Car owners feel 'betrayed' by sharp price cuts after taking delivery of FANGCHENGBAO vehicles; how can the brand improve its reputation?

![]() 08/22 2024

08/22 2024

![]() 535

535

As we enter the late August, the automotive market is gearing up for the golden sales season of 'September and October', pushing the industry's 'internal competition' to new heights. Despite precedents of premium luxury brands like BMW withdrawing from 'price wars', many automakers continue to introduce various price incentives to stimulate sales, igniting intense competition within the industry.

Recently, BYD's off-road vehicle brand FANGCHENGBAO announced a price reduction for its sole model on sale, the Leopard 5, including its Explorer, Navigator, CloudRider Luxury, and CloudRider Flagship variants. All four models underwent a price adjustment of RMB 50,000, with current prices ranging from RMB 239,800 to RMB 302,800.

This price reduction policy sparked widespread outrage among consumers. Not only did multiple FANGCHENGBAO offline stores witness rights protection incidents, but many existing car owners also expressed their dissatisfaction on social media platforms. Behind this sudden price drop lies the sales challenges faced by FANGCHENGBAO amidst its ambition to rejuvenate its brand.

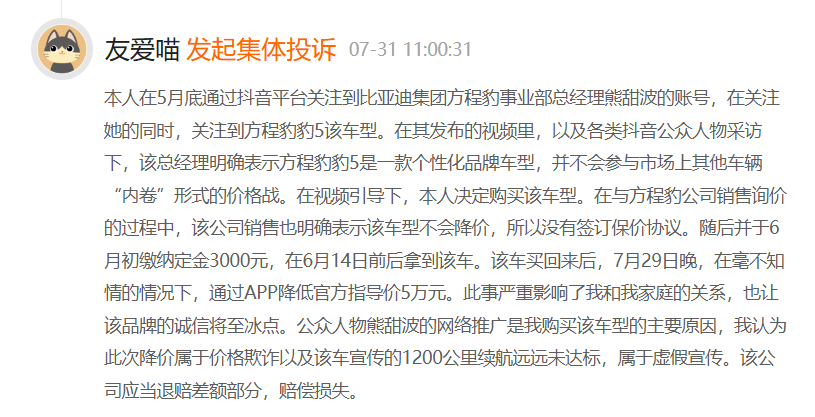

'FANGCHENGBAO deceives consumers' and 'refund the price difference'… On the HeiMao Complaints platform, there are currently 116 complaints related to the keyword 'FANGCHENGBAO Automobiles' as of press time, most of which are related to this price reduction. Car owners generally believe that FANGCHENGBAO's actions have severely compromised the consumer rights of existing owners and are suspected of false advertising and sales fraud.

One user stated that they became aware of an interview with Xiong Tianbo, General Manager of FANGCHENGBAO Business Unit, on social media at the end of May. In the interview, Xiong clearly stated that the Leopard 5 was a personalized brand model and would not participate in 'price wars,' and sales personnel also explicitly mentioned that the model would not be discounted. Trusting the brand, the user did not sign a price guarantee agreement.

However, a month after taking delivery, FANGCHENGBAO announced a reduction in its official guide price. The user believes that the online promotion by public figure Xiong Tianbo was the primary reason for their purchase, and the price reduction constitutes consumer fraud. Additionally, the advertised 1,200km driving range fell far short of expectations, amounting to false advertising. FANGCHENGBAO should refund the price difference and compensate for the loss.

After reviewing relevant reports, Beiduo Finance learned that Xiong Tianbo stated in a media interview at the 2024 Beijing International Automobile Exhibition that 'price wars are not very helpful for FANGCHENGBAO' and emphasized that 'for a new brand, price is not the only way out.' This statement was made less than three months before FANGCHENGBAO announced the price reduction.

