"Xiaoli" rift highlights intense auto market competition

![]() 08/06 2024

08/06 2024

![]() 589

589

Author | Zhang Wen, Editor | Jiang Jiao, Cover | "Fast & Furious 7"

The automakers' sales rankings for July were released yesterday.

After adjusting its pace, Lixiang Auto's sales continued to climb, reaching a record high of 51,000 units delivered in July. AITO's sales declined month-on-month to 41,535 units, still lagging behind Lixiang. Even based on Huawei HarmonyOS Intelligent Connectivity's full-system data, its 44,090 units also fell short of Lixiang's figure. The main reason may be that AITO M5 is not competitive enough, with sales roughly one-third of Lixiang L6's. However, excluding models priced below 300,000 yuan, HarmonyOS Intelligent Connectivity claims to have "continued to lead the monthly sales of new energy vehicles priced above 300,000 yuan."

Most of the remaining new-energy vehicle brands performed similarly to last month, with NIO and ZERO EV delivering over 20,000 units and XPeng and NEZHA around 10,000 units respectively.

Without launching any new models, NIO has maintained sales above 20,000 units for three consecutive months, demonstrating that its battery swap model is starting to gain wider acceptance. Since November last year, at least seven automakers have partnered with NIO on battery swap services. Li Bin also seems more active on social media; since registering on Douyin in March, he has amassed 910,000 followers and posted 42 short videos. However, the most popular among them is his collaboration with Lei Jun.

XPeng and NEZHA are stuck at around 10,000 monthly sales and have struggled to make further progress. He Xiaopeng pins his hopes on the upcoming budget model XPeng MONA 03. The test drive vehicles have gradually arrived at dealerships, and XPeng sales representatives have begun inviting interested customers to visit the showrooms for test drives.

With Zhou Hongyi's influence, NEZHA has recently appeared more frequently in media headlines. Zhang Yong has also been working hard – he may be the most avid learner of Lei Jun among all automaker CEOs. His latest endeavor was participating in Shandong TV's "Happy Forward" challenge, which NEZHA sponsors. Unsurprisingly, he fell into the water at the third level.

Xiaomi Auto's tone remains consistent with last month, only announcing that deliveries have exceeded 10,000 units. Given Xiaomi's abundant orders, production capacity remains the primary factor limiting its sales. After briefly surpassing 20,000 sales in the previous month, ZEEKR slipped to 15,655 units this month. Perhaps due to sluggish sales, ZEEKR focused its promotion yesterday on cumulative deliveries exceeding 300,000 units, claiming to have "set a new record for the fastest delivery among new-energy startups."

However, people seem more concerned with the CEOs' spat over weekly sales rankings than the numbers on the list. This time, it's not the traditional automakers but the once-close "Xiaoli" trio at the forefront.

NIO was the first to voice its discontent. In an interview with the media on July 27, Li Bin and Qin Lihong expressed their dissatisfaction with the weekly rankings. Qin Lihong argued that the rankings' data were inaccurate and not approved by NIO, adding that NIO had not authorized any third party to use its brand for promotion. "Why should they use our brand? Can they exclude us?" he questioned.

Li Bin added that the monthly sales release is already harsh enough in the automotive industry. If they were to rank first in sales, they would never release weekly rankings.

– It was almost like pointing directly at Lixiang Auto. He Xiaopeng also mocked during his company's intelligent driving technology conference that Chinese tech companies were still obsessed with weekly sales rankings and finding ways to make money, which he believed was not the proper form of technological competition. Last July, XPeng pointed out the significant discrepancy between its official sales figures and Lixiang's weekly rankings, urging people to "pay attention to official information instead of unreliable sources."

