Alibaba: The decline of Tmall drags down the group, while other subsidiaries hold up half the sky

![]() 08/16 2024

08/16 2024

![]() 517

517

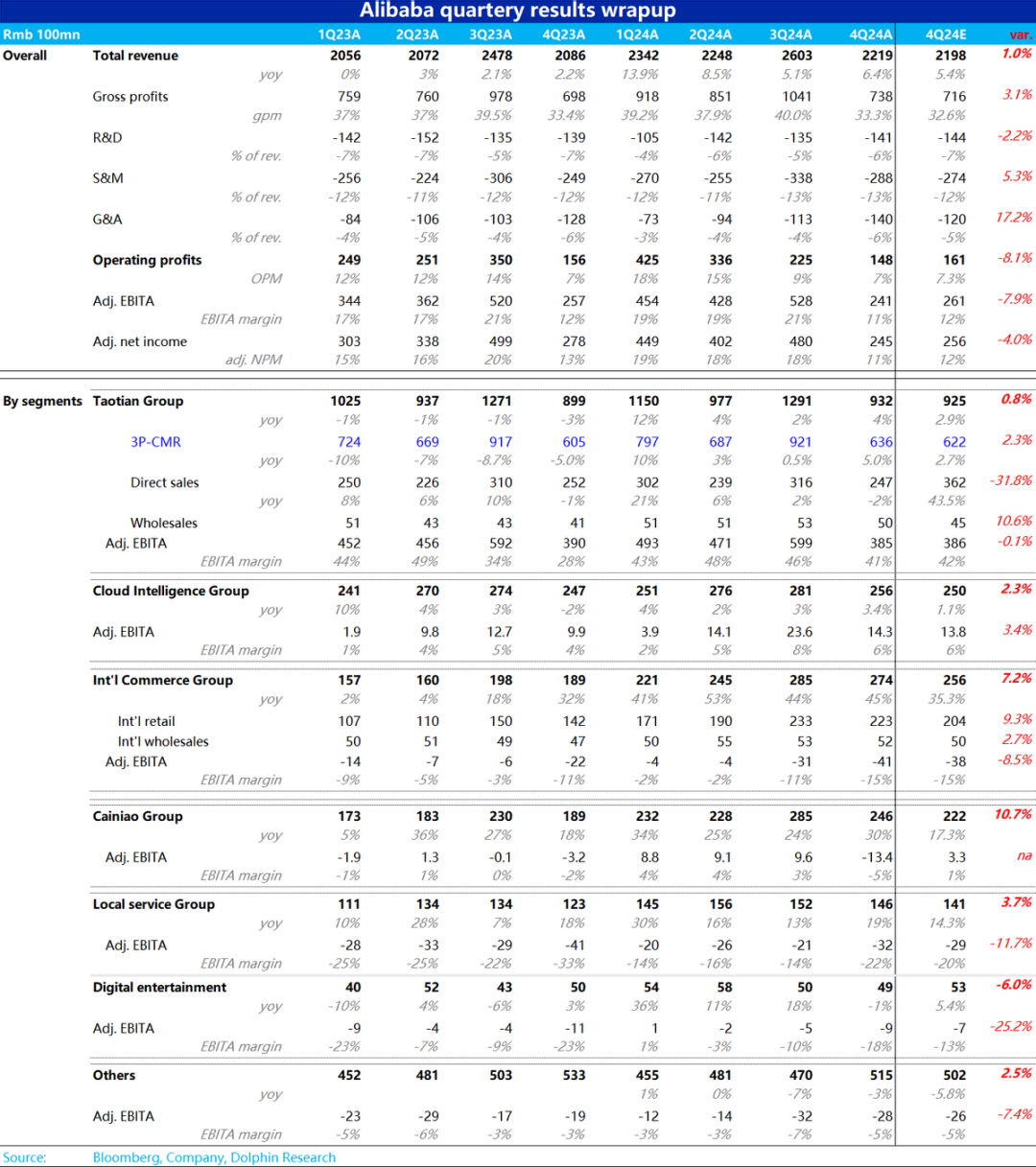

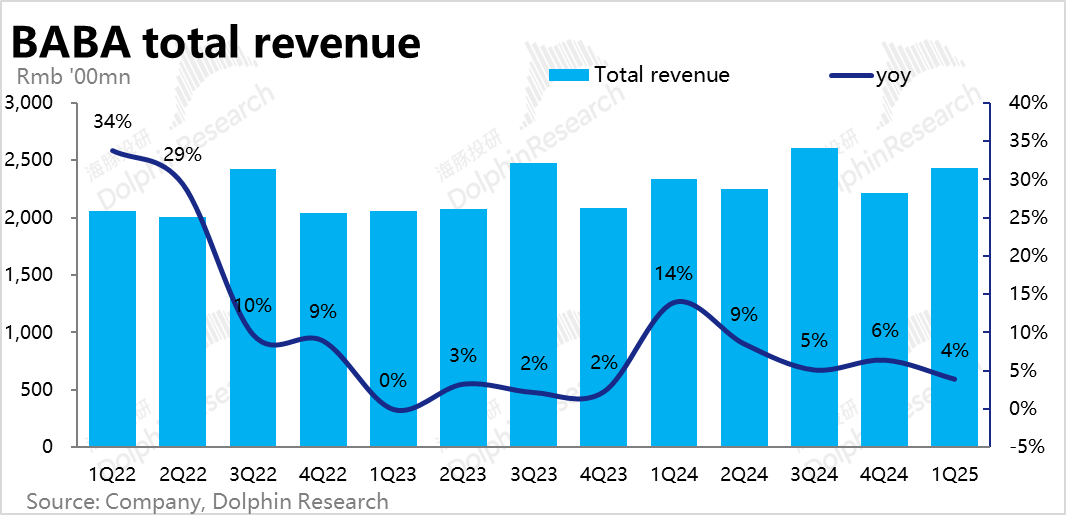

Although Alibaba's share price has been lackluster, it has always been a focus of market attention and a key recommendation for sellers. Alibaba Group recently announced its first quarterly report for fiscal year 2025. How did it perform? Here's Dolphin Investment Research's take:

