How ambitious is Kuaishou's late entry into finance?

![]() 08/06 2024

08/06 2024

![]() 466

466

Kuaishou's financial ambitions have quietly taken another step forward.

According to Tianyancha, on July 26, Shanghai Shengda Insurance Brokerage Co., Ltd. underwent a business change, with the original controlling shareholder Hainan Zhonghe Yunlian Technology Co., Ltd. withdrawing, and Chengdu Kuaigou Technology Co., Ltd. becoming the new controlling shareholder.

▲Source: Tianyancha

The latter is precisely Kuaishou's wholly-owned subsidiary, the well-known short video giant. In other words, just four months after obtaining a small loan license, Kuaishou has effectively gained control of an insurance brokerage license, adding another layer to its financial services offerings.

01

Kuaishou's Collection of Multiple Financial Licenses

The saying 'the end of the internet is finance' has been proven true for Kuaishou as well.

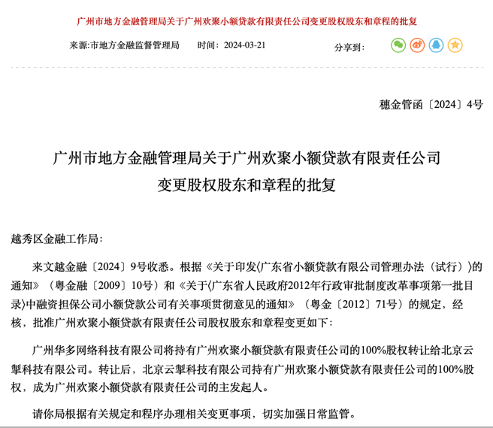

In March of this year, the Guangzhou Municipal Local Financial Administration issued an approval for the equity transfer of Guangzhou Huanju Small Loan Co., Ltd., with the transferee, Beijing Yunche Technology Co., Ltd., being a member of the Kuaishou family.

▲Source: Guangzhou Municipal Local Financial Administration

Together with the insurance brokerage license acquired this time and the payment license purchased in 2020, Kuaishou has now obtained the key licenses necessary to enter the financial sector, clearing the way for its expansion.

In fact, Kuaishou's financial activities were already evident long before it obtained any licenses. It has been involved in loan facilitation within its platform and has displayed numerous loan advertisements, credit card delinquency consultations, and anti-collection tips.

When Qicaijing explored the Kuaishou app, they found that clicking on 'Wallet' and then 'Borrow Money' led to multiple lending institutions. One product matched for the author offered a maximum loan amount of RMB 200,000, with an annual interest rate starting at 7.2%, highlighting flexible repayment options, quick disbursements, and daily interest calculations.

▲Source: Kuaishou App

Moreover, Kuaishou's financial monetization efforts are accelerating. Recently, Kuaishou has recruited heavily in both credit and traffic areas, involving positions in operations, product development, compliance, and more.

For instance, the recruited Financial Product Operations Manager is responsible for leveraging Kuaishou's in-app information flow resources to plan and promote advertising commercialization efforts in the financial industry, increasing advertising revenue, and providing industry solutions to financial clients.

The recruited Financial Risk Control Model Strategy Expert is responsible for developing overseas credit models from scratch, leading the formulation of risk review and credit granting strategies, and regularly inspecting and managing the compliance of credit business.

The recruited Financial Legal Compliance Specialist is responsible for compliance management of corresponding financial licenses, communicating with regulatory authorities, collecting and tracking the latest legislative and industry regulatory developments, accurately interpreting legislation and regulatory policies, and providing optimization suggestions.

It is clear that Kuaishou's exploration of finance goes beyond mere dabbling and represents a well-thought-out strategic layout, actively seeking innovation and breakthroughs.

After obtaining the insurance brokerage license, Kuaishou has another avenue for financial monetization, adding another financial product to its offerings.

Theoretically, leveraging its vast traffic, data, and technological advantages, Kuaishou is well-positioned to develop its insurance business.

As of the end of the first quarter of 2024, Kuaishou's average daily active users and average monthly active users reached 394 million and 697 million, respectively, up 5.2% and 6.6% year-on-year. Each daily active user spent an average of 129.5 minutes per day on the app, up 8.6% year-on-year.

However, it cannot be ignored that Kuaishou's users are mostly distributed in third- and fourth-tier cities and below, and the platform is flooded with bizarre, sensational, and vulgar content, commonly known as the 'Laotie culture.'

This lowbrow tone and crude image, while colloquially described as 'down-to-earth' with a strong local flavor, is inherently incompatible with the high trust requirements and complementary nature of commercial insurance.

Meanwhile, in this competitive field, there are already established players like Tencent WeProtect, Ant Insurance, JD Insurance, and more recent entrants like Toutiao Hejiabao and Meituan Shengyibao, making it a crowded space.

Although Kuaishou has entered the insurance market late, whether it can succeed remains uncertain.

