Porsche's Electric Vehicle Plan Falters: Where is the Breakthrough?

![]() 08/06 2024

08/06 2024

![]() 649

649

Lead

As a globally renowned ultra-luxury brand, Porsche has experienced numerous setbacks this year. Both its failure to meet global electric vehicle (EV) sales targets and the challenges faced by Porsche China indicate that the brand, which once achieved remarkable performance in China, needs to make more profound strategic adjustments to better adapt to global competition.

Produced by: Heyan Yueche Studio

Written by: Zhang Dachuan

Edited by: Heyanzi

Full text: 2486 words

Reading time: 4 minutes

Recently, Porsche issued a statement that while EV sales could potentially account for over 80% of its new vehicle sales by 2030, this is no longer a specific company target.

According to Porsche's assessment, its transition to EVs is taking longer than initially anticipated five years ago. Specific EV sales will depend on market demand and the global development of EVs. As Porsche's flagship EV product, Taycan sold fewer than 10,000 units in the first half of this year, a 51% year-on-year decline. Under the dual pressures of customer demand and market competition, Porsche has abandoned its previous EV sales targets, and will now focus on market demand for product launches as its new strategy.

△Porsche Taycan sales plummeted significantly in the first half of this year

Global EV Target May Be Unachievable

Globally, both the United States and Europe have seen signs of slowing EV growth in the first half of this year. Even in China, the growth of plug-in hybrid vehicles has significantly outpaced that of pure EVs. Under these circumstances, it is understandable that Porsche has abandoned its previous EV sales targets.

However, as a multinational automaker with a relatively complete vehicle development process, Porsche has already begun implementing its previously formulated EV development and launch plans and must proceed step by step. According to the plan, Porsche will introduce four new models this year: the new Taycan, Panamera, hybrid 911, and fully electric Macan. Notably, the Macan EV, rolled out at Porsche's Leipzig factory in May, is a strategic model for the company's EV lineup. According to Porsche, orders for the Macan EV are substantial and are expected to boost the company's EV sales. By the end of 2024, Porsche will also introduce the fully electric 718 and the fully electric Cayenne in 2026. Additionally, Porsche will launch its flagship, fully electric seven-seater SUV, which rivals Ferrari's Purosangue.

△The Macan EV will carry the flag of Porsche's electrification efforts

Porsche's statement can be interpreted from two perspectives: Firstly, EVs already in the company's cycle plan will continue to be launched, so investors need not worry. Unless there are clear market signals indicating that EV launches are inappropriate, Porsche will not shelve EVs that have already completed development. Secondly, the weak global demand for pure EVs suggests that the company's future focus will shift to gasoline-powered/hybrid models. Essentially, the core of gasoline-powered and hybrid vehicles lies in having an efficient internal combustion engine system, with hybrid systems requiring an additional efficient power distribution unit. Therefore, Porsche will also begin refurbishing and upgrading its internal combustion engines.

△Porsche will launch its flagship, fully electric seven-seater SUV, which rivals Ferrari's Purosangue

Porsche Struggles in China

Sales figures show that Porsche has performed poorly in the Chinese market over the past two years.

In 2023, Porsche sold 320,200 vehicles globally, an increase of 3% year-on-year. However, sales in the Chinese market were only 79,300 vehicles, a year-on-year decline of 15%. China became the only market where Porsche experienced a decline globally in 2023, and this trend has continued for two consecutive years. In 2024, the decline has intensified. In the first half of this year, Porsche sold 155,900 vehicles globally, a year-on-year decrease of 7%. China delivered only 29,600 vehicles, a further year-on-year decline of 33%. Clearly, Porsche's sales performance in China is significantly weaker than in other major markets. To meet sales targets, Porsche began pressuring domestic dealers and bundling unpopular models, ultimately leading to some Porsche dealers threatening to reject vehicle deliveries. To appease dealer dissatisfaction, Porsche adjusted its business policies and directly replaced its Chinese management: Starting September 1, Alexander Pollich will succeed Michael Kirsch as President and CEO of Porsche China.

△Porsche China changes its leader

However, changing leaders cannot solve all problems, and future challenges may become increasingly difficult.

