Overestimating human nature or sacrificing merchants: Why is 'Refund Only' not sustainable?

![]() 08/06 2024

08/06 2024

![]() 540

540

Popular among consumers, 'Refund Only' is being adjusted by e-commerce platforms due to opposition from some small and medium-sized merchants.

Why do consumers prefer 'Refund Only'? It goes without saying that it's frustrating to have to deal with merchants after discovering quality issues with online purchases. Historically, complaints about difficulties in returning goods during the annual 3.15 Consumer Rights Day have remained high.

As a policy that attracts users and improves after-sales efficiency, 'Refund Only' was first adopted by Amazon. If consumers encounter 'seriously inferior' or 'mismatched' products, or situations like delayed or forced shipping without buyer permission, the platform, after comprehensive assessment, will support rapid return and refund or 'Refund Only'.

In 2021, Pinduoduo pioneered 'Refund Only', making it a powerful tool in the battle for e-commerce users. As the e-commerce industry's dividends gradually diminish and platforms compete fiercely, 'Refund Only' has become a standard feature.

Image source: Pinduoduo ad screenshot

However, in recent years, controversy surrounding 'Refund Only' has grown. Initially, when this service was becoming standard, many wondered: Can merchants handle it?

Indeed, some merchants cannot. Wool-gathering gangs have emerged.

According to various media reports, small merchants have encountered increasing cases of 'Refund Only'. A metropolitan newspaper conducted a small-scale survey of nearly 100 merchants, with over 35% reporting that wool-gathering gangs caused them distress, and over 42% stating that it 'has severely affected daily operations'.

Some merchants have even traveled long distances to confront 'Refund Only' buyers. Even if they recover the payment, it does not cover costs, but they seek justice. Facing strict e-commerce giants, small merchants become vulnerable, a primary reason for their opposition to 'Refund Only'.

01

The Past and Present of 'Refund Only'

'Refund Only', a standard feature on major e-commerce platforms, undoubtedly boosts consumer confidence and platform reputation.

As early as 2017, Amazon supported 'Refund Only'. If a consumer returns an item due to dislike, misdescription, or damage, Amazon customer service will negotiate an automatic refund without merchant consent. If the consumer claims not to have received the item, Amazon will refund unless the merchant proves delivery; for items under $25 without a U.S. return address, Amazon offers 'Refund Only'.

In the U.S., not only Amazon but also Temu offers full refunds for most items within 90 days if unsatisfied, and items under $10 easily trigger 'Refund Only'.

Such lenient after-sales policies can expand consumer bases, attracting price-sensitive or less tech-savvy seniors. They also boost purchasing confidence, as refunds are immediate without complex steps like scheduling pickups or filling out forms.

Image source: Temu ad screenshot

Lenient policies also attract wool-gathering gangs, weighing benefits against drawbacks. According to the National Retail Federation's 2017 survey, 11% of returns were refunds, with 11% considered fraudulent, implying a 1% fraud rate.

Amazon didn't blindly compromise. Due to merchant dissatisfaction, Amazon adjusted its policy in 2023: if a buyer returns more than 5 items monthly, Amazon checks for abuse. Marked abusers are blacklisted, charged return fees, or denied returns.

In China, 'Refund Only' is also a competitive tool.

Pinduoduo, leading in low-price wars, introduced 'Refund Only' in late 2021, showcasing its foresight. A year later, platforms stopped announcing Singles' Day GMV, entering a stagnant competitive phase.

As Pinduoduo's financial reports shone, Taobao, JD.com, and Douyin followed suit with 'Refund Only'.

02

Who Gets Hurt by One-Sided Policies?

Consumers get better after-sales service, and platforms gain new users. It seems only merchants suffer, but this isn't entirely true.

When platforms excessively cater to buyers, enabling easy 'Refund Only' without reasonable merchant compensation, grey and black industries thrive.

Online guides teach wool-gathering gangs how to successfully exploit policies, with some reports claiming 'Refund Only' orders can reach 20% of total orders in extreme cases, burdening price-war-weary merchants, especially SMEs.

Merchants feel unjust, traveling far to recover $9.90 for socks or visiting e-commerce headquarters for justice. Merchants lose both money and goods, platforms gain without subsidies, and merchants face high individual rights protection costs.

Merchants also face fines. For example, some platforms fine merchants multiples of sales for 'Refund Only' due to quality complaints.

China Securities Journal reported that merchants fined or deducted from 'after-sales reserves' by TEMU visited its headquarters, demanding justification, such as evidence of product issues or consumer complaints.

New questions arise: what constitutes a quality issue? As the platform, it must set standards.

