Silicon Valley AI “siege” and “counter-siege”

![]() 08/20 2024

08/20 2024

![]() 496

496

Author | Xuushan, Editor | Yifan

“

Tech giants use various tactics to acquire AI startups.

”

Wolves hunt in packs when necessary, meticulously planning each hunt. They often follow their prey, encouraging it to run, then strike at the right moment.

The same is true in Silicon Valley's “hunt”. Within just four days, three tech giants simultaneously targeted generative AI startups. On August 3, Google acquired the 30-person team behind Character.AI for a staggering $2.5 billion. On August 1, Microsoft officially declared OpenAI as a competitor in its search and advertising businesses. On July 31, Canva announced its acquisition of generative AI startup Leonardo.ai.

Caption: Leonardo.ai announces acquisition by Canva Source: Leonardo.ai website

Tech giants like Microsoft and Google, like wolves stalking their prey, wait for AI startups to validate their products in the market before swiftly striking with acquisition offers or competition, further consolidating their dominance in the industry.

Faced with the siege by tech giants, AI startups have varying responses. Some fiercely resist, while others eagerly await acquisition offers. “A year ago, I couldn't have imagined this,” says an investor with a long-term focus on the AI sector.

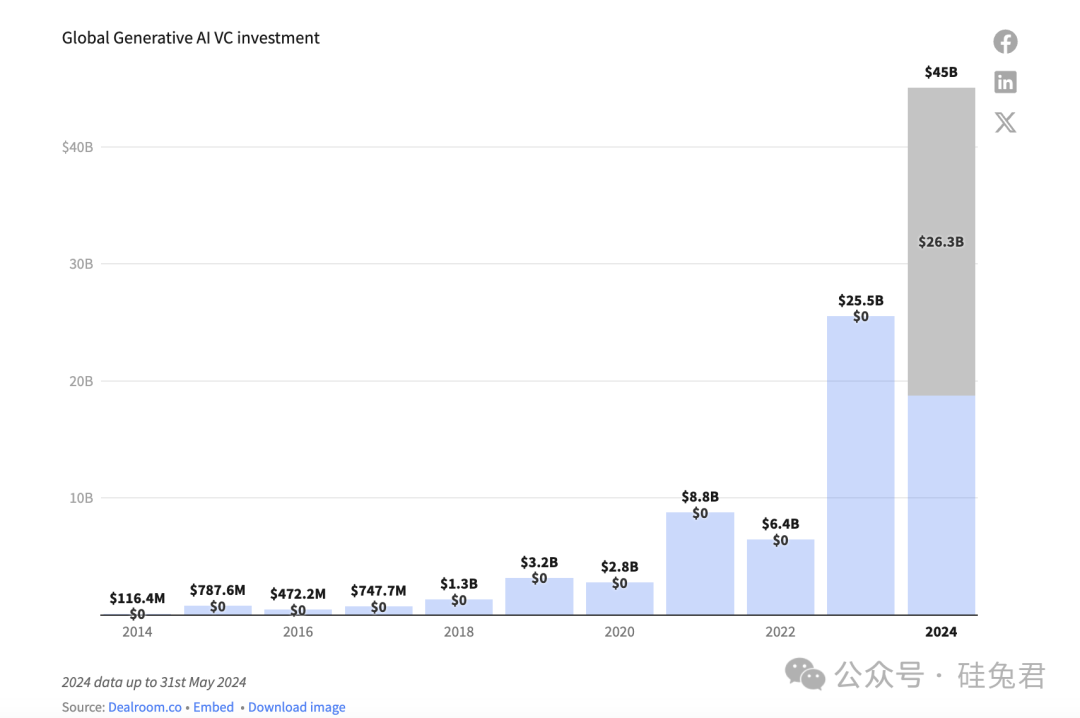

Just a year ago, AI startups were among the most sought-after in Silicon Valley. At its peak, investors had to queue up for meetings with executives from prominent AI startups. According to market analysis firm Dealroom, global funding for generative AI startups exceeded $25 billion in 2023 alone, making it a veritable goldmine.

Caption: Total VC investment in global generative AI startups Source: Dealroom

As everyone anticipated the generative AI sector's continued rise, many startups turned to internet giants for acquisition. “Not only were star AI startups receiving multiple acquisition inquiries, but the inboxes of internet giants were flooded with acquisition offers from generative AI startups,” a source told Silicon Bunny.

What are generative AI startups in Silicon Valley facing that makes them so eager for acquisition? How are internet giants acquiring these startups? Can the story of generative AI continue? The giants of the internet era are now launching a “siege” on startups in the “AI-native” era, and we're witnessing a shift in the offensive and defensive dynamics between generative AI startups and internet giants.