I. Increased shareholder returns

According to the company's disclosure, Alibaba repurchased a total of $5.8 billion in shares during the quarter ending June, an increase from the previous quarter's $4.8 billion. If the repurchase pace continues in the second half, the annualized total repurchase amount could exceed $21 billion. Assuming Alibaba distributes at least $2.5 billion in dividends this fiscal year, with its current market value of less than $190 billion, the direct shareholder return rate could exceed 12%. Even among dividend stocks, few can match Alibaba's return rate. However, it's worth noting that Alibaba's net cash on hand has dropped to approximately RMB 300 billion. With an annualized operating cash flow slightly below RMB 140 billion, considering the AI capex requirements, even if there is an annualized repurchase and dividend of $20 billion+, it's likely to be a one-time occurrence.

II. Key answer: Tmall, once a pillar, now a drag

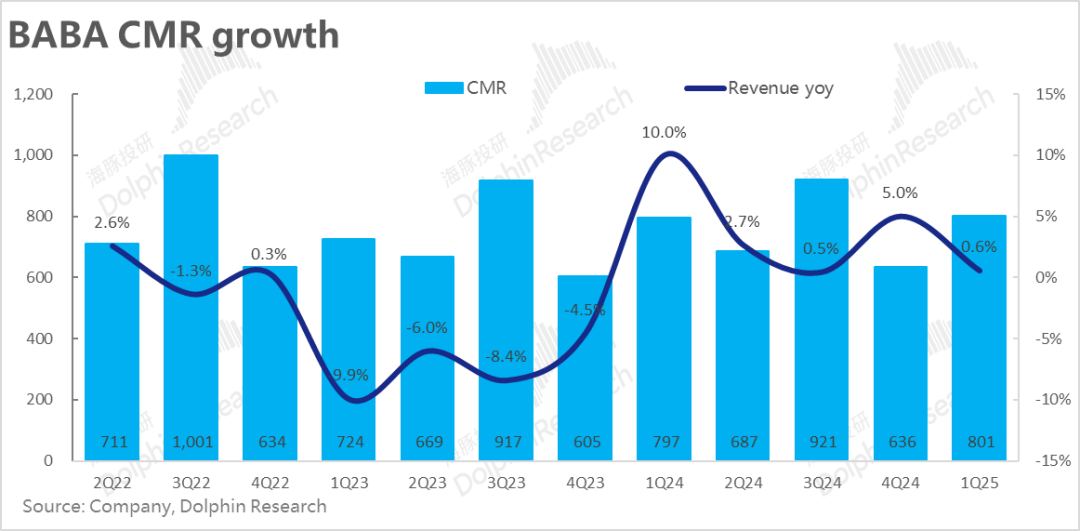

The market's expectations for Alibaba's core Tmall business were already conservative. With overall online retail sales declining by 1.4% YoY in June and growing by just 6.4% YoY in Q2, market expectations for Tmall's CMR growth fell to a low-single-digit rate of 2.7% for the quarter, with EBITA still expected to decline YoY.

In reality, Tmall's GMV and order volume, excluding cancellations, grew at a mid-to-high single-digit and double-digit rate, respectively, which is not bad. However, Tmall's customer management revenue (CMR) grew by just 0.6%, significantly underperforming even conservative expectations. This suggests that Tmall's take rate has declined due to favoring small and medium-sized merchants, and it's also possible that advertisers have reduced their budgets amid a weaker economic environment.

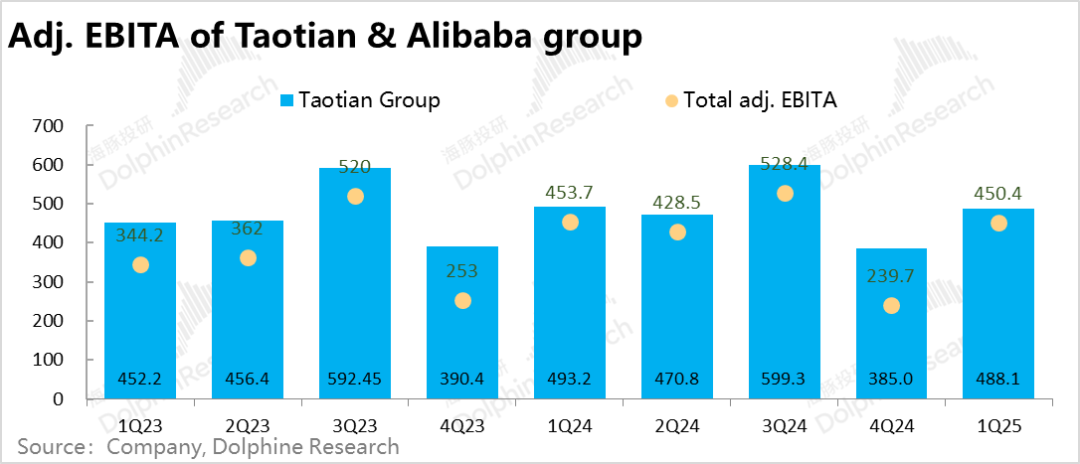

At the profit level, Tmall's adjusted EBITA declined by about 1% YoY, in line with expectations but without any surprises. While the double-digit growth in 88VIP memberships indicates potential improvements in user experience, which is good news for Tmall's long-term business ecosystem, the stagnation in revenue growth and continued decline in profits are undoubtedly disappointing for investors. In the short term, the market, which functions more as a voting machine than a weighing machine, has responded negatively.