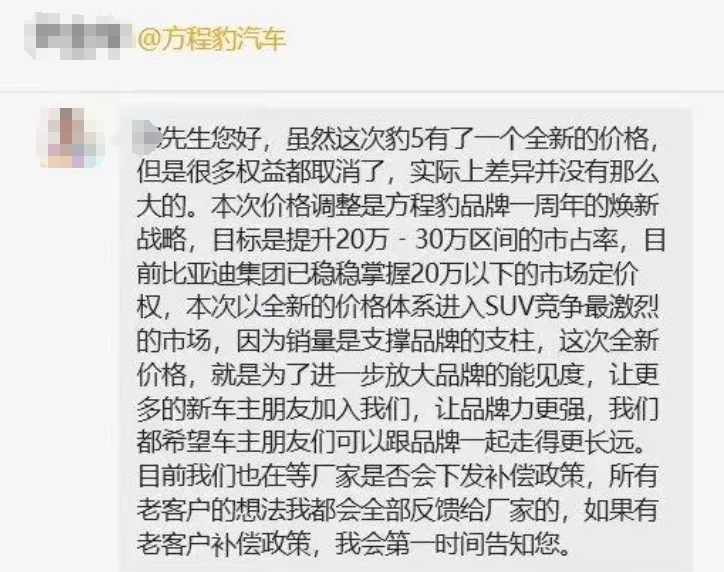

A FANGCHENGBAO staff member revealed to users that this move is part of the brand's first-anniversary rejuvenation strategy. The staff member stated that the new pricing is intended to further enhance brand visibility, attract more new car owners, and strengthen the brand's influence, adding that 'many benefits have been canceled under the new pricing, so the actual difference is not that significant.'

It is noteworthy that the price reduction controversy surrounding FANGCHENGBAO has been brewing for nearly half a month, yet the brand has not made any public response or introduced any compensation policies for existing owners. Sina Tech also reported that FANGCHENGBAO's official app deleted numerous user complaints, seemingly attempting to silence consumers.

In contrast, Li Auto (02015.HK), which recently implemented a price reduction policy, announced that while continuing to use the new pricing system, it would proactively offer cash rebates to owners who had already taken delivery of their vehicles. This stands in stark contrast to FANGCHENGBAO's silence, severely damaging the latter's customer trust.

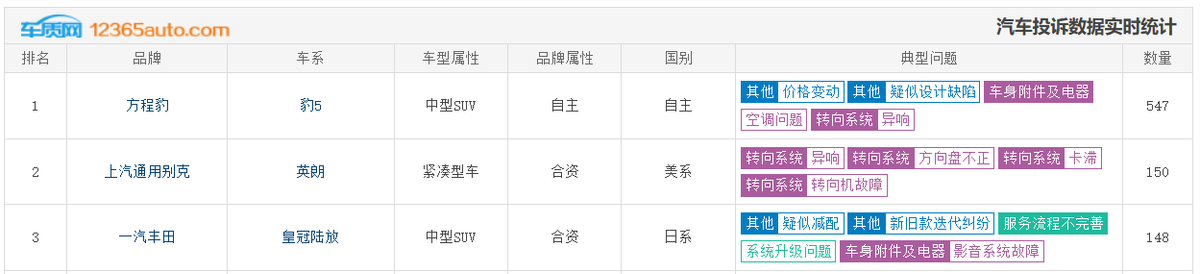

Over the past month, the Leopard 5 has topped the AutoHome complaint chart with 547 complaints. In addition to the uproar caused by the price change, FANGCHENGBAO has also been accused of hardware issues such as faulty driver assistance systems, defective brake oil line designs, and abnormal noises in the steering and transmission systems. The current customer satisfaction rating stands at just 1.8 out of 5.

