"The New Era of Going Global: How Chinese Enterprises Take Root Abroad?"

![]() 08/13 2024

08/13 2024

![]() 671

671

It's challenging for Chinese enterprises to directly replicate their domestic success models in overseas markets. Instead, they need to develop a new paradigm for going global that encompasses not just information technology infrastructure, but also compliance, supply chain management, sales channels, cultural integration, and more, to strengthen their localized brand building in international markets.

This approach transforms Chinese enterprises' going global from a simple "going out" to a genuine "settling in" based on a comprehensive and collaborative ecosystem.

Author: DouDou

Editor: PiYe

Produced by: Industry Insider

In 2024, "going global" is undoubtedly a hot topic in the field of enterprise development.

On July 12th, customs data for the first half of the year released by the General Administration of Customs showed that China's total exports exceeded 12 trillion yuan in the first half of 2024, an increase of 6.9% over the same period last year.

With China's rapid economic development, many enterprises' strong supply capabilities not only meet domestic demand but also exhibit significant spillover potential. Finding new growth opportunities has become imperative, and going global has emerged as a natural choice for many enterprises.

However, the journey to international markets is not without challenges.

Objectively speaking, overseas markets differ fundamentally from domestic ones in terms of culture, business environment, market dynamics, and policies, necessitating fresh development strategies for enterprises.

Taking Xiaomi's experience in Southeast Asia as an example, it initially struggled in the Indian market due to insufficient localization. Products and designs failed to fully accommodate Indian users' habits and needs, leading to poor market reception. Similarly, leading Chinese industrial enterprises like Haier and Hisense faced challenges in supply chain and logistics management during their globalization processes.

These cases signal that regardless of an enterprise's maturity in the domestic market, new challenges await when venturing abroad. Aspects such as brand building, supply chain management, compliance, cultural differences, and channel expansion all require reevaluation and adjustment.

To navigate these challenges, Chinese enterprises must find new strategies and methods for going global to ensure steady progress in international markets.

So, what's the right approach for Chinese enterprises going global in 2024?

I. Chinese Enterprises Embrace Globalization: New Phases and Challenges

In 1979, the Chinese government officially launched a strategy encouraging enterprises to "go out," and Chinese enterprises began their journey by exporting low-value-added products.

As the "go out" strategy deepened and domestic e-commerce platforms emerged, enterprises focused on cross-border e-commerce platform expansion, supply chain digitization, product compliance, and organizational capability enhancement.

The internet wave spurred enterprises to prioritize digital capability building, fueling the rise of numerous SaaS products. Website construction, data security management, marketing, and fiscal management became new focal points, catalyzing the emergence of SaaS vendors.

However, with the demographic dividend waning, enterprises under growth pressure must intensify R&D, invest in localized production capacity, create cost-effective products, and strengthen product and brand building to truly integrate into local markets.

If Phase 1 was an exploratory period focused on low prices, Phase 2 saw accelerated growth through cross-border e-commerce channels, and Phase 3 was marked by digitalization and localization efforts. The current era represents an upgrade towards crafting cost-effective products and establishing roots in overseas markets.

Yet, this isn't easy. Despite products like "Chuan Beii Pi Pa Gao" and "Lao Gan Ma" being Amazon bestsellers, they mainly target overseas Chinese rather than integrating into local consumer markets.

This sparks new thinking: How can Chinese enterprises truly localize and win broader market recognition when going global?

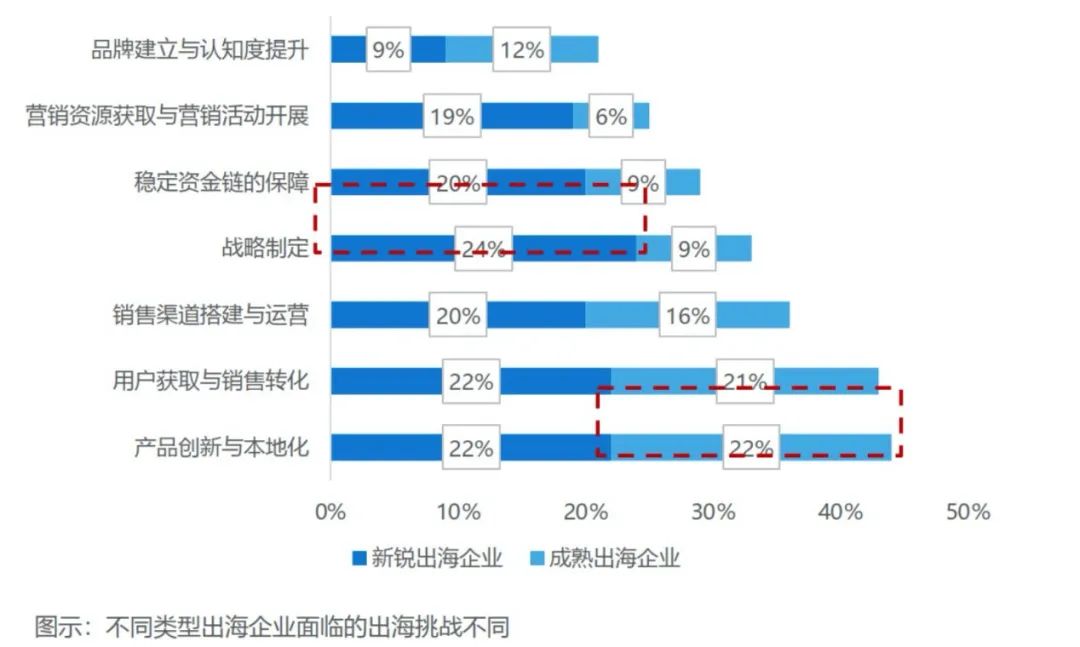

According to Beyondclick's "2023 Chinese Enterprise Going Global Confidence Report," different types of enterprises face varying challenges. Beyond tools, enterprises must address compliance, supply chains, branding, channels, and cultural differences.