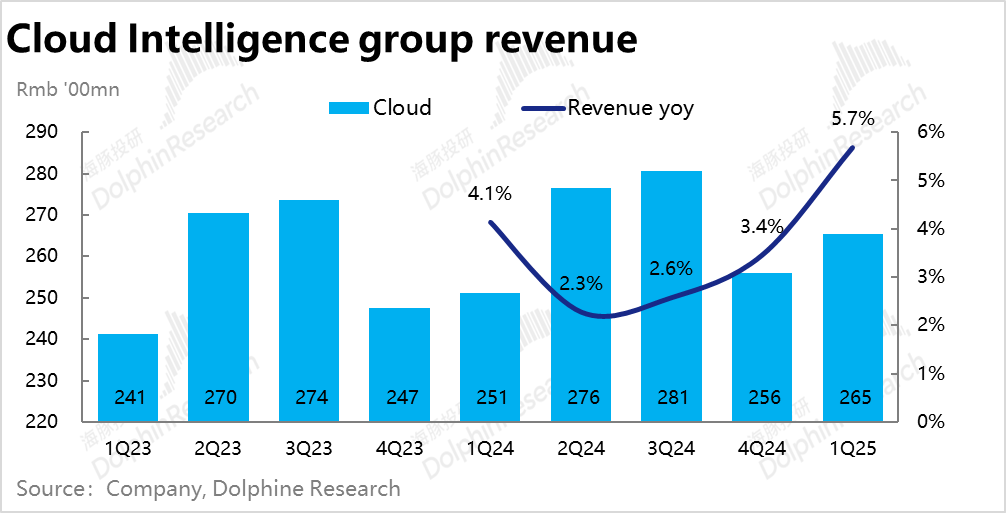

III. Key answer: Alibaba Cloud grows revenue and profits, can it hold up half the sky?

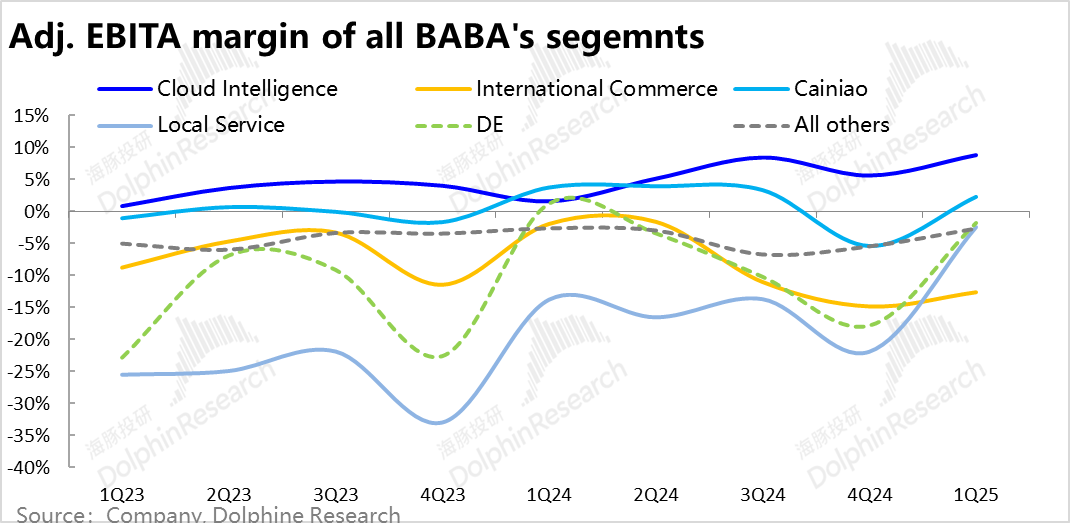

Alibaba Cloud, the group's second most important segment, has struggled with single-digit revenue growth over the past two fiscal years. Its lack of growth has been a major concern. However, after reducing inefficient projects and navigating a major customer's lease termination, management stated that cloud business growth would rebound to double digits in the second half of the year.

In reality, Alibaba Cloud generated RMB 26.5 billion in revenue during the quarter, with YoY growth accelerating to 5.7%, slightly above expectations. The continuous acceleration in revenue growth over the past few quarters has reassured investors about the company's ability to deliver on management's guidance.

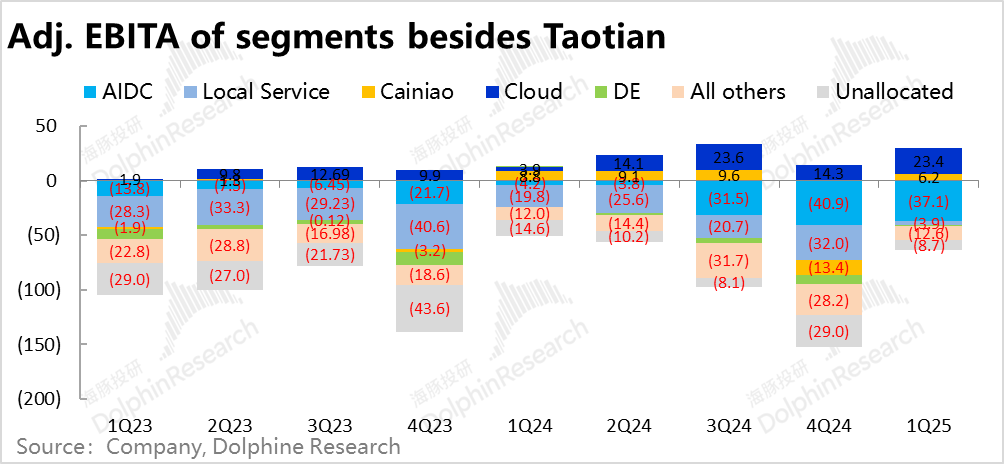

Simultaneously, Alibaba Cloud's adjusted EBITA profit reached RMB 2.3 billion, up over 60% QoQ and exceeding market expectations by a similar margin. While the market had expected some improvement in Alibaba Cloud's growth due to AI investments, the nearly "perfect" performance of both revenue and profit growth is likely to prompt the market to recognize and price in the potential multi-billion-dollar valuation of this segment.

