiscal Q3 2024 (i.e., 24Q2), up 86.9% year-on-year. The automotive business was the fastest-growing segment, driven by increased demand for new vehicles equipped with Qualcomm's Snapdragon digital cockpit products. Although the automotive business continued to grow at a high rate, it still accounts for less than 10% of the company's total revenue, with a relatively small impact on the company's overall performance.

2.3 IoT Business

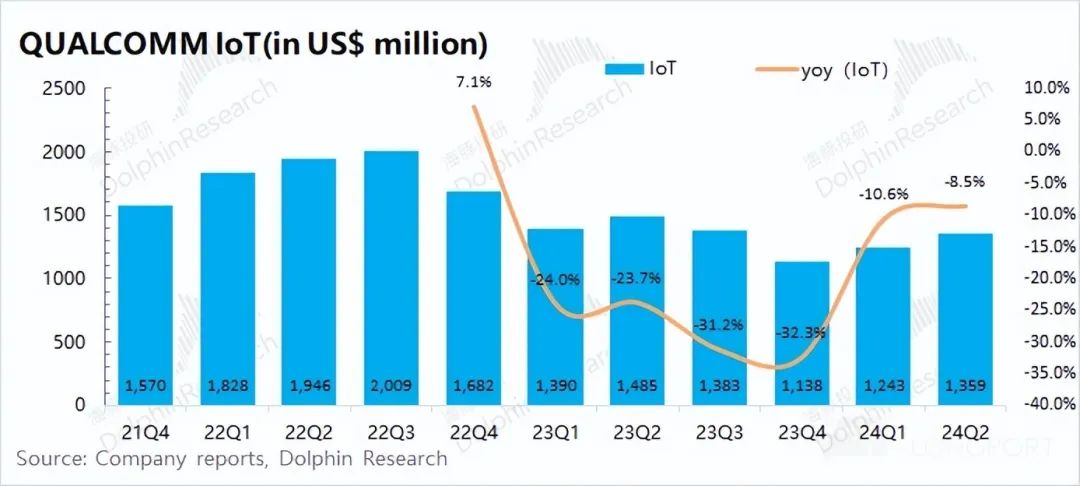

Achieved revenue of $1.359 billion in fiscal Q3 2024 (i.e., 24Q2), down 8.5% year-on-year. The decline in IoT business narrowed but has not yet reversed. The low demand for consumer electronics products such as XR is the main factor behind the decline in IoT business. Qualcomm's IoT business includes consumer electronics, edge network, and industrial products. According to the company's financial report, Qualcomm Snapdragon X-series platforms supporting Copilot+ PCs are also included in the IoT business. With increasing demand for AI PCs, the IoT business is expected to return to growth.

- END -