A former state-owned enterprise technician starts a business and is fined for falsifying information disclosure before IPO

![]() 08/07 2024

08/07 2024

![]() 534

534

The full text contains 4460 words and will take approximately 16 minutes to read

Written by Rui Finance and Economics / Cheng Mengyao

Photography makes you poor for three generations, and a DSLR ruins your life. Although it's a bit of an exaggeration, those who play with cameras know that it's the lenses that really burn money.

Original brand lenses from manufacturers like Canon and Nikon are expensive, while third-party lenses from brands like Sigma and Tamron offer similar optical performance at almost half the price, making them the best "budget alternative".

In June of this year, lens manufacturer Guangdong Sirui Optics Co., Ltd. (hereinafter referred to as Sirui Optics) submitted its IPO prospectus to the Beijing Stock Exchange. Professional photographers and videographers, as well as photography enthusiasts with a certain level of financial strength, are supporting an IPO with their strong financial backing.

Recently, the Beijing Stock Exchange sent inquiry letters to Sirui Optics and its sponsor, Suzhou Securities, inquiring about the sustainability of Sirui Optics's performance growth; the market size and growth potential of its main products; compliance in production and operation; the authenticity of the growth in export sales revenue; and the authenticity of revenue under various sales models.

For this IPO, Sirui Optics plans to raise 272 million yuan. Prior to the submission, the company conducted two cash dividends, distributing 16.0667 million yuan in May 2023 and 5.45656 million yuan in April 2024.

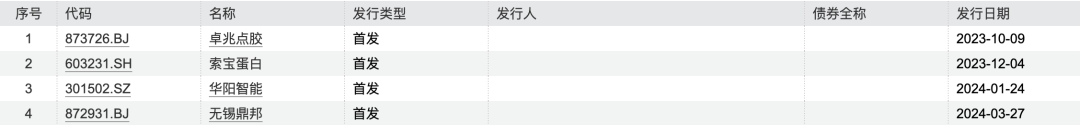

According to Wind data, since the "827 New Policy" in 2023, as of July 29 this year, out of the 23 IPO enterprises sponsored by Suzhou Securities, a total of 4 have successfully listed, raising a cumulative total of 1.404 billion yuan.

By sector and industry, there are 2 listings on the Beijing Stock Exchange: Zhuozhao Dispensing (873726.BJ) and Wuxi Dingbang (872931.BJ); and 1 each on the Shanghai and Shenzhen stock exchanges: Sobao Protein (603231.SH) and Huayang Intelligent (301502.SZ). They belong to the industries of industrial machinery, energy equipment, food, and electrical engineering. During the same period, 11 IPO enterprises voluntarily withdrew their applications, with a withdrawal rate close to 50%.

01

The actual controller is a former technician

Invests in 129 enterprises

Sirui Optics is an absolutely controlled by Li Jie, a high-tech enterprise specializing in the research, development, production, and sales of precision photographic equipment and optical components. Its predecessor, Gaohong Precision, was established in 2006.

At the time of its establishment, Gaohong Precision was owned by Li Jie, Li Qi, and Li Ji, holding 80%, 10%, and 10% respectively. Among them, Li Jie and Li Qi are brothers. As the shareholding structure evolved, the shareholdings of the three also changed continuously.

