Tmall Genie has released its Bestie device, so why is Baidu Duer's annual new product struggling?

![]() 08/21 2024

08/21 2024

![]() 641

641

Text/Leon

Edited by/Hou Yu

The AI performance improvements brought about by large models have added fuel to the competition for living room smart terminal devices, and a new round of new product competitions is entering a white-hot stage. Manufacturers led by Xiaomi and Tmall Genie have launched new products within the year, hoping to boost the entire market through product upgrades. However, Baidu's Duer seems to be absent from this competition.

Recently, Tmall Genie held a high-end brand and new product launch event, introducing the mobile smart screen product "Wow Bestie Machine," with popular singer Zhou Shen appearing to vigorously promote it.

The IoT market is a huge pie and a fiercely contested territory among internet giants. As we all know, the entrance to the IoT market is king. Currently, Xiaomi leverages its status as a hardware manufacturer and the advantages of Xiaomi's ecological chain to dominate the market share with hardware entry points such as mobile phones, tablets, TVs, and speakers. Other players like Alibaba's Tmall Genie and Baidu's Duer also have high hopes for this market.

Selling hardware is only part of the demand. Manufacturers' vision is to gradually cover the IoT ecosystem through a combination of hardware and software. In the AI era, hardware entry points have become even more important, so Tmall Genie's foray into the mobile smart screen field is strategically significant.

However, Duer, one of the top three players in the IoT market, has rarely released new products this year. Apart from the "Duer Learning Machine Z30" launched at the end of May priced at 6,999 yuan, neither its Bestie screen nor smart speaker product lines have been updated. In particular, the Bestie Machine, which was once considered an important tool for Duer to capture the market, now appears to be overtaken by competitors like Tmall Genie.

Duer's Early Layout, Followed by Product Stagnation

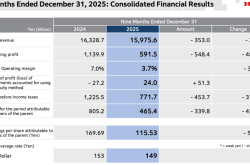

Wow Bestie Machine is a mobile smart screen product equipped with multi-angle adjustment and lifting brackets, omnidirectional wheel bases, and can be freely moved within the home environment. Its hardware highlights include a standard 27-inch 4K true color eye-care screen, an 8-core processor, 8+128/256GB storage, a 3.1-channel speaker, and a 9500mAh battery, reaching the highest level in the current market.

Thanks to Alibaba Group's Tongyi large model, Wow Bestie Machine emphasizes "hardware and software integrated OS capabilities based on user scenarios" in terms of user experience. This is achieved by combining high-end base hardware with core capabilities such as intelligent engines and multi-modal control to enable multi-scenario user experiences including audio-visual entertainment, smart home, information assistants, education, fitness, and sports, making Wow Bestie Screen the family's smart hub.

The concept of the so-called "Bestie Machine" originated from the Korean manufacturer LG. In 2022, LG launched the "StanbyME Bestie Machine," essentially a large Android tablet with a 27-inch screen, adjustable stand, and omnidirectional wheels, positioning it between TVs and tablets. Compared to TVs, the mobile large screen can be moved freely, making it more convenient for binge-watching dramas and expanding applications such as fitness exercises. Compared to tablets, the 27-inch screen offers a superior viewing experience.

Subsequently, some home appliance and upstream manufacturers entered the mobile large screen market leveraging their industrial chain advantages, such as Hisense, Konka, Skyworth, Dangbei, and KTC. However, the entire market remained lukewarm. The reason is that home appliance manufacturers lack experience in intelligence and their advantages are inferior to those of internet platforms.

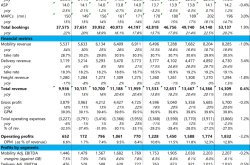

Against this backdrop, Duer entered the Bestie Machine market in May 2023 and quickly captured a significant market share. According to Lotto Research, in the first half of 2024, China's mobile smart screen online monitoring market sold 76,000 units, up 288% year-on-year, with sales of 290 million yuan, up 256% year-on-year.

Among them, Duer ranked first in the market with a share of 41.1%. Other brands, including KTC, Dangbei, Skyworth, and Baseus, have also achieved some share growth, but they have yet to shake Duer's leading position. (For details, see: Exclusive: The Large Screen Economy Booms, and Baidu Enters the TV Market)

Although Duer firmly holds the top position in this field, a figure that cannot be ignored is that its market share has decreased by 10.3% year-on-year. The reason is the lack of follow-up iterative products leading to insufficient market competitiveness.

(Units: 10,000 units, 100 million yuan, yuan)

2024H1 China Living Room Smart Device Online Market Size and Changes

As a 2023 product, Duer's Tian Tian Bestie Machine's hardware is already outdated at the same price point (4,999 yuan), mainly in terms of screen, processor, storage, and battery. Let's compare it with Tmall Genie's Wow Bestie Machine.

Firstly, Duer Tian Tian's screen resolution is 1080P, while Tmall Genie's is 4K. In terms of storage, the former is 6+128GB, while the latter is 8+128/256GB. In terms of battery, Duer Tian Tian only specifies a maximum standby time of over 5 days, while Tmall Genie clearly states a 9500mAh battery with a maximum standby time of over 8.5 days.

