Kuaishou achieves profitability for five consecutive quarters with efforts in general shelf scenarios

![]() 08/21 2024

08/21 2024

![]() 523

523

On August 20, Kuaishou Technology released its financial results for the second quarter and the interim period of 2024.

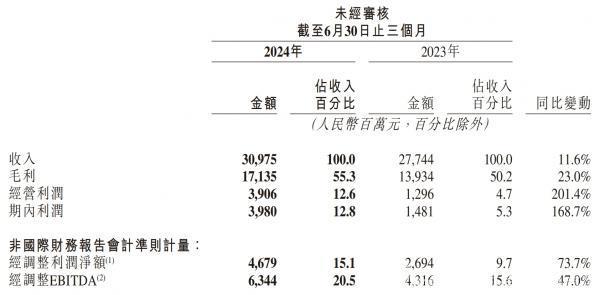

In the second quarter of this year, the company achieved revenue of RMB 30.98 billion, an increase of 11.6% year-on-year; profit for the period was RMB 3.98 billion, a substantial increase of 168.7% year-on-year.

Following its first annual profitability in 2023, Kuaishou has maintained profitability in both quarters of the first half of this year; currently, Kuaishou has achieved profitability for five consecutive quarters.

It can now be said that Kuaishou's profitability is sustainable. The users have successfully “supported” the development of a profitable short video platform.

Slight increase in active users, continued improvement in profitability

Kuaishou's adjusted net profit reached a record high. In the second quarter, Kuaishou's adjusted net profit reached RMB 4.68 billion, an increase of 73.7% year-on-year.

At the same time, Kuaishou's gross margin and adjusted net profit margin also reached new single-quarter highs, with the two figures standing at 55.3% and 15.1%, respectively, representing an increase of 0.5 and 0.2 percentage points from the first quarter of this year and a significant increase of 5.1 and 5.4 percentage points from the second quarter of last year.

These two figures reflect that Kuaishou's profitability is based on efficiency improvements rather than solely through scale expansion.

Kuaishou's user base continues to show slight growth. In the second quarter, Kuaishou's average daily active users increased by 5.1% year-on-year to 395 million, while its average monthly active users increased by 2.7% year-on-year to 692 million.

Of course, pure traffic growth is becoming increasingly difficult. According to Cheng Yixiao, Kuaishou's co-founder, chairman, and CEO, after the market baptism of the 618 promotional event in the second quarter, both e-commerce platforms and merchants are facing the challenge of slowing short-term domestic consumer demand. In an environment where traffic dividends are diminishing, the e-commerce business needs to achieve a better balance between content and commercial efficiency.

The effectiveness of the general shelf strategy, continued e-commerce growth to be observed

Kuaishou's revenue consists of three main components: online marketing services, live streaming, and other services, with other e-commerce businesses included in the latter.

E-commerce is a key business segment for short video platforms. From Douyin and Kuaishou's previous decision to "sever ties" and establish an "internal loop" to the rapid growth of GMV, e-commerce business is the most promising future for short video platforms from any perspective.

In the second quarter, Kuaishou's GMV increased by 15% year-on-year to RMB 305.25 billion, with e-commerce buyer MAU penetration rate reaching a new high of 18.9%, and monthly active merchants growing by over 50% year-on-year.

A more crucial statistic is that in the second quarter of this year, the overall GMV from Kuaishou's general shelf scenario accounted for more than 25% of the total, with search GMV increasing by over 80% year-on-year.

Last year, Kuaishou introduced the general shelf strategy, focusing on general shelf scenarios. Cheng Yixiao stated at this year's Gravity Conference that the core of the general shelf is to have products that are always available, meeting consumer needs 24/7 without relying on live streaming hours.

During this year's 618, Kuaishou's general shelf paid orders increased by 67% year-on-year, general shelf paid users increased by 59% year-on-year, search paid GMV increased by 65% year-on-year, search paid orders increased by 57% year-on-year, and search paid users increased by 60% year-on-year.

The significance of the general shelf lies in fostering users' habit of shopping on short video platforms, even making them the primary destination for consumption. This is currently the clearest, simplest, and most growth-potential commercialization path identified by short video platforms.

Kuaishou has done a lot of operational work. For example, in the second quarter, Kuaishou's e-commerce business vigorously promoted the cold start and growth of new merchants, especially small and medium-sized merchants. On the one hand, it empowered them with traffic by launching the New Merchant Launch Plan with up to RMB 100 billion in traffic, coupled with the Fuyao Plan, helping merchants rapidly expand their business scale from the cold start of their first broadcast. On the other hand, by innovating sales management and other business models, it lowered the operational thresholds for merchants.

