Easy to defend, hard to attack Xiaohongshu

![]() 08/06 2024

08/06 2024

![]() 573

573

Original: Shumou Finance (chutou0325)

Recently, the resignation of Dong Yuhui and Yu Minhong's response have caused quite a stir, and live commerce hasn't been this lively in a long time.

Since Xiaohongshu's e-commerce business exploded with Dong Jie's live streaming last year, only frequent financial public opinion has stood out this year.

In fact, if we talk about significant events for Xiaohongshu so far this year, financing is one of them. According to the Financial Times, Xiaohongshu has recently completed a new round of financing, valued at $17 billion (approximately RMB 120 billion).

There are two notable points. First, DST participated in this investment round. DST has invested in classic projects like Facebook, Zynga, Snapchat, and Twitter, and can also be seen in domestic companies like Alibaba, JD.com, Meituan, ByteDance, and later cross-border e-commerce companies like SHEIN, Cider, PatPat, as well as the internet education platform Yuanfudao and SaaS platform Fenbietong.

Second, this financing round involved the transfer of existing shares, which has been interpreted by the market in two ways. On one hand, early investors have chosen to exit due to uncertain prospects for the short-term IPO channel. On the other hand, later investors who are optimistic about Xiaohongshu's future have entered. Their optimism is closely related to Xiaohongshu achieving positive earnings in 2023: According to the Financial Times, Xiaohongshu generated $3.7 billion in revenue last year, with a net profit of $500 million, marking its first profit after ten years of establishment.

It remains to be seen whether Xiaohongshu can continue its profitability in 2024, but based on its current business strategy and market competition, the overall outlook is difficult to be optimistic.

01

Inherent Advantages

As the "preferred platform for users' life decision-making searches," Xiaohongshu has a distinct advantage in commercial monetization among its content community peers.

First, Xiaohongshu's differentiated user value for commercialization is notable. Data shows that as of September 2023, users from first- and second-tier cities accounted for 50% of Xiaohongshu's user base, with post-95s comprising 50% of users. This means the platform has a concentration of high-net-worth customers with strong spending power, allowing merchants to sell products at higher price points.

This aligns with previously reported data on the average order value in Dong Jie's live streaming room, which was nearly $600. In comparison, Kuaishou has disclosed that its e-commerce average order value is around $5-$6, Douyin's is around $9, Taobao's is $12-$15, and JD.com's is around $20.

Second, Xiaohongshu users demonstrate high user stickiness.

Generally speaking, as the last stop for consumers before shopping or traveling, an increasing number of users are directly using Xiaohongshu as a new-generation search engine. In consumption scenarios such as travel, fashion, beauty, and restaurant exploration, Xiaohongshu has become the go-to choice for discovering new trends and avoiding pitfalls.

Data also shows that 60% of Xiaohongshu users actively search, with nearly 300 million daily search queries on the platform. Moreover, Xiaohongshu's active user base continues to grow, with monthly active users (MAU) reaching 312 million in 2023, an increase of 20% from 2022.

Furthermore, the platform boasts an increasingly rich, vertical, and professional content pool created by UGC and PUGC. According to official Xiaohongshu data, over 80 million users share content on the platform, with 90% of notes being original and mostly focused on product recommendations.

These three points predestine Xiaohongshu to have a strong commercial atmosphere and drive strong consumption. While it may not be able to form a closed loop from discovery to purchase, being an indispensable platform for e-commerce users' decision-making and orders still has its own story to tell.

This is also why Xiaohongshu has been able to continuously attract investments. Over the years, internet giants and star capital have been optimistic about Xiaohongshu's unique product discovery culture, and brands and merchants have also recognized its promotional and marketing value.

Therefore, after accelerating its commercialization pace last year, Xiaohongshu achieved $3.7 billion in revenue, an increase of 85%, with a net profit of $500 million. Advertising accounted for the majority of its revenue, with advertising revenue accounting for up to 80% of total revenue, according to the 2021 Xiaohongshu Brand Survey Report.