02

Where Else Can Kuaishou Find New Revenue Streams?

In 2023, Kuaishou delivered impressive results with total revenue of RMB 113.47 billion, up 20.5% year-on-year, and both adjusted net profit and annual profit turning profitable.

In the first quarter of 2024, Kuaishou's total revenue reached RMB 29.4 billion, up 16.6% year-on-year, with a net profit of RMB 4.1 billion (compared to a loss of RMB 876 million in the same period last year) and an adjusted net profit of RMB 4.388 billion, setting a new quarterly record.

However, despite these positive results, Kuaishou's share price continued to decline. The reasons may lie in its future growth engines.

Cheng Yixiao has publicly stated that e-commerce will be a crucial growth driver for Kuaishou in the future, emphasizing the business pillars of 'affordable quality products, premium content, and attentive service.'

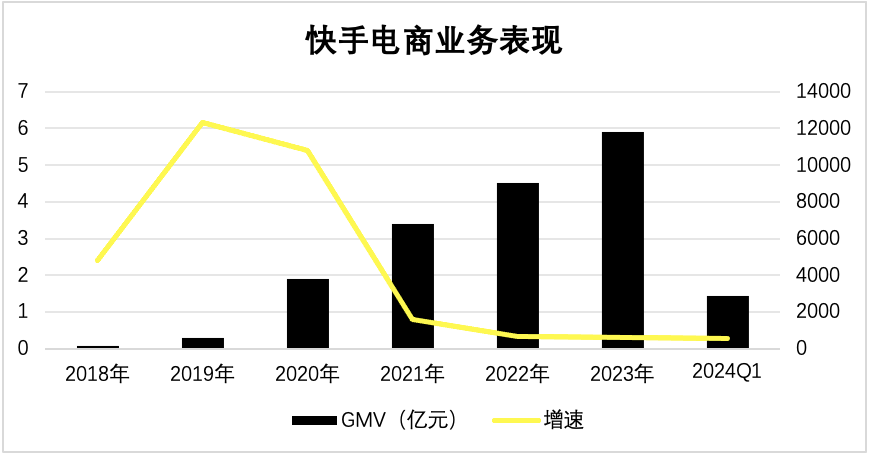

According to financial reports, Kuaishou's e-commerce platform has been operational since 2018. From 2018 to 2023, Kuaishou's annual GMV (Gross Merchandise Volume) increased from RMB 96.6 million to RMB 1.18 trillion.

Simply put, Kuaishou's e-commerce GMV growth rate has slowed from triple digits to double digits, dropping to 28.2% in Q1 2024. As user growth plateaus, future GMV growth is likely to stagnate or experience minimal increases.

▲Data Source: Kuaishou Financial Report

On the other hand, Douyin's 2023 GMV reached RMB 2.2 trillion, almost double that of Kuaishou, putting additional pressure on the latter.

In this context, finding new revenue streams in other areas is crucial. Currently, Kuaishou is focusing on short dramas, local services, and finance as potential growth areas.

In terms of short dramas, Kuaishou has produced popular hits like 'Princess in Power,' 'Bar in the Song Dynasty,' 'Mandarin Duck Break,' and 'Superhero Office Workers' in recent years, but their long-term potential remains to be seen.

After all, new developments in the cultural industry differ significantly from those in high-tech industries. The 'spring' of the former is often fleeting, with limited opportunities and benefits. The fast-paced and satisfying nature of short dramas may also limit their ability to drive sustained growth.

In local services, Cheng Yixiao stated in March that 'as a high-quality content provider, local services not only contribute to GMV but also better meet user needs and enhance user stickiness, making it a crucial new business for us.'

In 2024, Kuaishou has increased its investment in local services, offering billions of platform subsidies, traffic, and a package of technology, products, and services, as well as a RMB 200 million advertising campaign to support local merchants.

According to QuestMobile data, in 2023, group buying penetration in local services was less than 40%, and food delivery penetration was 15.6%. The lower-tier markets are attracting fierce competition.

However, low online penetration does not necessarily translate to easy conquests. Lower-tier markets are inherently based on personal connections, with residents having their preferred restaurants and no need to search for the best options on apps.

Taking a small city in northwest China as an example, the geographical area is small, making dining and entertainment convenient. Word of mouth is clear and established, and there is often no need to use apps to find places to eat. Even low-priced group deals or influencer visits may only temporarily bring in orders but fail to generate stable repeat business.

Moreover, in the promising lower-tier markets, Meituan and Douyin have already established a strong presence, with Meituan's local services GMV growing by 100% in 2023 and Douyin's by 256%. Kuaishou, as a late entrant, faces an uphill battle.

Regarding finance, as previously mentioned, while seemingly lucrative, it is fraught with uncertainties and risks. Issues in payments, small loans, or insurance could have far-reaching consequences.

Kuaishou's new narrative is indeed challenging to craft.