IV. Key answer: International e-commerce slows but reduces losses, entering into refined operations

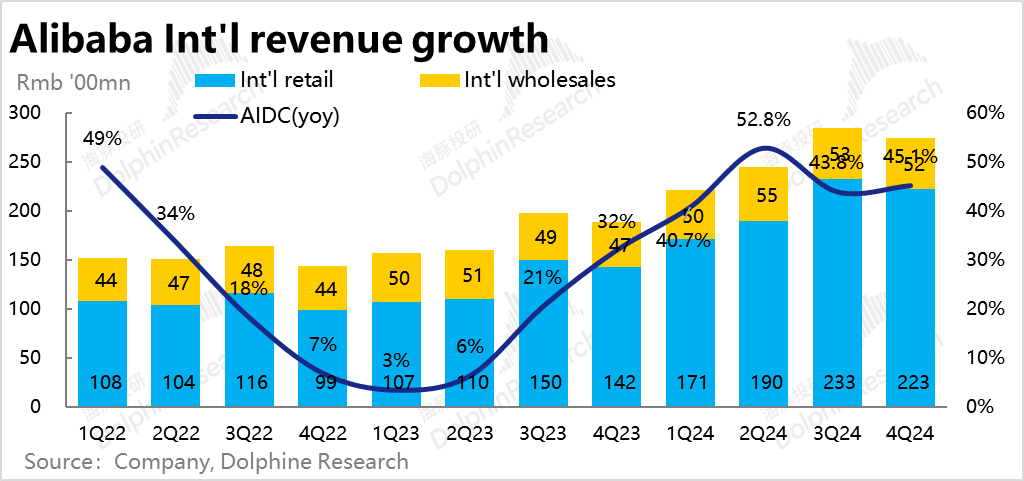

Alibaba's international e-commerce segment, which has the second-largest revenue, previously experienced rapid growth but also incurred widening losses, leading to concerns about when it would become profitable. This quarter, the segment shifted from an aggressive growth strategy to refined operations.

Revenue grew 32.4% YoY but decelerated by nearly 13 percentage points QoQ, in line with market expectations. The main driver was the slowdown in international retail sales growth from 56% to 38% YoY. International wholesale sales continued to grow at a double-digit rate. However, the slowdown in growth was accompanied by a narrowing of losses, with adjusted EBITA losses shrinking by about 9% QoQ to RMB 3.7 billion, lower than the expected RMB 3.9 billion loss.

The QoQ reduction in EBITA losses (EBITA loss rate down 2.2 percentage points) marks the entry into refined operations and significant improvement in unit economics. If international business turns profitable sooner than expected, the market may be more inclined to value this segment separately. Looking ahead, Dolphin Investment Research believes that balancing investment and losses while maintaining solid growth will be a core challenge for the international segment.

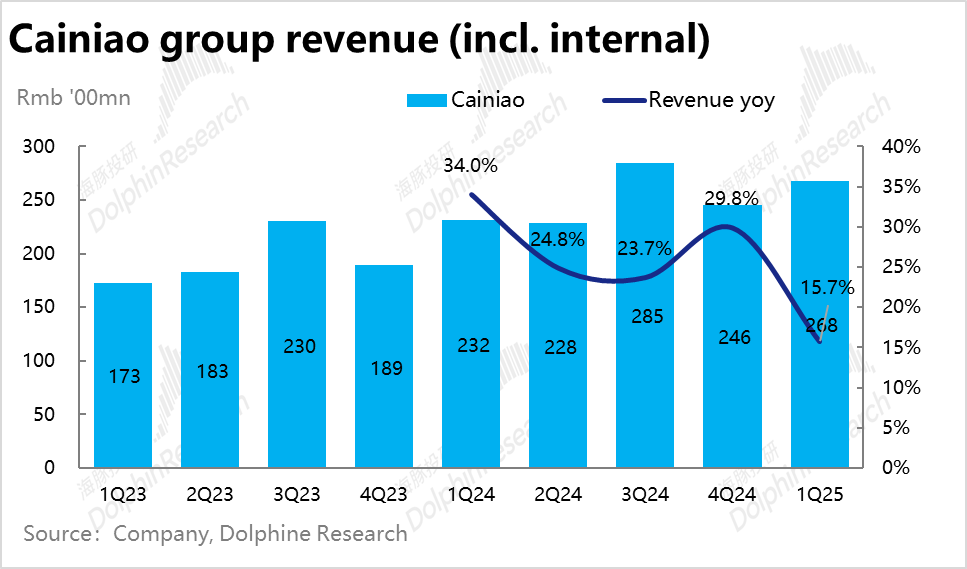

V. Cainiao turns profitable through refined operations

Closely tied to the development of international business, Cainiao's revenue growth decelerated by about 14 percentage points YoY to 15.7%, similar to the deceleration in the AIDC segment. Surprisingly, Cainiao's adjusted EBITA swung from a loss of RMB 1.3 billion in the previous quarter to a profit of RMB 620 million, significantly better than the expected loss of RMB 250 million. This reflects the significant improvement in unit economics after shifting to refined operations.

