Did Baidu catch the last bus of short dramas?

![]() 08/06 2024

08/06 2024

![]() 445

445

Written by Wu Xianzhi

Edited by Wang Pan

In 2020, both ByteDance and Baidu saw the potential of short dramas.

Due to internal disapproval and lack of resource investment, Baidu's short drama business was intermittent, such as Baijiahao's "Breakthrough Plan" to incubate micro-short dramas.

Around the same time, Douyin (TikTok's Chinese version) also noticed the content appeal and commercial potential of Kuaishou short dramas.

An insider told Photon Planet that in the second half of 2020, Douyin set up a short drama team. On one hand, they recruited Kuaishou short drama staff to establish standardized operation procedures (SOP); on the other hand, they closely monitored every Kuaishou short drama, taking screenshots whenever a producer appeared and using Qichacha to query business information before reaching out.

The insider said, "The short drama circle is small, so we had interns call each one individually. If we could secure one MCN agency, we could secure the whole circle."

Douyin's "sincere" efforts left no room for MCN agencies to refuse. For MCNs just starting out with micro-short dramas, Douyin offered not only abundant traffic but also proactive promotion, trending, and publicity for their dramas. "Douyin is like a much-needed rain," said one MCN agency.

An insider told Photon Planet that as of now, Douyin short dramas have 50-60 million monthly active users, while Kuaishou has one-fifth of that. Baidu currently has no data to disclose.

Douyin has explored content directions suited to its tone, taking a different commercial path from Kuaishou, objectively accelerating the productization of short dramas.

Kuaishou and Douyin's explorations greatly expanded the imagination of short dramas. Today, including Alibaba, Tencent, Meituan, and Baidu, all have entered the field in different ways. Short dramas are essentially a new form of content that can not only increase platform user engagement time, establish immersive consumption scenarios but also to a certain extent, realize the content transformation of tool-type applications.

Different giants have different core businesses, with significant differences in decision-making and execution, leading to a flourishing short drama market.

Free or Paid?

At an annual meeting at the end of last year, Robin Li suddenly said, "I think Baidu and short dramas are a good match. Why don't we have any?" So, an emergency project was launched internally to re-enter the short drama market.

The broader context of Baidu's entry into short dramas was Song Jian's resignation and Li Xiaowan's appointment. The personnel changes reflected a shift in Baidu's content ecosystem from heavy supply to heavy demand, with short dramas being one manifestation of this transformation.

An industry insider believes that Baidu's mobile ecosystem can "tap into" this round of short drama traffic. Therefore, Robin Li's belief that Baidu should have its own short dramas is undeniably sound.

The insider pointed out, "Douyin short dramas are becoming more refined and customized, also needing to cater to contemporary themes, leaving room for other giants to enter." Another insider mentioned that Baidu's main site, with its relatively sink (less sophisticated) traffic and user demographics (40+), is one of the target audiences for sink short dramas, and Baidu's existing operational strategy aligns with this.

"Agriculture, Countryside, and Farmers," "Fortune-telling," and "Square Dancing" have always been the top three traffic generators for Baidu's main site, especially "Fortune-telling" content, which has the highest ROI among other verticals. The commercial value of middle-aged and elderly users is objectively there, and Baidu's initial idea of introducing short dramas may have been to fill content gaps.

Although Robin Li did not directly mention short dramas in his first-quarter OKRs, in the first-quarter OKRs of Helen He, Baidu's Senior Vice President and Head of MEG, short dramas appeared as the third KR under O1, indicating significant importance: [Baidu APP]: Seize the opportunity of the Spring Festival, establish a smooth distribution and user growth path for short dramas, establish Baidu's brand image in short dramas, complete the logical reconstruction of user growth, reach xxx million DAU, and outpace the market in time growth (aggressive).

With top-level attention, alignment flowed from top to bottom. Baidu operates short dramas by verticals and promotes them as special projects. It is understood that the project enjoys a very high level of support, with R&D, product, and operations staff drawn from various departments, and their first key objective (O1) will include key results (KR) related to short dramas.

