Avatr "fails" Changan Auto

![]() 08/07 2024

08/07 2024

![]() 616

616

The brutal competition has long proven that the market cannot accommodate "small and beautiful" players.

Born into privilege, Avatr, jointly created by Changan Auto, CATL, and Huawei, sparked boundless visions for Changan Auto to stand atop the automotive world.

Recently, Avatr has been active, embarking on sweeping reforms, closing down numerous direct-sales stores, while simultaneously promoting its upcoming Avatr 07 model, signaling its official entry into the extended-range electric vehicle (EREV) market.

The current market is dominated by a "price war," with BBA (BMW, Benz, and Audi) successively announcing their withdrawal from it, aiming to alleviate dealer operational pressures and maintain their luxury brand image.

However, Avatr, which has always strived in the premium market, cannot afford such luxury, and must instead humble itself, reduce costs, and cater to market demands.

Under immense pressure, Avatr has demonstrated a strong desire for change.

Nonetheless, fulfilling Changan Auto's mission to penetrate the premium new energy vehicle market remains a long and arduous journey.

01

Idealistic visions vs. harsh realities

Avatr's birth with a "golden spoon" is a rare occurrence.

In 2022, Zhu Huarong, Chairman of Changan Auto, Xu Zhijun, Rotating Chairman of Huawei, and Zeng Yuqun, Chairman of CATL, gathered to pledge their commitment to building Avatr. Changan Auto took charge of vehicle R&D and manufacturing, Huawei provided intelligent vehicle solutions, and CATL contributed to the smart energy ecosystem. Together, they established the CHN intelligent electric vehicle technology platform.

Pooling the strengths of these three parties, Avatr was positioned as a "global premium smart electric vehicle brand." This vision not only carries Changan Auto's ambition for electric transformation but also its aspiration for premium market penetration.

At the end of last year, Zhu Huarong personally took over as Chairman of Avatr Technology, publicly promising, "As long as Avatr needs it, Changan Auto will fully support it with funding, personnel, and technology." According to Tianyancha, Changan Auto currently holds approximately 41% of Avatr's equity, and Avatr ranks first in Changan Auto's business introductions, underscoring its importance.

With its luxurious lineup, lofty goals, and unwavering determination, Avatr inspired boundless visions. However, the harsh reality shattered these dreams, as Avatr failed to reach the pinnacle of the industry, instead embarking on an awkward path of highbrow exclusivity.

As Avatr's first full year of deliveries in 2023, it managed to ship 29,600 units, equivalent to a single month's deliveries for top-ranking brands. This fell short of its annual target of 100,000 units, achieving only 29.6% of the goal.

In the first seven months of this year, Avatr's sales doubled to 32,655 units, averaging less than 4,700 units per month. Still significantly short of its annual sales target, Avatr remains at the bottom of the sales rankings.

Some market observers argue that Avatr's biggest issue is its lack of brand recognition, exacerbated by its obscure brand name. However, in reverse, brand recognition also relies on product performance, which is inextricably linked to brand perception.

Ultimately, poor product sales stem from inadequate product quality.

Avatr is known for its unique design and Huawei's intelligent driving capabilities.

From its streamlined headlights, elegant yet understated body shape, to its immersive cockpit design, Avatr's aesthetics stand out among competitors. However, Avatr compromised many user experiences for its unique design, earning criticism as "a car that sells design."

Moreover, Avatr's positioning is relatively ambiguous. Competitors like NIO emphasize their dynamic performance alongside unique designs, while AITO becomes a benchmark for Huawei's intelligent driving capabilities. In contrast, Avatr lacks a clear brand identity.

On the other hand, Avatr's reliance on Huawei's intelligent driving capabilities has not significantly boosted sales.

According to sales consultants, the lower-end models sell better, and many customers are not enthusiastic about paying extra for intelligent driving features. Surveys also indicate that customers prioritize safety, quality, and ownership costs over intelligent features when purchasing vehicles.

In practical terms, even with intelligent driving features enabled, drivers remain vigilant and attentive during daily driving, failing to fully relax or leverage the advanced assistance features.

Under sales pressure, Avatr has had to engage in the price war. When Avatr 11 debuted in 2022, it was priced at 349,900 yuan, setting a high entry barrier. However, the 2024 Avatr 12 has adjusted its price range to 265,800 to 400,800 yuan, lowering the entry price below 300,000 yuan.

To stay in the game, Avatr desperately needs a high-volume model.

02

The second AITO?

Unable to sit idly by, Avatr has ultimately lowered its stance and embraced the EREV route.