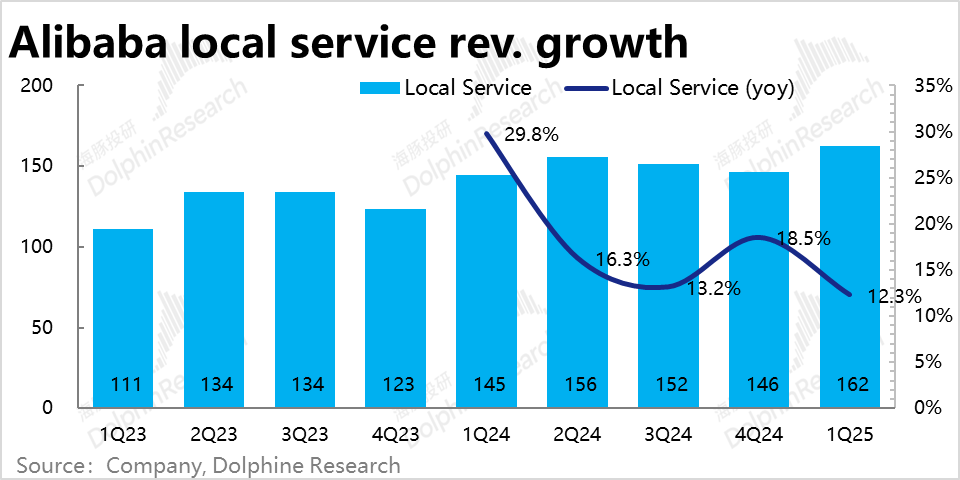

VI. Local services significantly reduce losses, on the verge of profitability?

Alibaba's local services revenue grew 12.3% YoY, slower than the previous quarter but in line with market expectations. Local services' adjusted EBITA losses narrowed significantly to RMB 390 million, well below the expected loss of RMB 2 billion, approaching breakeven.

VII. Media and Entertainment and 'N' companies also highlight loss reduction: Media and Entertainment's losses narrowed to nearly RMB 100 million, significantly lower than the expected loss of RMB 400 million. However, the sustainability of such loss reductions remains to be seen, as the segment has experienced significant loss reductions and even profitability in the past. The combined adjusted EBITA losses of 'N' companies narrowed to RMB 1.26 billion, significantly lower than the expected loss of RMB 1.6 billion.

VIII. Increased expenses lead to YoY decline in group profits: Despite cost-cutting and asset divestitures, Alibaba's adjusted gross margin improved by 0.9 percentage points YoY. However, total operating expenses (excluding share-based compensation) increased by over RMB 9 billion YoY, resulting in a 0.85 percentage point decline in adjusted EBITA margin. While total profit exceeded expectations by RMB 2.5 billion, it was still slightly lower YoY by about RMB 300 million.

Dolphin Investment Research's Viewpoint:

Overall, Alibaba's performance this quarter was weighed down by negative YoY growth in both revenue and profits, particularly from Tmall, which underperformed even conservative market expectations. It's fair to say that Alibaba invested but failed to generate meaningful growth, despite potential improvements in user engagement and experience.

While Tmall, as the group's largest subsidiary, struggled, the good news is that other subsidiaries are rapidly reducing losses and moving towards profitability following the 1+6+N restructuring. With Tmall no longer subsidizing other businesses, subsidiaries have significantly exceeded loss reduction expectations, with Alibaba Cloud and Cainiao achieving notable profits. As subsidiaries approach profitability, investors may be more willing to assign positive valuations to all Alibaba's businesses, either through SOTP or a holistic approach.

At the current stage, Dolphin Investment Research's assessment of Alibaba's investment value is as follows:

Downside: With annualized repurchases and dividends exceeding $20 billion against a market capitalization of less than $200 billion, shareholder direct returns exceeding 10% provide a solid floor for Alibaba's valuation, even if its core Tmall business fails to improve significantly.

Upside: Upcoming technological advancements and southbound capital inflows could serve as short-term positive catalysts. Fundamentally, Tmall's new 0.6% technical service fee is expected to generate significant additional revenue and profits. While it's difficult to predict future consumption trends, expected improvements in Tmall's take rate could bring CMR growth closer to GMV growth. Additionally, other businesses like Alibaba Cloud and international e-commerce are expected to deliver growth and profit improvements, potentially leading to a revaluation of Alibaba's overall valuation.

Detailed Performance Analysis

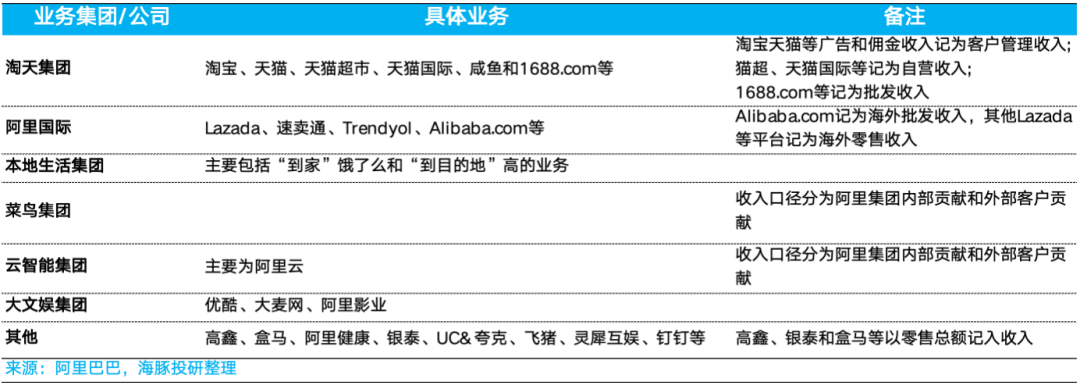

I. Alibaba's New Financial Reporting Framework

Starting in June 2023, Alibaba significantly adjusted its financial reporting framework. Here's an overview to aid understanding of subsequent analysis:

1) Tmall Group: Taobao, Tmall, Tmall Supermarket + Import Direct Sales; Domestic Wholesale

2) International Group: Cross-border Retail (AliExpress), Cross-border Wholesale (Alibaba.com), Overseas Local Retail (Lazada, Trendyol, etc.)