01

Tactics of giants in the siege of AI startups: chains of schemes, psychological warfare, and turning the tables

In this “siege” of generative AI, tech giants employ various tactics for strategic layout.

One of the most notable is Microsoft's chain of schemes against OpenAI.

Microsoft cleverly opened the door to OpenAI with an initial $1 billion investment, followed by an additional $2 billion to strengthen their partnership and secure Microsoft as OpenAI's exclusive cloud computing provider.

In January 2023, while other tech companies were still observing the generative AI landscape, Microsoft boldly invested up to $10 billion in a strategic partnership, binding itself tightly with OpenAI in terms of funding, technology, and future profit sharing. This move catapulted Microsoft into the spotlight, with its market value surpassing $3 trillion.

This $10 billion deal garnered much attention. According to Fortune magazine, the investment spans multiple phases: Phase 1 grants Microsoft 75% of OpenAI's profits until its investment is recouped; Phase 2 reduces Microsoft's share to 49% once OpenAI reaches a certain profit threshold, with the remainder going to other investors and employees; Phase 3 returns Microsoft's and other investors' shares to OpenAI's nonprofit foundation upon reaching an even higher profit milestone.

Microsoft stands to gain significantly. It can sell access to GPT through its Azure cloud service and compete directly with GPT through upcoming models. If OpenAI succeeds, Microsoft will recoup its $10 billion investment swiftly and capture nearly half of OpenAI's profits. At this stage, it's not far-fetched to say OpenAI is essentially working to repay Microsoft's debt.

In contrast, Google's acquisition of Character.AI resembles a well-orchestrated psychological warfare.

Internally, Google lured former employees Noam Shazeer and Daniel De Freitas, founders of Character.AI, back to the fold with generous compensation and nostalgia.

Externally, Google not only eliminated a formidable generative AI competitor but also demoralized other generative AI startups. Notably, Google acquired Character.AI for just $2.5 billion, half of Inflection AI's peak valuation of $5 billion despite being acquired by Microsoft for twice that amount just five months earlier. This valuation shrinkage reflects a more rational approach to generative AI.

This type of CEO acquisition, known as “synthetic acquisitions,” occurs due to regulatory pressures on large tech mergers and acquisitions, according to Chetan Puttagunta, partner at investment firm Benchmark.

Investors in these deals suffer no losses. According to The Information, Character.AI investors received at least 2.5 times their original investment, while Inflection AI investors will recoup 1.1 to 1.5 times their initial investment, partially due to the company's unspent funds. Additional returns may accrue if Inflection successfully develops new AI products.

“Capable companies build, incapable companies buy.” Unlike Microsoft and Google, Canva took a more direct approach, acquiring the entire Leonardo.ai team with a single move, turning the tables on the startup. With 150 million monthly active users across 190+ countries, Canva creates 200 designs per second on average. Leonardo.ai's addition enhances Canva's innovative product competitiveness.

This move allows Canva to quickly address its generative AI design gap, leveraging Leonardo.ai's innovation and market foundation to accelerate product development and iteration, setting it apart in the increasingly competitive AI design tool market.

Furthermore, tech giants excel at “horizontal and vertical integration,” injecting capital into generative AI startups to bring them into their ecosystems.

The generative AI industry spans upstream infrastructure like data centers and computing power, midstream AI model development, data processing, and development tools, to downstream diverse AI applications.

Caption: Artificial Intelligence Industry Map

Whether it's NVIDIA partnering with AI startups or Microsoft with AI application startups, by building generative AI ecosystems, tech giants leverage AI startups' capabilities to offer more comprehensive services and solutions, enhancing their market competitiveness.

NVIDIA excels at this, acquiring AI management startups like Run:ai and deep learning AI startup Deci, while investing in 14 generative AI startups including Mistral AI, Cohere, and Together AI.

Caption: North American tech giants' generative AI startup landscape (compiled by Silicon Bunny)