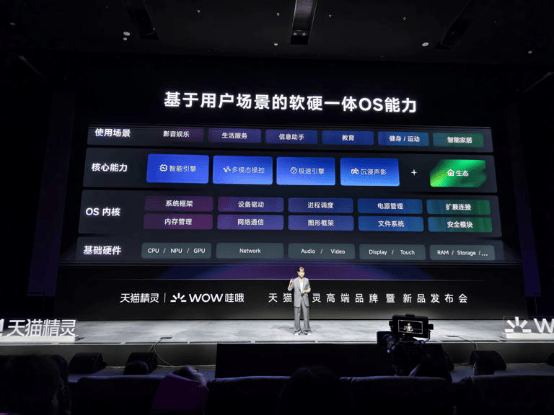

Mobile screens are essentially Android devices, so the processor is crucial. According to media reviews, Duer Tian Tian uses the MediaTek MT8768 processor, an 8-core processor using a 12nm process (4+4 A53 cores) commonly used in low-end Android tablets, phones, or TVs.

Duer Tian Tian Bestie Screen Hardware and Benchmark Scores

Tmall Genie's Wow Bestie Machine, on the other hand, uses the MediaTek MT8195 processor, featuring an 8-core design (4 A78 big cores + 4 A55 small cores), 6nm process, and integrated APU 3.0, providing 4 TOPs of computing power for stronger AI performance.

Tmall Genie Wow Bestie Machine (left) vs. Duer Tian Tian Bestie Machine (right) Parameter Comparison

Following Duer's annual product line update pattern, iterative products for smart speakers and Bestie screens should have been introduced during this year's Baidu AI Developer Conference. However, only an overpriced "Duer Learning Machine" was unveiled, reflecting to some extent that Duer's hardware department has adjusted its new product schedule. (For details, see: Duer, Riding the Wave of the Large Screen Economy)

The Era of Ying: Difficulties in Updating Hardware Products

After Duer's former CEO Jing Kun left his position, the size of Duer's company has shrunk from nearly a thousand people to around 700. (For details, see: Centrifugal Baidu Executives)

As a leading figure in the field of AI interaction, Jing Kun created the "Xiaoice" voice assistant at Microsoft and then developed "Duer" at Baidu, laying the foundation for Baidu's entry into the smart hardware market and securing a 38% share of China's smart speaker market, ranking first. Duer has also received three rounds of financing and was once intent on going public.

However, all of this came to an abrupt halt with Jing Kun's departure.

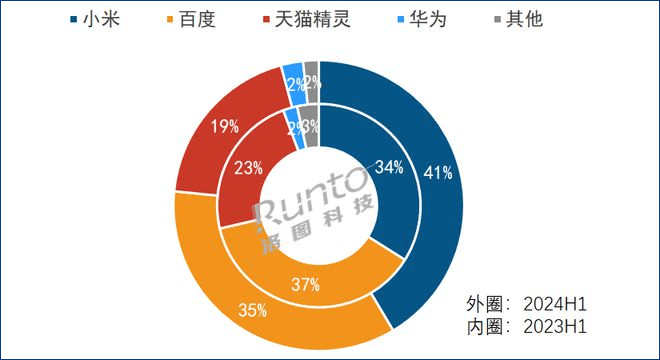

The turmoil in Duer's management is directly reflected in its market share. According to Lotto Research, as of the first half of 2024, Xiaomi captured 41% of the smart speaker market share, ranking first, while Baidu's market share continued to decline, falling 5.4% year-on-year from 37% to 35%. Additionally, as mentioned earlier, Duer's Bestie screen market share also decreased by 10.3% year-on-year.

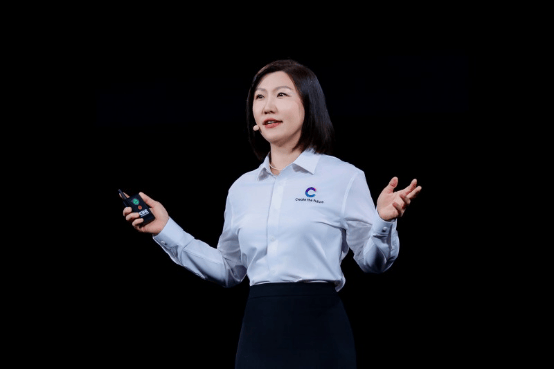

Currently, Li Ying serves as CEO of Duer Technology. Her resume shows that she joined Baidu in 2004 through campus recruitment and worked in the Web Search Department, followed by positions in the Internet Data Research and Development Department, AI Technology Ecosystem Department, and Baidu Maps Business Unit, before being appointed Chief Information Officer (CIO) and Deputy President of Baidu Group. She took over as CEO of Duer Technology on October 8, 2023.

