Did LeDao L90 Pre-Sales Skyrocket? NIO Shares Surge 18% in Three Days!

![]() 07/15 2025

07/15 2025

![]() 686

686

On July 14, Beijing time, NIO, a Hong Kong-listed electric vehicle maker, closed up 10.60%, marking its largest single-day gain in Hong Kong this year.

Since the pre-sale price of NIO's sub-brand LeDao's second model, the L90, was announced on July 9, NIO's share price has surged 18% over three trading days, with gains of 10.60%, 5.98%, and 0.73% respectively.

Judging from NIO's share price performance since the L90 pre-sale price announcement, particularly after the first weekend following the news, when customers visited stores on July 12 and 13, NIO opened higher on Monday and rose nearly 12% intraday, closing up 10.60%. This marked the company's largest single-day gain in 2023.

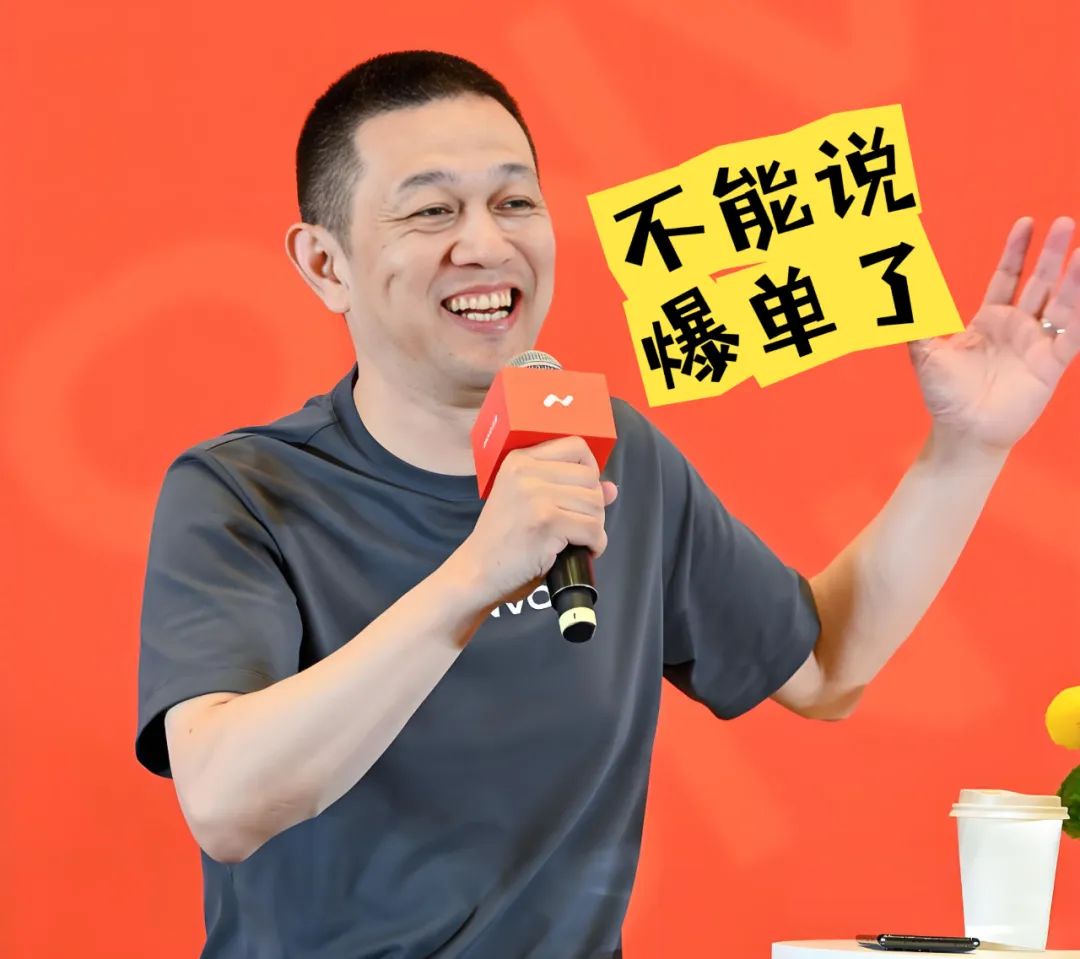

Investor optimism about the pre-sale orders for the LeDao L90 is evident. Notably, NIO has not disclosed the order situation (pre-sale orders) for the L90, adhering to its recent practice of withholding such information for new car models.

