252 days: From selling 1,000 units a week to 10,000 units a week, how many more tough battles does NIO have to fight?

![]() 10/24 2025

10/24 2025

![]() 601

601

By Su Cheng

At the NIO House in Xingye Taikoo Hui, Shanghai, even on a weekday afternoon, there are still quite a few customers looking at cars. NIO sales staff, now dressed in autumn and winter work attire, said, 'If you buy the new ES8 now, delivery will be in April next year, but many people are still placing orders.'

Even though customers know the waiting time is long, Lianxian Chuxing noticed that many users and sales staff are still selecting options and paying deposits on their phones at the scene. The reason is that they are very satisfied with the test drives, and they do not see other products with configurations, space, and prices that better match their needs in the short term. Additionally, there are purchase tax guarantees and point compensations, so they are willing to wait.

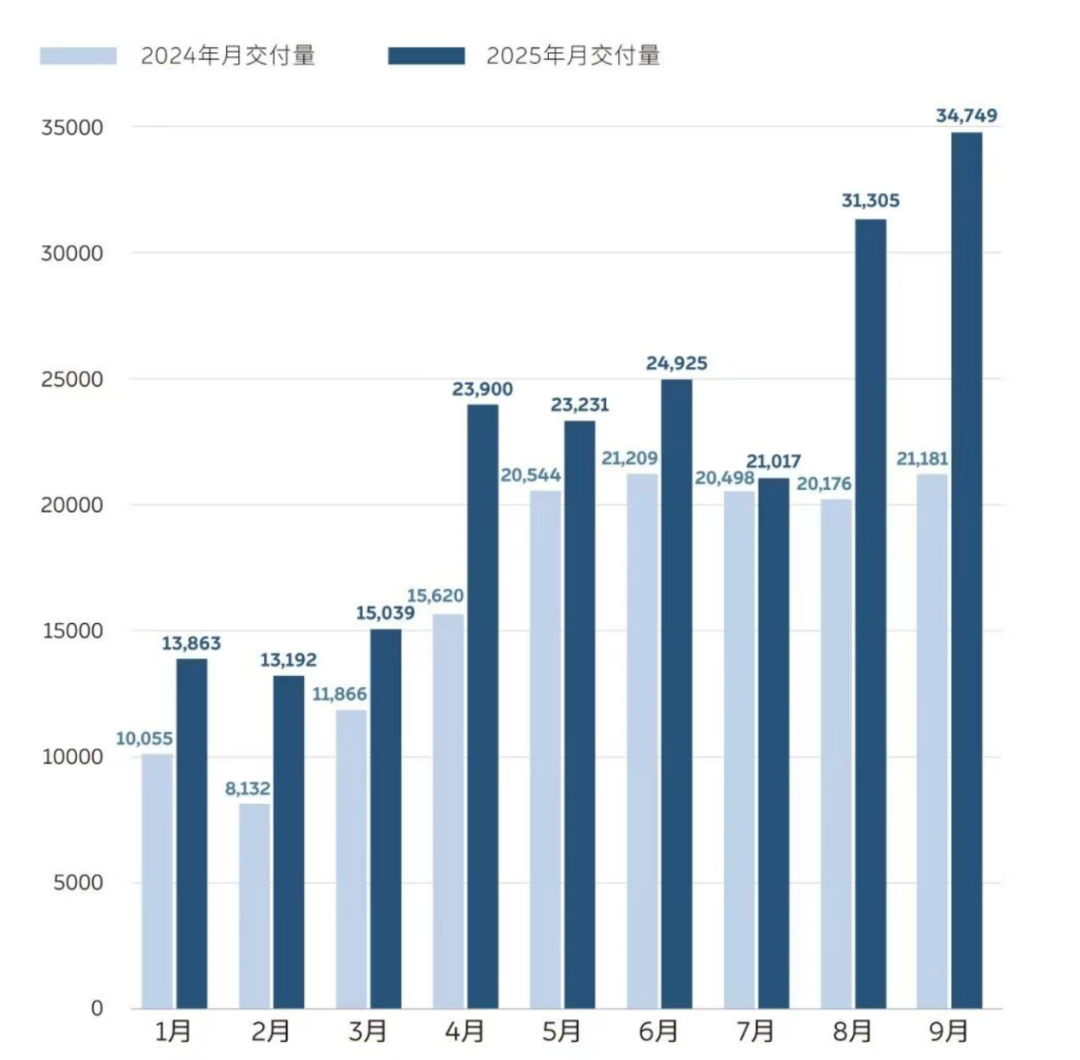

According to a leak by the well-known Weibo auto blogger 'Sun Shaojun,' NIO's three major brands surpassed 10,000 units in sales volume in the third week of October, with the NIO brand exceeding 4,000 units. LeDao and Firefly together exceeded 6,500 units, with the L90 model alone delivering nearly 3,500 units in a single week. This data has been indirectly corroborated by analysts from multiple institutions.

This would have been almost unimaginable even for DeepSeek more than half a year ago.

Let's go back to February 9th of this year when NIO was only selling 1,470 units per week. At that time, public opinion believed that NIO was experiencing 'a deeper and longer trough than in 2019.' With a first-quarter loss of 6 billion yuan, the three-brand strategy was repeatedly questioned, and the stock price fell to a historic low. Few people believed that the two products, the LeDao L90 and the new ES8, could quickly win market favor.

However, from selling a thousand units per week to surpassing ten thousand, NIO's sales curve has depicted a steep upward trajectory over the past 252 days. Climbing from the low at the beginning of the year to breaking through 30,000 deliveries in September and the stock price repeatedly hitting new highs this year, NIO has gradually drawn an upward rebound curve.

The value of this achievement is undoubted, marking that NIO's adjustments in product and market strategies have paid off. However, the delivery pressure that comes with the surge in sales volume and the imminent profitability target for Q4 clearly remind everyone that although the dawn has arrived, the real tough battles have just begun.