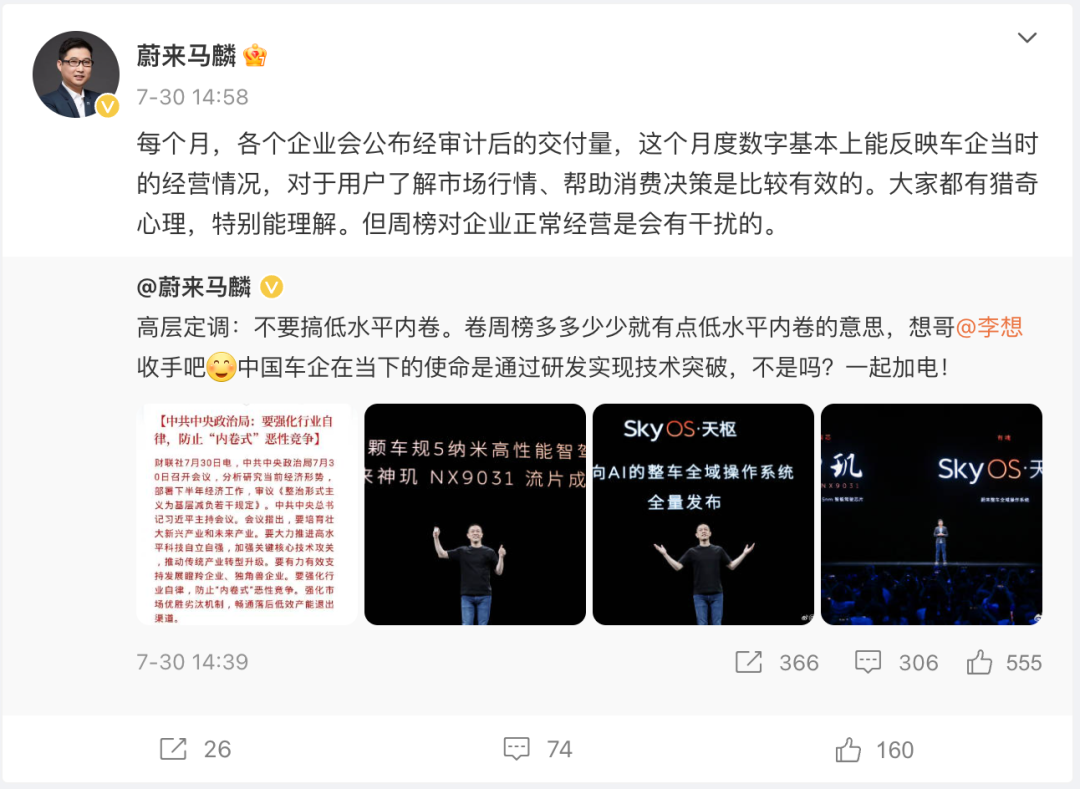

While the CEOs expressed their dissatisfaction anonymously, their vice presidents were more direct. Ma Lin, NIO's Assistant Vice President of Brand and Communication, shared a central government document on social media, stating, "The top leadership has set the tone: no low-level competition. Weekly rankings are somewhat indicative of low-level competition." He even tagged Li Xiang, urging him to stop.