3) Local Services: Ele.me and Amap

4) Cainiao Group: Similar to before, but now includes revenue generated by serving other Alibaba Group businesses as customers

5) Intelligent Cloud Group: Alibaba Cloud; DingTalk was spun off in Q3 2023

6) Media and Entertainment Group: Youku and Ali Group Pictures

7) All Others: RT-Mart, Hema, AliHealth, Intime Retail (self-operated new retail with offline presence, formerly part of Domestic Commerce); Lingxi Interactive, UC Browser, Quark (formerly in Media and Entertainment); Fliggy (formerly in Local Services); DingTalk (formerly in Cloud)

II. Tmall, once the leader, now the biggest burden

After the new management team set a top-level strategy for Taobao and Tmall to focus on users, measures like tilting traffic towards small and medium-sized merchants and offering discounts to consumers resulted in order growth > GMV growth > revenue growth > profit growth, which has been a hallmark of Tmall's performance in recent quarters.

This quarter, due to weak retail sales data, market expectations for Tmall's growth were conservative. Many sell-side analysts expected CMR growth of around 3%. In reality, Tmall's order volume grew at a double-digit rate, and GMV grew at a mid-to-high single-digit rate, both impressive figures. However, domestic retail CMR grew by just 0.6% YoY, well below even conservative expectations, marking a significant miss.

While order volume and GMV grew well, revenue significantly underperformed, indicating a more severe decline in take rate due to the tilt towards small and medium-sized merchants than expected. It's also possible that advertisers reduced their budgets.

Despite the revenue miss, Tmall's adjusted EBITA declined by about 1% YoY, in line with expectations but without surprises. While the double-digit growth in 88VIP memberships suggests improvements in user experience, a key focus for Tmall, these improvements did not translate into meaningful growth in revenue or profits. In the short term, the market, functioning more as a voting machine than a weighing machine, responded negatively.

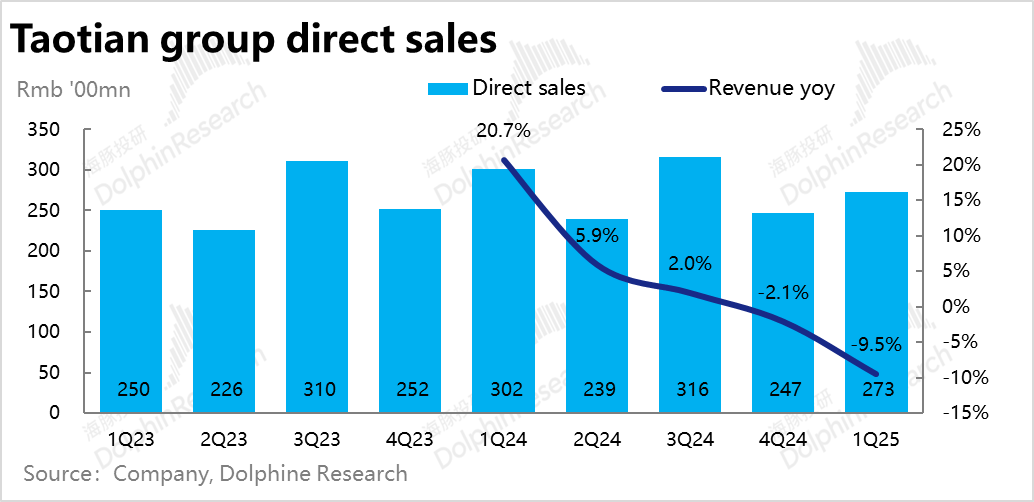

III. Heavy asset self-operated business: fighting for survival?

After restructuring and adjusting its financial reporting framework, Alibaba retained only core online self-operated businesses like Tmall Supermarket and Tmall Global. Self-operated retail revenue declined by 9.5% YoY to RMB 27.3 billion, significantly below market expectations by RMB 16 billion. This significant revenue contraction cannot be solely attributed to weak consumer sentiment and must also stem from Alibaba's proactive de-stocking. According to the company, it has exited some self-operated consumer electronics and home appliance businesses to focus more on daily necessities and groceries. While the new management team's focus on divesting heavy assets is understandable, the side effects of this proactive de-stocking may have been excessive.

Alibaba.com, as a key pillar of Tmall's "value-for-money" strategy, achieved 16.1% YoY revenue growth this quarter, a notable achievement, driven by its transformation to a 2C model and its role in cross-border e-commerce supply chains.

Overall, due to the more severe and anti-slip growth of CMR and a significant decline in self-operated retail revenue, Taobao Tianmao Group's revenue for this quarter decreased by 1.4% year-on-year, 3.6% lower than market expectations.

IV. Overseas growth slows, but losses narrow, indicating more balanced growth

Amidst the intense competition in domestic e-commerce, expanding overseas through cross-border e-commerce has become a consensus among domestic internet companies since 2023. However, the previously rapid growth in international business was accompanied by continually expanding losses, sparking concerns about when these businesses would become profitable.

This quarter, the international business shifted from an aggressive expansion strategy to a more refined operational approach. International e-commerce revenue grew by 32.4% year-on-year, but decelerated by nearly 13 percentage points quarter-on-quarter. The market had anticipated this deceleration, with consensus estimates at just 33.4% growth. Notably, the year-on-year growth rate of international retail business declined from 56% to 38%, while international wholesale business maintained a 12% growth rate without deceleration. However, the company did not officially disclose the growth rate of international business orders, which showed a noticeable slowdown.

