Understanding JD.com's Strategy for Breaking the "Involution" Cycle Through Q2 Earnings

![]() 08/16 2024

08/16 2024

![]() 463

463

On August 15, JD.com released its Q2 and interim financial results, exceeding expectations.

In Q2, JD.com reported revenue of RMB 291.4 billion, with first-half revenue reaching RMB 551.4 billion, maintaining growth momentum. Net profit attributable to shareholders in Q2 reached RMB 14.5 billion, up 69% year-on-year, marking the first time net profit margin hit 5.0%.

As the company's "Fast, Convenient, Quality, and Affordable" user experience gained further traction, JD.com's quarterly active users and shopping frequency continued double-digit growth in Q2, with new merchant additions also seeing robust growth.

On the secondary market, driven by the positive earnings report, JD.com's U.S. shares rose more than 6% in pre-market trading to $27.47.

Amidst the industry's "involution" and price wars, JD.com rejected the involution trend, stuck to its long-term strategy, and once again reaped its just rewards.

01

Diversified Growth: Eye-catching Q2 Results

In recent years, as the era of internet traffic dividends wanes, the e-commerce market has shifted from incremental to stock-based, intensifying competition. Many e-commerce platforms have participated in the intense involution competition in pursuit of short-term benefits.

In the Q2 earnings call on August 15, JD.com stated that it would not seek unsustainable price advantages through subsidies. Over the past year, JD.com has proactively transformed around cost, efficiency, and user experience, creating tangible value for consumers and merchants while building a competitive edge and exceeding growth expectations.

In Q2 2024, JD.com's merchandise revenue was RMB 233.9 billion, accounting for 80.3% of total revenue, while service revenue was RMB 57.5 billion, accounting for 19.7%. Platform advertising and other service revenue reached RMB 23.4 billion, up 4.1% YoY, and logistics and other service revenue reached RMB 34.1 billion, up 7.9% YoY.

By business segment, JD.com Retail, JD.com Logistics, and New Business generated revenues of RMB 257.1 billion, RMB 44.2 billion, and RMB 4.6 billion, respectively, in Q2.

JD.com Logistics' operating profit has been profitable for five consecutive quarters, with the highest operating profit margin since its IPO.

Among the data, the growth momentum of JD.com's users and merchants is particularly noteworthy. In Q2, JD.com's quarterly active user growth and shopping frequency continued double-digit YoY growth, while new merchant additions grew 46% QoQ.

During JD.com's 618 Grand Promotion in Q2 2024, over 500 million users placed orders, setting new records for transaction volume and order volume. Both new and established merchants experienced significant sales growth, with over 150,000 SMEs seeing sales growth exceeding 50%.

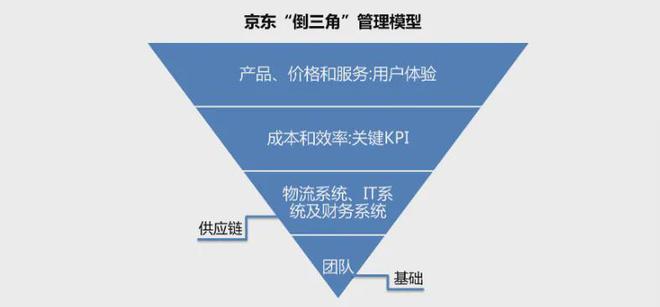

Since its inception, JD.com has been a unique player in the e-commerce space. Unlike platform-based models, JD.com's self-operated business model prioritizes user experience over transaction volume. In JD.com's famous inverted pyramid model, user experience takes precedence.

Over the years, JD.com has maintained strategic focus, rejected involution, and achieved long-term success in a competitive environment. 2024 is a year of execution for JD.com, based on a clear strategy.

So, how does JD.com achieve this?

02

Rejecting Involution, Committed to Long-Termism

In JD.com's inverted pyramid model, "products, prices, and services" are the three pillars of user experience. Users perceive JD.com through these three elements.

Since 2023, consumers have noticed JD.com's efforts to reduce prices, from the "Billion Subsidy" program, "9.9 Free Shipping," lower free shipping thresholds, "Refund without Return" service, to "Really Cheap" and "Even Cheaper" during Singles' Day, and procurement negotiations to lower costs.

In 2024, JD.com intensified its low-price strategy. In early August, it announced significant adjustments to the Billion Subsidy program, increasing subsidies for beauty products by over RMB 3 billion with no upper limit. It is estimated that these subsidies will reduce prices of participating beauty products by 10% to 30%.

Fundamentally, JD.com's low-price strategy enhances user experience.

Liu Qiangdong admitted that JD.com had given some consumers the impression of becoming more expensive. JD.com aims to serve diverse consumer segments, considering both wealthy and ordinary individuals. "Some families in China have never tasted high-quality kiwifruit. If we can make it affordable for them, that would be meaningful."

While reducing prices for self-operated products, JD.com also launched the "Spring Dawn Plan" to attract millions of merchants, broadening product offerings and low-price options.

In the first half of 2024, the "Spring Dawn Plan" was upgraded twice, with 32 measures to support merchants, enhancing operational efficiency and sales growth.

For example, in March, the "Spring Dawn Plan" offered AI tools for free to merchants across categories, covering store setup, image and video creation, customer service, and live streaming, saving merchants 50% in operational costs.

