JD.com's "Dramatic Comeback”? Not Quite!

![]() 08/19 2024

08/19 2024

![]() 433

433

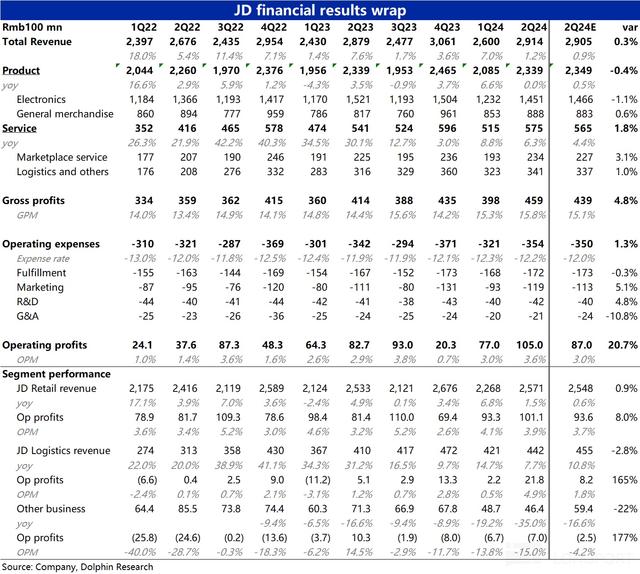

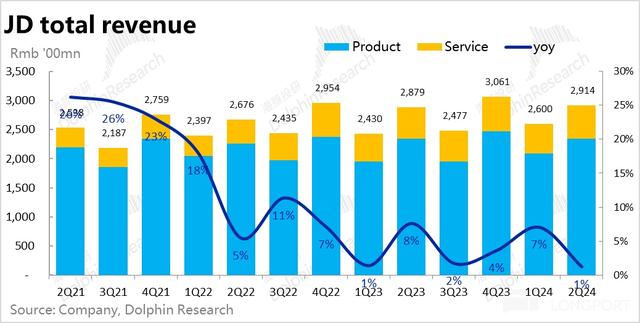

On the evening of August 15, Beijing time, before the U.S. stock market opened, JD.com (JD.US) released its second-quarter financial report for fiscal year 2024. In summary, the overall revenue growth rate was barely above 1%, which was quite weak, but slightly better than the more pessimistic expectations. The main highlight was that profit margins once again significantly exceeded expectations. The detailed key points are as follows:

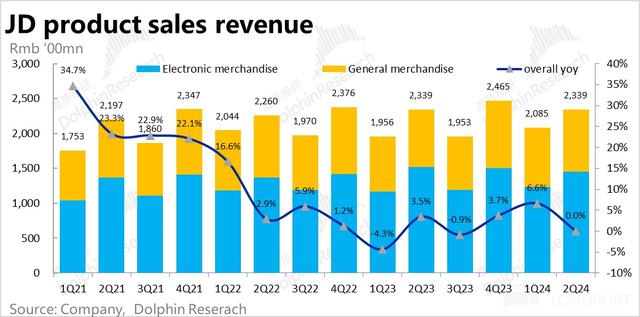

1. This quarter, JD.com's self-operated retail business generated revenue of RMB 233.9 billion, with near-zero year-on-year growth. Although market expectations were not high, the actual performance was still 0.4% lower than expectations. The overall online retail industry saw a 5.2% quarter-on-quarter decline in the second quarter, while JD.com's self-operated retail revenue growth rate fell by a relatively higher 6% quarter-on-quarter.

