Haimalun: Anhui's Cloud Gaming Pioneer Generates Annual Revenue of 520 Million Yuan, Leading the Industry in China

![]() 07/15 2025

07/15 2025

![]() 548

548

A new star has emerged from Anhui: Haimalun, a leading player in cloud gaming.

While its name might not ring a bell, gamers are likely familiar with its "invisible services." For instance, playing high-end 3D games on mobile phones without frame drops or running professional 3D software smoothly on ordinary computers could be attributed to Haimalun's cloud-based assistance.

The brain behind this venture is Dang Jinfeng, a quintessential tech enthusiast. Preferring casual shorts over suits, he sports black-framed glasses and a stylish beard, and his office is a showcase of the latest gadgets.

This seemingly laid-back individual has accomplished something groundbreaking: constructing servers and technical platforms that enable games and software requiring high-end equipment to run smoothly on ordinary mobile phones and computers.

The industry still presents ample opportunities, warranting entrepreneurs' attention.

Technological integration fosters new experiences: Leveraging 5G+AI+VR technology, Haimalun optimizes VR device rendering, reducing latency to under 20 milliseconds, delivering immersive cloud gaming experiences, and transcending traditional scene limitations.

Niche market potential remains untapped: Developing "cloud-native" games such as social and dress-up games tailored for female players, enhancing image quality to meet aesthetic needs; focusing on elderly and family scenarios, optimizing TV-end adaptation, and crafting easy-to-operate casual games.

Innovation and upgradation of business models: Exploring cross-border services like "cloud gaming + education," expanding the B2G model through 3D interactive scenarios; collaborating with hardware manufacturers to preload services and reach users based on sales volume.

- 01 -

Haimalun's founder, Dang Jinfeng, is an 80s-born entrepreneur and a quintessential tech enthusiast. Opting for casual shorts over suits, his office is a treasure trove of the latest products.

He graduated from Beijing University of Posts and Telecommunications in 2003 and earned a master's degree in Communication and Information Systems from Chongqing University of Posts and Telecommunications in June 2006.

Post-graduation, he worked at Potevio Information Technology Research Institute Co., Ltd. until March 2007. From May 2007 to June 2014, he served as a vice president at Beijing NQ Mobile Internet Technology Co., Ltd. In 2013, he led NQ Mobile's founding team to establish Haimalun's predecessor, Beijing Haiyu Dongxiang Technology.

The company independently designs and develops servers, builds GPU clusters, and provides cloud rendering services to enterprises.

To understand its business, consider this: Playing large games or using 3D software demands high-performance computers/mobile phones, which ordinary devices cannot handle. In response, Haimalun built its "cloud computer room" equipped with high-performance GPU servers dedicated to graphics rendering and computing.

In 2016, Haimalun successfully developed the first generation of ARM array servers, pioneering the global vertical cloud computing business based on the ARM architecture and venturing into cloud gaming computing.

This was made possible by Dang Jinfeng's decisive leadership.

In 2016, when the industry widely used the X86 architecture for Android games, Dang Jinfeng proposed rebuilding the underlying technology with the ARM architecture. This decision sparked intense internal debate as ARM servers' compatibility and performance were deemed insufficient for cloud gaming at the time. Yet, he stood firm.

In 2017, its products began commercial use, collaborating with China Mobile Migu Interactive Entertainment, 360 Games, China Literature, and other enterprises, pioneering the commercialization of cloud gaming.

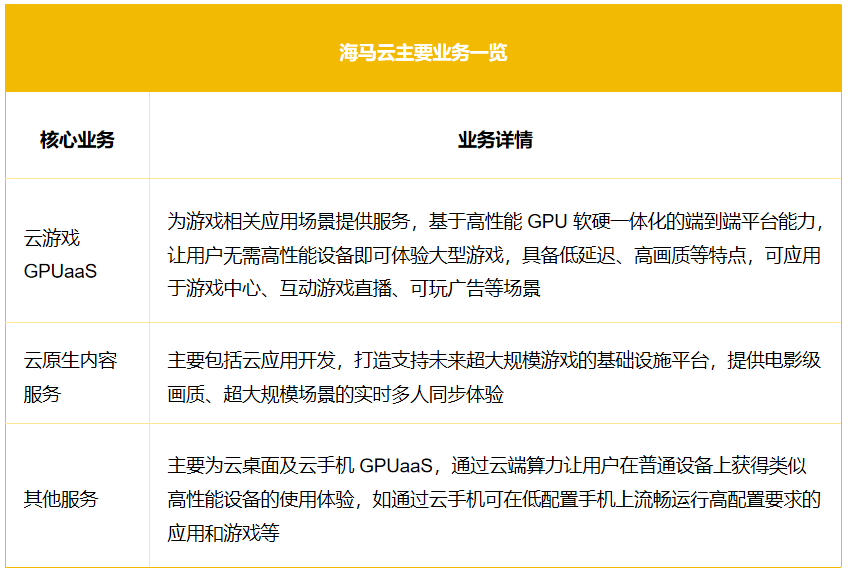

Currently, cloud gaming GPUaaS constitutes the largest share of Haimalun's revenue. From 2022 to 2024, the company's cloud gaming GPUaaS revenue was 248 million yuan, 220 million yuan, and 458 million yuan, respectively, accounting for 85.4%, 65.4%, and 88.1% of total revenue.