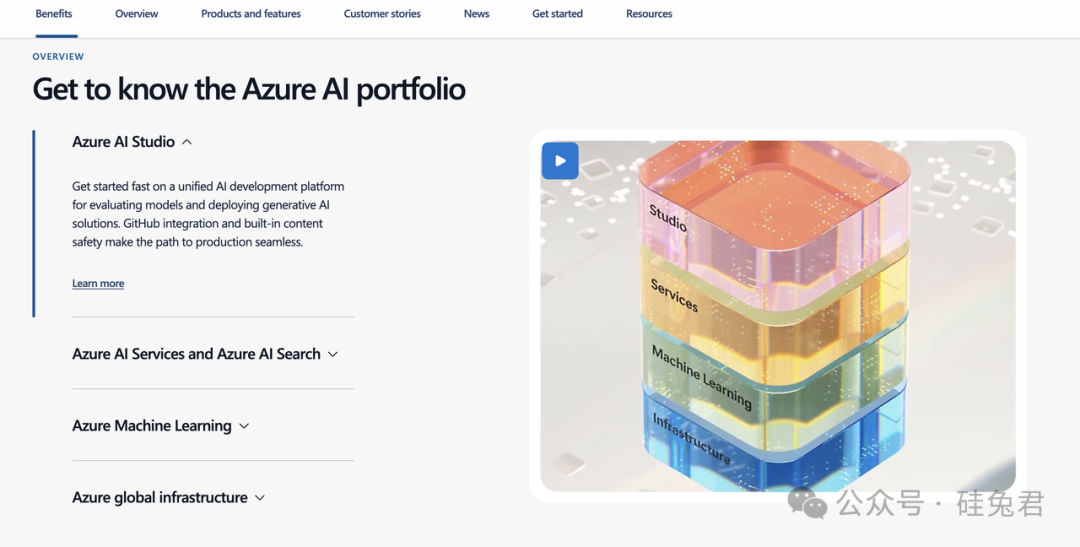

Microsoft partners with large language model companies like Cohere and Mistral AI, bringing them onto the Azure platform. Mistral AI will sell its models directly on Microsoft's cloud, becoming the second company after OpenAI to offer commercial AI models on Azure. Cohere will also host its enterprise AI models, Cohere Command R and Command R+, on Azure AI as managed services.

This expands Azure's reach, offering a diverse range of AI models to meet various user needs while attracting new customers and driving cloud service growth.

Caption: Microsoft Azure AI Platform

“For startups like Character and Inflection, (acquisition) is their best option,” says Gayatri Sarkar, founder of AI-focused investment firm Advaita Capital. “Some startups require significant funding and fare better under a larger umbrella.”

Guru Chahal, partner at Lightspeed Venture Partners, isn't surprised by the consolidation in the AI industry. “Not every company can reach its full potential,” he says, noting his firm's investment in AI model developer Mistral. “Our thesis has always been that cutting-edge models will be oligopolized.”

In this battle for generative AI dominance, tech giants strategically encircle AI startups. After this series of moves, most AI startups are intricately tied to tech giants, making independent paths increasingly difficult.

02

Capital, talent, competitiveness: Three hurdles for generative AI startups

Tech giants' siege of generative AI startups marks the beginning of their relentless pursuit of AI acquisitions.

Under the siege, generative AI startups face three major challenges.

Firstly, the capital crunch. Driven by the Scaling Law (model performance improves with larger datasets and compute power), funding is a significant hurdle for every generative AI startup, each facing unique funding challenges.

Star AI startups like OpenAI spend heavily on large model research but generate limited revenue. Large model development involves data collection, processing, model design, training, evaluation, and optimization, with training being the most expensive aspect.

Stanford University's 2023 AI Index Report mentions that training GPT-3, with 175 billion parameters, cost roughly $1.8 million in 2020. GPT-3's parameter count is 117 times that of GPT-2, resulting in a 36-fold increase in training costs. The rapid release of GPT-4, GPT-4o, and GPT-4o mini indicates OpenAI's escalating R&D costs.

According to The Information, OpenAI's operating costs are estimated at $8.5 billion, including inference, training, and labor costs, while revenue ranges from $3.8 to $4.5 billion, indicating potential losses of up to $5 billion. With $3.5 billion in revenue, $5 billion in net losses, and $10 billion in investment “debt,” OpenAI, the most promising generative AI startup, still bears the weight of funding challenges.

How to effectively manage finances is fundamental to the survival of companies like OpenAI after the hype fades. If startups struggle financially, it creates opportunities for tech giants to step in. In the generative AI space, cost-cutting efforts are often futile, while monetization remains a challenge.

For instance, Character.AI focuses on virtual social interaction. Despite high user engagement, it faces difficulties in monetizing its product, making it hard to form a closed business loop. Currently, it has fewer than 100,000 subscribers, accounting for less than 0.1% of its total user base.

Companies like Anthropic, Stability AI, and Inflection AI, which have gained some recognition but lack the high traffic of OpenAI, face similar issues as Character.AI. For example, Anthropic has an annual budget deficit of up to $1.8 billion, while Stability AI operates under significant financial pressure without the support of tech giants.

Caption: Stability AI official website

This has led some AI startups to seek partnerships with tech giants for additional funding and resources.