The "vertical + special project" approach theoretically allows Baidu MEG's elite forces to productize the business in a short time, but the actual situation has gone in the opposite direction.

For example, obtaining the UID (User Identity) of the decision-maker and producing content tailored to their preferences. Before April, the Baidu App did not even provide an entry point for short dramas, and encountering Baidu short dramas on Haokan Video was more of a "chance encounter."

As of now, Baidu has not yet fully established an internal distribution path for short dramas. The Baidu App provides a search-direct entry and a secondary entry (Video - Short Dramas in the bottom bar), but users rarely encounter Baidu short dramas while scrolling through short videos.

This product logic is not user-friendly for Baidu short dramas, which need to establish user awareness, as users rarely encounter short dramas while scrolling through videos. Additionally, Baidu Lite currently does not have a secondary entry for short dramas, indicating that Baidu has yet to find a clear positioning for short dramas within its content ecosystem.

Left: Search entry, Right: Haokan Video entry

Left: Search entry, Right: Haokan Video entry

Photon Planet understands that Baidu short dramas are benchmarked against Douyin and Kuaishou, with their specific operational strategies experiencing multiple shifts, with direction adjustments roughly every quarter. Commercially, the model shifted from paid to free and then back to paid in the second quarter. Content-wise, during Song Jian's tenure, there was an attempt to mimic Bilibili, but later, the strategy was overhauled to focus on C-end operation logic.

The reason lies in Baidu users' low willingness to pay, and with all businesses under pressure to meet profitability targets and without budget support, the paid model seemed to alleviate some pressure. However, in reality, the free model seems most suitable for Baidu's content ecosystem.

"Free and paid are two completely different business models," said an industry insider. The free model is essentially a scenario-based medium pursuing monetization, while the paid model has higher production costs and requires a paid user base.

Frequent directional changes are detrimental for giants, not only distorting organizational inertia but also making it difficult for MCNs to adapt.

Whether self-produced or distributed, MCN agencies are currently the most critical link in short dramas, and platforms need to establish positive interactions with them. Baidu short dramas frequently changed their business model within a short period, earning criticism from some MCN agencies.

"Strong distribution" requires high data

As mentioned earlier, business and organizational differences shape the current short drama landscape.

For content platforms like Douyin and Kuaishou, short dramas are both content supply and another form of content marketing medium, roughly understood as "content advertising pro" and "mini-series." The former's business model simplifies to content as a means and monetization as the goal. The latter's model uses paid content as a means, with content as the goal.

In other giant ecosystems, short drama production methods and roles differ. Taking Ali Group's Digital Media and Entertainment Group as an example, its short drama operations and positioning differ significantly from Douyin and Kuaishou.

Ali Group's Digital Media and Entertainment Group has its own film and television resources, either customizing short dramas through Youku or procuring them internally. Internal procurement is more akin to web series production, with many production teams from Mango TV and CCTV working under the banner of studios, whose KPIs involve creating scripts. Once a script is ready, actors and investors are recruited.

After these steps, further integrations follow.

"Any new business at Ali Group, once its business loop is closed, will start integrating with other group businesses," said an insider, making the short drama team first focus on bilateral integrations before applying for tripartite resources. "Internal ratings and funding allocations are based on SAB, more like internal entrepreneurship."

This process makes Ali Group's short dramas highly interactive with other businesses, with a business model closer to customized dramas.

Starting on May 10, Ali Group's short dramas collaborated with Ele.me on the "Heartfelt Gift" series, testing instant retail + short dramas to strengthen users' perception of Ele.me's instant retail capabilities. For example, the "True and False Heiress" trilogy was launched from May 10-12, coinciding with Mother's Day, and the "President's Wife Turns into a Cute Baby" trilogy from May 25-30, coinciding with Children's Day.