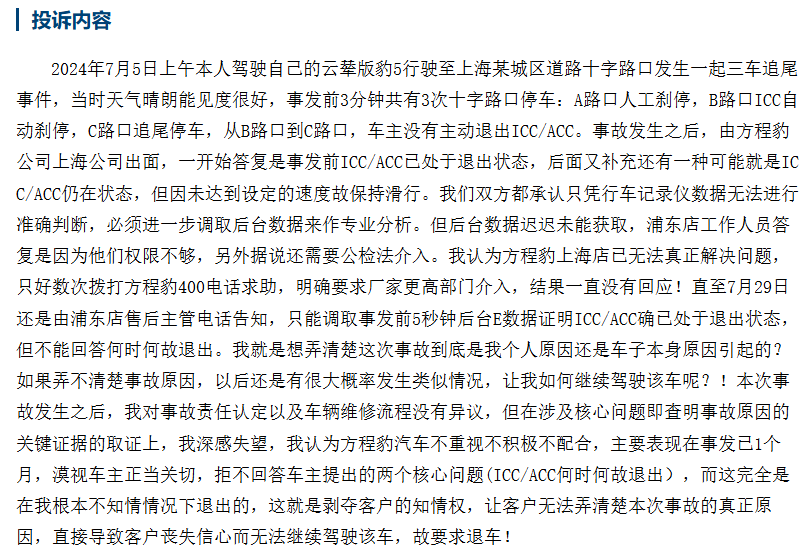

According to one complaining owner, while driving the Leopard 5 CloudRider version through a sunny and well-lit urban intersection, a three-car rear-end collision occurred. At the time of the incident, the owner had activated the vehicle's built-in ICC/ACC driver assistance system and did not manually disengage it.

FANGCHENGBAO initially responded that the ICC/ACC was already deactivated before the incident but later suggested that it might have remained active but maintained a glide due to not reaching the set speed. However, after the owner requested a higher-level department to intervene for a professional analysis, FANGCHENGBAO hesitated to provide a response.

Multiple owners have also reported safety hazards with the Leopard 5's driver assistance system, such as sudden braking with no vehicle in front and failing to recognize road markings, leading to unexpected deviations towards highway guardrails. Furthermore, the model's automatic parking system has been criticized for intermittent radar failures.

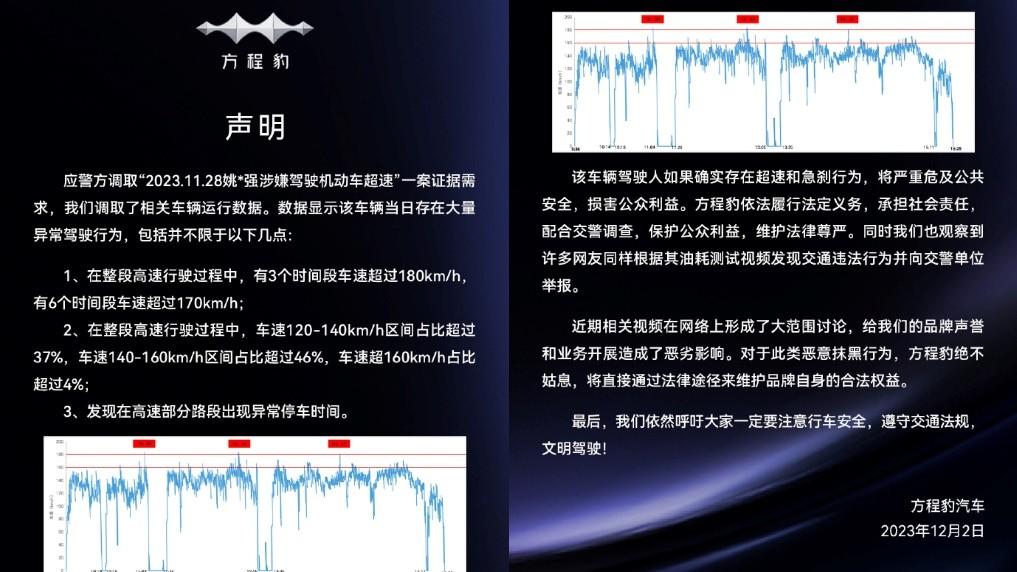

Previously, FANGCHENGBAO was embroiled in a 'fuel consumption controversy,' sparking discussions among netizens about the authenticity of its claims. Upon launch, the Leopard 5 advertised a minimum fuel consumption of 7.8L/100km under certain conditions, but one auto blogger posted a video claiming their actual fuel consumption reached 18L/100km, a significant discrepancy.

