High-end mouse is out! Going to make a breakthrough with AI?

![]() 08/06 2024

08/06 2024

![]() 584

584

When was the last time you bought a new mouse?

For internet addicts like me, a mouse is often a "lifetime" companion. Gamers have extremely strict requirements for a mouse's shape, weight, weight distribution, and button feel, which means most people won't easily switch mice. Even if the old mouse has issues, they often buy the same model instead of a new one.

Moreover, Logitech and Razer have excellent after-sales service in China. Even if a mouse is worn out, it can be replaced for free through official after-sales, which is akin to getting a free refill. Unfortunately, this era of easy refills may soon be over.

In an interview with The Verge, Logitech's new CEO Hanneke Faber made an interesting point:

In the future, you may keep using the same mouse, but we (Logitech) will add new software features to your device if you subscribe.

Yes, even in the straightforward business of selling mice, Logitech wants to introduce internet thinking.

The Dilemma of Traditional Mice

Over the past decades, the mouse, as a standard peripheral for computers, has undergone technological innovations from the scroll mouse to the optical mouse and then to the wireless mouse. However, in recent years, the traditional mouse market has faced increasing challenges and dilemmas. Market sales data also shows that the growth rate of the mouse industry has slowed significantly, even showing a downward trend.

According to market research firm GfK, global mouse sales have remained stable in recent years, but the growth rate has declined annually: global mouse sales increased by only 1.2% year-on-year in 2019, dropping to 0.5% in 2022. Admittedly, during the pandemic, the demand for remote work and online learning boosted sales of laptops, monitors, and peripherals like headphones and mouse-keyboard sets. However, as the concept of remote work fades, sales of these tech products have declined as well.

In my opinion, there are three main reasons for this sales decline.

Firstly, the market is saturated. As a durable tool, the mouse market is already highly saturated. Most users only require a mouse that connects stably, has working buttons, and has long battery life. These fundamental requirements make the mouse a low-barrier peripheral product.

Sure, a good mouse emphasizes ergonomic design, allowing users to use it for extended periods without fatigue and delaying the onset of "mouse hand" (carpal tunnel syndrome). However, these features come at a cost, and the low technical threshold keeps the end price of mice low. After all, for users, a slightly inferior mouse is still usable.

Image source: JD.com

Secondly, mouse technology evolves slowly. For high-end mouse users like professional gamers, they rarely update their mice unless their sponsor changes. While newer mice offer improvements in design, sensor accuracy, and wireless technology, these advancements are relatively limited and hardly entice high-spending users.

Moreover, compared to rapidly evolving smartphones, mouse technology progresses slowly with fewer functional innovations. The current iterations of high-end gaming mice mainly involve adopting lighter honeycomb designs or higher refresh rate sensors. In terms of core functionality, mice remain largely unchanged. In fact, the most notable evolution in mice over the years, apart from going wireless, was the now-obsolete "mouse smoothing" feature.

Lastly, the emergence of smartphones and tablets poses a new threat to mice. Unlike computers with precise pointing interactions, smartphones and tablets, which rely on gesture-based operations, have become primary entertainment devices for most users. As peripherals for computers, mice face "structural unemployment."

In summary, the dilemmas of the traditional mouse market stem primarily from market saturation, slow technological innovation, and the emergence of substitutes. Despite these challenges, through technological innovation and business model transformations, mouse manufacturers still have opportunities to find new development spaces in this competitive market.

Will Mice "Bump Into" AI?

So, how can mice enhance their competitiveness and avoid "structural unemployment"? Or what features does Faber hope to introduce to persuade Logitech users to continue paying for their mice?

Surprisingly, it's AI again.