In fact, Xiaohongshu's ability to maintain its current advertising base is already a remarkable achievement, considering the overall instability of the advertising industry. The 2023 China Internet Advertising Data Report shows that the China internet advertising market is expected to reach RMB 573.2 billion in 2023, a year-on-year increase of 12.66%, but the growth rate in 2022 was -6.38%. Moreover, the top four giants in China's internet advertising market—Alibaba, ByteDance, Tencent, and Baidu—account for up to 77% of the market, leaving only 23% for many other players, highlighting the increasing head effect.

Starting from product discovery and monetizing through advertising, other internet platforms are also attempting to tackle this approach. For example, Taobao has launched "Taobao Wander," a content-driven main channel for product discovery, while JD.com has introduced "Grass-seeding Show" to improve product conversion rates. Even Zhihu, which has always emphasized "professional content," is attempting to strengthen its commercial operations with a content-driven approach.

However, compared to these competitors, Xiaohongshu has inherent advantages and finding it easier to maintain its product discovery stronghold. The challenge lies in Xiaohongshu's ambition to conquer e-commerce, whether it be traditional e-commerce, live streaming e-commerce, or buyer-based e-commerce.

02

Lack of Acquired Skills

As previously analyzed, Xiaohongshu's product discovery nature predetermines that its commercialization path will not be as twisted as platforms like Bilibili or Zhihu. "Earning while doing what you love" is not shameful. However, Xiaohongshu faces more challenges stemming from its past foundation, including insufficient e-commerce genes and infrastructure.

To excel as an e-commerce platform, there are three key foundations: user scale, merchant scale, and supplier service quality.

According to Zhuang Shuai from Bailian Consulting, a large user base is essential for converting demands into shopping behaviors. The merchant scale meets users' shopping needs, while supplier service quality affects fulfillment and repurchases. A harmonious match among these three factors can lead to a virtuous cycle.

In terms of user scale, Xiaohongshu does not have any obvious shortcomings. This explains why during this year's 618 shopping festival, Xiaohongshu's live streaming orders reached 5.4 times that of the same period last year, with live streaming buyers increasing by 5.2 times. While there is a significant gap compared to Taobao, JD.com, and Pinduoduo, Xiaohongshu is still on an upward trajectory.

In terms of merchant scale or supply, Xiaohongshu has been working on attracting more business flows from multiple angles.

First, it combines in-house live streaming with influencer live streaming. Specifically, in May this year, it was rumored that Xiaohongshu's live streaming e-commerce business underwent another adjustment, merging its buyer operations and merchant operations into an e-commerce operations department, a secondary unit within the e-commerce division.

Second, Xiaohongshu has upgraded its merchant investment and digital marketing tools, including its repeatedly emphasized marketing methodology: "KFS" (KOL, Feeds, Search), which involves identifying KOLs to generate high-quality notes, amplifying these notes through feed ads, and leveraging search to precisely target users' decision-making scenarios.

However, both approaches seem to have yielded limited results.

In terms of business flows, Xiaohongshu currently lacks advantages in product variety and pricing, with a focus on beauty and fashion categories.

Regarding merchant marketing services, according to Ifeng Tech, Xiaohongshu currently lacks a transparent data dashboard. If merchants want to understand their campaign performance, frontline employees need to manually run data and compile it into Excel tables for scheduling and delivery to merchants. The advertiser tool "Lingxi," launched in 2022, is not yet fully available. It is impossible to measure how many orders are closed through search ads.

In terms of logistics, Xiaohongshu currently relies heavily on service providers like STO Express, YTO Express, ZTO Express, and Yunda Express, which mainly serve the low- to mid-end e-commerce market. However, many users have complained about slow delivery and inadequate services, such as not delivering packages to their doorstep.

The rationale is simple: A complete e-commerce closed-loop process requires heavy asset investments and long-term commitments. Backend fulfillment capabilities such as supply chain, logistics, and payment are crucial, and Xiaohongshu needs to invest time and resources to build these capabilities. It is challenging to overcome the moat built by e-commerce giants over the past two decades in a short period.