Initially, the EREV route was not favored due to perceived technological backwardness. However, it has since proven itself, inspiring a sense of resilience and perseverance.

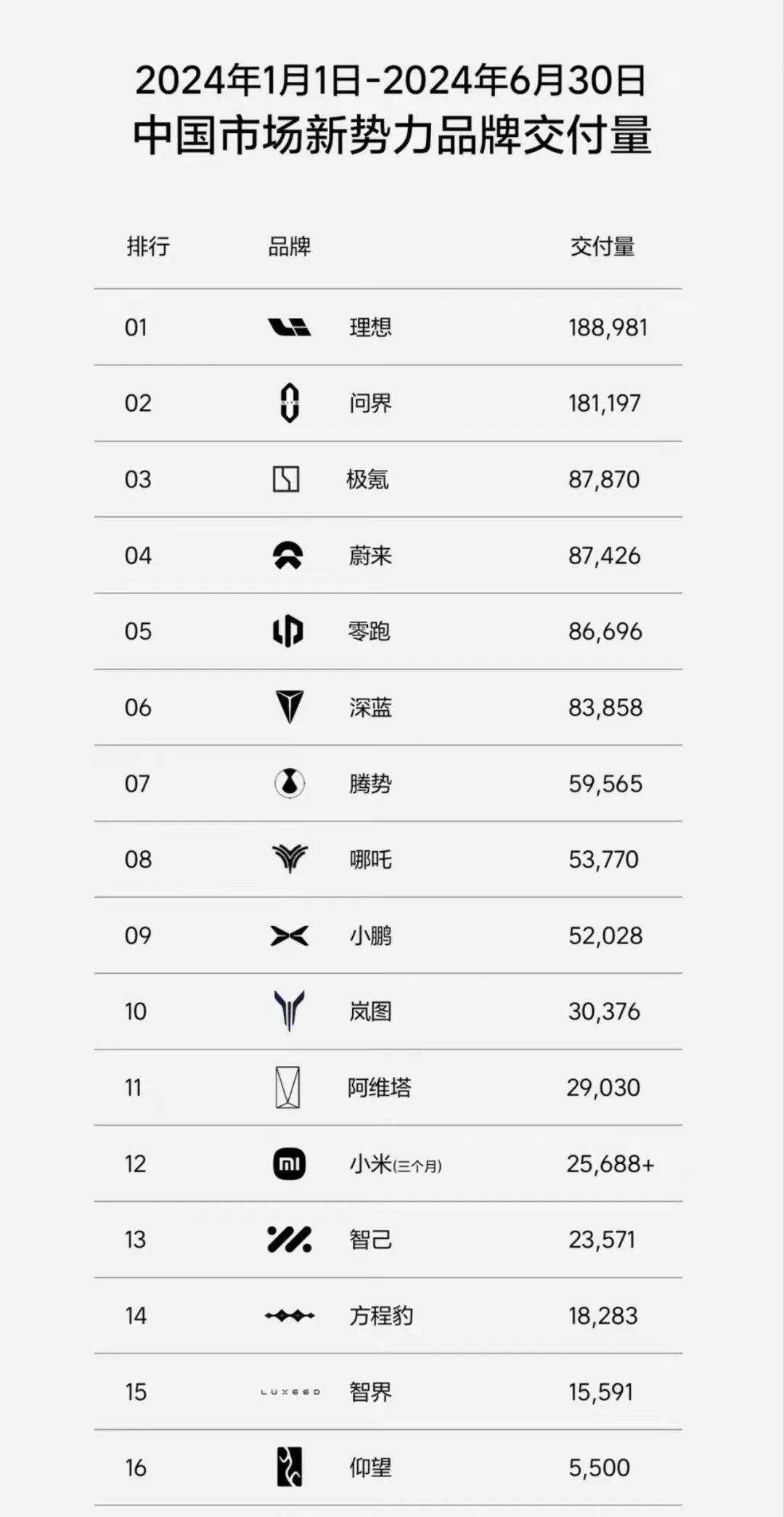

In the first half of this year, the top-selling EREV brands, Lixiang and AITO, surpassed the 180,000-unit mark. Four out of the top six brands (Lixiang, AITO, Leapmotor, and ARCFOX) focused on EREV models.

This turnaround is attributed to their unique characteristics and the evolving landscape of the new energy vehicle industry.

For pure electric vehicles, technologies like 800V high-voltage platforms and 5C ultra-fast charging are yet to be widely adopted. To fully enjoy advertised features, customers must pay extra and consider infrastructure readiness, posing stringent requirements. In contrast, EREVs offer fuel-range extension, significantly alleviating range anxiety, a crucial advantage over pure electric vehicles.