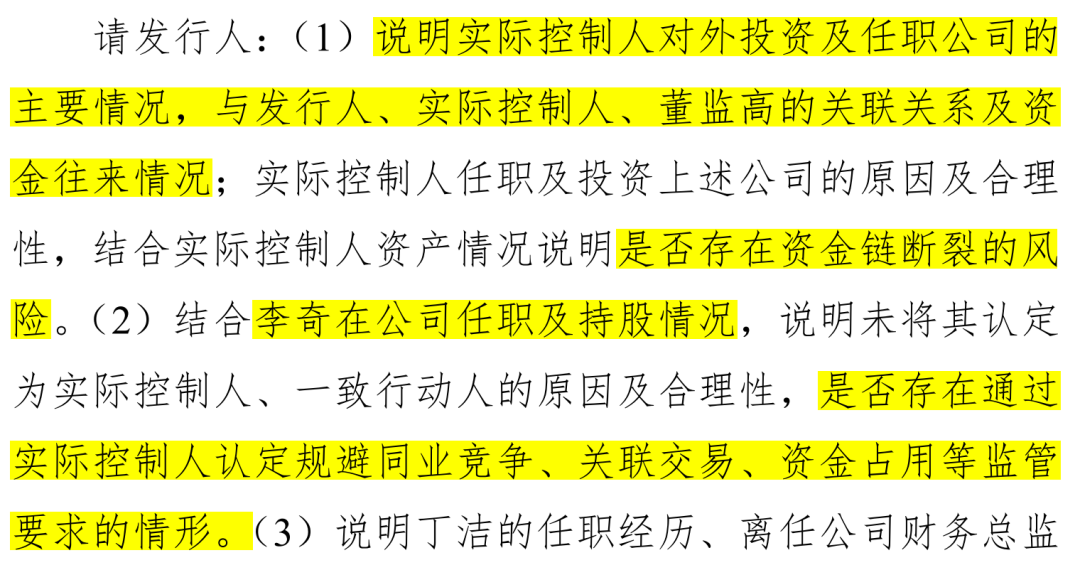

At the time of the IPO submission, Li Jie directly held 75.64% of the shares and controlled an additional 4.58% through the employee shareholding platform Caisheng Investment, totaling 80.22% of the shares, making him the controlling shareholder. Simultaneously, Li Jie serves as Chairman and General Manager, making him the actual controller. Li Qi directly holds 4.12% of the shares and resigned as a director in November 2023, currently serving as the domestic customer service manager. Li Ji's name does not appear in the prospectus, but Tianyancha shows that he exited in August 2016, holding 5% of the shares at the time of exit.

Before founding Gaohong Precision, Li Jie founded Zhongshan South District Gaohong Metal Products Factory (hereinafter referred to as Gaohong Metal) in March 2001 and served as its general manager from March 2001 to December 2008 before exiting. In other words, Gaohong Precision was actually founded by Li Jie while he was serving as the general manager of Gaohong Metal, meaning Sirui Optics's history can be traced back to 2001. Currently, Gaohong Metal is wholly owned by a natural person named Liu Zhijun.

Before starting his business, Li Jie held a secure position as a technician at the state-owned Hongyuan Machinery Factory. It is worth mentioning that Liang Wengen, the founder of Sany Heavy Industry, was also assigned to work as a technician at Hongyuan Machinery Factory after graduating from university. With only a secondary technical school education, Li Jie started his career at a relatively high level.

In the wave of entrepreneurship in 1997, 26-year-old Li Jie gave up his secure job and headed south. After working as a technician at Guangdong Xiangshan Weighing Apparatus Group Co., Ltd. for two years, he jumped to Zhongshan Fujia Products Co., Ltd. as the technical director. After 22 months, Li Jie left to found Gaohong Metal.

Judging from his resume, Li Jie's entrepreneurial history is relatively straightforward: he gave up his secure job, ventured south, and achieved success in technology-based entrepreneurship. However, the stock exchange has focused its attention on Li Jie's background.

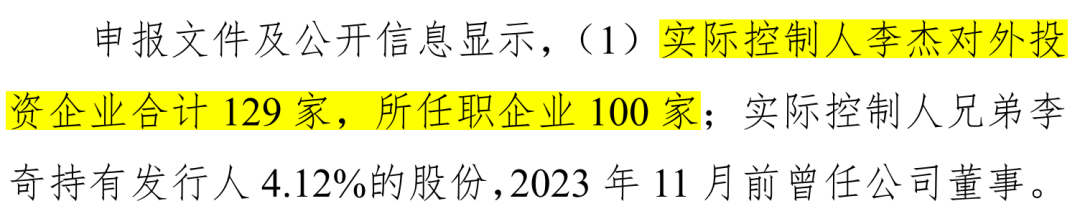

The Beijing Stock Exchange pointed out that Li Jie has invested in a total of 129 enterprises and holds positions in up to 100 enterprises, prompting inquiries about corporate governance and internal control standards.