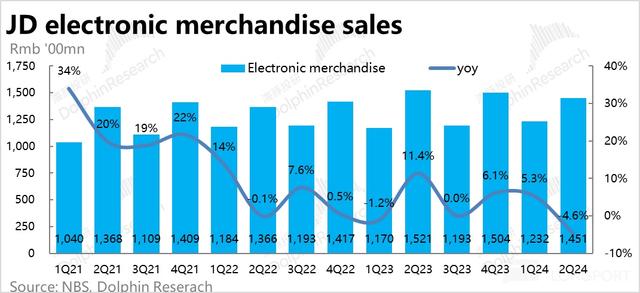

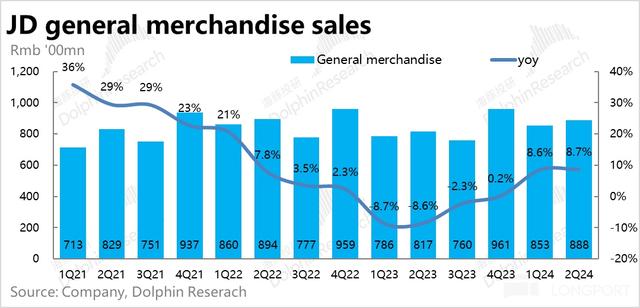

Specifically, the decline was mainly driven by a 4.6% year-on-year decrease in revenue from electrical appliances, mainly due to poor sales of popular summer appliances such as air conditioners and refrigerators, according to the company. After general merchandise retail surpassed the base period of mode changes, it continued to maintain a high growth rate of 8.7% this quarter, roughly the same as the previous quarter and slightly higher than expectations. JD.com performed better in high-frequency consumer goods such as supermarkets and daily necessities.

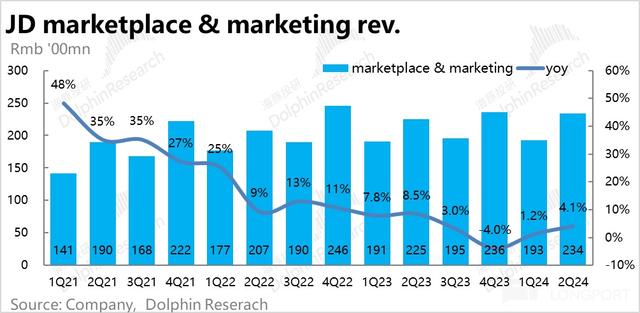

2. Commission and advertising business revenue for this quarter was RMB 23.4 billion, representing a year-on-year increase of 4% and a noticeable acceleration (nearly 3 percentage points) quarter-on-quarter, outperforming market expectations. According to the company, this growth was primarily attributed to strong advertising revenue growth (double-digit growth), which drove the increase in service revenue. JD.com's support for third-party sellers (3P business) has finally started to bear some fruit.

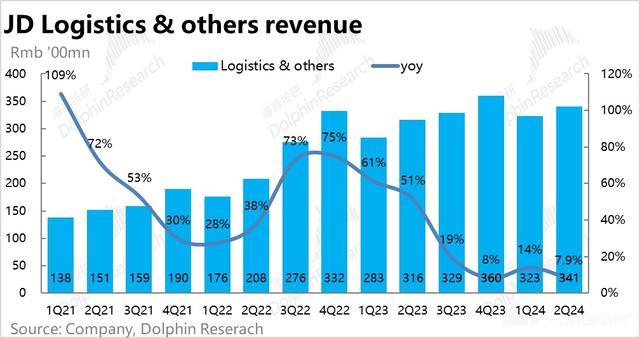

3. Revenue growth in the logistics segment decelerated by approximately 6-7 percentage points quarter-on-quarter to 7.9%, roughly in line with the deceleration in self-operated retail revenue. Although growth slowed, expectations were not high, and actual performance was slightly better than expected (1%). Overall, the performance of logistics and retail businesses was roughly matched, representing a neutral performance.

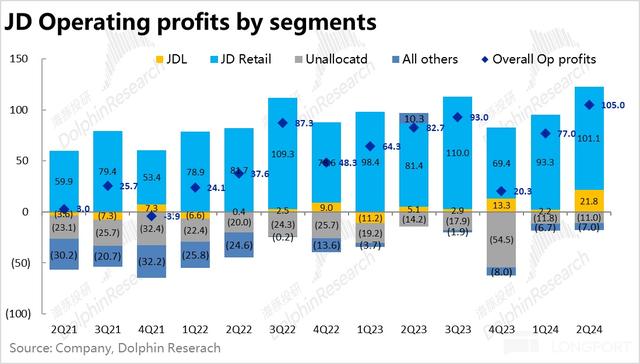

4. Despite a comprehensive slowdown in revenue growth across various businesses, JD.com's profit performance was quite impressive this quarter. The group as a whole achieved an operating profit of RMB 10.5 billion, representing a year-on-year increase of 27% and significantly exceeding market expectations of RMB 8.7 billion.