The talent shortage is another challenge for generative AI companies, in addition to financial and revenue concerns.

Generative AI primarily relies on deep learning and NLP. However, since Google introduced the Transformer architecture in 2017, fewer than eight years ago, there are not many researchers deeply rooted in this field, and even fewer earn million-dollar salaries. As a result, they are highly sought after by various enterprises.

The headhunting firm Rora revealed that OpenAI offers annual salaries of up to $865,000 to some employees, including a base salary of $665,000 and stock options worth $200,000. Moreover, OpenAI promised multi-million-dollar salaries when recruiting senior researchers from Google.

Apart from financial flows and talent competition, startups also face intense product competition.

Large model parameters are released at an increasingly faster pace, with more similar products emerging, leading to lower prices. According to incomplete statistics from SVRabbit, tech giants launched 11 AI models across various fields in the first seven months of 2024 alone.

Google launched five AI models, including Gemini 1.5 Flash and Pro, the open-source model Gemma, the video generation model Veo, and the text-to-image model Imagen. Meta released the large language model Llama 3.1, the video processing model Segment Anything Model 2 (SAM 2), the hybrid model Meta Chameleon, and the AI music generation model JASCO. Microsoft and Apple unveiled the Phi-3 series of AI micro-language models and the Apple Intelligence AI macro-model, respectively.

Caption: Meta launches Llama 3.1

Tech giants are also competing on pricing. Google's Gemini 1.5 Flash model offers a low price of $0.13 per 1M tokens ($0.013/K). AWS provides Titan Text Express and Titan Text Lite models at $0.20 per 8K tokens ($0.025/K) and $0.15 per 4K tokens ($0.0375/K), respectively. As the industry engages in price wars, startups cannot remain unaffected. OpenAI's GPT-4o model, as of its August 6, 2024 version, is priced at $2.50 per 128K tokens (approximately $0.0195/K).

Moreover, competition among startups remains intense. Lightspeed's Chahal notes, "We're seeing shorter intervals between funding rounds, and more companies starting up."

High investments, difficulty in profitability, and intense competition are common challenges faced by generative AI startups. Many AI startups have already fallen victim to these market dynamics.

According to TechNode, from the launch of ChatGPT (November 30, 2022) to July 29 of this year, nearly 80,000 AI-related companies in China have been deregistered, suspended, or are operating abnormally. This glimpse into China's situation reflects the challenging environment for generative AI startups globally.

The 'siege' by the wolves has begun. However, for the generative AI industry and AI startups, this 'siege' is not necessarily a bad thing. Industry consolidation and acquisitions are common in the business world, beneficial to both giants and startups.

03

Layoffs, Price Increases, Collaborations: AI Startups Strive to Break Out

In the business world, there is often little time to choose between survival and death.

Layoffs are the first step for many AI startups to break out. AI programming unicorn Replit announced layoffs of 20%, affecting 30 employees. AI speech recognition software startup Deepgram also announced layoffs of about 20%. The CEO of AI chatbot Jasper announced on LinkedIn that the company was laying off some employees to refocus its business direction.

Other AI startups are focusing on core market demands to generate more revenue. For instance, OpenAI disrupted traditional search engines with SearchGPT, entering a new business arena. Midjourney achieved annual revenue of $100 million through its paid subscription model and amassed nearly 15 million users on Discord with its AI drawing tool. Anthropic has told some investors that it expects to reach annual revenue of $500 million by year-end, up from $100 million earlier. Harvey AI has also surpassed $25 million in total revenue. Some generative AI startups have established stable revenue streams, meeting their basic survival needs.

AI search engine company Perplexity launched a revenue-sharing program for publishers. When Perplexity earns from instant replies based on their articles, publishers receive compensation. Rumor has it that OpenAI is secretly courting Microsoft customers like luxury brands to expand its client base.

Caption: Perplexity official website

Naturally, more generative AI startups are seeking partnerships with tech giants. Microsoft, NVIDIA, and Google have established cooperation platforms with AI startups, with Microsoft's Azure AI being a prime example.

Just as in the animal kingdom, where competition, cooperation, and mutual benefit coexist, businesses in the commercial ecosystem also engage in a game of survival of the fittest.

Judging from the simultaneous moves by Microsoft, Google, and Canva, the generative AI landscape is undoubtedly undergoing a shakeup. Giants leverage their resources and influence to dominate the market, while startups use their flexibility and innovation to challenge the status quo.

Both parties seek a balance between cooperation and competition, jointly advancing AI technology and its applications. This is not just a technological competition but also a game of wisdom and foresight.