"Ningde Times" was pushed to the limit by BYD, and Zeng Yuqun personally spoke at Huawei's Enjoy S9 event

![]() 08/07 2024

08/07 2024

![]() 686

686

Following his appearance at Chery's iCAR brand event in April, Zeng Yuqun, Chairman and CEO of Contemporary Amperex Technology Co., Limited (CATL, 300750.SZ), spoke at Huawei's HarmonyOS SmartRide Enjoy S9 launch event on August 6.

Only Avatar, in which CATL has a direct investment, has had its CEO speak at an event to endorse a new car's quality before.

At the Enjoy S9 event, Zeng Yuqun announced that the new car uses CATL's eighth-generation production line batteries, which employ AI technology for optimization and upgrades, are waterproof, heat-resistant, and impact-resistant, with a defect rate of one in a billion. Furthermore, based on the reliability of the batteries, Zeng mentioned that CATL is exploring the V2G (Vehicle-to-Grid) model, allowing consumers to charge their cars during off-peak hours and sell excess power back to the grid during peak hours, thereby earning a profit.

Image sourced from event screenshot

Not only are CATL batteries safe, but they can also generate income? On August 7, YuanMeiHui inquired with CATL's PR department about this, but had not received a response by the time of publication.

If the idea of earning money while your car's battery sits idle were to become a reality, it would be reasonable to believe that CATL's domination of the EV battery market is not far-fetched. However, the reality is harsh, and it is undoubtedly premature to discuss the widespread adoption of V2G technology, given the challenges associated with the construction of supporting hardware.

CATL's departure from its usual pragmatic approach and promotion of its batteries through grandiose claims reflect deeper concerns and undercurrents.

01

Leading automakers seek to "de-CATL-ize"

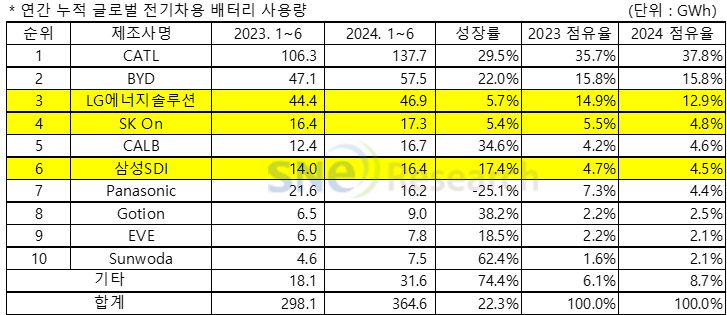

According to the latest data released by SNE Research on August 7, CATL holds a 37.8% market share in the global EV battery market, leading BYD (002594.SZ, 01211.HK) by 12 percentage points. CATL's position as the industry leader remains solid. However, its strong influence is starting to have adverse effects.

Image sourced from SNE Research

In July, Great Wall Motor's Hive Energy, a major shareholder of CATL, unveiled its second-generation short-blade battery. In June, Geely (00175.HK) followed up on its Jinzhuan battery from December 2023 with the launch of its Shendun short-blade battery. In December 2023, GAC Motor's (601238.SH, 02238.HK) Aion brand's Inspire Battery Smart Eco-Factory officially commenced production of its P58 microcrystalline super battery...

As the penetration rate of the new energy vehicle market surpasses 50%, surpassing that of traditional gasoline-powered vehicles, automakers with substantial resources and capabilities are taking battery production into their own hands to maintain control. While automakers may have previously been content with purchasing battery cells and assembling them into packs, they are now producing their own battery cells, a practice known as full-stack in-house battery research and development (R&D).

The advantages of full-stack in-house battery R&D are immediately apparent. Firstly, there are cost savings. Taking Geely as an example, the Zeekr 007, equipped with the Jinzhuan battery, has a starting price of under RMB 210,000, making it the most cost-effective model in its class eight months after its launch and contributing to Zeekr's continuous sales record highs.

Having tasted success, Geely is switching more of its upcoming premium models to in-house batteries. In addition to the Zeekr E5, which received 15,000 orders upon its launch and uses Geely's in-house Shendun short-blade battery, YuanMeiHui has learned that the upcoming Zeekr 7X will also partially incorporate the in-house Jinzhuan battery.

Image sourced from Weibo @Dr. Zhu Ling of Zeekr

This trend is clearly not what CATL wants to see. Zeekr has always been a close partner of CATL, with the latter's key new product, the Qilin battery, choosing the Zeekr 001 and Zeekr 009 as its launch vehicles. Now that Zeekr's volume models, the 007 and 7X, are adopting in-house batteries, Zeekr's intention to "de-CATL-ize" is clear.

02

Overcapacity becomes a burden

Looking back at the time when CATL was dominant, automakers feared that CATL would not produce batteries for them. Prepayments of tens of millions of yuan were common, and terms such as requiring automakers to jointly invest in production lines and bear the cost of raw material price increases were rampant.

Amid the booming battery production and sales, CATL continued to expand its capacity. By the end of the first half of this year, CATL's battery system capacity reached 323GWh, making it the world's largest producer of EV batteries, according to financial reports.

Image sourced from CATL's official website

To sell its capacity, CATL has pulled out all the stops. Not only has its CEO, Zeng Yuqun, strengthened partnerships by speaking at various corporate events, but the company has also actively expanded into businesses beyond EV battery systems, including energy storage battery systems, battery materials, and recycling. It is rumored that Tesla's (NASDAQ: TSLA) new energy storage factory in Shanghai is a prime target for CATL.

Publicly available information indicates that Tesla's Shanghai Megafactory for Energy Storage is expected to commence operations in the first quarter of 2025 with a storage capacity of nearly 40GWh. Currently, neither Tesla nor CATL has commented on potential business cooperation at this factory.

Regarding its core business of EV battery systems, CATL is adopting a "take-all" strategy to counter challenges from competitors led by BYD. According to YuanMeiHui's analysis, CATL has announced partnerships with companies such as NIO Auto, Chery Automobile's Starway, Beijing Automotive Group's new energy vehicle division, Jiyue, Lantu, Thalys (601127.SH), Maxus Technology, and JAC Motor in the past year.

However, several high-profile new vehicles launched this year have seen CATL lose its monopoly or even be absent altogether. For instance, NIO's (09866.HK, NYSE: NIO) sub-brand Ledo L60 exclusively uses BYD's Blade Battery, while Chang'an Motor's (000625.SZ) best-selling new energy vehicle, the Shenlan G318, is equipped with batteries from China Aviation Lithium Battery. Additionally, battery suppliers for other notable new vehicles launched this year, such as Xiaomi's (01810.HK) SU7 and Lixiang's (02015.HK, NASDAQ: LI) L6, include competitors like BYD and Sunwoda (300207.SZ).

"Under the price war in the new energy vehicle market, many new vehicles opt for relatively low-cost LFP batteries, which is not a good sign for CATL. Although CATL also produces LFP batteries, such as its Shenxing battery, they are primarily targeted at mid-to-high-end models. When it comes to price competition, BYD and Sunwoda are more adept," an automaker's procurement manager told YuanMeiHui on August 7.

Image sourced from CATL's official website

With a relatively high idle capacity rate and an increasing number of automakers seeking to "de-CATL-ize," the industry leader, CATL, indeed needs to plan ahead.

Some images are sourced from the internet. Please notify us for removal if there is any infringement.