It was required to explain the main situation of the actual controller's external investments and affiliated companies, their relationships and fund flows with the issuer, actual controller, directors, supervisors, and senior management; the reasons and rationality for the actual controller's positions and investments in these companies; and whether there is a risk of capital chain rupture, taking into account the actual controller's asset situation.

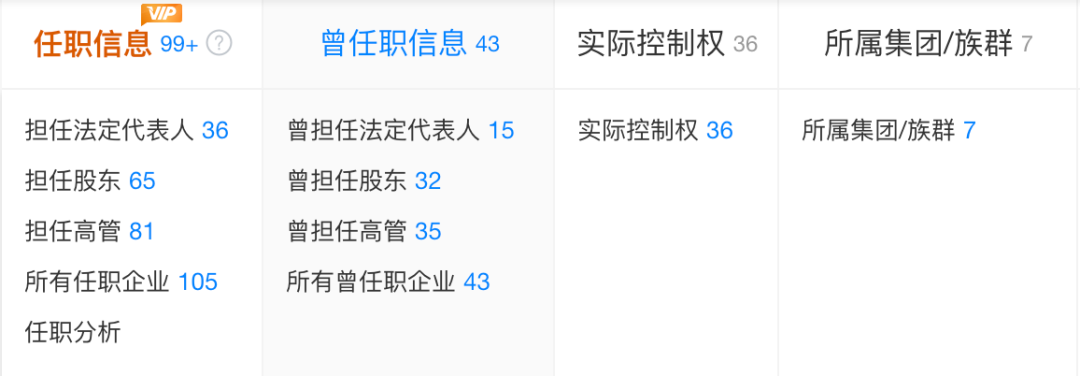

According to Tianyancha statistics, including Sirui Optics, Li Jie currently holds or has held positions in up to 105 affiliated enterprises, with 75 active enterprises, 22 cancellation , and 8 revoked. These enterprises span industries such as agriculture, apparel manufacturing, real estate, wholesale, and retail. Judging from the geographical distribution and industry affiliation, it appears that this Li Jie may be a different individual with the same name. However, Qichacha data shows that Li Jie is affiliated with only 10 enterprises, which seems more reasonable. Nevertheless, the truth will have to wait for Sirui Optics' response.

02

The Chief Financial Officer Subscribes Shares in the Private Placement

Penalized for Misusing Raised Funds

Judging from the current information, it is difficult to determine the authenticity of Li Jie's investment in over 100 enterprises as the actual controller. However, there are indeed other issues with Sirui Optics' corporate governance and internal control standards, and the exchange has also requested additional disclosures on whether there were any other violations during the reporting period and whether they constituted major violations of laws and regulations.

On November 28, 2022, Sirui Optics was listed on the New Third Board. During this period, due to issues such as irregularities in the use of raised funds, failure to implement the insider information informant registration management system, and inaccuracies in the disclosure of relevant data in the 2022 annual report, Sirui Optics, Chairman Li Jie, and Board Secretary Lin Bingkun were issued warning letters by the China Securities Regulatory Commission Guangdong Bureau and the National Equities Exchange and Quotations on November 24, 2023, and March 7, 2024, respectively.

During the listing period, Sirui Optics also experienced two instances of related party investments and subscriptions. In December 2021, Jiacheng Venture Capital, controlled by Lin Bingkun's brother, subscribed for 3.5556 million yuan of new share capital in Sirui Optics with a cash investment of 32 million yuan at a price of 8.9999 yuan per share.

In May 2023, Sirui Optics successfully conducted a private placement to Shen Jie, Liao Xiangbin, and Gaowei Investment, issuing 1.01 million ordinary shares at a price of 10 yuan per share, raising 10.1 million yuan. Among them, Shen Jie, as a company director and Chief Financial Officer, subscribed for 300,000 shares for a total of 3 million yuan. This was the only fundraising issuance by Sirui Optics during the reporting period from 2021 to 2023 (hereinafter referred to as the reporting period).