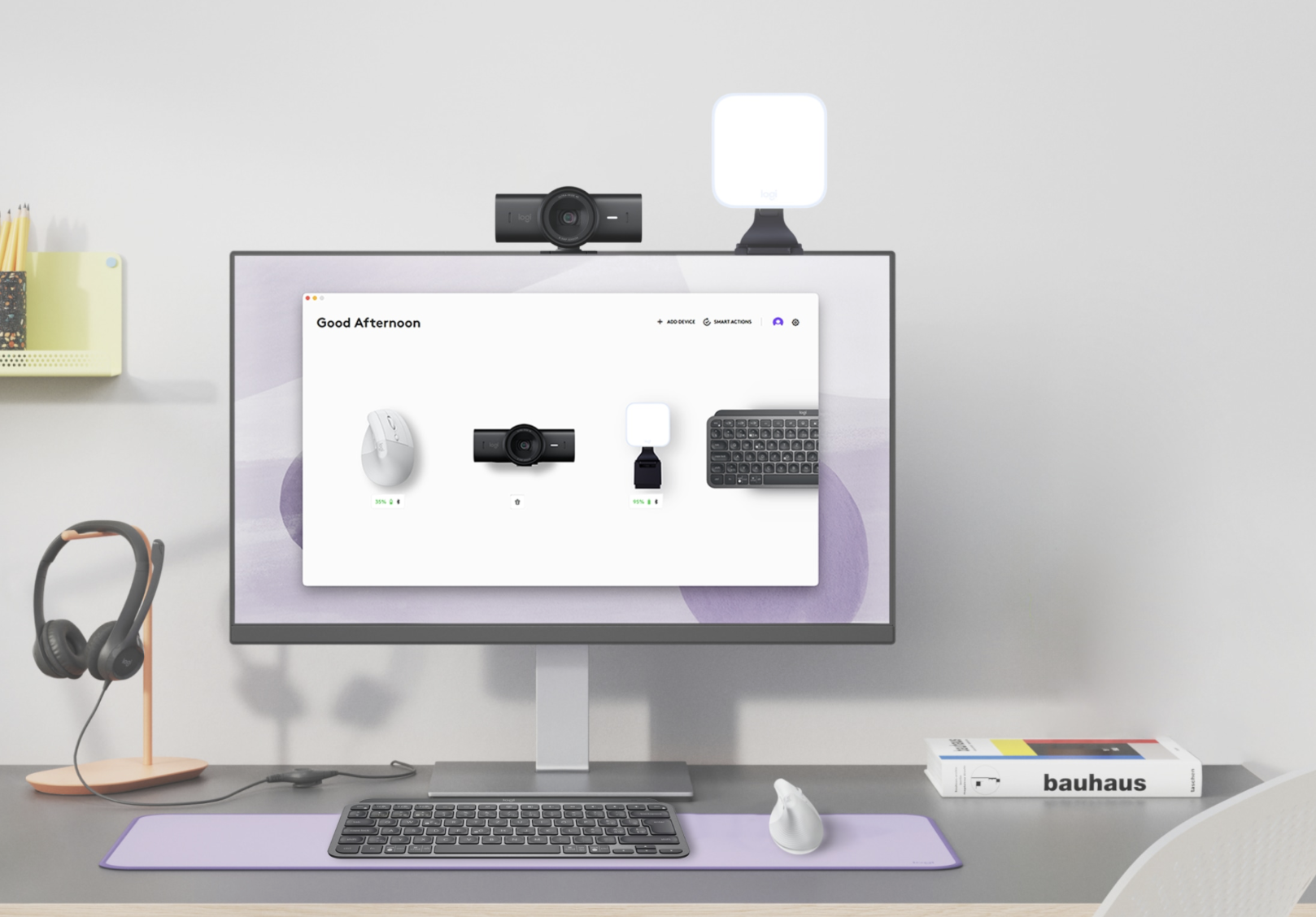

In the interview, Faber mentioned Logitech's Logi AI Prompt Builder. Simply put, this is an AI interface that can be quickly accessed with a mouse, providing users with quick email replies, text editing, and text summarization. While this is a software feature, unfortunately, it's integrated into Logitech's office mouse software, Option+, and is only available on specific new mouse models.

Image source: Logitech

In other words, users still need to buy a new mouse. However, under the subscription model, users can continue using their old mice and access the latest AI features by paying a monthly fee. According to reports, Logi AI Prompt Builder already has millions of users. This AI-empowered approach can indeed bring new revenue streams to Logitech.

However, the problem is that at this stage, all AI can only be considered a service (or even just an app) rather than hardware. This means users have multiple ways to access AI services. Given the more versatile options like web pages and apps, why would users lock themselves into a single product like a mouse?

Put it this way, I only use Apple's trackpad when not gaming, but that doesn't stop me from using ChatGPT to search for recipes, Stable Diffusion to create wallpapers, or AI plugins to add motion blur to videos.

As a hardware brand, Logitech wants its products to become AI entry points, but AI has no shortage of entry points.

Can Domestic Mouse Brands Catch Up?

On the other hand, the slow growth of international brands begs the question: Does this mean domestic mouse brands have an opportunity to catch up?

In my opinion, it's unlikely. While domestic mouse brands can match the hardware performance of flagship products from large manufacturers, they still lag behind in design, wireless connection stability, and firmware, making it difficult to meet the standards of demanding users.

For domestic brands, the lack of design and firmware development capabilities prevents them from competing with large manufacturers in the mid-to-high-end market. They can only compete in the low-end market with high cost-effectiveness. In my view, these issues are not easy to resolve in the short term, as each requires significant human and material resources. Moreover, the technological limitations of OEM factories cannot satisfy manufacturers' needs to enter the high-end market.

Of course, the emergence of domestic AI has indeed brought opportunities for domestic mouse brands to compete on the same stage. The unique paid models of domestic AI significantly reduce the cost for users to access and use AI. However, with similar price points, years of reputation and more stable experiences make gamers prefer products from large manufacturers.