Accompanying the slowdown in growth, the losses in the international segment also narrowed. The adjusted EBITA (excluding share-based compensation expenses and amortization expenses) of the international business group contracted by approximately 9% quarter-on-quarter to RMB 3.7 billion. Although the market had expected a narrowing of losses, the actual figure was still lower than the market's estimate of RMB 3.9 billion in losses. Despite over 30% revenue growth, the narrowing of losses (with EBITA margin improving by 2.2 percentage points quarter-on-quarter) indicates that overseas operations have entered a stage of refined operations, with marked improvements in unit economics. If the international business can turn profitable earlier than expected, the market may be more willing to assign a separate valuation to this segment.

V. Symbiotic with AIDC, Cainiao also experiences slower growth but turns profitable

With the booming cross-border business, Cainiao has developed a nearly symbiotic relationship with overseas expansion. Cainiao is a direct beneficiary of the warehousing and logistics services required to support the rapid growth of cross-border e-commerce. Due to the slowdown in international e-commerce growth, Cainiao's total revenue for this quarter was RMB 24.6 billion, with year-on-year growth also significantly decelerating by approximately 14 percentage points to 15.7%, similar to the deceleration seen in the AIDC segment. However, Cainiao's adjusted EBITA turned positive this quarter, from a loss of RMB 1.3 billion in the previous quarter to a profit of RMB 620 million, significantly better than the market's expectation of a loss of RMB 250 million. This reflects marked improvements in the unit economics of the logistics segment after shifting to refined operations.

VI. Alibaba Cloud generates both revenue and profit growth; can the group's second pillar support the sky?

Alibaba Cloud, the second pillar of Alibaba Group's market value, has also included internal revenue in its reported figures after restructuring. This quarter, Alibaba Cloud generated revenue of RMB 26.5 billion, with year-on-year growth continuing to accelerate to 5.7%, approximately 1 percentage point higher than expectations. Earlier, management had announced that cloud business growth would return to double-digit percentages in the second half of 2024, and this quarter's significantly higher growth rate provided a boost of confidence in management's guidance.

This marks Alibaba Cloud's path to recovery after proactively abandoning low-quality private/hybrid cloud business and overcoming the impact of a major customer. Additionally, the company disclosed that the number of users on its AI platform, Bailian, increased by 200% quarter-on-quarter, suggesting that AI development could bring significant incremental growth to Alibaba Cloud.

Concurrently, Alibaba Cloud's adjusted EBITA profit for this quarter reached RMB 2.3 billion, an increase of over 60% quarter-on-quarter, exceeding market expectations by a similar margin. While the market had anticipated some improvement in Alibaba Cloud's growth, it had not expected such a substantial increase in profitability this quarter, which may reflect the profit margins released from eliminating low-quality projects. Future attention should be given to whether this profit level can be sustained.

VII. Local services significantly reduce losses, approaching break-even

Alibaba's local services revenue grew by 12.3% this quarter, a notable slowdown from the previous quarter but within market expectations and thus not considered bad news. Concurrently, the local services segment's losses (adjusted EBITA) significantly narrowed to RMB 390 million, far lower than market expectations of RMB 2 billion in losses and approaching break-even. This substantial reduction in losses for the local services segment was unexpected and, if sustained, could potentially unlock a separate valuation for the segment. Furthermore, the marked improvement in Alibaba's local services profitability begs the question of whether similar improvements can be seen in Meituan and Didi's quarterly results.

VIII. Entertainment and other businesses also see significant loss reductions

While the losses in Alibaba's core businesses expanded, the more marginal entertainment and other 'N' companies also experienced notable loss reductions this quarter. The entertainment segment's losses narrowed to nearly RMB 100 million, significantly below market expectations of RMB 400 million in losses. However, the entertainment segment has historically seen substantial loss reductions or even profitability, so the sustainability of this trend remains to be seen. Meanwhile, the combined losses (adjusted EBITA) of the other 'N' companies narrowed to RMB 1.26 billion, significantly below market expectations of RMB 1.6 billion in losses. Facing pressure to become profitable and the potential for spin-offs, these 'N' companies are under intense pressure to generate revenue for the group.

IX. No longer reliant on Taobao Tianmao's financial support, subsidiaries strive for profitability

Due to Taobao Tianmao Group's negative growth and the significant slowdown in international, Cainiao, and local services growth (either due to a high base or proactive optimization), Alibaba Group's overall revenue growth significantly decelerated to 3.9% this quarter, with actual revenue 2.6% lower than expectations.

However, in terms of profits, while Taobao Tianmao Group's adjusted EBITA decreased by 1% year-on-year, other segments showed marked improvements. Alibaba Cloud's profit margin significantly improved, Cainiao turned profitable, and international e-commerce, local services, entertainment, and 'N' companies all saw notable loss reductions. As a result, the group's overall adjusted EBITA reached RMB 45 billion, RMB 2.5 billion higher than expectations. With Alibaba's restructuring into a 1+6+N model, the group has taken a solid step towards the goal of self-sufficiency for its subsidiaries.

