Will Aion's IPO be uncertain?

![]() 08/13 2024

08/13 2024

![]() 617

617

A loud scream of 'Ah' catapulted Aion Hyperion HT to the headlines of various websites' automotive sections on July 30th, prompting numerous bloggers to embark on a science-popularization spree about anti-pinch technology in cars.

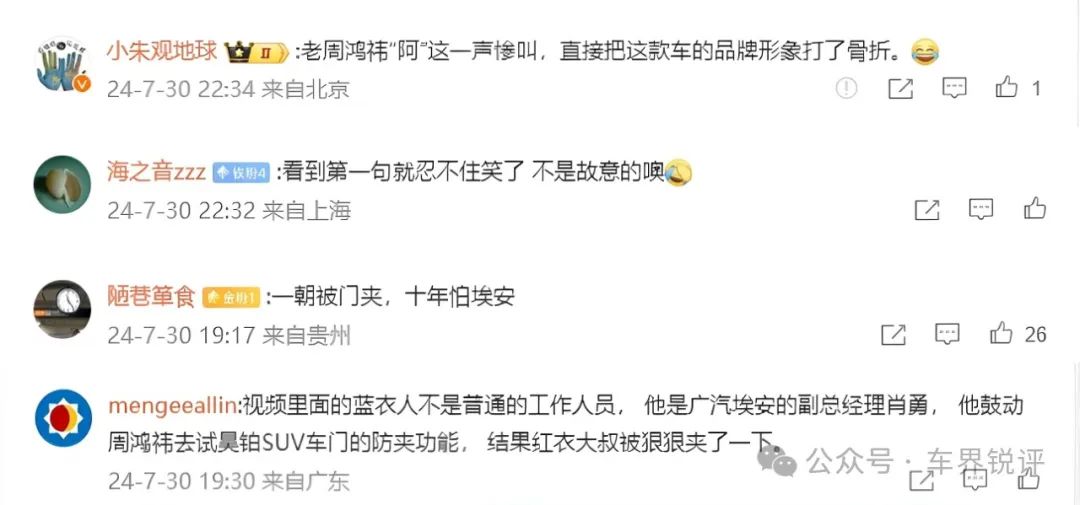

This triggered numerous jokes online: 'Zhou Hongyi's scream of 'Ah' directly broke the brand image of this car!'; 'If the anti-pinch function doesn't work, it could be fatal'; 'Once pinched by a door, scared of Aion for a decade'…

With rumors spreading rapidly, Aion found it difficult to contain the situation in a short time.

Under the pressure of public opinion!

Zhou Hongyi had to personally respond to the incident on social media, posting a video with the caption, 'Guangqi Aion cars are good cars, and my hands are good hands too.'

However, for Hyperion Automobiles, its reputation has suffered a significant blow.

Netizens unanimously believe that Aion's high-end brand is all talk and no action technically, suitable only for ride-hailing services but difficult to sell at prices exceeding hundreds of thousands.

So why is Guangqi Aion so eager to piggyback on Zhou Hongyi for traffic and exposure?

To be honest, Aion had no other choice.

Look, Nezha CEO Zhang Yong has been sprinting towards an IPO in Hong Kong, taking various internet celebrities and the 'Red Clothes Preacher' everywhere to create a buzz about intelligent driving and surfing forward, showing a daring determination to 'dare to bring down the emperor.'

You'd think Aion would be worried…

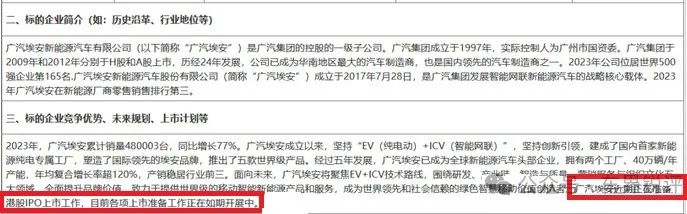

Everyone has the goal of sprinting towards an IPO in Hong Kong this year. While Nezha is steadily moving forward, Aion is struggling at the high end while being constantly eroded by BYD at the low end.

Most importantly, during the crucial period of Guangqi Aion's efforts to go public, shareholders of Guangqi Aion New Energy Automobile Co., Ltd. have recently started causing trouble again.

On the Beijing Equity Exchange website, bloggers noticed that China Cinda is transferring equity stakes in multiple companies on a large scale.

This includes Guangqi Aion, which should not be the case!

Even stranger, the 'investment invitation announcement for equity transfer' disappeared shortly after being posted on the Beijing Equity Exchange.

Currently, the relevant disclosure information for this announcement cannot be found on the Beijing Equity Exchange.

It is understood that this equity transfer is precisely related to Guangqi Aion's failure to go public as scheduled in the past two years.

According to relevant media reports, due to the postponement of the IPO, Cinda procedurally needs to carry out an asset disposal process.

(Source: National Business Daily)

How many netizens will believe this claim?

In fact, reaching this point, even their own shareholders and securities traders are not optimistic, which indirectly indicates that Aion's IPO path is uncertain…

In addition to this equity disposal and the negative controversy surrounding Zhou Hongyi's pinched hand, Aion's biggest stumbling block to going public lies in sales, profitability, and brand positioning…

Why do I say that?