03

Breaking Through in New Arenas is Key

If one path is blocked, try another.

This year, in addition to e-commerce, Xiaohongshu has ventured into the tourism industry through "content + traffic" and begun exploring on-site services in local living.

In terms of local living, according to 36Kr, Xiaohongshu has set three development strategies for 2024: First, expand nationwide, starting with first-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen, as well as online celebrity cities like Hangzhou, Chengdu, and Nanjing, before gradually expanding to second- and third-tier cities. Second, prioritize high-end categories like coffee, bakery, and homestays that align with Xiaohongshu's core user preferences. Third, support merchants and influencers through online campaigns and offline incubation programs to enhance the platform's brand reputation and establish a foundation.

With the success of Oriental Selection in tourism and the rise of new-generation platforms like Douyin in local living, both are proven business models. Moreover, the local living market is worth a gamble for Xiaohongshu.

According to Douyin's 2023 Local Services Annual Data, the platform's total transaction value increased by 256%, with live streaming transactions growing 5.7 times. Douyin aims for a GMV of RMB 3 trillion in 2024, while according to Haitong International's report, Douyin's local living GTV (Gross Transaction Value after verification) approached RMB 200 billion in 2023.

To break through its current commercialization dilemma, Xiaohongshu needs to evolve into a super app, aligning itself with vertical industry leaders and leveraging their strengths. From a macroeconomic perspective, local living seems to offer a more accessible breakthrough.

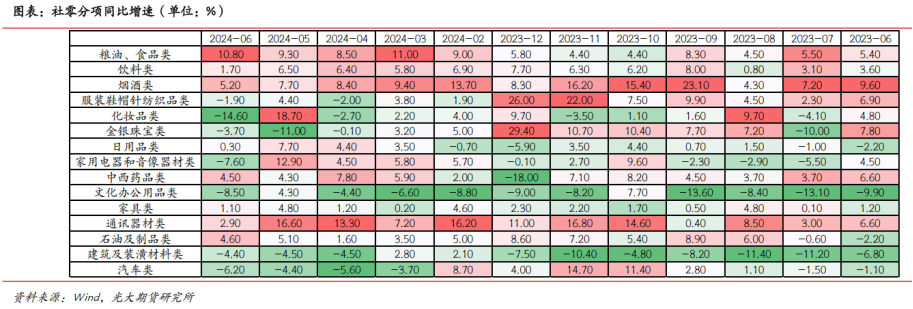

According to research by Wind and Everbright Futures Institute, retail consumption categories that have maintained growth over the past year include grain, oil, food, beverages, tobacco, alcohol, and telecommunication equipment.

Ultimately, successful implementation relies on fine-grained operations, segmented by city, category, and user.

Take group-buying packages as an example. While it makes sense to prioritize first-tier cities and online celebrity cities like Hangzhou, Chengdu, and Changsha, finding a differentiated approach beyond low prices is crucial. This may involve investing more in ground-level marketing efforts to understand the market and consumers better. The premise is that local living is inherently hard work.

In conclusion, in an era where marketing is ubiquitous and users are desensitized to product discovery, the community atmosphere may have "changed," but for platforms like Xiaohongshu, Zhihu, and Bilibili, which started as content-driven, this is inconsequential.

Users are aware and have their own perceptions and experiences, regardless of whether the platform chooses to monetize. Even if Xiaohongshu wants to monetize urgently, it depends on users' individual awareness.

After years of market education, users understand the need for platforms to monetize and are willing to try multi-channel consumption. However, the core lies in what the platform can offer users, which is the essential aspect of economic activities.

Merchants and brands are also weighing the commercial value of platforms. Whether through advertising investments or direct operations, in-house live streaming or buyer-based approaches, long-term retention and repurchases depend on quality and overall value for money.

* Images sourced from the internet. Please contact us for removal if there is any infringement.