However, during the use of the funds raised in 2023, Sirui Optics transferred 3 million yuan of the raised funds to its subsidiary Yazhong Technology, and on the same day, Yazhong Technology transferred 2.2172 million yuan back to Sirui Optics to repay bank loans, which did not align with the disclosed purpose. This incident, along with the involvement of related parties and irregular use of funds, exposed weaknesses in Sirui Optics' internal control management.

In addition, Sirui Optics' current independent director Ding Jie served as the company's Chief Financial Officer from July 2017 to August 2018; and has served as an independent director since November 2023. The Beijing Stock Exchange has also requested clarification on Ding Jie's work experience, reasons for leaving her position as Chief Financial Officer, whether she holds shares in the issuer, and whether there are any circumstances that affect her independence and ability to perform her duties independently.

03

Mismatch between Profit and Revenue Growth

Product Market Share Questioned by Regulators

Sirui Optics is a national high-tech enterprise specializing in the research, development, production, and sales of interchangeable optical lenses, tripods, and other photographic and videographic equipment, as well as precision optical components. It primarily provides interchangeable optical lenses, tripods, gimbals, photography lights, desiccators, and other photographic and videographic equipment to global customers and consumers under the "SIRUI" brand, as well as precision optical components to clients.

From 2021 to 2023, Sirui Optics' operating revenues were 189 million yuan, 183 million yuan, and 262 million yuan, respectively. There was a slight decline in 2022, followed by a 42.9% year-on-year increase in 2023. Over the same period, net profits were 19.045 million yuan, 20.586 million yuan, and 31.7539 million yuan, respectively, showing steady growth; and net profits after deducting non-recurring gains and losses were 15.2935 million yuan, 18.0423 million yuan, and 31.0307 million yuan, respectively, with a significant 72.00% year-on-year increase in 2023, exceeding the revenue growth rate by 30 percentage points over the same period.

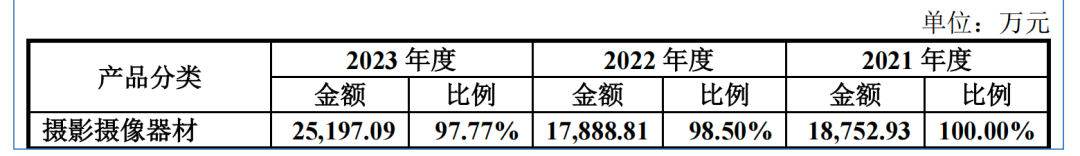

Sirui Optics' products are divided into two main categories: photographic and videographic equipment and precision optical components. During the reporting period, sales revenue from photographic and videographic equipment accounted for more than 96% of operating revenue, making it the primary source of income.

Based on product functionality and usage, its photographic and videographic equipment products are further classified into optical and non-optical categories.

Among them, non-optical photographic and videographic equipment such as tripods and gimbals are Sirui Optics' traditional and basic products. During the reporting period, sales revenue from these products accounted for 60.77%, 53.12%, and 44.16% of the company's main business revenue, respectively, showing a gradual decline year by year.

Correspondingly, the proportion of interchangeable optical lenses in optical photographic and videographic equipment has increased year by year, contributing from 29.19% to 38.00% to the main business. The gap with tripods and gimbals is narrowing, and if this trend continues, Sirui Optics' main business will undergo changes accordingly.

While performance has grown significantly, the exchange has expressed concern about the core technology sources and competitive advantages of Sirui Optics' optical products, requesting clarification on the technical sources and specific manifestations of competitive advantages of its interchangeable optical lenses.

Sirui Optics began its involvement in imaging optics in 2015, establishing an optical design and R&D team to develop optical products for photography and videography. To avoid direct competition with giants in the photography lens field such as Sony, Canon, and Zeiss, Sirui Optics chose to enter the expensive cinema lens market, pursuing a consumer-grade cinema lens route and competing with Cooke and Atlas with price advantages. From 2020 to 2023, Sirui Optics' annual sales of cinema lenses increased from 12,100 to 25,400 units.