Migu Culture, a China Mobile subsidiary specializing in digital content like music, video, reading, games, and animation, is Haimalun's largest customer. Since their 2017 partnership, Migu Culture has contributed 123 million yuan, 156 million yuan, and 185 million yuan in revenue from 2022 to 2024, respectively, accounting for 42.5%, 46.4%, and 35.7% of Haimalun's total revenue.

- 02 -

The evolution of the cloud gaming industry can be broadly categorized into three stages.

The initial stage was conceptual, where limited internet technology and hardware capabilities confined cloud gaming to the theoretical realm.

With increasing internet bandwidth and hardware performance, the industry entered the technology exploration phase. Some enterprises attempted to develop cloud gaming technology, but due to cost and technological maturity constraints, large-scale commercialization remained elusive.

In recent years, the proliferation of 5G networks and the rapid development of cloud computing technology have propelled cloud gaming's growth.

According to Frost & Sullivan, China's real-time cloud rendering services market for cloud gaming scenarios is projected to reach 11.6 billion yuan by 2029, with a compound annual growth rate of 35.4% from 2024 to 2029.

Internationally, the cloud gaming industry is fiercely competitive, with foreign tech giants like Google's Stadia and Microsoft's xCloud holding advantageous positions. Compared to foreign counterparts, domestic cloud gaming enterprises lag in technological R&D and global market layout but excel in localized services, understanding domestic market demands, and policy support.

Haimalun's competitors include NetEase Cloud Gaming and Tencent Instant Play. Haimalun's key differentiator lies in its full-stack self-developed technical approach. It provides enterprise customers with full-stack services, from IaaS layer hardware infrastructure to PaaS layer software core technology. This capability grants Haimalun advantages in technical stability, customized services, and cost control.

In terms of 2024 revenue, Haimalun holds a 17.9% market share in China's real-time cloud rendering service providers for cloud gaming scenarios, ranking first. From 2022 to 2024, Haimalun's revenue was 290 million yuan, 337 million yuan, and 520 million yuan, respectively, with a compound annual growth rate of 33.8%, indicating robust growth. However, in terms of profit, Haimalun has consistently incurred losses, with net losses of 245 million yuan, 217 million yuan, and 185 million yuan, respectively.

Future industry opportunities primarily lie in:

I. Integration of 5G+AI+VR Technology: Creating Immersive Experiences in New Markets.

VR + Cloud Gaming Immersion: While traditional cloud gaming addresses "device limitations," VR technology further transcends "scene limitations." For example, players can don VR glasses to enter the game's virtual world and control characters through body movements. Leading enterprises like Haimalun host over 28,000 games, including many 3A masterpieces supporting VR adaptation. New players can optimize VR device rendering, reduce latency to under 20 milliseconds (the industry-recognized standard for "imperceptible latency"), and offer a differentiated experience.

II. Vertical Niche Markets: Female Gamers + Elderly Groups.

Female Gamer Market: Industry research shows that the proportion of women among cloud gaming users has risen from 28% in 2022 to 35% in 2024. However, among existing games, content catering to women's preferences, such as social interaction, dress-up, and light puzzle games, accounts for less than 20%. New players can develop "cloud-native" female-oriented games that run smoothly on mobile phones and tablets without downloads, enhancing character costumes and scene details through cloud rendering to meet aesthetic needs.

Elderly Groups and Family Scenarios: With smart TVs gaining popularity, family cloud gaming scenarios are emerging. Data indicates that TV-terminal cloud gaming users increased by 120% year-on-year in 2024, with users over 50 years old accounting for 15%. This demographic prefers chess and card games, casual puzzles, and demands ease of operation. New players can optimize TV-end adaptation, develop exclusive versions with voice control and simplified interfaces, and tap into this untapped market.

III. Business Model Innovation: From "Time-based Charging" to "Contextualized Services".

"Cloud Gaming + Education" Cross-border Services: For instance, integrating history and science into game plots, schools or parents can purchase services by course packages and enable 3D scene interaction (like "virtual museum" tours) through cloud rendering. This B2G model enjoys policy support and minimal competition.

Hardware Bundling Collaboration: Partner with smart TV and VR device manufacturers to preload customized cloud gaming services and share revenue based on device sales. This model swiftly reaches users, particularly beneficial for new players lacking traffic resources.

In summary, new players need not compete with industry leaders like Haimalun in "full-category coverage" but can leverage technology integration to create immersive experiences or focus on niche group needs.

The content of this article is for reference only and does not constitute investment advice.