Among them, the core JD Mall achieved an operating profit of RMB 10.1 billion, up 24% year-on-year, significantly higher than market expectations of RMB 9.36 billion. Due to the company's previously conservative guidance of seeking only flat year-on-year profit growth, increased marketing investments, subsidies of up to RMB 10 billion, and lower free shipping thresholds were not conducive to profit margins. The market did not have high expectations for the mall segment's profits.

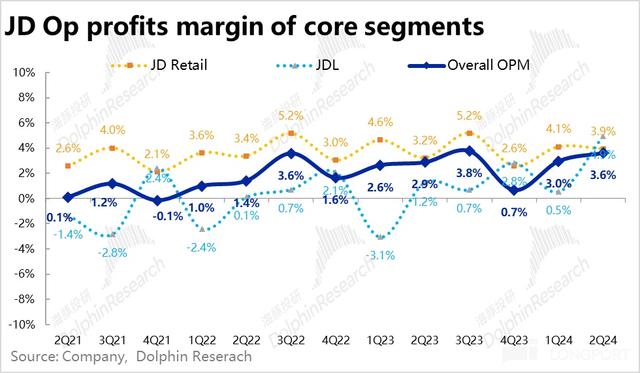

Furthermore, although JD Logistics' growth decelerated significantly this quarter and was slightly below expectations, its profit release was quite astonishing, achieving an operating profit of RMB 2.18 billion, far exceeding market expectations of RMB 820 million. The operating profit margin reached 4.9%, the highest level in history excluding the outlier of Q2 2020 due to the pandemic. It can be inferred that internal cost reduction or efficiency optimization measures have been implemented on a large scale.

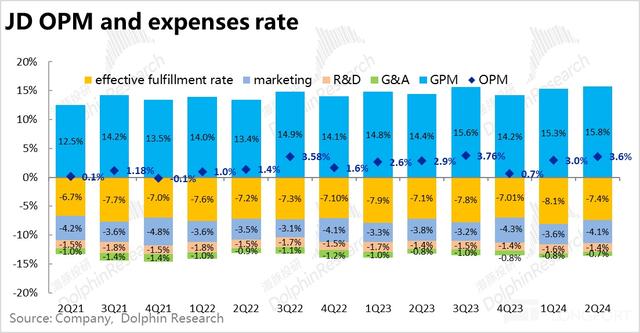

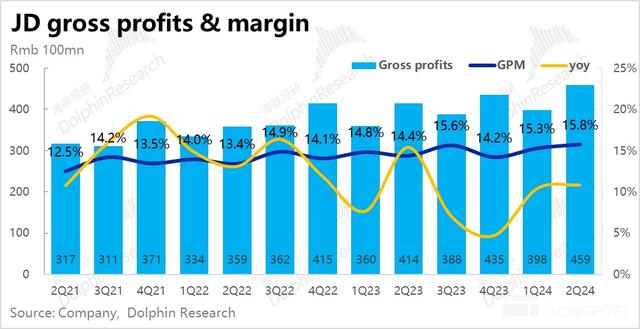

5. From a cost and expense perspective, the biggest contributor to the quarter's profit exceeding expectations was the increase in gross profit margin. Despite revenue growth decelerating significantly and barely exceeding 1% year-on-year, gross profit growth increased to 10.9%, with a gap of over 9 percentage points compared to revenue growth. Gross profit exceeded market expectations by RMB 2 billion, undoubtedly the biggest contributor.

The gross profit margin reached 15.8%, continuing to rise by 0.5 percentage points quarter-on-quarter and 1.4 percentage points year-on-year. According to the company, this was primarily due to its position as the largest single retailer, which allowed it to optimize procurement processes, reduce procurement costs, and achieve a gross margin increase that exceeded expectations.