For NIO, the importance of the LeDao L90 cannot be overstated. It can be argued that whether Li Bin's goal of achieving profitability in Q4 will be realized depends heavily on the performance of the L90. Indeed, one might even say that NIO's future hinges on the success of this model.

Outlook for LeDao L90

Pricing the LeDao L90 is a delicate balance for NIO, as it must consider whether the new model will cannibalize sales of the current high-volume ES6 and whether it can offer potential consumers a compelling "WOW" price.

The L90 is available in two seating layouts: a three-row, six-seat configuration and a three-row, seven-seat configuration. The BAAS plan (excluding the battery, with a monthly battery rental fee) is priced at 193,900 yuan, while the pre-sale price for purchasing the entire vehicle (including the battery) starts at 279,900 yuan, meeting Li Bin's previously announced starting price below 300,000 yuan.

The official selling price is expected to be slightly lower than the pre-sale price, but if pre-sale orders are strong, the pre-sale price may remain unchanged.

Currently, the market is comparing the LeDao L90 with the upcoming Li Xiang i8, set to be released on July 29. Both are all-new electric models from emerging automakers. While the LeDao L90 is slightly larger than the Li Xiang i8, the difference is not significant in terms of dimensions.

However, the pricing for the i8 has not yet been announced, so comparisons at this point are premature.

Comparing the L90 with Xiaomi YU7 is even less relevant. First, their target demographics differ, with YU7 aiming at younger consumers and L90 targeting families. Second, Xiaomi has a much stronger market presence, so LeDao should avoid direct competition.

Comparing it with Tesla's Model Y is even less advisable, as that segment is reserved for LeDao's L60 model.

For the record, some analysts have stated that the LeDao L90's competitors include AITO M9, Li Xiang L9, Li Xiang L8, and Li Xiang i8. Others have suggested a broader range, including Li Xiang L9, AITO M8/M9, NIO ES8, Xpeng X9, and G9.

In reality, the LeDao L90 must focus on attracting consumers in the large electric SUV market, where a clear leader is still lacking.

If LeDao L90 Fails, It's Goodbye for NIO

Sales of the LeDao L60 are steadily increasing, with 6,400 vehicles delivered in June. While these figures are impressive, they are heavily reliant on promotional policies. As a brand-new model, the L90 must not only boost sales but also improve the gross profit margin for LeDao and NIO as a whole.

Li Bin has publicly stated that NIO aims to achieve profitability in Q4. With both NIO and LeDao's current models relying on promotional policies, the success of this goal hinges on the L90.

Some media outlets are suggesting that the L90 aims to achieve monthly sales of 25,000 vehicles by the end of the year. Only time will tell if this ambitious target is met.

It remains to be seen how the arrival of the LeDao L90 will affect NIO's current SUV models, including its mainstay ES6. Perhaps the L90's primary task is to first capture sales from NIO's existing models before competing with rival brands.

Observing the sales trends of other models after the L90's delivery will provide a clearer picture of whether it cannibalizes sales from NIO-branded models.

But in the niche market of large electric SUVs, will any model truly sell over 10,000 or even 20,000 units in a single month? If so, will it be the L90?

If not, and if the L90 fails to achieve monthly sales of over 10,000 units, what will be its financial contribution to NIO? Will it help the company achieve its Q4 profitability goal? If not, does NIO have a contingency plan?