Unable to compete, Avatr has chosen to join the EREV fray. While conceding face, it stands a chance to win substance, a lesson Avatr understands all too well. Moreover, Changan Auto has already tasted success with EREVs.

Changan's ARCFOX brand has seen a surge in sales since launching the EREV model SL03, with follow-up models like ARCFOX S7 and the mid-to-large SUV ARCFOX G318 gaining market traction, largely due to their EREV offerings.

Avatr's upcoming Avatr 07 model boasts EREV as a key selling point. Additionally, Avatr 11 and 12 EREV versions have been submitted for new vehicle registration with the Ministry of Industry and Information Technology, marking the brand's focus on EREV development. For the long-struggling Avatr, this pivot may offer a chance to soar.

△Avatr 07 Source: Avatr Official Weibo

Beyond EREVs, Avatr's other trump card is its intelligent driving capabilities, becoming one of the first brands to adopt Huawei's Kunpeng ADS 3.0 system after AITO S9.

This reveals Avatr's ambition to create a second AITO.

Unfortunately, Avatr shares similar offerings with competitors, failing to establish a unique advantage.

Brands like AITO and Xpeng, heavily supported by Huawei, have always leveraged intelligent driving as a market differentiator. Even Changan's newly launched ARCFOX S07 has pioneered Huawei's Kunpeng Intelligent (pure vision-based) solution, leaving Avatr in an awkward position.

However, from a developmental perspective, Avatr is gradually addressing its shortcomings, such as niche market positioning and aggressive pricing strategies. Its shift towards traditional SUVs, EREVs, and low-cost intelligent driving solutions demonstrates its respect for market demands.

As the new energy vehicle industry enters its second phase, truly grasping consumers' core needs poses the greatest challenge. Only by creating products that closely align with real-world requirements can one hope to remain unbeatable.

03

Changan Auto's premium conundrum

"Traditional automakers must adapt or risk being left behind. That's why we're pushing for change," said Zhu Huarong, acknowledging the changing times and accelerating Changan Auto's transformation efforts.

While demand for fuel-powered vehicles persists, Changan Auto retains a competitive edge in the traditional market, particularly in lower-tier cities where it has deep roots. However, the broader trend undeniably favors electrification. The China Passenger Car Association predicts that new energy vehicle penetration will reach 49.7% in July this year.

The transition from fuel to electric power is inevitable for traditional automakers. For Changan Auto, this means venturing into the premium new energy segment, an uncharted territory.

However, Changan Auto's new energy sales still rely heavily on its mid-to-low-end Qiyuan and ARCFOX series, while Avatr, tasked with premiumization, has failed to shoulder the burden. In the first half of this year, Qiyuan (72,968 units) and ARCFOX (83,858 units) combined accounted for 52% of Changan Auto's new energy autonomous brand deliveries.

△Source: Changan Auto Official Weibo

Avatr's delivery share stands at just 9.7%, sustained by ongoing losses. Changan Auto's financial report reveals that Avatr's net loss widened by 83.22% from 2.015 billion yuan in 2022 to 3.693 billion yuan, accumulating over 6 billion yuan in losses since 2020.

Intending to leverage Avatr to propel Changan Auto into the premium market, the initiative instead became a burden. Frustrated by this outcome, Zhu Huarong embarked on sweeping reforms:

First, transitioning from direct sales to agency models to reduce costs. Second, embracing live-streaming marketing to boost brand recognition.

Widespread direct sales stores were initially a hallmark of premium new energy vehicle brands but proved unsuitable for all. The shift to a hybrid model of direct sales and agency reduces costs, mitigates dealer inventory risks, and offers greater flexibility in expansion and pricing.

Channel reforms and the EREV pivot facilitate cost reduction, enabling Avatr to participate more comfortably in the price war. Consequently, future Avatr models are expected to compete at lower price points, a boon for sales.

Even the finest products need exposure. Beyond crafting superior products, enhancing brand recognition is crucial.

To raise Avatr's profile, Zhu Huarong, a seasoned industry veteran in his 60s, transformed into a livestreamer, leveraging his charisma to engage audiences and subtly promote Avatr 11, Avatr 12, ARCFOX G318, and ARCFOX S07.

Changan Auto aims to sell 2.8 million vehicles in 2024. With over 1.33 million units sold in the first half, up 9.74% year-on-year, it has yet to reach its halfway mark.

Therefore, second-half sales are crucial. If Avatr can shoulder more responsibility, it would not only help achieve the annual target but also signify a promising step forward for Changan Auto in the premium new energy vehicle market.