In terms of expenses, marketing expenses were RMB 11.9 billion, an increase of approximately RMB 800 million year-on-year, reflecting increased brand promotion and subsidies, which were higher than the expected RMB 11.3 billion. Research and development expenses increased by only RMB 100 million year-on-year, while administrative expenses decreased. Overall, equity-based compensation decreased by more than 30%. It can be seen that while JD.com is not hesitant to invest in promotions and fulfillment to drive growth, it remains quite frugal with internal expenses, maintaining its cost-saving and efficiency-enhancing nature. Overall, the company's total operating expenses amounted to RMB 35.4 billion, slightly higher than market expectations by RMB 400 million.

Dolphin Investment Research View:

Overall, in a relatively weak macroeconomic environment, JD.com's growth performance was also quite weak, underperforming the overall retail sales growth. Although the company disclosed low-to-mid-single-digit gross merchandise value (GMV) growth and double-digit order growth, neither translated into revenue growth. It seems that the company is gaining attention without seeing tangible financial benefits, akin to “busywork” with little tangible reward.

The difference is that while JD.com had previously released pessimistic revenue and profit guidance of zero growth, there has been an improvement on the profit side. However, the real marginal benefit for JD.com as an online retailer in this earnings report is:

a. On the gross margin front, after Alibaba strategically retreated from self-operated retail, JD.com, as a retailer that bears inventory risks, faced more aggressive price negotiations with suppliers, squeezing out some gross margin gains.

b. As an online retailer that operates both the merchandise flow and logistics in-house, JD.com has greater ability to squeeze costs from marginal areas.

c. According to research, in the process of promoting subsidies for home appliances, due to the more transparent nature of online retail transactions and JD.com's self-operated retail model, the gross margin exceeded expectations. Dolphin Investment Research does not rule out that JD.com may have benefited to some extent from the government's policy to promote equipment upgrades.

Due to the actual profit performance exceeding expectations, JD.com revised its guidance, changing the previously projected zero growth in both revenue and profit to an adjusted net profit guidance for the full year that was increased to double-digit growth.

However, in fact, the first half of the year already saw a year-on-year increase of 45%, raising questions about whether the second half will perform even better. The gross margin exceeding expectations due to procurement price negotiations and the company's private communication during earnings calls indicating that low prices rely on procurement negotiations for self-operated products suggest that JD.com's future remains tied to self-operated retail.

Given that self-operated retail is currently growing at a slower pace than overall retail sales, Dolphin Investment Research still believes that JD.com is the weakest link in the current environment of consumer price reductions and intensifying industry competition. In this context, the so-called profit exceeding expectations is only a short-term stimulus, and without self-operated retail growth, stock price support primarily comes from shareholder buybacks.

Regarding buybacks, JD.com's momentum has noticeably weakened: during the quarter, JD.com repurchased shares worth a cumulative USD 2.1 billion, and in the entire first half of the year, it repurchased 7.1% of its total share capital. Even after excluding the dilutive effect of the previously issued USD 1.5 billion in convertible bonds, which amounted to approximately 2.9% of the total share capital, the total share capital was still reduced by 4.2%.

However, one issue is that JD.com currently has only USD 400 million remaining in its buyback authorization. Therefore, without an increase in the authorization, it will not be able to maintain its current buyback pace in the second half of the year. Furthermore, JD.com has privately expressed that conducting high-intensity buybacks in the short term within the current authorization limit would be challenging.

Therefore, regarding JD.com's financial report, Dolphin Investment Research believes that the marginal benefit of profit exceeding expectations primarily leads to a short-term recovery from overly pessimistic expectations. Another source of stock price support—buybacks—appears to be trending downward in the future, while long-term stock price support—the growth of self-operated retail—remains uncertain. The core electrical products business remains sluggish even with the stimulus of equipment upgrades. Before a clear revenue growth inflection point emerges, the time has not yet come to be bullish on JD.com in the long run.

Detailed Interpretation of This Quarter's Financial Report:

Weakness in Electrical Appliances, Strength in FMCG and 3P

1. The largest segment, self-operated retail, generated revenue of RMB 233.9 billion this quarter, representing near-zero year-on-year growth. Although market expectations were already low, actual performance was still 0.4% lower than expected. Compared to the overall online retail industry's 5.2% quarter-on-quarter decline in the second quarter, JD.com's self-operated retail revenue growth decelerated by more than 6% quarter-on-quarter, a higher deceleration rate than the industry average.