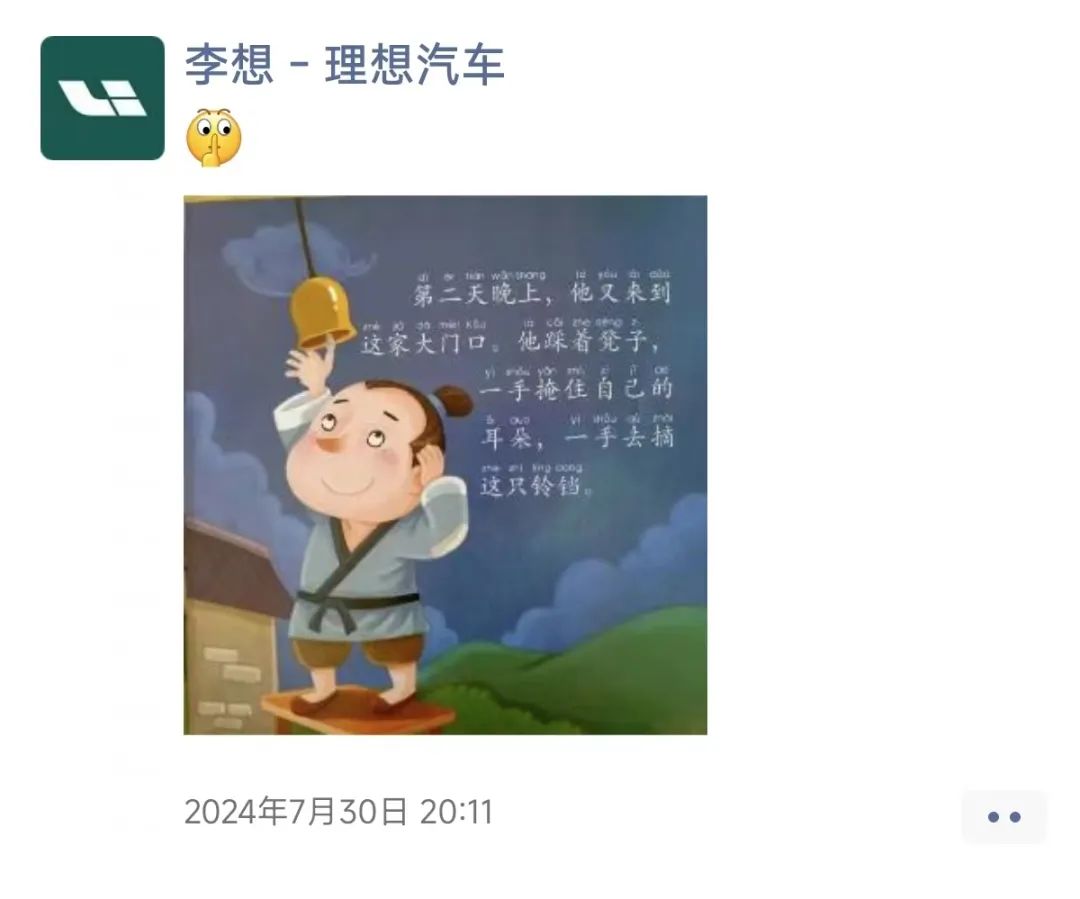

Li Xiang, who rarely speaks publicly, did not respond on Weibo but instead shared a meme of "plugging one's ears while stealing a bell" on WeChat Moments, accompanied by a shushing emoji. Lixiang Auto updated its weekly sales rankings as usual.

The debate over weekly rankings also drew the attention of Geely's Senior Vice President Yang Xueliang, who shared Ma Lin's post, stating, "I also oppose weekly rankings," and agreeing with He Xiaopeng's viewpoint. However, it was soon discovered that Geely's ZEEKR brand was a supporter of weekly rankings, with Yang Xueliang sharing them multiple times on Weibo, inviting ridicule from some quarters.

The late-July backlash against weekly rankings can be seen as a continuation of last month's opposition to internal competition among automaker CEOs. Competition in China's automotive industry far surpasses that in other regions globally. Amid the technological transformation from gasoline to electric vehicles, price wars have erupted, and rumors of various "black PR" tactics in the industry have never stopped.

Generally, mid-year is not the most intense period of competition for automakers, as summer is not a peak sales season for the automotive market. However, the traditional distinction between peak and off-peak seasons in the automotive market has long disappeared, reflecting the fierce competition in the industry. The China Passenger Car Association (CPCA) noted that the characteristics of a less pronounced off-season in the summer automotive market have become increasingly apparent in recent years. While July's auto retail sales accounted for an average of 6.9% of annual totals from 2014 to 2019, this figure has risen to 8.4% over the past three years, reaching a high of 8.8% last year.

Amid fierce competition, leading automakers are more willing to highlight their sales advantages. Lixiang Auto began releasing weekly rankings in 2023, coinciding with the surge in sales of its L series. Over the past year, it has paused the rankings only twice, most recently due to the lackluster reception of its MEGA model, but has since resumed updates.

In each weekly sales ranking of new-energy vehicle brands, Lixiang Auto or Huawei AITO usually top the list. Both companies have gained a significant lead over other pure electric vehicle makers with their extended-range SUVs. NIO's Ma Lin questioned why vehicles of different price points and categories should be included in the same ranking, arguing that it does not reflect the actual market situation. "When making rankings, they must be reasonable and comparable," he said.

This argument may not hold up to scrutiny, as most automakers' sales achievements are accompanied by numerous qualifiers, making each one appear to be market leaders in their respective niches. However, consumers do not care whether you are number one above 200,000 or 300,000 yuan, number one in pure electric vehicles, or number one in extended-range vehicles. Tesla's Model Y, also a pure electric vehicle, is still China's top-selling model each month, regardless of body type or energy source.

Automaker CEOs who preach against internal competition have never hesitated when it comes to pricing their new products. ZEEKR's new 001 model saw price reductions ranging from 31,000 to 57,000 yuan across its lineup. In the first half of the year, XPeng also reduced prices for several of its models, including the G9 and P7, leading media outlets to describe XPeng as a "price slayer."

Perhaps the new-energy vehicle startups should learn from Lei Jun, who transitioned from smartphones to automobiles. Having gone through China's brutal smartphone elimination game, this protagonist-like CEO once said, "Xiaomi has been in a tight competition since its inception. In terms of competition, who can outdo us?"

Before the launch of the Xiaomi SU7, Xiaomi Auto's advertising slogan was, "Together, we are Chinese automobiles."