NIO, Xpeng, and Li Auto's share prices are trapped in the smart driving market

![]() 08/19 2024

08/19 2024

![]() 575

575

Commenting on automotive stocks for the week, observing the diversity of the automotive market.

After BYD shouted the slogan "electricity is cheaper than oil", the price war in the domestic new energy vehicle market has intensified. However, against this backdrop, NIO, Xpeng, and Li Auto have stabilized their deliveries in the first half of this year, and have even achieved a certain degree of year-on-year growth.

Specifically, NIO, Xpeng, and Li Auto delivered 87,400, 52,000, and 189,000 vehicles respectively in the first half of 2024, with year-on-year growth rates of 60.2%, 26%, and 35.87%, respectively, accounting for 38%, 18.6%, and 33.75% of their annual sales targets, respectively.

It is worth mentioning that there have been significant changes in the top five brands in terms of delivery volume among China's new-energy vehicle startups, shifting from NIO, Li Auto, WM Motor, Nezha, and Xpeng in 2020 to Li Auto, AITO, Aion, NIO, and Leapmotor. Additionally, brands with the imprint of traditional automakers, such as AITO, Aion, and Zeekr, have also risen to the top of the rankings.

Unlike Li Auto and NIO, which still rank high, Xpeng's sales lag significantly.

In addition to the reshuffling of NIO, Xpeng, and Li Auto, the list of delivery volumes of China's new-energy vehicle startups in the first half of 2024 has also seen the emergence of younger brands. For example, on March 28, 2024, Xiaomi released its first new-energy vehicle product, the Xiaomi SU7. The product has been highly sought after since its launch, with delivery volumes exceeding 10,000 in both June and July.

The rapid rise of relatively younger automakers such as AITO, Xiaomi, and Nezha within just a few years indicates that the first-mover advantage of new-energy vehicle startups like NIO, Xpeng, and Li Auto is not particularly pronounced. Latecomers can easily open up the market by building business moats in areas such as smart driving, marketing, and pricing.

Facing fierce market competition, NIO, Xpeng, and Li Auto have all sought changes this year, either by incubating new products or increasing investments in smart driving technology.

On NIO's side, in the first quarter of this year, NIO Chairman William Li stated during the earnings call that starting in June, NIO would focus on adjusting its product mix, increasing the proportion of high-margin products, and narrowing short-term promotional policies.

"On the whole, optimizing gross margins while ensuring steady sales growth is an important task for us in the next stage," Li said. He predicted that the company's gross margin on vehicle sales would return to double digits in the second quarter of this year and continue to improve in the third and fourth quarters.

Additionally, Li expressed high expectations for the newly launched Ledo brand, stating that the company's long-term business goal is to maintain a gross margin of over 15%. From a break-even perspective, Ledo needs to sell around 20,000 to 30,000 vehicles per month to achieve profitability.

However, Li also emphasized that the market competition in which Ledo operates is fierce, but the company will not sacrifice margins for sales. In Li's view, the launch of the Ledo brand will help NIO improve the efficiency of its entire production system, technology, services, and community capabilities, leading to cost reductions and efficiency gains.

According to Li, when Ledo's first model, the Ledo L60, is delivered in September, more than 100 offline stores will be operational nationwide. "Each Ledo sales store is expected to cost between 1 and 2 million yuan to invest in, which will not put too much pressure on the company," Li said.

However, despite NIO's listings in three markets this year, its share price performance has been challenging. In the U.S. market, the company's share price has been on a volatile downward trend since 2021, falling to single digits. In the Hong Kong market, NIO's share price decline began in the second half of 2022 and has since fallen by 80% from its peak of HK$199.20 per share in June 2022.

Some analysts point out that NIO's share price is closely related to its financial performance. Last year, NIO's net loss attributable to shareholders amounted to RMB 21.15 billion, representing a year-on-year increase of 45%. This was the second time since 2018 that NIO's net loss exceeded RMB 20 billion, following a loss of RMB 23.3 billion that year. From 2018 to 2023, NIO's cumulative net loss reached RMB 86.63 billion.