Judging solely from the short drama and instant retail collaborations, there were both Ele.me brand placements (e.g., in "True and False Heiress") and content-driven product consumption considerations (e.g., Wall's ice cream in "President's Wife Turns into a Cute Baby").

Meituan's short drama format is similar to Ele.me's, except that Meituan's short dramas are not self-produced but sourced externally – a logic similar to its earlier short video strategy, filling content gaps and retaining user engagement time.

With Douyin, Kuaishou, Ali Group, and Meituan leading the way, Baidu's positioning for short dramas remains unclear.

Photon Planet understands that Baidu attempted self-production last year, but former Baidu Content Ecosystem General Manager Song Jian conducted "field research" and rejected this path upon return. After Song Jian's resignation and Li Xiaowan's appointment, Baidu shifted from strong supply to strong operation, with the short drama strategy changing to either outsourcing to suppliers or introducing MCNs and letting them operate on behalf, with Baidu focusing solely on C-end "distribution."

This consideration clearly has practical reasons. Amid cost reduction and efficiency enhancement efforts, all departments must tighten their belts, and investments in short dramas are relatively limited, unable to cover self-production costs and timelines. Additionally, under Li Xiaowan's tenure, sweeping changes were made, shifting the entire operational logic from the B-end to the C-end, reigniting growth in Baidu's content ecosystem.

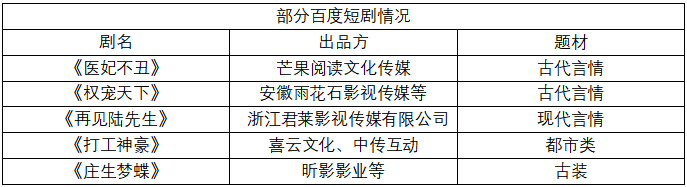

Another example of the "strong distribution" logic: Almost all short dramas currently online on Baidu are previously released "inventory" products from Douyin and Kuaishou. In other words, Baidu essentially acts as a "distribution channel," repackaging Douyin and Kuaishou short dramas.

As of now, we have not seen Baidu launch any new self-produced or exclusive short dramas. An MCN agency said that Baidu's heavy reliance on "Douyin and Kuaishou inventory" for its short dramas is largely due to funding constraints. "Everyone is waiting to see how committed and patient Baidu, or its top leaders, are in pursuing short dramas."

Content or ROI?

Whether free or paid, revenue-sharing or not, platforms will never lose.

Multiple MCN agencies involved in short videos said that short dramas heavily rely on paid traffic, leading to low revenues for producers. One MCN agency had several hit short dramas earlier this year. While not disclosing specific figures, they mentioned that out of a 10 million revenue stream, the platform takes a portion, most of the rest goes to paid traffic, leaving less than 10% for themselves.

"After calculations, the actual conversion rate is only around 1.1%. Paid traffic is almost a must. The logic of natural traffic is fundamentally contrary to the fast-paced nature of short dramas. No one wants to invest time in a production that doesn't guarantee returns," they said.

For MCN agencies, rising production costs further squeeze their profits.

A short drama producer said that three changes have occurred this year: cute babies and female-oriented themes have become popular genres. The second change is a shift from quantity to quality, with larger production teams and more sophisticated on-set roles akin to web series. Actor costs have also risen; in Zhengzhou, for example, lead actors' daily wages have increased from around 2,000 yuan last year to 3,000 yuan now.

Despite producers' grievances towards platforms, they all acknowledge that platforms reap the lion's share while they get a small portion. However, with many non-content giants starting to source external short dramas this year, the short drama market has witnessed another boom.

The only surprise is MCN agencies' attitude towards Baidu, which has left them somewhat confused after the back-and-forth between paid and free models. If the strong distribution logic proves successful, it could be a viable path, as Douyin and Kuaishou's paid dramas often leave little for MCNs, producers, and traffic buyers, while the distribution model offers more revenue for players in the industry chain.

However, this requires Baidu short dramas to continuously grow their data after establishing user awareness, so that the distribution can truly demonstrate the value of the short drama industry.