Although FANGCHENGBAO quickly issued an official statement alleging that the blogger's driving behavior during the test, including abrupt braking, speeding, and unusual parking, was irregular, the local traffic management department ultimately penalized the blogger. Nevertheless, the market remains skeptical about FANGCHENGBAO's actual fuel consumption figures.

On AutoHome, one owner reported driving their Leopard 5 for a total of 11,970km, charging it 1,300 times. Based on filling up with 870L of fuel and achieving 7,300km on HEV mode, the actual fuel consumption under battery depletion conditions was 11.9L/100km, and the actual pure electric driving range was only 90km, significantly lower than the advertised 125km.

FANGCHENGBAO recently announced that the brand is entering its 2.0 development phase, with overall rejuvenation strategies leading to readjustments and redeployments in its channel system, product structure, and pricing. The adoption of a new pricing system is a crucial step in expanding the product line and broadening the brand's price range on the occasion of its first anniversary since its technology launch.

However, external observers attribute the sudden price reduction by FANGCHENGBAO directly to its consistently underwhelming sales performance. Public information indicates that the Leopard 5, FANGCHENGBAO's first model, debuted in November 2023 as a super hybrid hardcore off-road SUV, offering three versions priced between RMB 289,800 and RMB 352,800.

In the launch month, FANGCHENGBAO sold 626 units, and achieved monthly sales exceeding 5,000 units in December 2023 and January 2024. In comparison, the Tank 400 Hi4-T, which debuted a month earlier with similar pricing and positioning, sold 4,086 and 4,586 units during the same period, significantly outperforming FANGCHENGBAO.

However, FANGCHENGBAO's popularity did not last long, and sales declined steadily after the Lunar New Year. Following a steep drop to 2,310 units in February, only March surpassed the 3,000-unit threshold, with sales of 2,110, 2,430, and 2,680 units in April, May, and June, respectively. July saw a new low of 1,842 units.

In contrast, the Tank 400 Hi4-T sold 1,539, 3,060, 3,107, 3,116, and 4,107 units from February to June 2024, overtaking the Leopard 5. July sales reached 4,007 units, further widening the gap with the Leopard 5.

To boost sales, FANGCHENGBAO opened up franchising in June, shifting from a direct sales model to BYD's mainstream 'direct + dealer' model, with initial plans covering 22 provinces, 4 municipalities, and 5 autonomous regions nationwide. FANGCHENGBAO revealed that over 100 leading dealers from provinces and cities have submitted applications.

According to Xiong Tianbo's plans, FANGCHENGBAO will expand its product line into mainstream markets and broaden its price range. The brand is set to introduce the mid-to-large hardcore SUV Leopard 8 in the third quarter of this year, and official images of the Leopard 3 were recently released, completing the '583' hardcore family lineup.

Furthermore, adhering to the '2+X' product plan, FANGCHENGBAO will launch sports car models represented by the SUPER 9 and explore other automotive segments in the future. With new models yet to be launched and lackluster performance in the used car market, adjusting prices in line with market trends seems to be FANGCHENGBAO's inevitable choice to boost sales.

It is not difficult to imagine that price reductions can help FANGCHENGBAO expand its sales volume in the short term. However, rushing to expand the 'incremental market' before stabilizing the 'base market' of existing users will undoubtedly cause irreparable damage to the brand's reputation. FANGCHENGBAO, eager for progress, must strike a balance between the rights of new and existing users while enhancing product quality.