However, Sirui Optics has not completely abandoned the larger photography lens market. In November 2023, it launched the Sniper series APS-C autofocus photography lens, selling 6,300 units immediately after its launch.

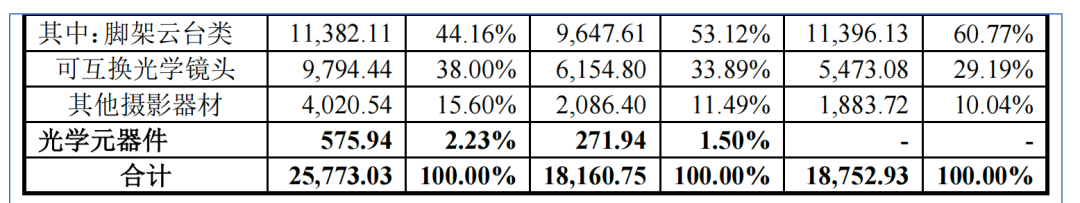

Its optical design and R&D team is primarily composed of Japanese optical engineers with years of experience working in optical companies such as Canon, Panasonic, and Samsung. During the reporting period, the company increased its efforts to recruit R&D talent, with the number of R&D personnel increasing year by year, and their salaries also growing annually. The number of new product developments by the company has also increased year by year, leading to a corresponding increase in the amount of direct materials used for R&D projects.

During the reporting periods, Sirui Optics' R&D expenses were 17.4349 million yuan, 20.7687 million yuan, and 26.4267 million yuan, respectively, with corresponding expense ratios of 9.24%, 11.34%, and 10.09%. Approximately 90% of this was spent on employee compensation and direct material inputs for R&D personnel. Out of its 766 employees in 2023, 95 were R&D personnel, accounting for 12.40% of the total.

Currently, Sirui Optics' interchangeable optical lens products cover anamorphic cinema lenses, cinema lenses, and autofocus photography lenses, totaling 30 products in six series. Its end-users include photography and videography enthusiasts, professional teams, photography studios, and film directors. With the market size of cinema lenses estimated at approximately 2.336 billion yuan in 2023 and photography lenses at approximately 21.027 billion yuan, Sirui Optics' market share for cinema lenses is 3.81%, and for photography lenses, it is 0.04%.

With revenue primarily coming from tripods, gimbals, and interchangeable optical lenses, the exchange has also focused on the market size and growth potential of Sirui Optics' main products. It was required to disclose the calculation methods, bases, and data sources for the aforementioned market shares; the sustainability of the stable growth in tripod and gimbal revenue; the stability of future market demand for cinema lenses; and whether Sirui Optics possesses the necessary technical reserves and cost control capabilities in the photography lens field.

04

Over 70% of Revenue Comes from Overseas

Regulators Demand Verification of the Authenticity of Distribution Revenue",

Due to its high proportion of export revenue, Sirui Optics was required to explain the authenticity and compliance of its export revenue, and its revenue authenticity under various sales models was also questioned.