Figure: Li Ying, CEO of Duer Technology

After taking over Duer, Li Ying focused on further strengthening the large model's support for Duer products, including leading the reconstruction of products like Baidu Ruliu based on the Wenxin large model. On the surface, she is no less proficient in search technology than Jing Kun, but she lacks successful hardware experience.

Wall Street Tech Eye exclusively learned that Li Ying has recruited people from outside to expand her business team. However, neither the "Ying-Tier 1" level nor the core executive level close to Li Ying have hardware experience. Take Zhang Beini, who is highly regarded within Li Ying's team, as an example. Before joining Clearstream Capital, she served as General Manager of Baidu Music Business Unit, and her resume does not indicate any hardware-related experience.

Moreover, Li Ying will face a more complex and volatile market environment than during Jing Kun's era.

Baidu Encounters a Downturn in the Smart Hardware Market

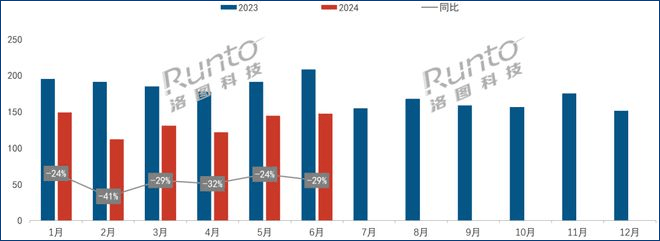

Despite the full integration of major brands with AI large models, the smart speaker market remained sluggish in the first half of this year, showing no signs of recovery. What are the reasons?

Firstly, it is clear that the current generative AI based on large models still has a significant gap with true "strong AI." AI cannot think independently but relies more on massive data and algorithms to achieve contextual dialogue. For example, ChatGPT stores user and AI interaction history through Message interfaces and queue management to enable AI to respond based on previous information. Coupled with the low hardware configuration of speakers and smart screens, which lack independent units like NPUs to process AI data, the AI experience falls short of user expectations.

Secondly, generative AI still requires innovative application scenarios. Currently, AI's performance on speakers and smart screens remains limited to somewhat redundant question-and-answer sessions and AI painting that is barely better than nothing. The core functions are largely similar, as those who have used Tencent Yuanbao, Wenxin One, and Douyin Doubao can attest.

(Units: 10,000 units)

2024 China Smart Speaker Market Monthly Sales and Changes

Of course, this does not mean that generative AI is useless but rather that AI computing power still needs to be boosted and algorithms evolved to enable the implementation of application scenarios. Song Gang, head of Tmall Genie's business center, once stated that AI+hardware is more technology-driven, and Tmall Genie is already testing interactive dialogue functions, which will take some time to achieve scene judgment and multi-modal interaction.

In other words, smart speakers and other devices are still in the "darkness before dawn." Until the AI experience truly materializes, the market may continue to be sluggish for some time. During this period, even slight experience enhancements require manufacturers to continuously iterate their products to compete for market share, or they will quickly be eliminated from the market. Tmall Genie's entry into the Bestie screen market is a typical example.

Returning to Baidu, Duer's current product line positioning falls into three directions: Duer for AI inclusiveness, Tian Tian as a tech-focused brand, and Xiao Du Qinghe for youth education, with products mainly including speakers, screen-based speakers, learning tablets, Bestie screens, and learning machines.

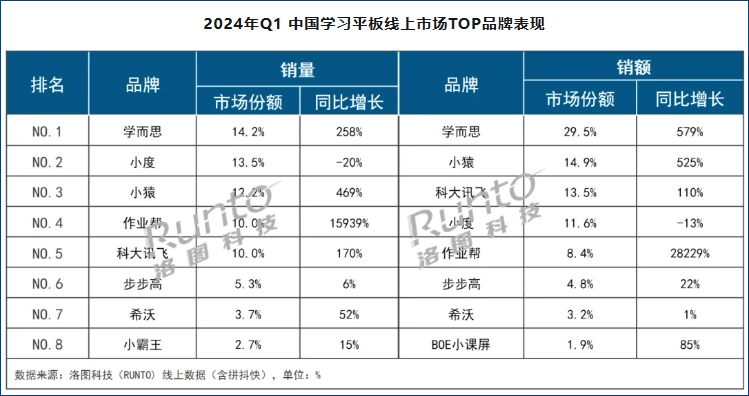

In the learning tablet sector, Lotto Research data shows that Duer's market share was 13.5% in the first quarter of this year, a year-on-year decrease of 20%. Of course, the learning tablet market is also relatively small, with online sales of 689,000 units during the same period; while generalized tablet shipments for the same period were 7.13 million units (IDC data).

Combining the above data, Duer's hardware "big three" of speakers, learning tablets, and Bestie machines have all seen declining market shares this year, which is not a good sign. There are not only competitions from top players like Xiaomi and Tmall Genie but also threats from audio-visual companies like Dangbei and Skyworth.

It has been over two months since Li Ying officially took over Duer. Perhaps she still needs more time to integrate the hardware team and plan the product line to lead Duer back on track. However, how much time and market space remains for Duer?