Beyond prices and products, JD.com also focuses on improving service experience, from lowering free shipping thresholds, implementing "Trade-In" subsidies in 20 provinces, expanding "Refund Only" to third-party merchants, and upgrading "Free Home Return" coverage to over 90% for third-party merchants.

JD.com understands that involution offers little long-term value to the e-commerce industry. Delivering tangible benefits to consumers and merchants is the true value, enabling the industry to break the involution cycle and achieve healthy, stable, and sustainable growth.

03

Continuous Investment in Difficult Yet Right Paths

Beyond products, prices, and services, JD.com's superior user experience stems from its robust supply chain infrastructure optimizing costs and efficiency.

Unlike "asset-light" platforms, JD.com invested heavily in self-built logistics in 2007. This heavy asset model enables strict control over the entire logistics process, enhancing efficiency and service quality, ultimately delivering an exceptional user experience and distinguishing JD.com from other e-commerce platforms.

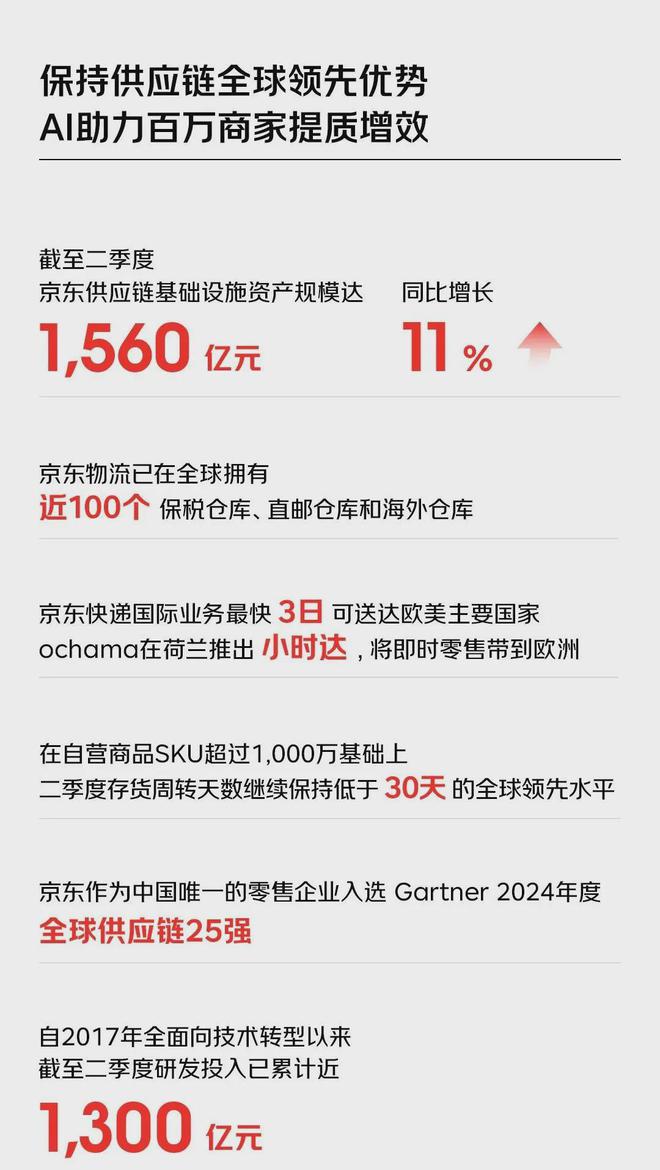

As of Q2 2024, JD.com's supply chain infrastructure assets totaled RMB 156 billion, up 11% YoY.

Since JD.com's technological transformation in 2017, it has invested nearly RMB 130 billion in R&D. This continuous investment has improved supply chain efficiency. In Q2, with over 10 million SKUs, JD.com maintained a global-leading inventory turnover of 29 days.

JD.com's investment and influence in the supply chain sector continued to grow, earning it a spot among Gartner's Top 25 Global Supply Chains of 2024 as the only Chinese retail company.

Notably, JD.com prioritizes employees, investing heavily in human capital.

In 2023, JD.com's total human resources expenditure reached RMB 104.7 billion, creating jobs for nearly 620,000 people.

In 2024, JD.com continued to boost employee compensation, particularly for frontline staff like procurement and customer service:

From January 1, annual fixed salaries for frontline staff like procurement increased nearly 100%, with an average raise of at least 20% for JD.com Retail employees.

During the Spring Festival, JD.com invested over RMB 500 million to subsidize delivery drivers working on the frontlines.

From February 1, over 20,000 frontline customer service staff received a salary increase of over 30%.

From July 1, annual fixed salaries for procurement staff increased from 16 to 20 months, with uncapped performance incentives.

In late July, JD.com opened "JD Youth City" in its HQ, providing nearly 4,000 furnished apartments for employees.

JD.com's deep investment in human resources stems from its insight into the nature of service businesses: Employees are the most valuable asset, and investing in them is a strategic long-term investment that will grow into a core competency over time.

04

Conclusion

Jeff Bezos once said that people often ask him about future trends over the next decade. "But hardly anyone asks me, 'What won't change over the next 10 years?'"

What endures over a decade is a steadfast commitment to long-term strategy and a belief in the future vision, qualities possessed by few companies.

JD.com's Q2 results showcase the triumph of long-termism, offering new perspectives for the involution-ridden e-commerce industry.

•END•