Specifically, the significant year-on-year decline of 4.6% in revenue from electrical appliances was a notable drag, exceeding market expectations of a 3.6% decline. According to the company, this was mainly due to poor sales of popular summer appliances such as air conditioners and refrigerators.

After overcoming the base period of the transition from self-operated to 3P mode, general merchandise retail continued to maintain a high growth rate of 8.7% this quarter, roughly the same as the previous quarter and slightly higher than expectations. This suggests that JD.com's focus is more on high-frequency or reinforced categories such as supermarkets, daily necessities, apparel, and beauty products.

However, it is important to note that lowering the free shipping threshold for self-operated products will further delay the break-even point for self-operated supermarket-like businesses.

2. Platform service revenue: The commission and advertising business, primarily targeting 3P sellers, generated revenue of RMB 23.4 billion this quarter, representing a year-on-year increase of 4% and a noticeable acceleration (nearly 3 percentage points) quarter-on-quarter, outperforming market expectations. According to the company, this growth was primarily driven by strong advertising revenue growth (double-digit growth), which fueled the increase in service revenue. While we cannot definitively determine how much of this growth stems from increased 3P business GMV and how much from improved take rates, it is clear that JD.com's support for its 3P business is starting to pay off.

3. Logistics and Other Services: Including JD Logistics and Dada Quick Delivery, the logistics segment's revenue growth decelerated by approximately 6 percentage points year-on-year to 7.9%, roughly in line with the deceleration in self-operated retail revenue. Although growth slowed, it was slightly better than expected (1%). Overall, the performance of the retail segment was matched, representing a neutral performance.

Weak Growth, But Profit Release Far Exceeds Expectations

Summarizing the above business segments, JD.com achieved total revenue growth of 1.2% year-on-year to RMB 291.4 billion this quarter. Although the absolute growth rate of just over 1% is relatively weak, it was not entirely unexpected given the lower market expectations of only 0.9%. JD.com has been significantly impacted during the deleveraging and consumption downgrade period.

Looking at the performance of each segment in detail:

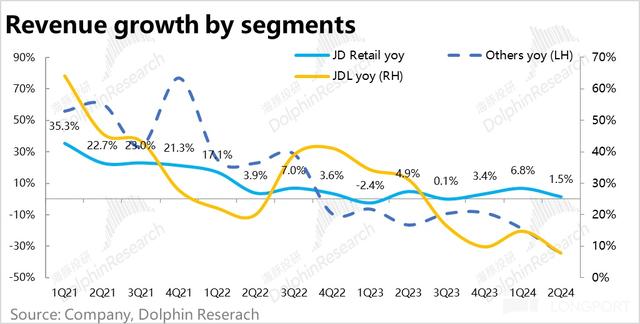

1) Core JD Mall revenue grew 1.5% year-on-year this quarter, decelerating by 5.3 percentage points quarter-on-quarter but slightly better than the expected 0.6%.

2) JD Logistics (JDL) revenue was RMB 44.2 billion this quarter, with growth decelerating by 7 percentage points quarter-on-quarter to 7.7%.

3) Including Dada and other innovative businesses, revenue declined by 35% year-on-year, significantly below expectations. Since Dada has not disclosed its own results separately, we cannot break down the performance. However, it can be inferred that JD.com is continuing to aggressively downsize unprofitable marginal businesses.

Despite a comprehensive slowdown in revenue growth across various businesses, JD.com's profit performance was quite impressive this quarter. The group as a whole achieved an operating profit of RMB 10.5 billion, representing a year-on-year increase of 27% and significantly exceeding market expectations of RMB 8.7 billion.

Looking at each segment specifically:

1) JD Mall achieved an operating profit of RMB 10.1 billion, up 24% year-on-year, significantly higher than market expectations of RMB 9.36 billion. Due to the company's previously conservative guidance of seeking only flat year-on-year profit growth, a series of measures such as subsidies of up to RMB 10 billion, increased marketing, and lower free shipping thresholds have so far only demonstrated that 1P (first-party) remains the core of JD.com as an online retailer, while 3P (third-party) has always been a “supplement” to expand product offerings, with the so-called concessions primarily serving as marketing gimmicks.

