The road for German-made electric cars is quickly blocked

![]() 08/06 2024

08/06 2024

![]() 578

578

Rising domestic new forces

”

Author | Wang Lei Editor | Qin Zhangyong

The German new energy vehicle industry is experiencing a silent demise.

This is not an exaggeration. Germany's emerging automotive suppliers are lining up for bankruptcy.

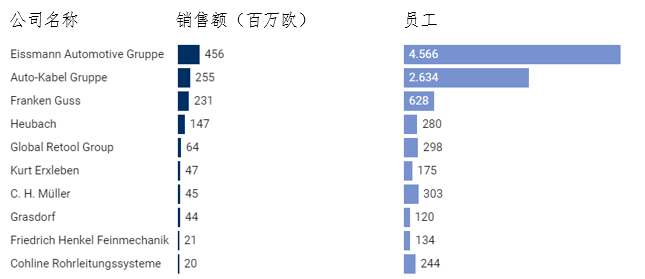

According to information released by Falkensteg, a well-known German consulting firm, in the first half of 2024, up to 20 German automotive component suppliers with annual revenues exceeding 10 million euros (approximately US$78.72 million) filed for bankruptcy, a 60% year-on-year surge compared to last year.

Moreover, Horváth, a German corporate consulting firm, conducted surveys with 91 industry leaders in the second quarter of this year, half of whom came from the automotive manufacturing industry. These leaders in the automotive industry were highly unanimous on one issue during interviews:

A large number of jobs in the German automotive industry are at risk, and significant layoffs are expected in the next five years.

Just recently, ZF, a German automotive component giant, also announced a significant strategic adjustment, planning to lay off about 14,000 employees in the coming years, equivalent to a quarter of all ZF jobs in Germany.

As we all know, Germany is the hometown of automobiles, and BBA is a shining gold standard. However, in the face of the new energy transition, this established automotive industrial nation is starting to show signs of decline.

01 Automotive suppliers are going bankrupt in batches

In fact, the situation of German automotive component companies has been worrying for several years now.

In the first half of this year, 20 companies with annual revenues exceeding 10 million euros went bankrupt, but this figure is far from its peak.

In the first half of 2020, 28 automotive component suppliers filed for bankruptcy, affecting over 10,000 jobs in total. Of course, this was during the pandemic, and the reality led to large-scale corporate bankruptcies.

By 2022, the energy crisis had further exacerbated the situation for the German manufacturing industry, with a large number of automotive-related companies going bankrupt. In 2023, Germany made concessions on energy price surcharges, inflation compensation, and supplier price adjustments related to inflation, but the situation remained bleak.

The number of automotive suppliers filing for bankruptcy in 2023 decreased by 3% compared to 2022. In the first half of this year, the number surged again, from 12 last year to 20 this year.

The reason for using annual revenues exceeding 10 million euros as the statistical standard is that these companies are essentially medium-sized supply chain enterprises in Germany, with relatively solid financial foundations that are not easily shut down. This better reflects the current state of the automotive supply chain industry.

But in fact, it's not just these medium-sized suppliers that are shutting down. Among them are many established companies with over a hundred years of history.

FIT Hon Hai Precision Industry Co., Ltd., a subsidiary of Foxconn Technology Group, officially announced on July 11 that its automotive division, FIT Voltaira Group, would strategically acquire the renowned German automotive supplier Auto-Kabel Group for 72.5 million euros. This company had filed for bankruptcy in Germany earlier in 2024.

Borgers, one of the leading manufacturers of textile coverings and shock absorbers in the automotive industry, once supplied interior materials to automakers such as BMW, Mercedes-Benz, and Volkswagen, employing over 4,500 employees and founded in 1866. However, in 2022, after 156 years of operation, it filed for bankruptcy.

Later, in April 2023, it was acquired by Swiss competitor Autoneum for 117 million euros, citing bankruptcy due to "continuously strained economic conditions within the group" since fiscal year 2018.

Founded in 1964, Eissmann Group Automotive, an automotive interior supplier with 5,000 employees worldwide, recently filed for bankruptcy in Germany, affecting over 1,000 employees. The reason for the bankruptcy was the inability to offset the negative impacts of economic recession, rising energy and material costs, and increasing interest rates.