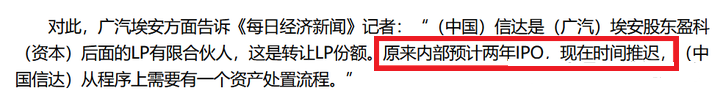

According to the latest sales data: Guangqi Aion sold 29,200 vehicles in July, a year-on-year decline of 37.17%, making it the brand with the largest decline under Guangqi Group. From January to July, cumulative sales reached 154,600 vehicles, also a year-on-year decline of 39.21%, again the largest decline under the group.

It is understood that Guangqi Aion has experienced seven consecutive months of declining sales, while its 2024 sales target is 700,000 vehicles. As of July, it has achieved 22% of its target sales, and the remaining five months will require sales to stabilize at over 110,000 vehicles per month, which is incredibly challenging and almost impossible to accomplish.

Why has there been such a precipitous decline in sales?

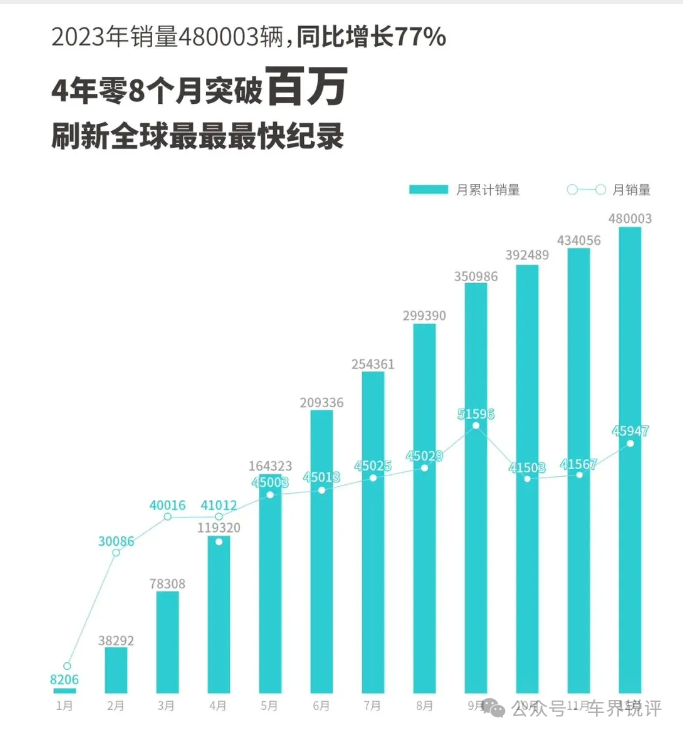

As everyone knows, Guangqi Aion was established in July 2017 and reached its peak popularity in 2023, with annual cumulative sales of 480,000 vehicles, a year-on-year growth of 77%, and a peak monthly sales figure exceeding 50,000. In the new energy vehicle sales rankings, Guangqi Aion ranked second only to BYD and Tesla, demonstrating strong market competitiveness.

In those days, it was hailed by the internet as the 'BAT' of the new energy sector (B for BYD, A for Aion, T for Tesla), displacing NIO, Xpeng, and Li Auto.

However, much of this sales growth was fueled by the ride-hailing market.

Therefore, Guangqi Aion is known as the 'King of Ride-hailing.' In the price range of 120,000 to 150,000 yuan, due to their affordability, the AION S and AION Y models have become the preferred choice for most people buying ride-hailing vehicles, thereby quickly capturing the ride-hailing market.

However, as the ride-hailing market gradually becomes saturated, Guangqi Aion's sales problems emerged.

Entering 2024, amidst the intensifying price and configuration competition among major Chinese automakers. For example, BYD Qin, considered the biggest threat to Guangqi Aion, has lowered its price to below 100,000 yuan, directly targeting the ride-hailing market that Guangqi Aion has been cultivating. Additionally, brands such as NIO and Xpeng, which previously focused on the mid-to-high-end market, have also started to expand into the low-end market with products priced between 150,000 and 200,000 yuan.

As a result, Guangqi Aion's sales began to plummet, and unfavorable news such as layoffs of 20% of its workforce and rescinding job offers to recent graduates emerged internally.

Guangqi Group Chairman Zeng Qinghong urgently called for an end to the 'internal competition' at the 2024 China Automotive Chongqing Forum held in June this year, prompting reflection on why Guangqi's new energy efforts seem to be regressing, even to the point where even the boss can't stand it.

Most importantly, there's Guangqi Aion's high-end brand, Hyperion, which has consistently failed to carry the banner upwards.

Data shows that Hyperion's total sales in 2023 were just 8,087 vehicles. Since the beginning of 2024, Hyperion's sales have remained strained.

From January to July, sales were 823, 501, 1,523, 1,018, 1,443, 904, and 1,010 vehicles, respectively. Compared to domestic high-end new energy brands like Lixiang, Wenjie, NIO, and even Zhide, Lantu, and Avita, even Gu Huinan, the head of Guangqi Aion, admits with embarrassment that Hyperion is not the 'pride' of Guangqi's high-end offerings but rather its 'Achilles' heel.'

Currently, the issues Guangqi Aion must address before its IPO in Hong Kong include rapidly breaking the solidification image of its brand, quickly capturing market share, and seeking upward mobility in the mid-to-high-end market.

Otherwise, Aion's path to going public will be 'as difficult as ascending to heaven.' Do you agree?