With 1P playing the lead role, it is not easy to truly pass on significant benefits to consumers. Instead, JD.com has balanced this by aggressively negotiating prices with suppliers after competitors in the 1P model gradually exited, achieving revenue stability while preserving its profit margins as much as possible.

2) JD Logistics, while experiencing significant growth deceleration and slightly missing expectations this quarter, delivered an astonishing profit release, achieving an operating profit of RMB 2.18 billion, far exceeding market expectations of RMB 820 million. The operating profit margin reached 4.9%, which, excluding the outlier of Q2 2020 due to the pandemic, is the highest in history.

Treating the 3% year-on-year increase in fulfillment expenses as internal logistics revenue growth, the significant slowdown in revenue growth to less than 8% likely indicates a similarly pronounced slowdown in external logistics revenue growth.

Combined with the fact that many express delivery peers such as ZTO Express are increasingly prioritizing profits over market share, and given that logistics is a business driven by both revenue growth and cost control, Dolphin Investment Research reasonably suspects that JD Logistics is once again focusing on cost containment to release profits.

3) Regarding other business segments including Dada and innovative businesses, although revenue has shrunk significantly, the quarter's losses were only slightly higher than expected at RMB 670 million, with a loss of RMB 670 million. Dada still incurred a loss of RMB 700 million this quarter, slightly wider than the previous quarter, with no significant signs of improvement.

Negotiating Lower Procurement Prices and Boosting Gross Margins: The Key to Profit Exceeding Expectations

From a cost and expense perspective, what is the source of the profit exceeding expectations in the mall and logistics segments?

On the gross margin front, despite significant revenue growth deceleration and a year-on-year increase of barely over 1%, gross profit growth increased to 10.9%, with a gap of over 9 percentage points compared to revenue growth and exceeding market expectations by RMB 2 billion, undoubtedly the biggest contributor to the profit exceeding expectations.

Gross margin reached 15.8%, continuing to rise by 0.5pct month-on-month and increasing by 1.4% compared to last year. Although there is a long-term trend of gross margin improvement due to the increase in the proportion of high-margin revenue from services such as 3P, the actual growth rate is still higher than expected. According to the company's explanation, this is mainly due to the company's advantage as the largest single retailer, which has optimized the procurement process, reduced procurement costs, and resulted in a higher-than-expected gross margin increase.

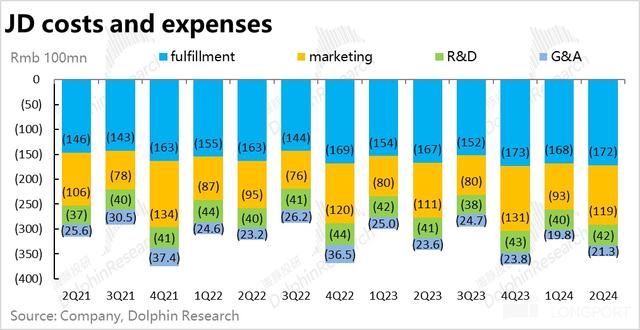

2. In terms of expenses, marketing expenses amounted to 11.9 billion yuan, an increase of approximately 800 million yuan year-on-year, reflecting an increase in brand promotion and subsidies, exceeding the expected 11.3 billion yuan.

Fulfillment expenses increased by only 3% year-on-year, slightly higher than the growth rate of self-operated retail, reflecting the results of lowering the free shipping threshold and the growth rate of order volume > GMV growth rate > revenue growth rate, but the deviation is not significant and within an acceptable range.

Among the relatively internal expenses, R&D expenses increased slightly by 100 million yuan year-on-year, while administrative expenses declined year-on-year. Equity incentives declined by more than 30% overall. It can be seen that while JD.com is not hesitant to invest in external growth drivers such as promotion and fulfillment, it remains quite "stingy" with internal expenses, and its essence of cost reduction and efficiency improvement remains unchanged.

Overall, the company's total operating expenses amounted to 35.4 billion yuan, slightly higher than market expectations by 400 million yuan. However, due to the higher gross margin increase, the final operating profit was still approximately 1.8 billion yuan (20.7%) higher than expected.