In addition, Allgaier, an important supplier to Porsche, also filed for bankruptcy. With approximately 1,700 employees, it is a well-known supplier in the automotive sheet metal forming field and also active in machine tools, tool manufacturing, and other areas, serving as a pillar of the local economy.

Regarding the reasons for this company's bankruptcy, Josef, the former financial department manager of Allgaier, stated that local costs in Germany are too high, with rising material and labor costs that can no longer support the company's positive business development.

Moreover, he believes that in the next 10 to 15 years, more and more companies will leave Germany.

Furthermore, amidst the overall shrinking market environment, no one can remain unscathed. Not only suppliers but also automakers are struggling.

In June of this year, e.GO, a star electric vehicle company founded in 2015 and considered a new model of the German automotive industry, officially ceased operations after filing for bankruptcy reorganization.

The spokesperson for e.GO explained the reason for the bankruptcy: "Due to adverse developments in the electric vehicle industry combined with capital market turmoil, the company lacked the ability to continue financing, and the recent situation of other industry participants has exacerbated this situation."

In other words, not only was the company's own cash flow insufficient, but overseas demand for electric vehicles was also low, coupled with turbulence in the automotive supply chain, ultimately leading to bankruptcy under various factors.

Faced with this wave of electrification, Germany, an established automotive industry nation, seems to be losing steam.

02 Where are the opportunities for incremental component suppliers?

As the automotive industry accelerates its transition towards electrification and intelligence, the supply chain structure of the automotive industry is undergoing profound changes, with software becoming an increasingly important core component product.

More and more traditional components are no longer used in new energy vehicles, which means traditional businesses will be affected and may even face elimination.

With industry adjustments, component companies must also undergo changes. For example, ZF, Bosch, Valeo, and others have announced structural adjustments, business divestitures, and accelerated R&D of intelligent products.

Many new players also view electrification as a transformative opportunity. To distinguish themselves from these traditional suppliers, a new category has emerged: suppliers of incremental components for smart cars.

The term "incremental" refers to components that serve the electrification, connectivity, and intelligence of automobiles. There are many types of these incremental component suppliers, some responsible for intelligent driving, and others for intelligent cockpits.

For example, Bosch established the LE Intelligent Driving and Control Systems Business Unit, centralizing domain controllers across various domains. It also consolidated its new energy sector into a separate business unit, making significant changes by restructuring and reorganizing its automotive and intelligent transportation technology businesses under the name "Intelligent Mobility Group."

Furthermore, as the autonomous driving sector becomes increasingly popular, LiDAR has become a crucial part of the industry chain, giving rise to many start-up LiDAR companies such as Quanergy, Leddar Tech, and Luminar.

Many automakers also directly acquire or establish such suppliers of incremental components for smart cars. For example, Stellantis acquired a stake in LiDAR start-up SteerLight to develop autonomous driving technology.

Behind these transformations lies the goal of transitioning to electrification services.

However, many German investors now view what was once a "transformative" opportunity as an "investment trap."

The primary factor leading to the bankruptcy of these suppliers is the low demand for electric vehicles in the local market.

Many suppliers overestimated the demand for electric vehicles in Germany. Local suppliers hoped to leverage the transition to bring growth opportunities, but they fell into an investment trap and could not compensate for the losses caused by declining demand.

In other words, additional investments are becoming increasingly burdensome. To prevent bankruptcy and reduce losses, layoffs have become the best means of avoiding it.

For example, Bosch Group plans to lay off about 1,200 employees in its software and electronics departments at two transmission factories in Germany by the end of 2026, with 950 of them in Germany. ZF also intends to lay off 14,000 employees in Germany by 2038, while Continental AG recently initiated a layoff plan affecting 7,150 employees.

Compared to Germany, China's suppliers of incremental smart components are starting to rise prominently.

The most typical example is Huawei's Intelligent Automotive Solution BU (Business Unit), initially positioned as a supplier of incremental components for intelligent connected vehicles, providing product solutions such as intelligent driving and HarmonyOS cockpit systems to OEMs.