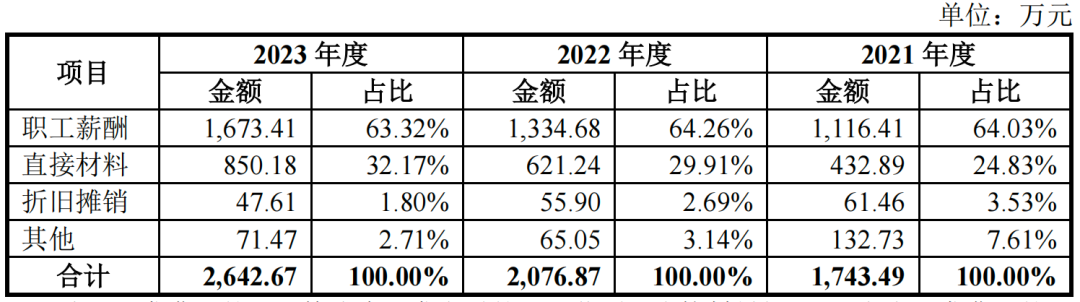

Sirui Optics has two sales models: online and offline sales. Both models are relatively stable in terms of performance contribution, with offline sales accounting for a larger proportion. While expanding sales channels and increasing operating revenue, its sales expenses have increased significantly, reaching 21.3156 million yuan, 27.2235 million yuan, and 44.222 million yuan during the reporting period, respectively, with sales expense ratios of 11.30%, 14.86%, and 16.89%, respectively, all increasing year by year.

Its online sales platform covers mainstream domestic and international e-commerce platforms such as Amazon, JD.com, and Tmall. It has also established its own independent website and expanded its online sales channels through crowdfunding platforms like Indiegogo. Online sales accounted for 43.26%, 44.01%, and 44.00% of total sales in each period, mainly focusing on B2C business.

Offline sales primarily rely on the distribution model. In foreign markets, Sirui Optics has subsidiaries in the United States and Germany, adopting the general distributor model. In other European countries and the Asia-Pacific region where no subsidiaries are established, the exclusive distributor model is used.

From 2021 to 2023, Sirui Optics' revenue from both the general distributor model and the exclusive distributor model totaled 104 million yuan, 91.3515 million yuan, and 118 million yuan, respectively. The Beijing Stock Exchange required the sponsor institution to verify Sirui Optics' distribution model and distribution revenue.

However, during the reporting period, the revenue from the direct sales model increased rapidly. Sirui Optics explained that this was mainly due to its successful cooperation with customers such as Insta360, YiQu Tech, Leishen Intelligence, and Moorexing Photonics.

During the reporting period, Sirui Optics sold non-optical photography equipment products, such as selfie sticks compatible with Insta360's action cameras, to Insta360 for 2.7632 million yuan, 7.6074 million yuan, and 20.1281 million yuan, respectively. In 2023, Insta360 became Sirui Optics' largest customer, accounting for 7.69% of its sales. The rapid growth in revenue from a single customer raises questions about its rationality and sustainability.

During the reporting period, Sirui Optics' total sales to its top five customers accounted for 28.91%, 26.50%, and 27.47% of its revenue in each period, respectively, indicating a relatively dispersed customer base.

Sirui Optics acknowledged that if its product sales do not go smoothly in the future, resulting in lower-than-expected sales receipts or a failure to timely raise funds to repay bank loans, it may face short-term debt repayment risks.

At the end of each period during the reporting period, the carrying values of its inventories were 68.5985 million yuan, 106 million yuan, and 143 million yuan, respectively, accounting for 69.42%, 73.40%, and 68.87% of current assets, representing a significant proportion.

The net cash flow generated from operating activities was 12.1155 million yuan, -8.3145 million yuan, and 24.5579 million yuan, respectively. The increase in inventory in 2022 led to a net cash flow from operating activities of -8.3145 million yuan in 2022.

During the period, the loan amount continued to increase. The combined balances of long-term and short-term loans (including long-term loans maturing within one year) at the end of each period were 45.2464 million yuan, 122 million yuan, and 164 million yuan, respectively. Among them, the combined balances of short-term loans and long-term loans maturing within one year were 15.8713 million yuan, 37.912 million yuan, and 61.4837 million yuan, respectively, showing continuous growth.

Over the same period, the asset-liability ratios were 43.46%, 53.44%, and 60.14%, respectively, significantly higher than the average of listed companies in the same industry and increasing year by year. For reference, the average asset-liability ratios of listed companies in the same industry were 28.95%, 29.80%, and 24.01%, respectively.

Attachment: List of Sirui Optics IPO Intermediaries

Sponsor: Dongwu Securities Co., Ltd.

Lead Underwriter: Dongwu Securities Co., Ltd.

Accounting Firm: PricewaterhouseCoopers Zhong Tian LLP (Special General Partnership)

Law Firm: Junzejun Law Firm (Shenzhen)