Image source: 36Kr Research Institute's "2023-2024 Report on the Development of Chinese Enterprises Going Global"

This complex demand signifies a new, comprehensive challenge.

Even with strong technical and pricing capabilities, products struggle to reach target audiences without effective sales channels, hindering sales growth.

Sales channel challenges often relate to digital technology and online platforms, requiring robust local IT infrastructure for data processing and analysis to facilitate efficient sales and marketing activities. Weak IT systems can lead to inefficient sales channels and impact overall performance.

Solving these challenges isn't straightforward with a single service provider or solution. Instead, it's interconnected, necessitating a holistic enterprise ecosystem to coordinate resources and support, enabling enterprises to tackle complex globalization challenges.

A fact must be acknowledged: Domestic success models don't directly translate to overseas markets. Chinese enterprises must develop a model tailored to their unique business characteristics and adapted to overseas market environments.

This model transcends IT infrastructure, encompassing compliance, supply chain management, sales channels, and cultural integration to strengthen localized brand building in international markets.

II. A New Ecosystem Answer

In 2023, China's auto industry reached a new peak in going global, with production and sales exceeding 30 million vehicles and exports topping 5 million, making China the world's largest auto exporter.

Data Source: Compiled from public data

However, there's more to this story than numbers. Chinese automakers are building a comprehensive, multidimensional ecosystem to navigate globalization's new phase.

First, they partner with consulting firms to ensure compliance with local laws, taxes, environmental regulations, and labor laws, crucial for navigating regulatory challenges.

Second, collaborations with local suppliers leverage their strong local service networks to help automakers adapt quickly, gain cultural insights, and address cultural adaptation challenges.

Moreover, partnerships with technology providers ensure fast, stable networks, supporting smart driving experiences and addressing overseas markets' infrastructure needs.

Collaborations with local dealers establish sales and distribution channels, addressing challenges in building overseas sales networks through direct stores or e-commerce platforms.

These strategies enable Chinese automakers to tackle overseas challenges, collaborate with global partners, empower brand building, and achieve sustained success.

Saudi Arabia's connected vehicle ecosystem exemplifies how compliance, channels, supply chains, and cultural integration enhance competitiveness, market adaptability, and brand reputation.

This integrated technology, market, and cultural ecosystem provides comprehensive globalization solutions, enabling Chinese automakers to truly settle in overseas markets and collaborate on brand influence.

Notably, cloud vendors play pivotal roles in automakers' globalization strategies, leveraging global deployment capabilities, local supplier resources, and extensive customer channels.

Over 20 years, Huawei trained over 18,000 IT engineers in Saudi Arabia and partnered with over 500 local suppliers, rapidly establishing a strong presence through market synergies and brand effects.

In September 2022, Huawei Cloud launched its Riyadh 3AZ node, offering localized cloud services in Saudi Arabia. Chery Automobile, the first Chinese automaker to invest in Saudi Arabia, announced new car models integrated with Huawei Cloud's connected vehicle services.

In the new era of globalization, Chinese enterprises going global is no longer just "going out" but requires a comprehensive, collaborative ecosystem to truly "settle in." This represents a strategic upgrade and capability leap.

Chinese enterprises need an ecosystem to succeed globally.

III. The New Era of Globalization: Ecosystem Foundation and Joint Roots Abroad

What's the ideal ecosystem model for Chinese enterprises to take root abroad?

Going global involves more than exploring new markets and sales opportunities; it's about establishing long-term, stable presences overseas.

This process necessitates a holistic ecosystem encompassing compliance, markets, supply chains, and culture. In this new era of globalization, such ecosystems are forming, providing a solid foundation for Chinese enterprises' overseas expansion.

Many enterprises leverage cloud vendors to expand and deepen their global footprints.

E-commerce industries use cloud services for personalized recommendations, inventory management, and logistics optimization, enhancing customer experience and operational efficiency. Audio-visual industries leverage cloud computing's processing power to deliver high-quality media content globally. In government and enterprise sectors, cloud services' security and reliability provide critical data management and analysis tools.

Cloud vendors have inherent advantages in ecosystem building. Huawei Cloud, for instance, boasts over 45,000 global partners, including over 6,700 overseas partners.

These partners span e-commerce, gaming, audio-visual, and government sectors, forming a diversified network that accelerates market adaptation and deepens local understanding and engagement.

Infrastructure is crucial for globalization. Cloud vendors deploy local nodes globally, ensuring service accessibility and stability. Huawei Cloud's presence in 33 regions and 93 availability zones serves 170 countries and regions with stable, high-quality cloud services.

This cloud vendor-led ecosystem supports individual enterprises and catalyzes industry innovation and growth. For instance, Kingsoft Office and WPS's close collaboration with Huawei Cloud and other partners has yielded remarkable international achievements, fostering global brand building and continuous business innovation.

Recently, Huawei Cloud launched Boosting 2.0, enhancing service scenarios, capabilities, and regions, providing more comprehensive support for going global enterprises, improving operational efficiency, and unlocking new business opportunities.

From localization to technological innovation and ecosystem integration, Huawei Cloud and other Chinese enterprises are becoming integral ecosystem components.

Crucially, compared to foreign cloud vendors, domestic cloud service providers better understand local enterprises' needs, business models, cultural environments, and organizational cultures. This deep understanding enables them to offer tailored services and products, better supporting enterprises' development.

For decades, Chinese enterprises' globalization largely meant simply "going out," with few truly taking root overseas. Today, with Huawei Cloud and more enterprises uniting under a robust ecosystem, new foundations and leverage points for Chinese enterprises' globalization are emerging.