Cheng Yixiao said during the earnings call, "In the second half of the year, Kuaishou will continue to vigorously develop content e-commerce and social e-commerce, focusing on the core value of live broadcasts and short videos, giving full play to the important role of content in attracting and activating new e-commerce users. At the same time, we will steadily build the general shelf scenario in the long run, increase user frequency in the shelf scenario, and establish user perceptions."

However, according to previous reports by LatePost, the growth rate of e-commerce business on short video platforms is gradually declining to a "plateau phase." Kuaishou's GMV in the second quarter increased by 15% year-on-year, which is already a historical low, and its sequential growth rate rebounded from -28.7% in the first quarter to 6%.

The other services revenue, which includes Kuaishou's e-commerce business, has seen two consecutive quarters of sequential declines. It is evident that e-commerce business on short video platforms has moved from a stage of "easy money" to a stage with higher growth difficulties, requiring more operational efforts to achieve conversions.

Accelerating exploration of AI business, short drama business becomes a pleasant surprise

Although e-commerce business is considered to determine the future ceiling of short video platforms, online marketing services are still Kuaishou's largest business segment, accounting for 56.5% of its revenue.

As the largest business segment, online marketing services maintained healthy growth, with revenue in the second quarter increasing by 22.1% year-on-year to RMB 17.52 billion, the highest growth rate among all business segments.

Kuaishou stated in its earnings announcement that in the second quarter of 2024, revenue from external marketing services increased significantly, with a higher year-on-year growth rate compared to the first quarter of 2024, especially in industries such as media and information, e-commerce platforms, and local life.

In the media and information industry, paid short drama marketing continued to improve user experience by deepening the native link, while combining intelligent subsidies to increase user payment scale, leading to a rapid growth in paid short drama marketing spending, with daily average marketing consumption of paid short dramas more than doubling year-on-year. Kuaishou was the first platform to layout short drama content, and its daily active users for short dramas have surpassed 300 million.

It is reported that Kuaishou's daily average marketing consumption of paid short dramas in the second quarter more than doubled year-on-year, accounting for a high single-digit percentage of external marketing revenue.

In terms of intelligent delivery, Kuaishou's external marketing product, Universal Auto X (UAX), continued to see an increase in penetration across industries in the second quarter of 2024, with customers using UAX for marketing spending accounting for more than 30% of total external marketing spending.

In terms of local life, from January to June, total spending by Kuaishou's local merchants increased by 172% quarter-on-quarter, with industries such as integrated services and catering experiencing high growth of 598% and 156%, respectively.

Furthermore, Kuaishou is accelerating its layout in the AI field, with core products including Kuaiyi, a large language model, Ketu, a large image model, and Keling AI, a large video generation model.

Although these large model products cannot significantly contribute to Kuaishou's revenue and profit in the short term, they can effectively reduce costs, improve operational efficiency, and prepare for the arrival of the AI commercialization era.

It is disclosed that Kuaishou's AI matrix has been seamlessly integrated into multiple business scenarios, supporting content creation, content understanding and recommendation, and user interaction, providing more efficient tools for merchants and marketing clients, thereby significantly enhancing our business competitiveness.

In the first half of this year, nearly 20,000 merchants optimized their operations on the Kuaishou platform with the help of the AI matrix. In the second quarter, the daily peak consumption of AIGC marketing materials from marketing clients reached RMB 20 million.

Conclusion

Kuaishou has proven that itself and short video platforms can achieve sustained profitability.

Traditional "external loop" business remains Kuaishou's most important business segment at present; the "internal loop" e-commerce carries Kuaishou's future, and after the initial high-growth "wild west" period, sustained growth will require more operational efforts.

Judging from the performance in the first half of this year, Kuaishou's greatest achievement is the successful implementation of the general shelf strategy, with retaining users on Kuaishou for shopping being the top priority.

After the announcement of its 2024 first-half results, Kuaishou's share price fell by more than 10%, possibly due to investors' concerns about the slowdown in the growth rate of the company's e-commerce business. However, Baima believes that user perceptions have already been formed, and although the GMV of short video platforms has passed the high-growth period, there is still significant room for improvement in conversion rates, so there is no need for excessive concern.

The peaking of traffic is the biggest industry backdrop for the internet, and the balance between operations, conversions, and user experience determines a platform's future.

The content and views expressed in this article are for reference only and do not constitute investment advice. Investment involves risks, and decisions should be made cautiously.