Image source: News screenshot

One-sided 'Refund Only' policies create a 'three-way loss':

Most merchants factor 'Refund Only' costs into overall expenses, leading to lower production costs or price hikes, burdening compliant consumers with hidden 'wool' losses.

Some merchants form support groups, assisting in recovering 'Refund Only' items or intimidating consumers with package warnings, potentially harming consumer sentiment and damaging merchant and platform reputations.

This balance depends on merchants' tolerance for wool-gathering gangs and fines. When platforms, consumers, and merchants experience negative impacts, will 'Refund Only' remain attractive?

No wonder Taobao and Pinduoduo are adjusting 'Refund Only' policies, raising application thresholds to protect merchant rights, preventing 'bad money driving out good.'

03

Time to Adjust Platform Policies

Due to changing circumstances, platforms are revising 'Refund Only' policies.

From August 9, Taobao's new rules allow high-quality merchants to negotiate with consumers first, with varying autonomy based on store ratings, encouraging quality improvements.

Taobao also optimized appeals, manually reviewing high-value cases, compensating merchants for undamaged items, and identifying abnormal users to deny 'Refund Only' requests.

LatePost revealed that Pinduoduo will follow Taobao, Tmall, and Douyin, prioritizing GMV and de-emphasizing factors like 'Refund Only' that hinder merchant development.

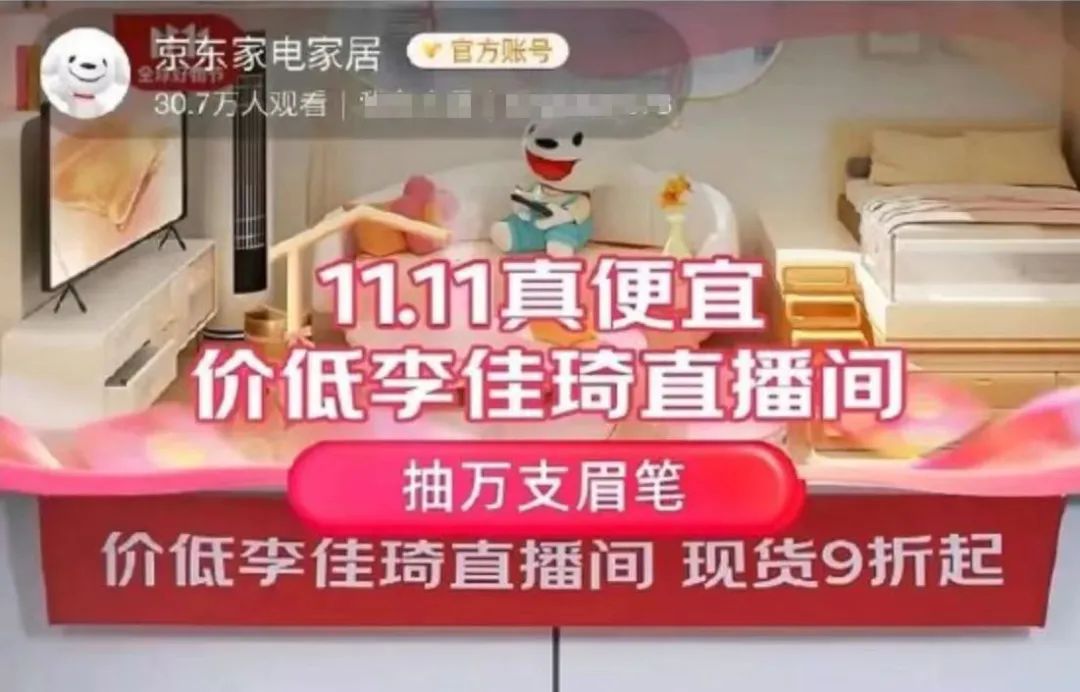

Image source: Livestream screenshot

Platforms are abandoning ultra-low prices and 'Refund Only' policies for simple reasons: they fuel unhealthy competition.

In June 2023's 618 sales, despite a month-long period, cumulative sales reached only 742.8 billion yuan, down nearly 7% YoY.

Not just e-commerce, but also industries like autos and photovoltaics face similar issues. Recent directives emphasize industry self-discipline to prevent unhealthy competition.

From September 1, the 'Provisional Regulations on Anti-Unfair Competition in Networks' will implement Article 24, prohibiting platforms from using service agreements or trading rules to unreasonably restrict or impose conditions on transactions or prices within the platform.

Reducing unreasonable internal friction and refocusing on healthy e-commerce development is becoming a consensus.

However, situations like 'Refund Only' are unlikely to disappear, as e-commerce competition remains fierce and brutal.