In early July of this year, it was reported that Huawei's Intelligent Automotive Solution BU generated revenue of RMB 10 billion in 2024, gradually transitioning from losses to profits.

For comparison, Huawei's Intelligent Automotive Solution BU generated annual revenues of RMB 2.1 billion and RMB 4.7 billion in 2022 and 2023, respectively. This means that the BU's performance in the first half of this year has already surpassed the combined totals of the past two years.

Furthermore, at a previous China Electric Vehicle Hundred Person Forum, Yu Chengdong, Chairman of Huawei's Consumer BG and Intelligent Automotive Solution BU, stated that the BU previously lost RMB 10 billion annually, then RMB 8 billion, RMB 6 billion last year, and is expected to turn a profit this year.

This profitability is impressive.

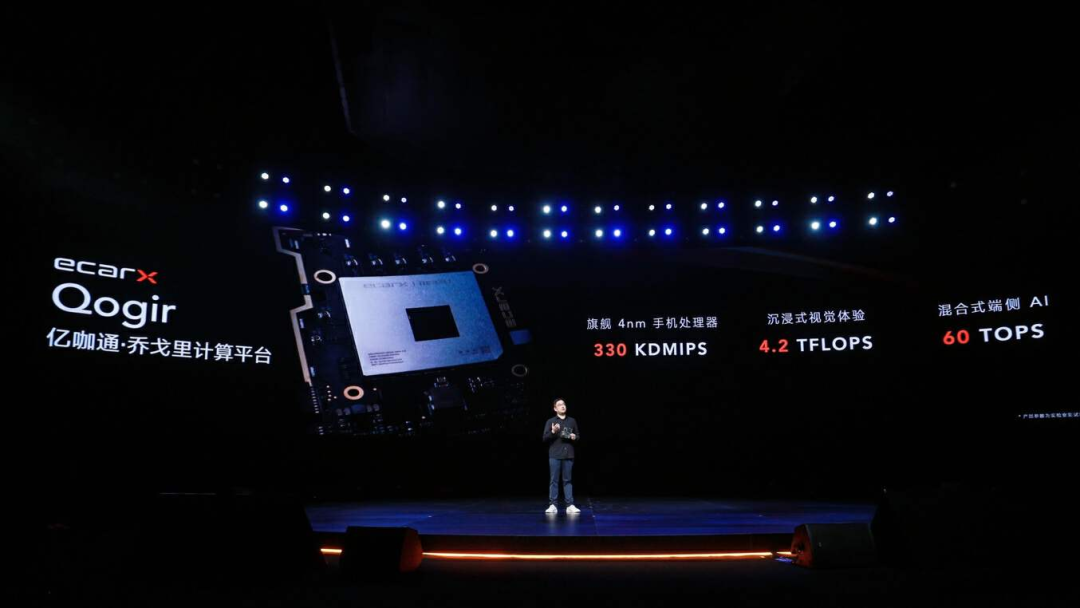

In addition, many outstanding domestic suppliers are emerging players. For example, ECARX, founded in 2016, became the first Chinese automotive technology company to list in the US.

Initially, ECARX provided customized in-vehicle systems for different Geely models, much like Aisin did for Toyota in the past.

However, with the transformation of the automotive industry, ECARX's business scope has expanded to provide core hardware and software solutions for intelligent mobility, including in-vehicle infotainment systems, digital smart cockpits, in-vehicle chip module solutions, and integrated software stacks.

This means that ECARX now has a dual identity. It serves as a Tier 1 supplier to OEMs, providing complete hardware and software solutions, and also serves as a supplier to Tier 1 companies, catering to domestic OEM brands.

Some domestic autonomous driving start-ups have also begun to forge deep partnerships with automakers or spin off their intelligent driving R&D departments to establish subsidiaries, such as Pony.ai, Horizon Robotics, and Momenta.

For example, Momenta has a deep partnership with SAIC Motor's IM brand, while Horizon Robotics maintains a somewhat distant relationship with Great Wall Motor. While serving Great Wall, it also seeks orders from other automakers.

It can be seen that opportunities will never be lacking in this transformation, but they also require the right timing and conditions.

This ship sailing towards the new world cannot carry the remnants of the old era.