Image source: Logitech

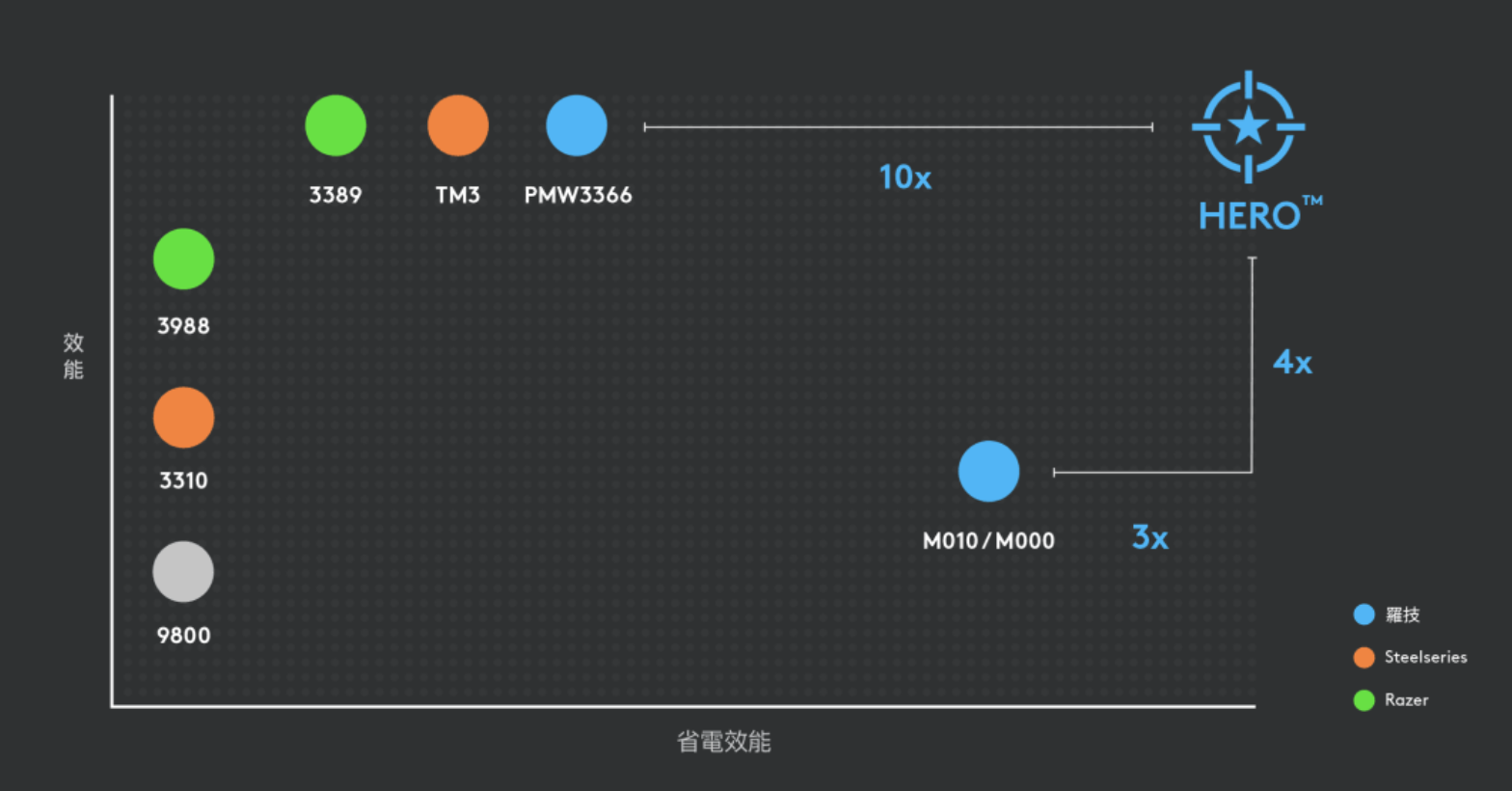

Furthermore, Logitech and Razer have advantages in sensors that domestic manufacturers cannot yet match. Logitech's proprietary Hero sensor is high-performing and cost-effective, already prevalent in its entry-level product line. Razer, on the other hand, has a close relationship with sensor giant PixArt, which exclusively supplies its latest flagship sensors to Razer, creating a significant generational gap with other manufacturers.

In conclusion, long-established manufacturers have numerous advantages. Domestic newcomers face many challenges in challenging their positions. When it's difficult to narrow the hardware and cost gap, the emergence of AI may be the best opportunity for domestic mouse brands to catch up with international giants.

After all, it's Chinese AI that understands Chinese users best.

Source: Lei Technology