1. Determination and Transformation: The Path to Profitability Becomes Clear

According to 21 Auto, the first item in NIO founder Li Bin's VAU (Objective Management) for Q4 this year is that the profitability target for the quarter must be achieved.

In his recent internal speech, he emphasized, 'Profitability fundamentally depends on selling more cars, not just on cutting costs.' He broke down this goal into three specific actions: effective marketing of key models, ensuring supply chain stability and cost reduction, and delivering high-quality software versions on time. 'In Q4, we just need to focus on selling cars, implementing cost-reduction measures, and improving user experience.'

Behind NIO's sales comeback over the past 255 days is not a Hollywood narrative of a savior descending from the sky.

The turning point, which has been repeatedly discussed, occurred with the launch of the LeDao L90 at the end of July. This large pure electric SUV, positioned for the family market, precisely met consumer demand, delivering 21,626 units within two months of its launch and setting a record for the fastest delivery of a large pure electric SUV. Subsequently, the new ES8 launched by NIO in September further raised the bar for large three-row pure electric products, with 150,000 test drives in nearly 10 days since its release, fully utilizing this year's production capacity. The Firefly has also emerged from the jokes (Six-Eyed Flying Fish) to become a representative of high-quality small cars with monthly sales approaching 6,000 units.

Market analysis generally attributes the success to the leading product strength and the successful three-brand strategy, but a deeper reason is NIO's long-term commitment to the pure electric route.

As the only domestic automaker with experience in developing three generations of pure electric platforms and eleven years of deep involvement in the pure electric field, NIO has been steadfast in its investment in core technology R&D and charging and battery swap infrastructure, despite facing considerable criticism.

Regarding the two technical routes of pure electric and extended-range electric, Li Bin emphasized that NIO has always adhered to the pure electric route and has never wavered or backtracked. Although Li Bin humorously mentioned that if time could be turned back, starting with extended-range electric to make some money might not be a bad idea, this was more of a joke.