As an ultra-luxury brand, Porsche does not have a production base in China, and most of its models are produced in Europe and exported to the Chinese market. Previously, the European Union imposed punitive tariffs on EV exports to China. If this policy becomes a five-year final policy, China is likely to retaliate against EU-imported models. Given that Porsche relies entirely on imports, it may find it difficult to remain unscathed.

In terms of product capabilities, Porsche's EVs do not have significant advantages over domestic models. Take the Taycan, for example, its power performance, fast charging, aerodynamics, and intelligent driving features are now commonplace among domestic new energy vehicle (NEV) companies. Xiaomi's SU7, for instance, is designed to compete with the Taycan, and the Ultra version recently tested by Lei Jun aims to become the fastest four-door EV on the Nürburgring racetrack.

△Xiaomi SU7 Ultra aims to become the fastest four-door EV on the Nürburgring racetrack

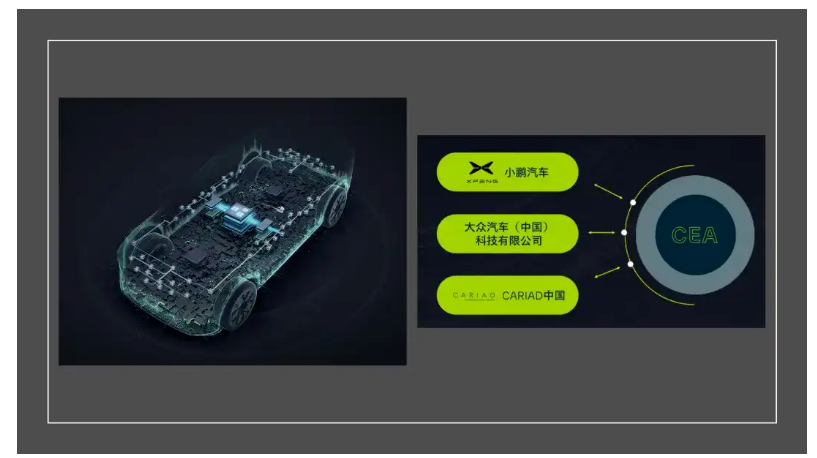

Conversely, Porsche will increasingly rely on Volkswagen Group's input. However, before Volkswagen's SSP architecture is fully deployed, neither MEB nor PPE can compete head-to-head with domestic EVs. This is the primary reason why Volkswagen invested in XPeng and developed the CEA (China Electrical Architecture) to compete with domestic NEV companies. In this context, Porsche's continued development in China will rely more on gasoline-powered and hybrid models to leverage its strengths and avoid weaknesses.

△Volkswagen partners with XPeng to develop the CEA architecture to compete with domestic NEV companies

Porsche China May Adjust Its Strategy

In fact, compared to other ultra-luxury brands, Porsche still has several cards to play:

Although Porsche has a high brand positioning, its sales are limited. Therefore, setting up a factory in China may lead to low factory utilization rates. However, compared to other brands, Porsche can leverage Volkswagen's factories in China for localization. Not only are Porsche and Volkswagen models built on the same platform, but even models produced in Europe are likely to use many domestic automotive components, so there is little resistance to producing Porsche models in Volkswagen's Chinese factories. Volkswagen currently has two joint venture factories in China (FAW-Volkswagen and SAIC Volkswagen) and its own factory in Anhui. Localization would significantly reduce tariffs for Porsche, shorten delivery times, and potentially slash costs for Porsche models sold in China, enhancing its overall competitiveness.

△Porsche can directly use Volkswagen's factories in China for production

Porsche needs to adjust its strategy in China. As the domestic automotive market, especially the luxury segment, has bid farewell to high growth rates, Porsche's assessment goals for the Chinese market cannot be limited to maintaining high growth rates. Instead, it should focus on enhancing profitability while maintaining appropriate sales growth, thereby fostering the growth of the entire automotive supply chain, including OEMs.

△Porsche's development in China must fully consider dealer interests

Commentary

As a brand that once dominated the domestic automotive market with its pioneering SUV models like the Cayenne, Porsche now stands at a strategic crossroads amid the EV transition and domestic market adjustments. Making a well-balanced decision is no easy feat.

(This article is original content from Heyan Yueche and may not be reproduced without authorization)