X. High investment intensity leads to overall profit exceeding expectations but declining year-on-year

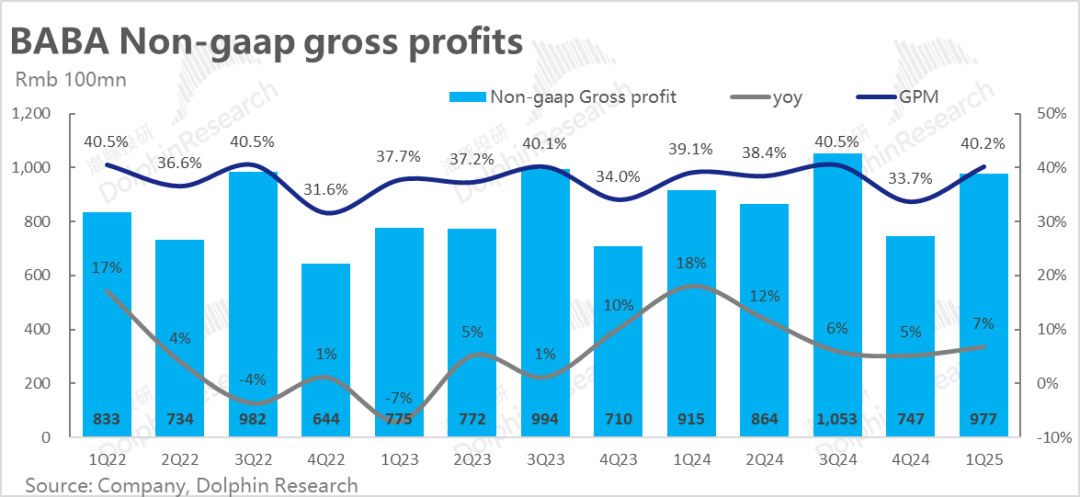

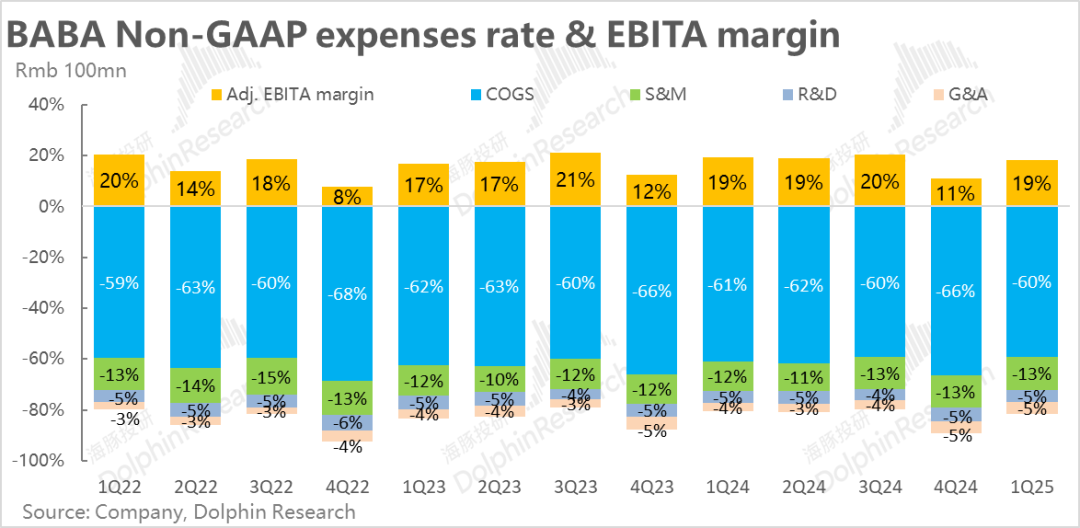

Regarding cost and expense changes, Alibaba's gross margin after excluding share-based compensation was 40.2% this quarter, an increase of 0.9 percentage points year-on-year. As Alibaba gradually abandons low-quality assets/businesses and subsidiaries reduce losses and improve efficiency, the group's overall gross margin should continue to improve in the medium term.

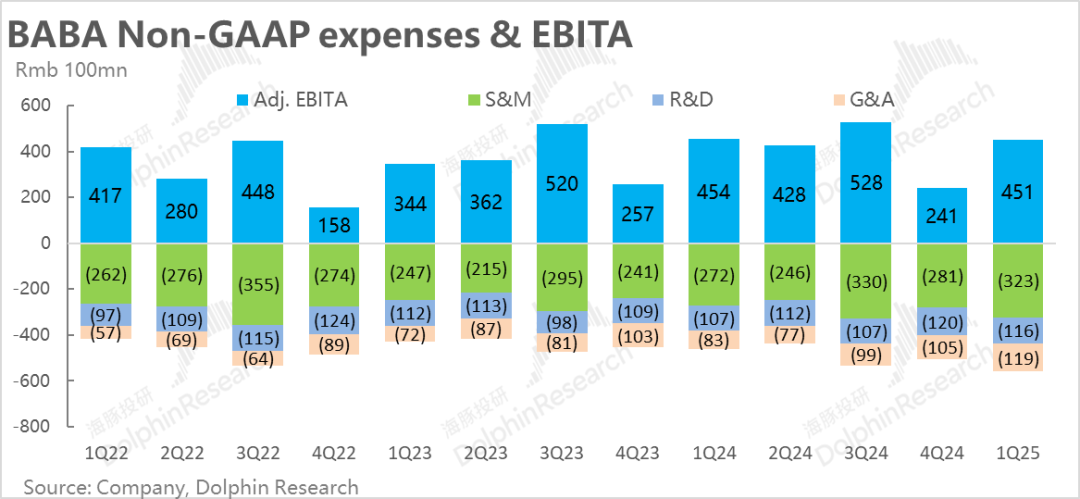

In terms of expenses, Alibaba announced its re-entry into an investment period. Marketing expenses increased by nearly RMB 5 billion year-on-year, R&D expenses increased by approximately RMB 900 million, and administrative expenses increased by RMB 3.6 billion year-on-year, indicating a substantial investment commitment. Despite a notable increase in expenses and a significant improvement in gross margin, resulting in profits significantly exceeding expectations, the group's overall adjusted EBITA margin still declined by 0.85 percentage points year-on-year, leading to a slight year-on-year decrease of approximately RMB 300 million in total profit.

- END -

// Reprint Authorization

This article is originally created by Dolphin Investment Research. For reprint, please obtain authorization.