He once pointed out in public that the batteries in extended-range electric vehicles are getting larger and larger, while the fuel tank is only used once or twice a year, and carrying hundreds of kilograms of extra weight every day is not cost-effective. Additionally, NIO conducted a special survey and found that for users who bought extended-range electric vehicles and used them for more than half a year, the vast majority said their next car would be pure electric because the best experience of an extended-range electric vehicle is still in pure electric mode.

On the other hand, many extended-range electric manufacturers have also started to large-scale lay out pure electric charging infrastructure on a large scale. In this regard, NIO's long-term investment in the charging and battery swap network over the past decade is beginning to show scale effects. As of now, NIO has built 3,533 battery swap stations, with its highway battery swap network covering 550 cities across the country. It has even further connected scenes representing poetry and distant places, such as the 318 National Highway, indicating that NIO's energy replenishment system has achieved a phased end to energy replenishment anxiety in core urban areas. This not only enhances user experience but also becomes a core moat that distinguishes NIO from other brands.

On the roadside in Heyuan, Guangdong, a charging pile shared by NIO users

Industry data shows that in the first eight months of this year, domestic pure electric vehicle sales increased by 46.1% year-on-year, far exceeding the 22.8% growth rate of hybrid vehicles. In September, sales of pure electric models reached 835,000 units, up 32% year-on-year, while plug-in hybrid and extended-range electric models saw a significant decline.

This trend validates Li Bin's judgment that the era of large three-row extended-range electric SUVs is passing, and the era of large three-row pure electric SUVs is arriving.

Lin Huaibin, Associate Director of China Light Vehicle Sales Forecasting at S&P Global Mobility, pointed out at a recent industry forum, 'The growth of hybrid models has stalled, and pure electric products have returned to rapid growth, with this turning point arriving earlier than expected.' This is undoubtedly good news for NIO, which adheres to the pure electric route.

However, the industry trend is just the general direction. To grasp this trend and translate it into sales growth, NIO has undergone painful and continuous organizational transformations, rapidly improving execution and operational awareness at key business nodes.

Li Bin has been aware of NIO's organizational issues since last year. He started piloting internal reforms in 2024 and launched the CBU (Basic Business Unit) mechanism in March this year, requiring each business unit to be financially self-sufficient. This transformation encountered significant resistance initially. 'Now, before any project is initiated, the return on investment must be calculated clearly, which was unimaginable before,' a NIO mid-level manager once said externally.

Lianxian Chuxing communicated with sales staff from multiple LeDao and NIO stores and learned that since this year, personnel at different stores have had clear performance evaluation standards, known as the CIP mechanism within NIO. Failure to meet performance targets requires signing a capability improvement plan, and failure to meet them again the following month results in termination. A strict system of survival of the fittest is enforced.

Some sales staff reported that while the number of personnel has indeed decreased, the tracking abilities of those who remain have significantly improved, and overall store transaction volumes have continued to rise. With the noticeable increase in sales, some sales staff are even willing to sacrifice their rest days, going to Hong Kong to open accounts in the morning and returning in the afternoon, actively purchasing NIO stocks. 'The sensitivity of sales staff is absolutely a barometer of a company.'

At the recently held NIO Day, Li Bin said, 'This year's NIO Day had many sponsor partners, and we even made a little profit after calculating the expenses.' This meticulous operational awareness is permeating every aspect of the company.

2. Challenges Remain on the Path to Profitability

Despite the favorable situation, NIO still faces multiple challenges. The foremost is the delivery pressure, as the monthly production capacity of the new ES8 needs to be increased to over 15,000 units to meet order demand.

Recently, a group chat record also revealed that NIO's Hefei factory is intensively recruiting personnel. There have even been scenes where office space is insufficient, and hundreds of people are being interviewed in groups in the cafeteria and indoor basketball court. Some users have shared on social media that NIO's charging piles are displaying information about the factory's hot recruitment.

Li Bin emphasized in an internal meeting, 'The production capacity of the new ES8 must reach over 15,000 units per month in December. From the current perspective, we are very confident.'