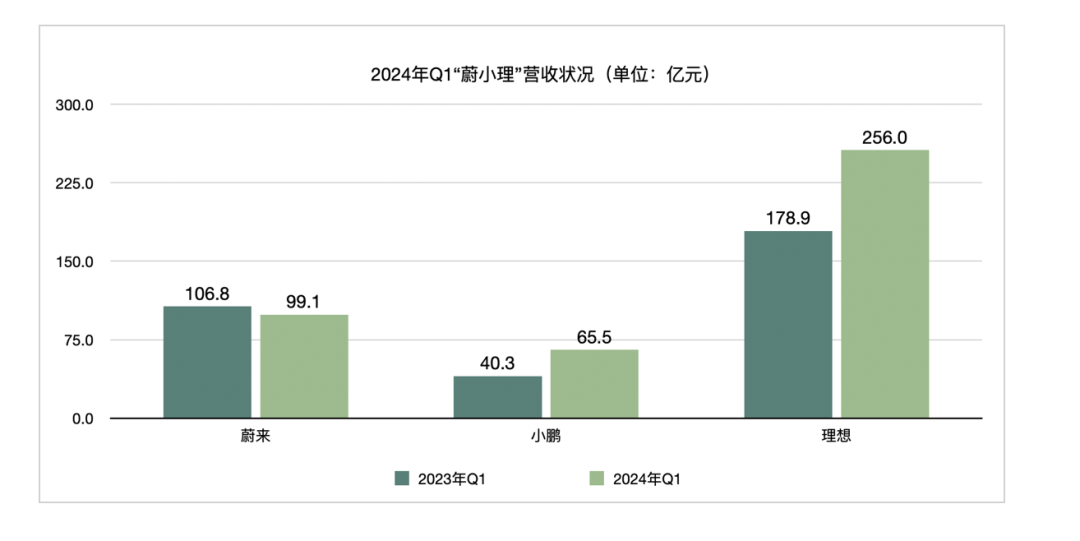

In the first quarter of this year, NIO's total revenue decreased by 7.2% year-on-year to RMB 9.909 billion, while its net loss widened by nearly 10% year-on-year to RMB 5.258 billion. Excluding share-based compensation expenses, the company's adjusted net loss in the first quarter was RMB 4.903 billion, an increase both year-on-year and quarter-on-quarter.

Amidst the fierce competition in the current new energy vehicle market, NIO, Xpeng, and Li Auto, as new-energy vehicle startups, each bear varying degrees of pressure. Xpeng continued to incur significant losses in the first quarter, although these losses narrowed year-on-year.

According to the financial report, Xpeng delivered 21,821 new vehicles in the first quarter, generating revenue of RMB 6.55 billion. Xpeng's gross margin surged to 12.9% in the first quarter, an increase of 11.2 percentage points year-on-year and 6.7 percentage points quarter-on-quarter. This boosted Xpeng's U.S.-listed share price, which rose as much as 26.19%.

According to Xpeng, the increase in "service and other revenue" was primarily due to the recognition of technology research and development service revenue related to the strategic technology cooperation between Xpeng and Volkswagen Group on platforms and software in the first quarter of 2024.

On April 17th of this year, Xpeng and Volkswagen Group announced their joint development of an electronic and electrical architecture. Under the agreement, the platform will integrate Xpeng's latest-generation central computing and domain controller-based electronic and electrical architecture, and the jointly developed architecture is expected to be applied to Volkswagen-brand electric vehicle models produced in China starting in 2026.

This means that Xpeng has begun to generate additional revenue sources through "technology exports" to Volkswagen. However, it is important to note that Xpeng is still incurring overall losses.

Like NIO, Xpeng has also unveiled a new series, MONA, aiming to popularize AI-driven smart vehicles. MONA's first product, positioned as a compact battery-electric sedan, is expected to be launched in the third quarter of 2024 with a price of approximately RMB 150,000.

"In the coming years, Xpeng will introduce multiple products on the A-segment platform and bring XNGP to this price range, popularizing high-level intelligent assisted driving in the largest sales price range," said He Xiaopeng.

Considering that both NIO and Xpeng are still incurring losses, their launch of lower-priced brands is apparently an attempt to follow the example of traditional automakers by spreading the high costs of technologies such as battery swapping and smart driving across higher-volume sub-brands, thereby expanding market influence and opening up profit margins.

Unlike NIO and Xpeng, which are incubating new products, Li Auto is focusing on addressing its shortcomings in smart driving technology.

According to media reports, Li Auto's smart driving leader Lang Xianpeng is leading a team of over 300 people to develop an end-to-end large model solution. "Development has been ongoing for over two months, and we expect results within the year," Li Auto announced on July 5th, unveiling its end-to-end autonomous driving technology architecture and launching an early access testing program for the new architecture. Clearly, Li Auto's smart driving technology is accelerating its rollout.

Li Auto's decision to increase investments in smart driving technology at this time is not accidental. Following the setback of the MEGA project, the launch of its pure electric product has been postponed until next year. In the second half of 2024, Li Auto faces a long product gap.

In the first quarter of this year, Li Auto's R&D expenses reached RMB 3 billion, a year-on-year increase of 64.6%, with progress made in intelligent driving, assisted driving, and active and passive safety technologies.

On the other hand, Li Auto is slightly ahead of NIO and Xpeng in terms of financial reporting.

According to the financial report, Li Auto delivered 80,400 vehicles in the first quarter of 2024, a significant year-on-year increase of 52.9%. However, revenue and net profit performance fell short of market expectations, with net profit declining by 36.7% year-on-year and 89.7% quarter-on-quarter.

It is worth mentioning that while Li Auto leads in sales among new-energy vehicle startups such as AITO, NIO, and Zeekr, its share price has fallen by nearly 60% from its intra-year high. Industry insiders attribute this decline in Li Auto's share price to factors such as the company's first-quarter 2024 financial results falling short of expectations, a sequential decline in vehicle sales revenue, and intensifying market competition.

Overall, while the new energy vehicle market has continued to grow since 2024, the growth rate has significantly declined, and market competition has intensified. The new-energy vehicle startups represented by NIO, Xpeng, and Li Auto have not been able to seize the market as they had hoped. Instead, under the siege of traditional automakers and new-generation automakers, NIO, Xpeng, and Li Auto are even feeling more pressure, and they will continue to compete fiercely in the coming period.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.