With the gradual phase-out of purchase tax incentives and reduction of local replacement subsidies, the new energy vehicle industry is generally facing production capacity constraints. Many brands, although having sufficient orders, are limited by the maximum production capacity of battery and core component suppliers, putting pressure on production lines and urgently requiring adjustments.

Sun Shaojun mentioned in a livestream that since NIO adheres to the pure electric route and has cooperated with battery suppliers like CATL for many years, its production line currently requires relatively fewer adjustments. This is also one of the reasons why NIO's weekly deliveries could surge to over 10,000 units in mid-October. It can be considered an unexpected gain from NIO's long-term commitment to pure electric vehicles.

At the same time, balancing sales growth with service quality is also a test. As delivery volumes rapidly increase, NIO's proud user service system is under pressure. Additionally, resource allocation under the three-brand operation, demand fluctuations after the purchase tax adjustment in the first quarter of next year, and other variables need to be addressed.

Meanwhile, the capital market is closely monitoring NIO's profitability quality. Besides whether it can achieve single-quarter profitability, the key is whether this profitability is sustainable. Li Bin is also clearly aware of this point. He emphasized internally that profitability 'is not for showing off to others but is the cornerstone for our company's long-term sustainable development.'

The user-created theme song 'Growth' performed at the NIO Day sings, 'Deeply rooted, slowly growing.' This perhaps best describes NIO's current development stage. With over 60 billion yuan invested in R&D over the past decade, building a nationwide charging and battery swap network, and adhering to the pure electric technical route, these long-term investments are now entering the harvest period.

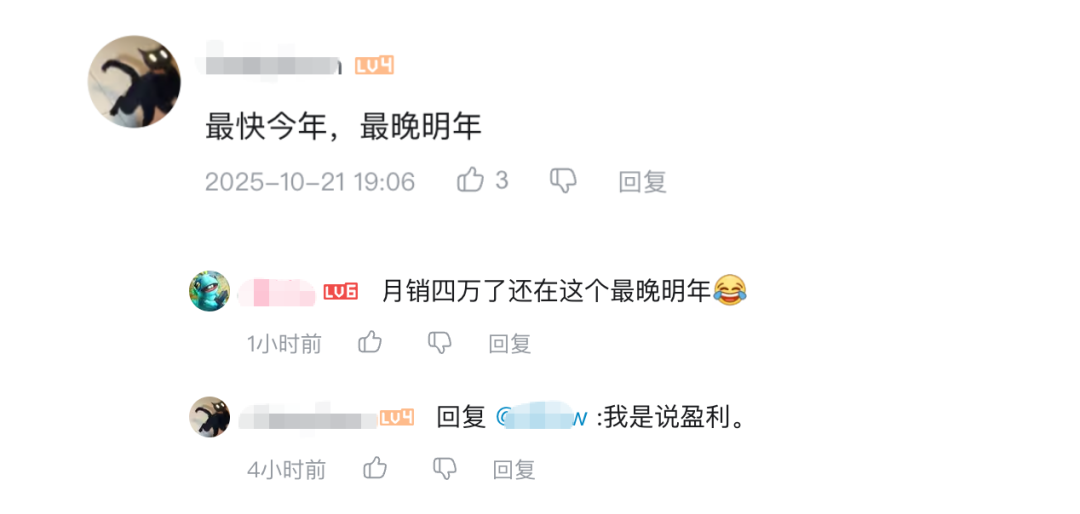

NIO's classic meme 'Soonest this year, latest next year' has also taken on a new interpretation. Under a video analyzing the significance of NIO's profitability, a netizen commented, 'Soonest this year, latest next year.' Someone questioned that with NIO's monthly sales approaching 40,000 units, why are they still saying 'latest next year?' The netizen explained that they meant NIO would achieve profitability soonest this year and latest next year.

With weekly sales surpassing 10,000 units, NIO has proven its product strength and brand power. However, to achieve a transformation from 'surviving' to 'sustained and healthy development,' it still needs to continue breaking through in supply chain management, service system upgrades, and multi-brand coordination.

Profitability is just a new starting point, and the real tests are just beginning.

(The header image of this article is sourced from NIO's official Weibo account.)